Wedge Trading Pattern

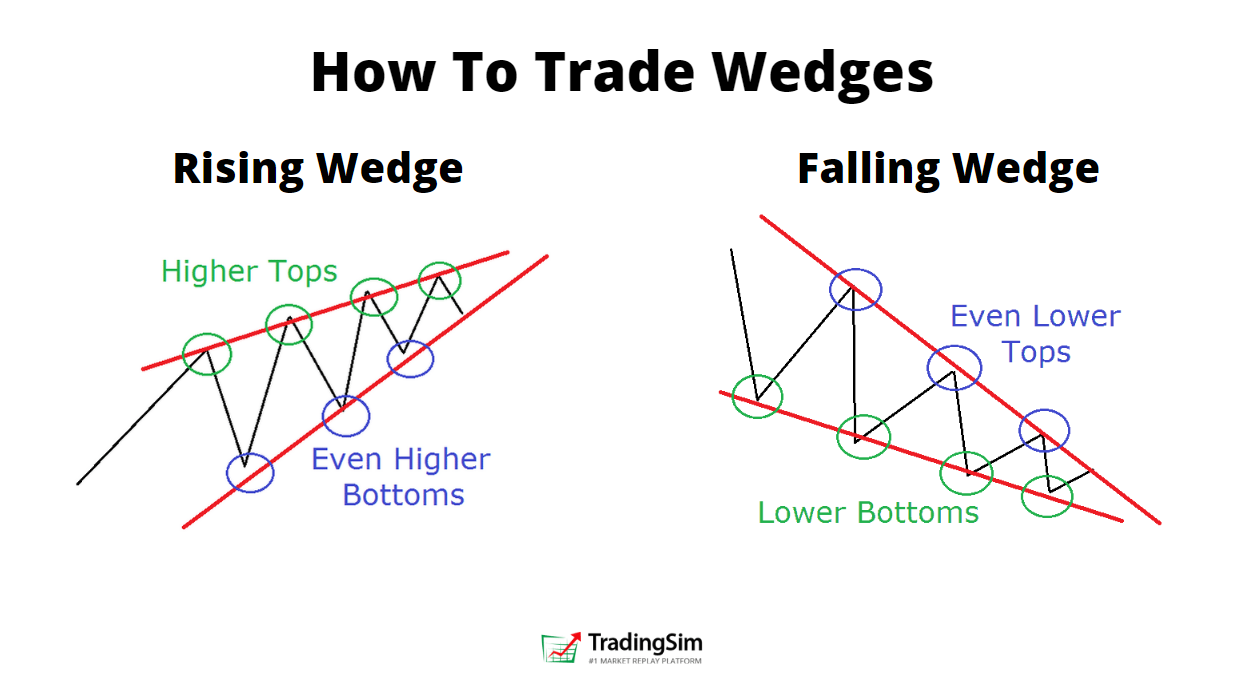

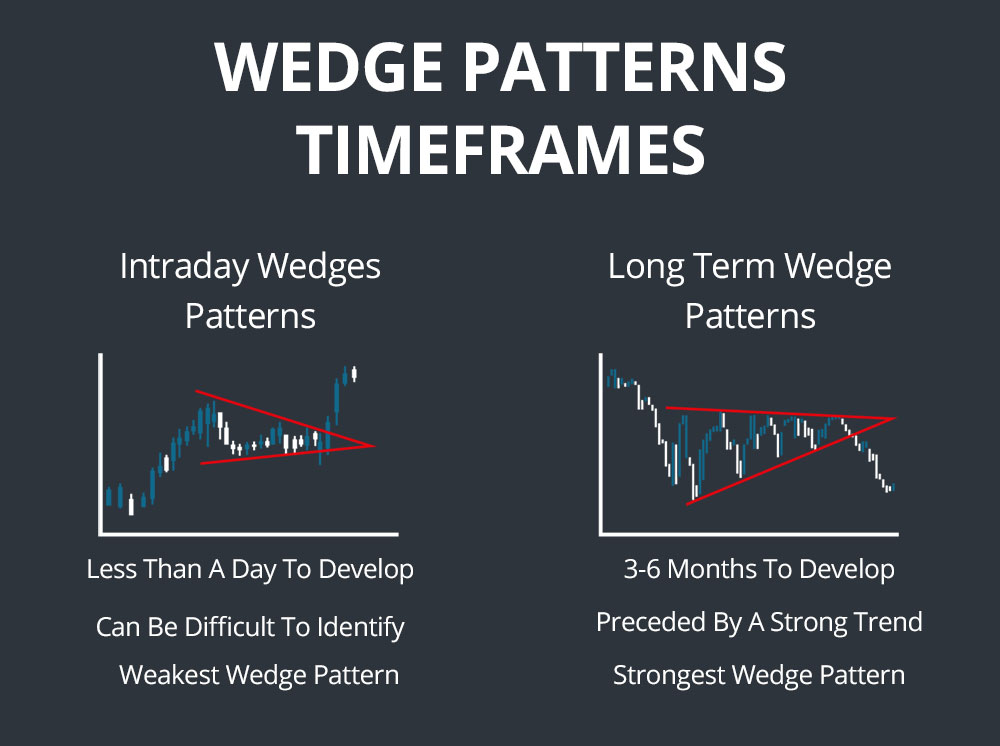

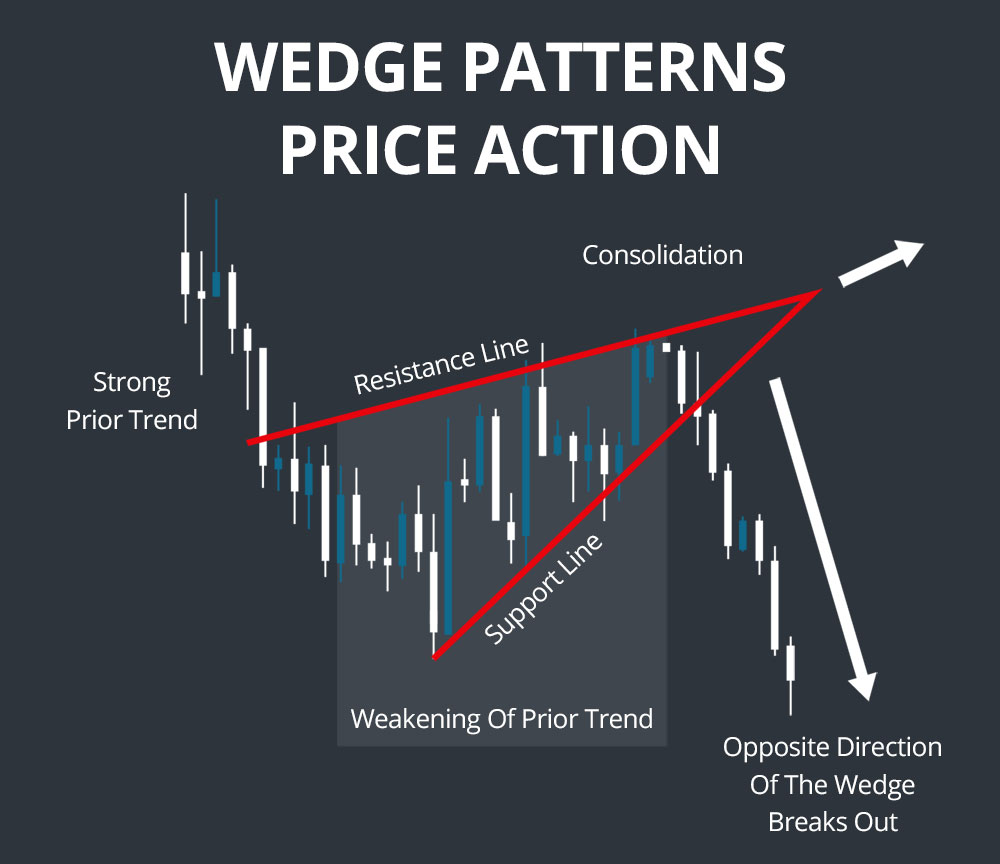

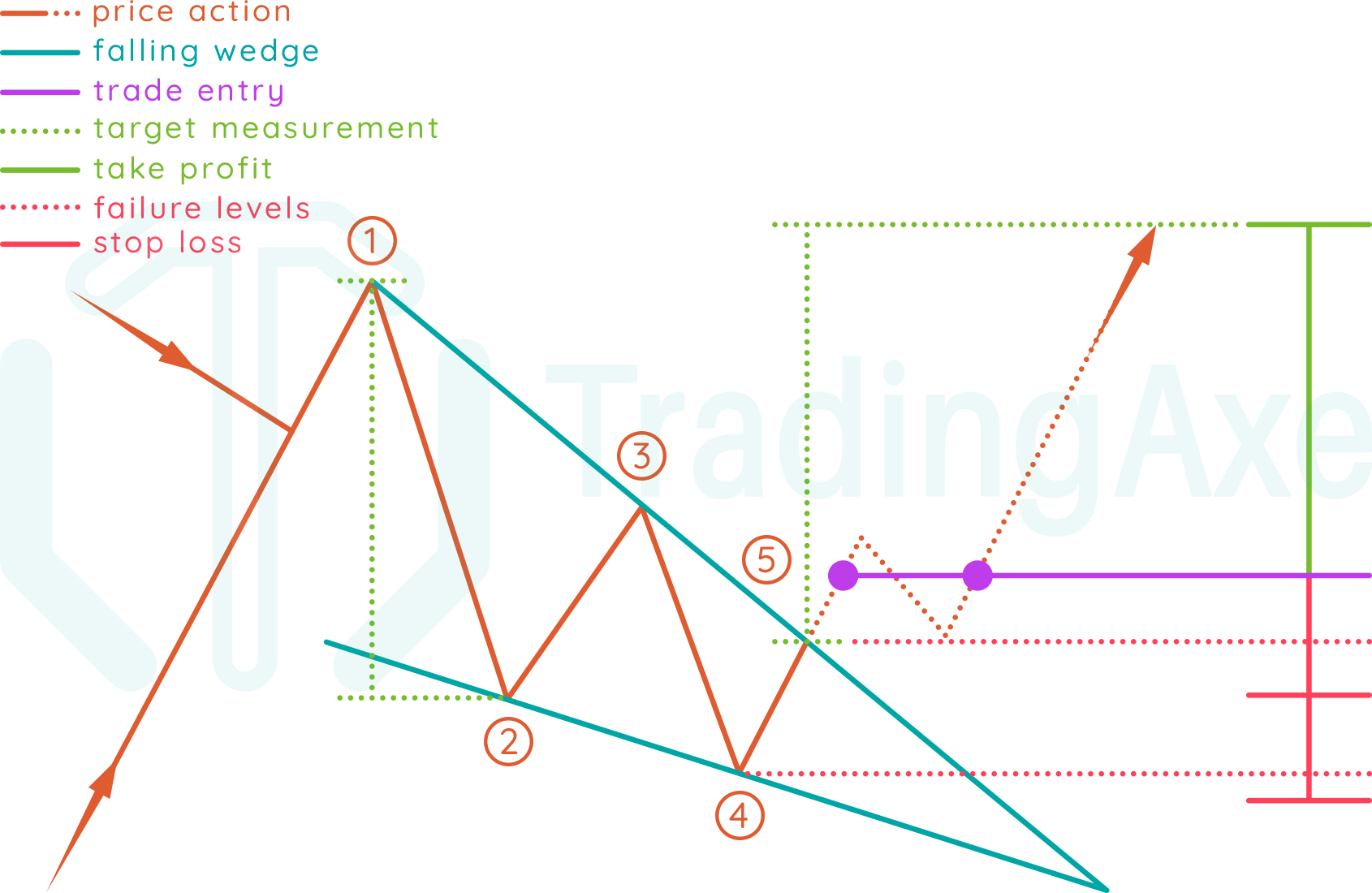

Wedge Trading Pattern - See examples, videos, scripts and. Web learn how to identify and use wedge patterns, which are formed by two trend lines that converge. The breakout direction from the wedge determines whether. This price action forms a cone that slopes down as the reaction highs and. Rising and falling wedges are a technical chart pattern used to predict trend continuations and trend reversals. These trading wedge patterns emerge on charts when. Find out the characteristics, types, and benefits of. Web learn how to identify and trade wedge patterns, chart formations that signal price reversals or continuations. Web a wedge pattern is a popular trading chart pattern that indicates possible price direction changes or continuations. The lines show that the highs and the lows are either rising or falling at differing rates, giving the appearance. Web the wedge pattern is a popular technical analysis tool used by traders to identify potential price reversals and trend continuations. A wedge is a price pattern marked by converging trend lines on a price chart. The wedge pattern can either be a continuation pattern or a reversal pattern, depending on the type of wedge and the preceding trend. There. Its unique shape resembles a. In many cases, when the market. This article provides a technical. Web the falling wedge is a bullish pattern that begins wide at the top and contracts as prices move lower. The main difference between them is in the. Wedges can signal a pause, reversal or continuation of the current trend,. Web the forex rising wedge (also known as the ascending wedge) pattern is a powerful consolidation price pattern formed when price is bound between two. The lines show that the highs and the lows are either rising or falling at differing rates, giving the appearance. A wedge is. It suggests a potential reversal in the trend. A stock that was trading at $310.40 in 2021 has crashed by about 80% to the. It is a type of formation in which trading activities are confined within converging. These trading wedge patterns emerge on charts when. Web which chart pattern is best for trading? The two trend lines are drawn to connect the respective highs and lows of a price series over the course of 10 to 50 periods. Find out the characteristics, types, and benefits of. Web the forex rising wedge (also known as the ascending wedge) pattern is a powerful consolidation price pattern formed when price is bound between two. These trading. It suggests a potential reversal in the trend. This article provides a technical. The lines show that the highs and the lows are either rising or falling at differing rates, giving the appearance. Web the wedge pattern is a popular technical analysis tool used by traders to identify potential price reversals and trend continuations. It is the opposite of the. It is the opposite of the bullish. The main difference between them is in the. Web which chart pattern is best for trading? The lines show that the highs and the lows are either rising or falling at differing rates, giving the appearance. Web the falling wedge pattern (also known as the descending wedge) is a useful pattern that signals. Web the wedge pattern is a popular technical analysis tool used by traders to identify potential price reversals and trend continuations. The breakout direction from the wedge determines whether. A wedge is a price pattern marked by converging trend lines on a price chart. Wedges can signal a pause, reversal or continuation of the current trend,. It is the opposite. The main difference between them is in the. It is a type of formation in which trading activities are confined within converging. Web learn how to identify and trade wedge patterns, chart formations that signal price reversals or continuations. Its unique shape resembles a. Web the rising wedge is a bearish chart pattern found at the end of an upward. These trading wedge patterns emerge on charts when. It is the opposite of the bullish. Find out the characteristics, types, and benefits of. The breakout direction from the wedge determines whether. A stock that was trading at $310.40 in 2021 has crashed by about 80% to the. The wedge pattern can either be a continuation pattern or a reversal pattern, depending on the type of wedge and the preceding trend. There are 2 types of. This price action forms a cone that slopes down as the reaction highs and. 11 chart patterns for trading symmetrical triangle. Web a wedge pattern is a popular trading chart pattern that indicates possible price direction changes or continuations. Web broadening wedges are one of a series of chart patterns in trading: Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. Its unique shape resembles a. Web the falling wedge pattern (also known as the descending wedge) is a useful pattern that signals future bullish momentum. Web the forex rising wedge (also known as the ascending wedge) pattern is a powerful consolidation price pattern formed when price is bound between two. Web which chart pattern is best for trading? It suggests a potential reversal in the trend. A wedge is a price pattern marked by converging trend lines on a price chart. There are 6 broadening wedge patterns that we can separately identify on our charts and each. In many cases, when the market. These trading wedge patterns emerge on charts when.

5 Chart Patterns Every Beginner Trader Should Know Brooksy

How to Trade Wedge Chart Patterns FX Access

Rising and Falling Wedge Patterns How to Trade Them TradingSim

How to Trade the Rising Wedge Pattern Warrior Trading

Wedge Patterns How Stock Traders Can Find and Trade These Setups

How To Trade Blog What Is A Wedge Pattern? How To Use The Wedge

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Simple Wedge Trading Strategy For Big Profits

How To Trade Falling Wedge Chart Pattern TradingAxe

Web Paypal Share Price Has Formed A Rising Wedge Pattern On The Daily And Weekly Charts.

Web Learn How To Identify And Use Wedge Patterns, Which Are Formed By Two Trend Lines That Converge.

A Stock That Was Trading At $310.40 In 2021 Has Crashed By About 80% To The.

It Is The Opposite Of The Bullish.

Related Post: