Wedge Stock Pattern

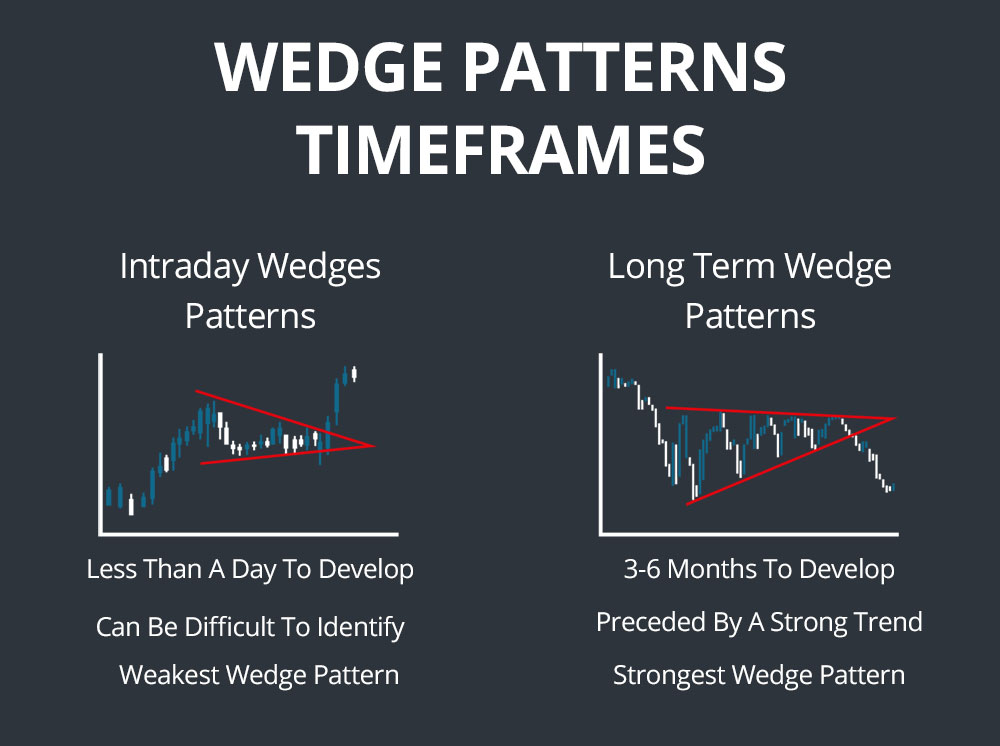

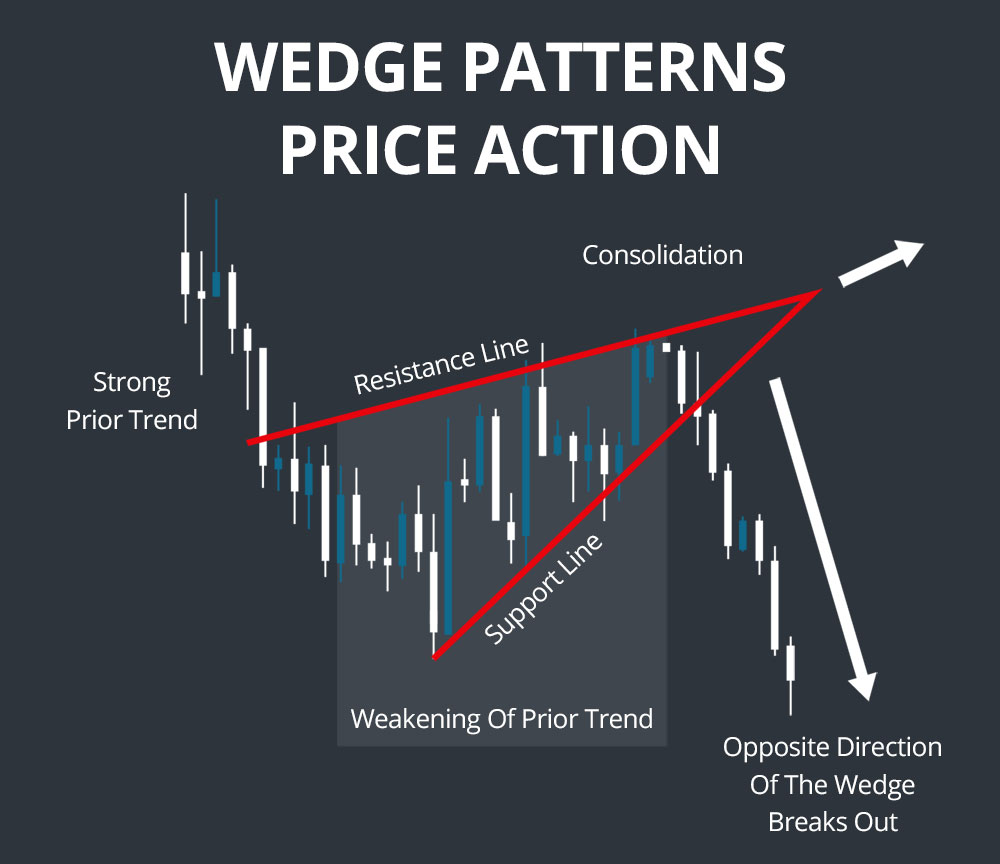

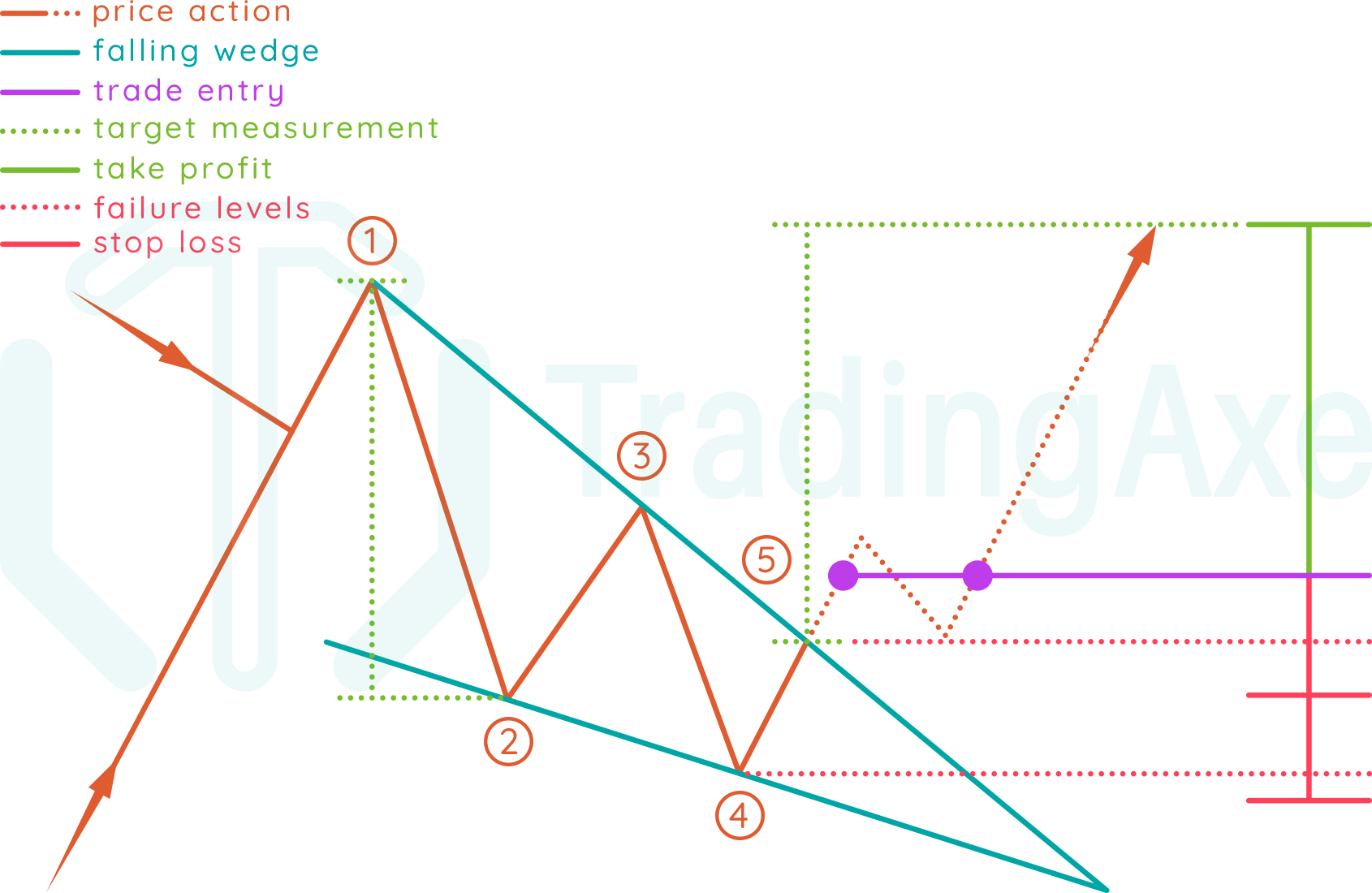

Wedge Stock Pattern - Welcome to the world of trading patterns. Web wedge patterns are a subset of chart patterns, formed when an asset’s price moves within converging trend lines, resembling a wedge or triangle. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. Stock wedge patterns constitute inflection points where trends reverse, breakouts bloom, or breakdowns begin. Web these trading wedge patterns emerge on charts when trend direction conflicts with volatility contraction. Wedges take many forms — rising, falling, expanding, and contracting. In this blog post, we’ll delve into the intricacies of trading with stock wedge patterns. A wedge pattern is a chart pattern that signals a future reversal or continuation of the trend. As outlined earlier, falling wedges can be both a reversal and continuation pattern. Web the rising wedge pattern, also known as ascending wedge, can be incredibly reliable and has the potential to generate profits if traded correctly. They are composed of the support and resistance trend lines that move in the same direction as the channel gets narrower, until one of the trend lines get broken and reverse the immediate trend on heavy volume. Web the falling wedge is a bullish pattern that suggests potential upward price movement. This article provides a technical approach to trading the.. A wedge pattern is a chart pattern that signals a future reversal or continuation of the trend. But they share one thing in common: The patterns may be considered rising or falling wedges depending on their direction. Web the rising wedge chart pattern is a recognisable price move that’s formed when a market consolidates between two converging support and resistance. The rising wedge has a reliability of 81% in testing 1. Web wedge patterns are a subset of chart patterns, formed when an asset’s price moves within converging trend lines, resembling a wedge or triangle. Web the ascending broadening wedge is one of six broadening wedge patterns to be found in price charts. Web a wedge pattern is a popular. Web what is a wedge pattern? In this blog post, we’ll delve into the intricacies of trading with stock wedge patterns. Web rising and falling wedges explained. These patterns can signal shifts in market trends. The pattern breakout is bearish 60% of the time. Let's dive in and see how they work. This pattern, while sloping downward, signals a likely trend reversal or continuation, marking a potential inflection point in trading strategies. The wedge pattern can either be a continuation pattern or a reversal pattern, depending on the type of wedge and the preceding trend. The pattern breakout is bearish 60% of the time.. In essence, both continuation and reversal scenarios are inherently bullish. It’s formed by drawing trend lines that connect a series of sequentially higher peaks and higher troughs for an uptrend, or lower peaks and lower troughs for a downtrend. The breakout direction from the wedge determines whether the price resumes the previous trend or moves in the same direction. The. It’s formed by drawing trend lines that connect a series of sequentially higher peaks and higher troughs for an uptrend, or lower peaks and lower troughs for a downtrend. The broadening aspect of them suggests increasing price volatility and increasing volume this spells out opportunity. But they share one thing in common: In many cases, when the market is trending,. In the world of stock trading, the wedge chart pattern stands out as a versatile and reliable chart pattern for traders. In this blog post, we’ll delve into the intricacies of trading with stock wedge patterns. It’s formed by drawing trend lines that connect a series of sequentially higher peaks and higher troughs for an uptrend, or lower peaks and. It’s the opposite of the falling (descending) wedge pattern (bullish). In contrast to symmetrical triangles, which have no definitive slope and no bullish or bearish bias, rising wedges definitely slope up and have a bearish bias. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. Web. As outlined earlier, falling wedges can be both a reversal and continuation pattern. The pattern is characterized by a contracting range in prices coupled with an upward trend in prices (known as a rising wedge) or a downward trend in prices (known as a falling wedge). If you appreciate our charts, give us a quick 💜💜 today, we'll explore two. Web the falling wedge is a bullish pattern that suggests potential upward price movement. I will show you how to identify and trade the rising wedge pattern to help you succeed. Web wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods. This pattern, while sloping downward, signals a likely trend reversal or continuation, marking a potential inflection point in trading strategies. Let's dive in and see how they work. Traders rely on these patterns to make informed decisions about future price movements, whether it’s a continuation of the current trend or a reversal. Web the falling wedge pattern (also known as the descending wedge) is a useful pattern that signals future bullish momentum. The pattern breakout is bearish 60% of the time. Web the rising wedge is a technical chart pattern used to identify possible trend reversals. The pattern is characterized by a contracting range in prices coupled with an upward trend in prices (known as a rising wedge) or a downward trend in prices (known as a falling wedge). Web rising and falling wedges explained. Web the rising wedge chart pattern is a recognisable price move that’s formed when a market consolidates between two converging support and resistance lines. On the technical analysis chart, a wedge pattern is a market trend commonly found in traded assets ( stocks, bonds, futures, etc.). But they share one thing in common: Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows. This article provides a technical approach to trading the.

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Wedge Patterns How Stock Traders Can Find and Trade These Setups

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

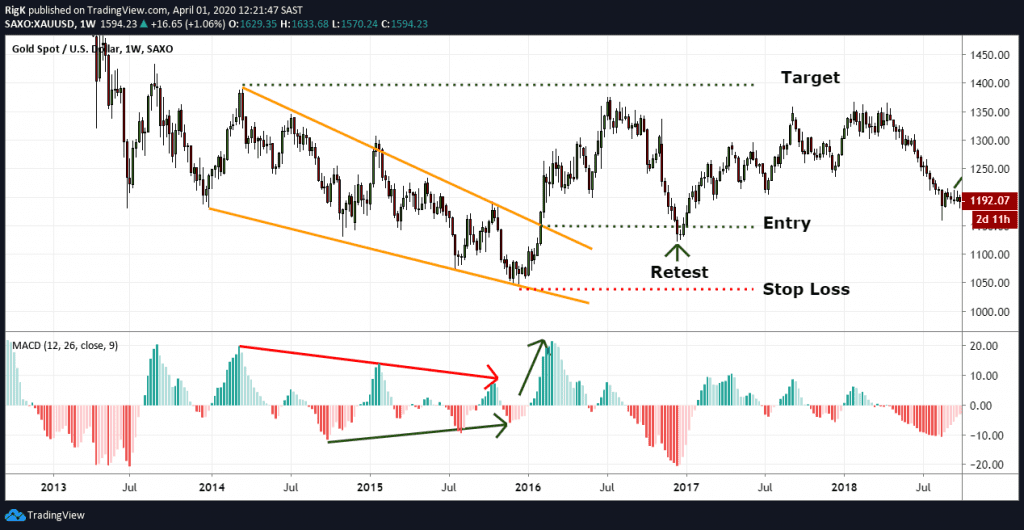

The Falling Wedge Pattern Explained With Examples

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Simple Wedge Trading Strategy For Big Profits

5 Chart Patterns Every Beginner Trader Should Know Brooksy

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

How To Trade Falling Wedge Chart Pattern TradingAxe

How to Trade the Rising Wedge Pattern Warrior Trading

To Form A Rising Wedge, The Support And Resistance Lines Both Have To Point In An Upwards Direction And The Support Line Has To Be Steeper Than Resistance.

Web These Trading Wedge Patterns Emerge On Charts When Trend Direction Conflicts With Volatility Contraction.

Enhance Your Trading Strategy Today.

Stock Wedge Patterns Constitute Inflection Points Where Trends Reverse, Breakouts Bloom, Or Breakdowns Begin.

Related Post: