Wedge Patterns Stocks

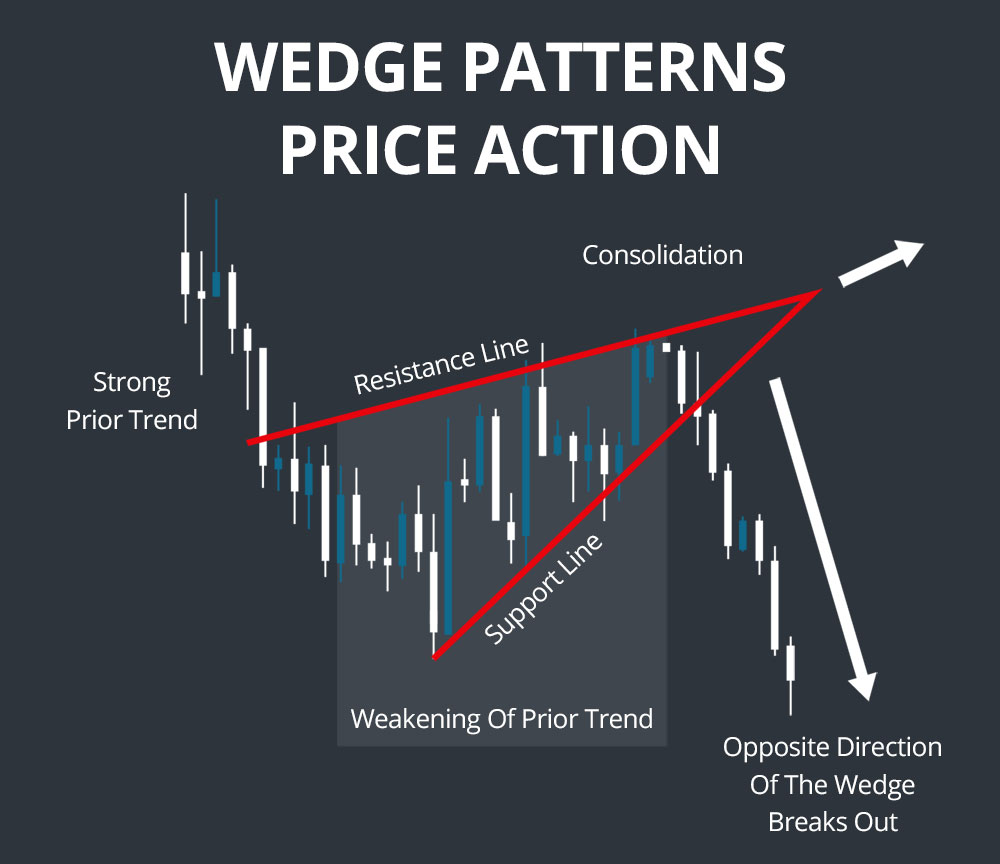

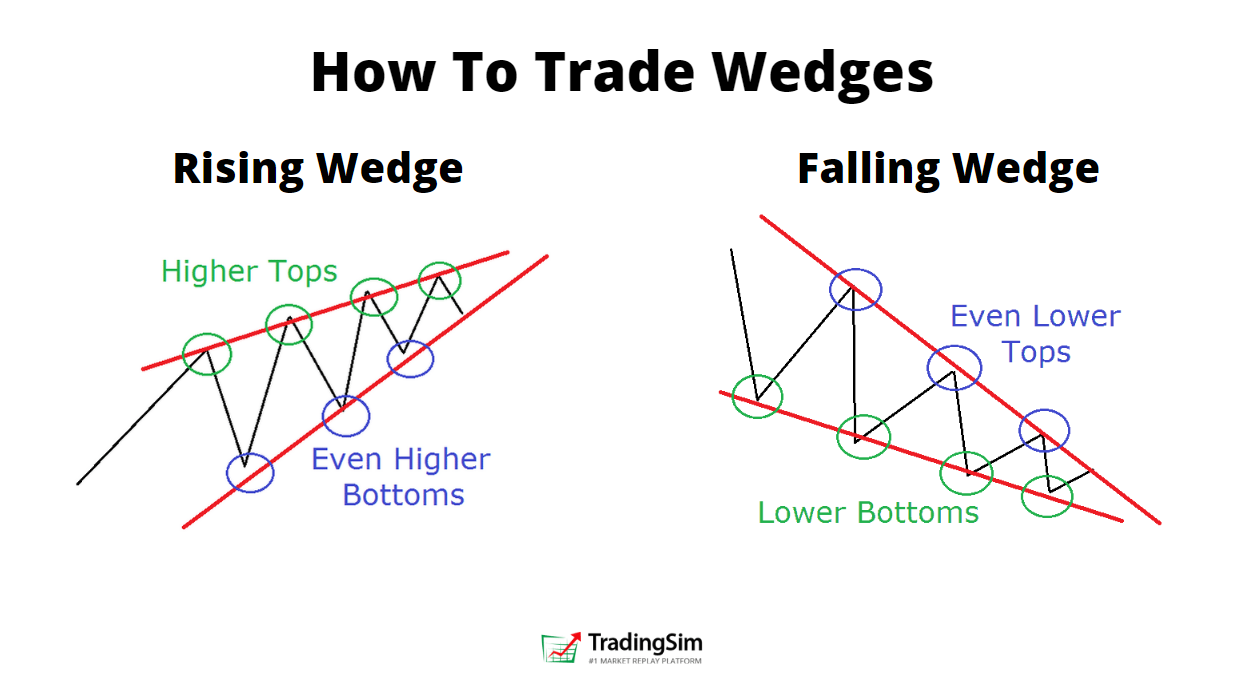

Wedge Patterns Stocks - This pattern, while sloping downward, signals a likely trend reversal or continuation, marking a potential inflection point in trading strategies. Web a rising wedge is generally considered bearish and is usually found in downtrends. Rising wedges put in a series of higher tops and higher bottoms. In price action analysis, wedges are some of the best reversal patterns in the market. Web paypal share price has formed a rising wedge pattern on the daily and weekly charts. That could be good for stocks. The rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows. The characteristic feature of the pattern is the narrowing price range between two trend lines that are converging towards each other, creating a wedge shape. Web falling and rising wedge patterns summed up. Web there are 6 broadening wedge patterns that we can separately identify on our charts and each provide a good risk and reward potential trade setup when carefully selected and used alongside other components to a successful trading strategy. Rising wedge #geldverdienen #bitcoin #crypto #cryptocurrency #ethereum #doopiecash #onlinegeldverdienen #investeren #geldverdienenonline. Web the fed is in a holding pattern. Patterns are the distinctive formations created by the movements of security prices on a chart and are the foundation of technical analysis. Rising wedges put in a series of higher tops and higher bottoms. Web a rising wedge is generally considered. 5 ways to make money online / gee singh. Web paypal share price has formed a rising wedge pattern on the daily and weekly charts. To trade them you’ll need to decide where to open your position, take profit and cut losses. The first is rising wedges where price is contained by 2 ascending trend lines that converge because the. This article explains the structure of a falling. Web the wedge pattern is frequently seen in traded assets like stocks, bonds, futures, etc. Wedge with downside slant is called falling wedge 2. The can either appear as a bullish wedge or bearish. (chart examples of wedge patterns using commodity charts.) (stock charts.) Wedge with downside slant is called falling wedge 2. A falling wedge is a technical analysis pattern with a predictive accuracy of 74%. A pattern is identified by a line. The falling wedge is formed when an asset price rises, but instead of. But they share one thing in common: These reversals can be quite violent due to the complacent nature of the. In price action analysis, wedges are some of the best reversal patterns in the market. The pattern is considered bearish because it signals that the stock's upward momentum. They can be found in uptrends too, but would still generally be regarded as bearish. The rising wedge is. Wedge patterns are defined by trend lines that come together, forming a narrowing wedge shape. Web on the technical analysis chart, a wedge pattern is a market trend commonly found in traded assets (stocks, bonds, futures, etc.). Wedge patterns are trend reversal patterns. Web these trading wedge patterns emerge on charts when trend direction conflicts with volatility contraction. A pattern. This pattern, while sloping downward, signals a likely trend reversal or continuation, marking a potential inflection point in trading strategies. Together with the rising wedge formation, these two create a powerful pattern that signals a change in the trend direction. Therefore, the outlook for the stock is extremely bearish, which can see it drop. Mcdonald’s corp (nyse:mcd) has recently formed. Web falling and rising wedge patterns summed up. Web paypal share price has formed a rising wedge pattern on the daily and weekly charts. Updated may 09, 2024, 9:08 am edt / original may 09, 2024, 1:00 am edt It is characterized by a narrowing range of price with higher highs and higher lows, both of. The pattern is considered. Mcdonald’s corp (nyse:mcd) has recently formed a death cross pattern, a bearish technical signal indicating a potential downtrend. Web to identify and interpret wedge patterns accurately, traders should pay attention to the following characteristics: Web the falling wedge is a bullish pattern. Web lets learn about bearish rising wedge a bearish rising wedge is a chart pattern that often appears. Web the wedge pattern is frequently seen in traded assets like stocks, bonds, futures, etc. The can either appear as a bullish wedge or bearish. Wedge with downside slant is called falling wedge 2. The falling wedge is formed when an asset price rises, but instead of. Web when the wedge pattern points down, the stock price should move upwards. Falling wedges can develop over several months, culminating in a bullish breakout when prices. In general, a falling wedge pattern is considered to be a reversal pattern, although there are examples when it facilitates a continuation of the same trend. 5 ways to make money online / gee singh. Web the rising wedge is a bearish chart pattern found at the end of an upward trend in financial markets. Rising wedges put in a series of higher tops and higher bottoms. Wedges are a technical pattern that traders use to identify upcoming bull and bear markets. But they share one thing in common: Together with the rising wedge formation, these two create a powerful pattern that signals a change in the trend direction. Mcdonald’s corp (nyse:mcd) has recently formed a death cross pattern, a bearish technical signal indicating a potential downtrend. Web a rising wedge is generally considered bearish and is usually found in downtrends. A falling wedge is a technical analysis pattern with a predictive accuracy of 74%. Web on the technical analysis chart, a wedge pattern is a market trend commonly found in traded assets (stocks, bonds, futures, etc.). It is the opposite of the bullish falling wedge pattern that occurs at the end of a downtrend. Web paypal share price has formed a rising wedge pattern on the daily and weekly charts. In many cases, when the market is trending, a wedge pattern will develop on the chart. Rising wedge #geldverdienen #bitcoin #crypto #cryptocurrency #ethereum #doopiecash #onlinegeldverdienen #investeren #geldverdienenonline.

5 Chart Patterns Every Beginner Trader Should Know Brooksy Society

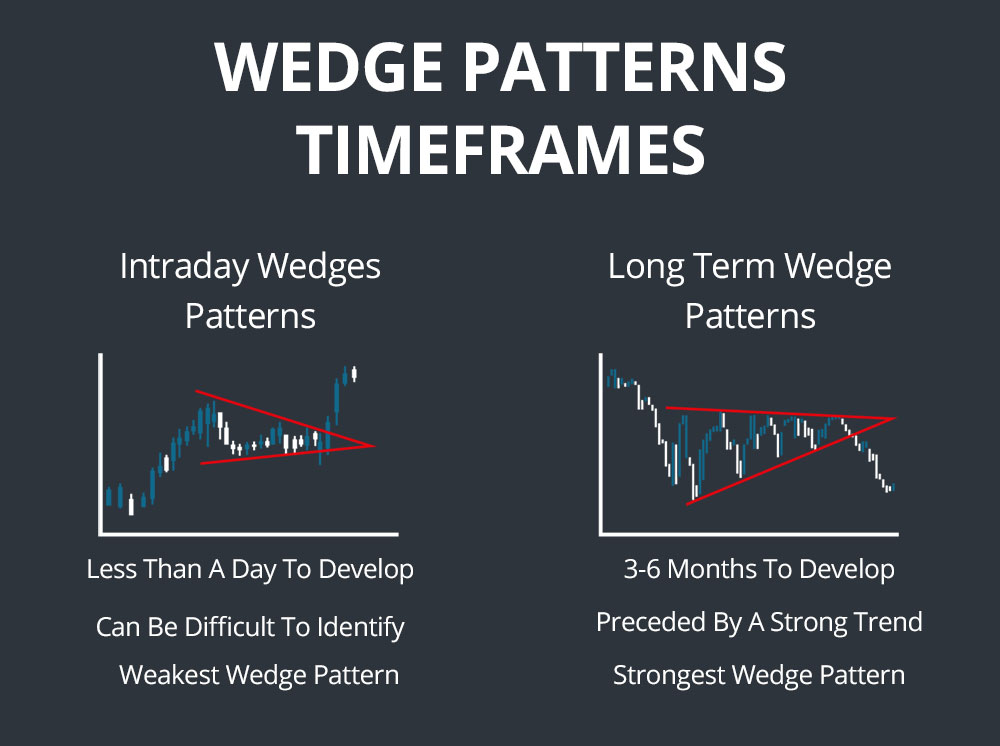

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Wedge Patterns How Stock Traders Can Find and Trade These Setups

How to Trade the Rising Wedge Pattern

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

Simple Wedge Trading Strategy For Big Profits

Rising And Falling Wedge Patterns The Complete Guide

Rising and Falling Wedge Patterns How to Trade Them TradingSim

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

Web When The Wedge Pattern Points Down, The Stock Price Should Move Upwards Theoretically.

In Contrast To Symmetrical Triangles, Which Have No Definitive Slope And No Bullish Or Bearish Bias, Rising Wedges Definitely Slope Up And Have A Bearish Bias.

This Wedge Could Be Either A Rising Wedge Pattern Or Falling Wedge Pattern.

The Pattern Is Characterized By A Contracting Range In Prices Coupled With An Upward Trend In Prices (Known As A Rising Wedge) Or A Downward Trend In Prices (Known As A Falling Wedge).

Related Post: