Wedge Pattern

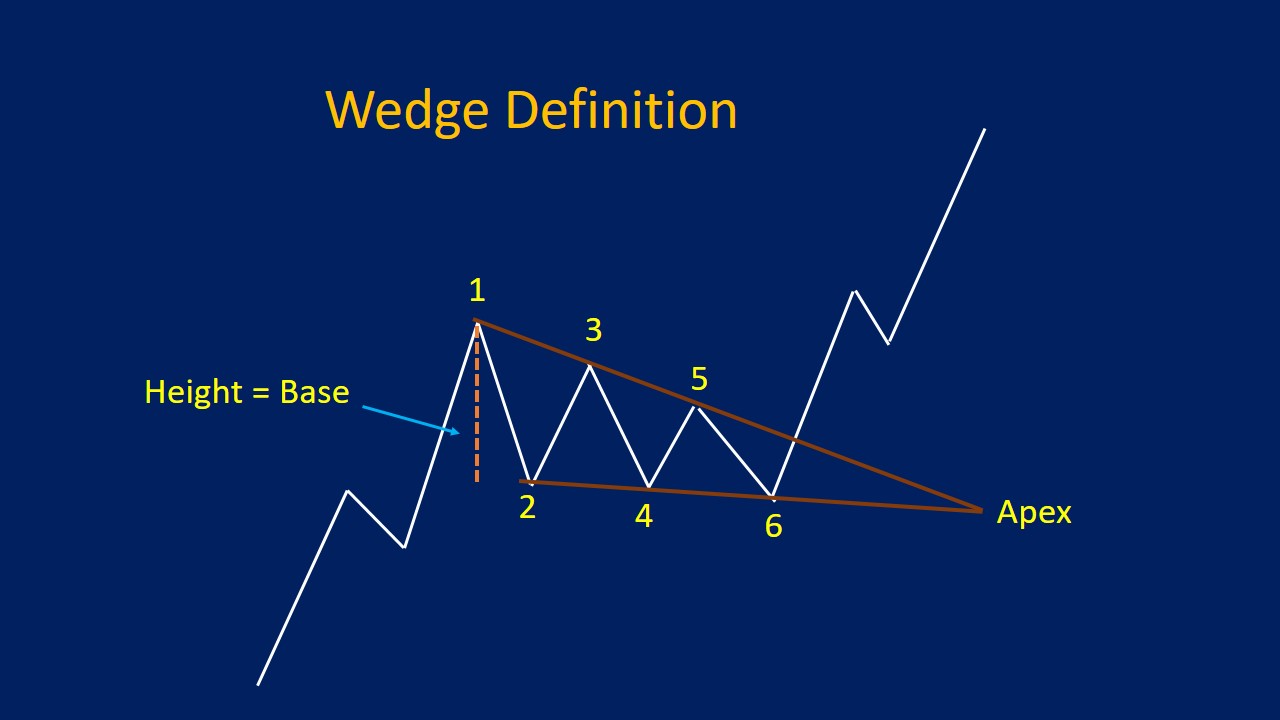

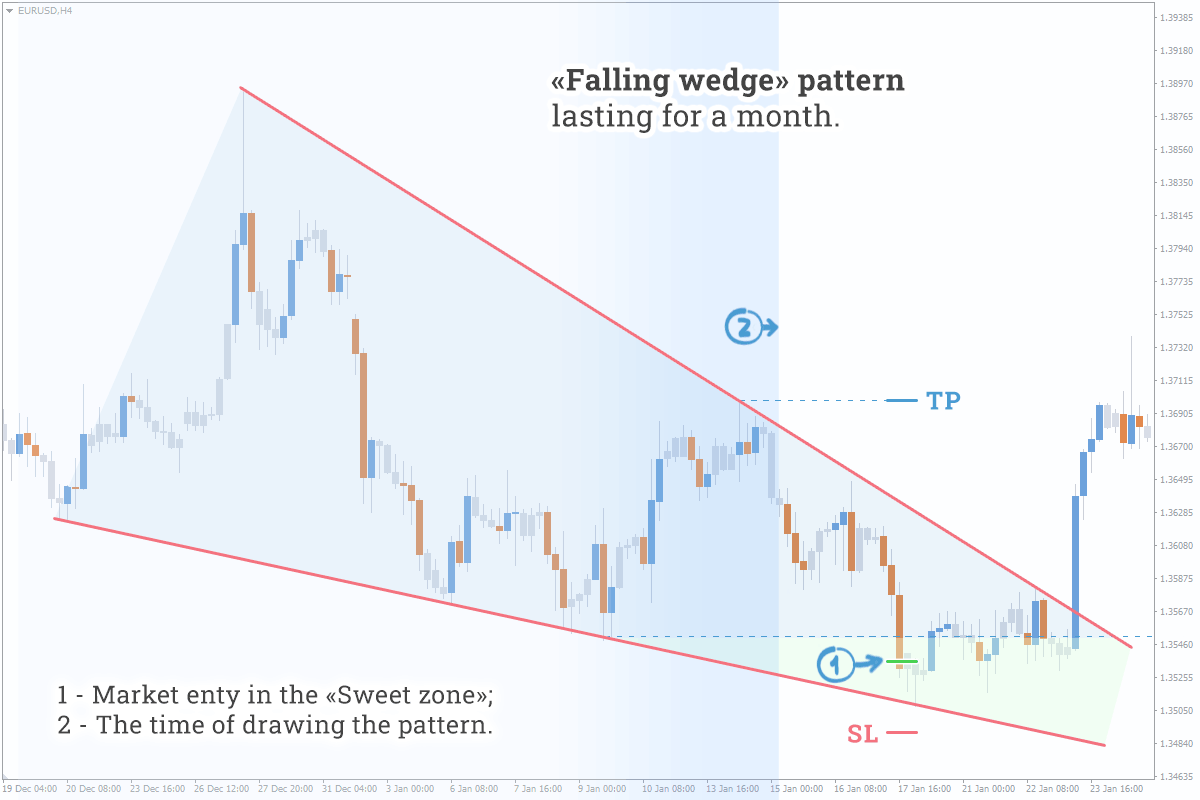

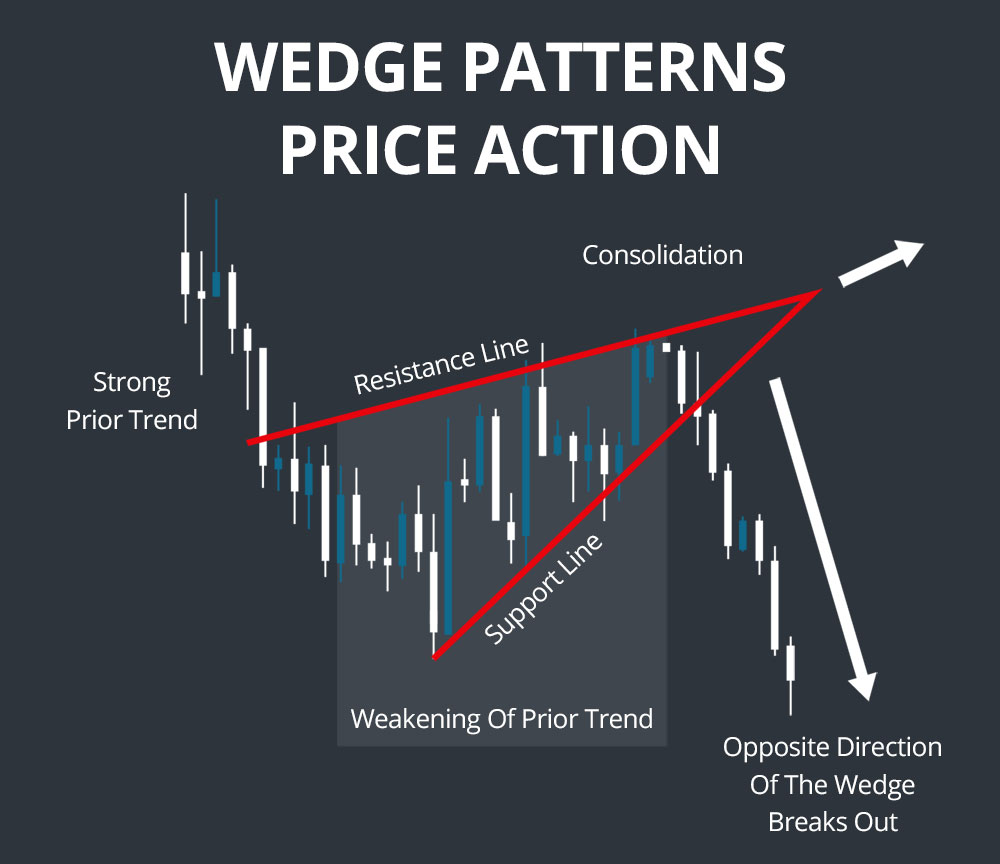

Wedge Pattern - Web a wedge is a common type of trading chart pattern that helps to alert traders to a potential reversal or continuation of price direction. Web in a wedge chart pattern, two trend lines converge. The wedge pattern can either be a continuation pattern or a reversal pattern, depending on the type of wedge and the preceding trend. Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows. Web understanding the wedge pattern. It should take about 3 to 4 weeks to complete the wedge. It is characterized by two trendlines that converge towards each other, forming a narrowing triangle shape. It’s the opposite of the falling (descending) wedge pattern (bullish), as these two constitute a popular wedge pattern. Web a wedge pattern is a technical analysis chart formation that can occur in an uptrend or downtrend and signals a potential trend reversal. The wedge pattern is frequently seen in traded assets like stocks, bonds, futures, etc. *written by ai, edited by humans. It’s the opposite of the falling (descending) wedge pattern (bullish), as these two constitute a popular wedge pattern. Web rising and falling wedges explained. By stelian olar, updated on: This price action forms a cone that slopes down as the reaction highs and reaction lows converge. The wedge pattern is frequently seen in traded assets like stocks, bonds, futures, etc. In addition to being an entry signal, this chart pattern also helps traders identify price reversal points effectively. Web a wedge pattern is a price pattern identified by converging trend lines on a price chart. Identifying and understanding wedge patterns is essential for effective technical analysis. This price action forms a cone that slopes down as the reaction highs and reaction lows converge. Updated 9/7/2023 11 min read. The wedge pattern can either be a continuation pattern or a reversal pattern, depending on the type of wedge and the preceding trend. Web the wedge pattern is a popular pattern used in forex trading. These patterns can. Wedges signal a pause in the current trend. Web rising and falling wedges explained. When you encounter this formation, it signals that forex traders are still deciding where to take the pair next. The wedge pattern can either be a continuation pattern or a reversal pattern, depending on the type of wedge and the preceding trend. Experience this special chart. The first is rising wedges where price is contained by 2 ascending trend lines that converge because the lower trend line is steeper than. This price action forms a cone that slopes down as the reaction highs and reaction lows converge. Identifying and understanding wedge patterns is essential for effective technical analysis and successful trading strategies. It should take about. Whether the price reverses the prior trend or continues in the same direction depends on the breakout direction from the wedge. It is characterized by two trendlines that converge towards each other, forming a narrowing triangle shape. This wedge could be either a rising wedge pattern or falling wedge pattern. These patterns can signal shifts in market trends. Updated 9/7/2023. Web the rising wedge is a chart pattern used in technical analysis to predict a likely bearish reversal. *written by ai, edited by humans. In addition to being an entry signal, this chart pattern also helps traders identify price reversal points effectively. Web the rising wedge pattern. In many cases, when the market is trending, a wedge pattern will develop. By stelian olar, updated on: The duration (short/medium/long term) of the top depends upon the timeframe on which it appears. It is characterized by a narrowing range of price with higher highs and higher lows, both of. Bitcoin has been pulling back this week following a test of. As outlined earlier, falling wedges can be both a reversal and continuation. The characteristic feature of the pattern is the narrowing price range between two trend lines that are converging towards each other, creating a wedge shape. These patterns can be extremely difficult to recognize and interpret on a chart since they bear much resemblance to triangle patterns and do not always form cleanly. The first is rising wedges where price is. These patterns can signal shifts in market trends. Rising and falling wedges are a technical chart pattern used to predict trend continuations and trend reversals. Updated 9/7/2023 11 min read. Web understanding the wedge pattern. The wedge pattern is a chart formation used in technical analysis to predict price movements. Mesmerizing as modern art yet orderly as geometry—wedge patterns capture a trader’s imagination. *written by ai, edited by humans. Web the falling wedge is a bullish pattern that begins wide at the top and contracts as prices move lower. The first is rising wedges where price is contained by 2 ascending trend lines that converge because the lower trend line is steeper than. These patterns can signal shifts in market trends. The wedge pattern can either be a continuation pattern or a reversal pattern, depending on the type of wedge and the preceding trend. The duration (short/medium/long term) of the top depends upon the timeframe on which it appears. Web a wedge pattern is a price pattern identified by converging trend lines on a price chart. This price action forms a cone that slopes down as the reaction highs and reaction lows converge. It should take about 3 to 4 weeks to complete the wedge. These patterns can be extremely difficult to recognize and interpret on a chart since they bear much resemblance to triangle patterns and do not always form cleanly. In either case, this pattern holds three common characteristics: Web in a wedge chart pattern, two trend lines converge. Web the wedge pattern is a popular pattern used in forex trading. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. In contrast to symmetrical triangles, which have no definitive slope and no bullish or bearish bias, rising wedges definitely slope up and have a bearish bias.

Wedge Patterns How Stock Traders Can Find and Trade These Setups

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

Wedge Pattern Rising & Falling Wedges, Plus Examples

The “Wedge” Pattern is a Classical Forex Pattern All Types on Chart

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Rising And Falling Wedge Patterns The Complete Guide

5 Chart Patterns Every Beginner Trader Should Know Brooksy

Simple Wedge Trading Strategy For Big Profits

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

In Contrast To Symmetrical Triangles, Which Have No Definitive Slope And No Bias, Falling Wedges Definitely Slope Down And Have A Bullish Bias.

It Is Characterized By Two Trendlines That Converge Towards Each Other, Forming A Narrowing Triangle Shape.

Web The Rising Wedge Is A Chart Pattern Used In Technical Analysis To Predict A Likely Bearish Reversal.

When You Encounter This Formation, It Signals That Forex Traders Are Still Deciding Where To Take The Pair Next.

Related Post: