Wedge Chart Pattern

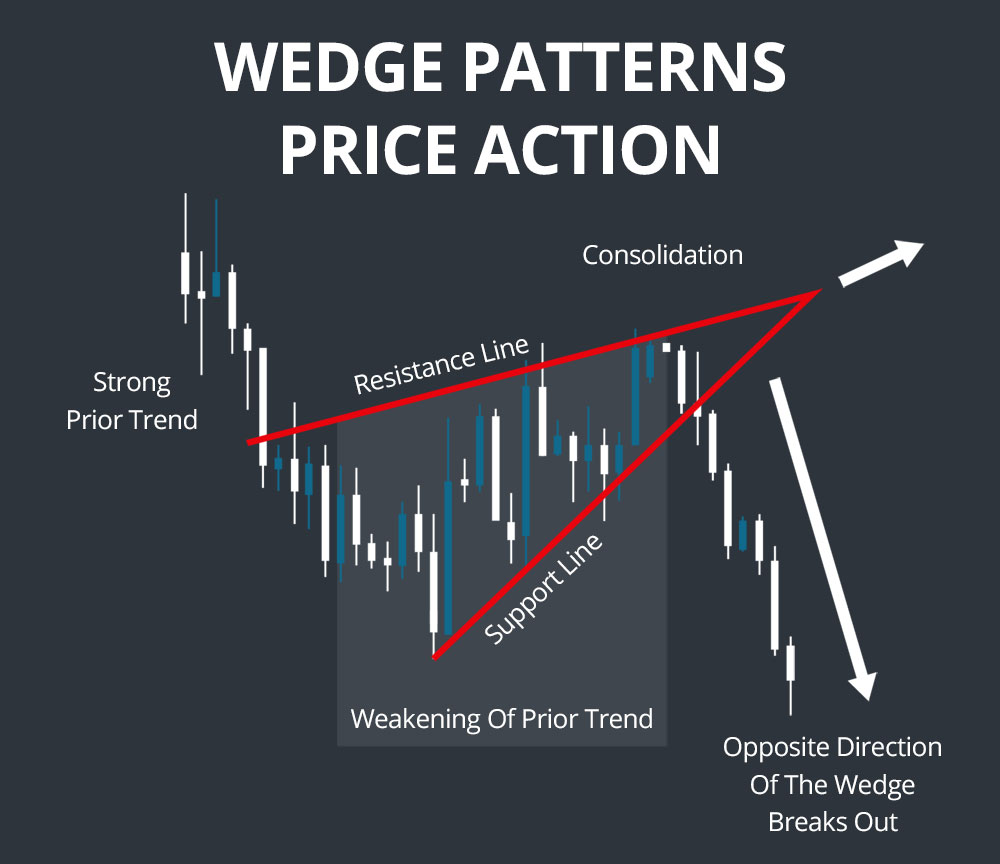

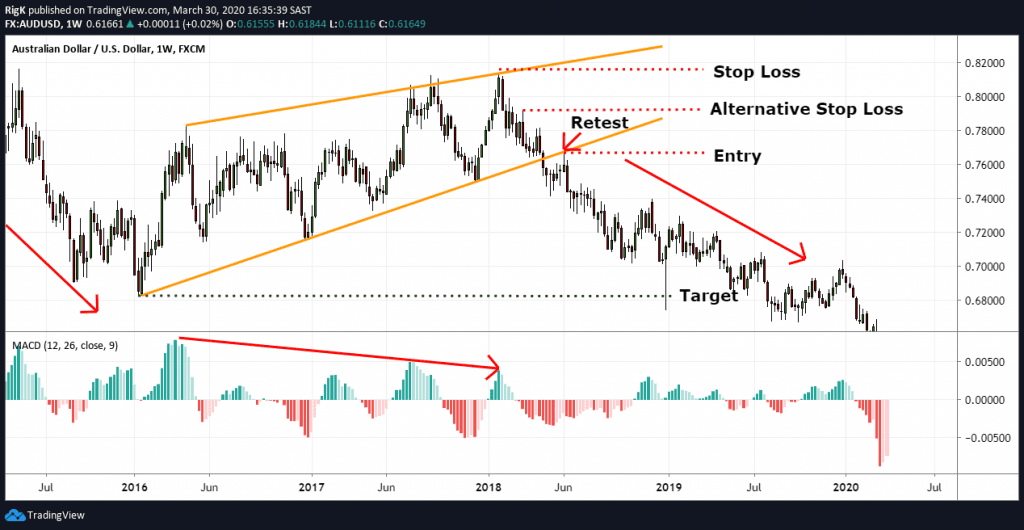

Wedge Chart Pattern - Web that advance broke out of a prior descending bullish wedge and expanded the top boundary line of the pattern. A wedge emerges on charts when there is a conflict between directional price movement and contracting volatility. Web a wedge pattern is a popular trading chart pattern that indicates possible price direction changes or continuations. These patterns can be extremely difficult to recognize and interpret on a chart since they bear much resemblance to triangle patterns and do not always form cleanly. While both trendlines are in the same direction, one trendline has a greater slope than the other. The rising wedge has a reliability of 81% in testing 1. The patterns may be considered rising or falling wedges depending on their direction. Web lets learn about bearish rising wedge a bearish rising wedge is a chart pattern that often appears in the stock market and is seen as a bearish signal. Wedge patterns are a subset of chart patterns, formed when an asset’s price moves within converging trend lines, resembling a wedge or triangle. Web in a wedge chart pattern, two trend lines converge. In a wedge pattern two trend lines are moving in the same direction but narrowing in width. It means that the magnitude of price movement within the wedge pattern is decreasing. There are 2 types of wedges indicating price is in consolidation. Web in a wedge chart pattern, two trend lines converge. The wedge pattern is a chart formation used. Volume is low but is a potential sign of accumulation. Web that advance broke out of a prior descending bullish wedge and expanded the top boundary line of the pattern. In the technical wedge formation, the two trend lines run in the same direction, but with different slopes. Wedge patterns are a subset of chart patterns, formed when an asset’s. Traders rely on these patterns to make informed decisions about future price movements, whether it’s a continuation of the current trend or a reversal. What is the rising wedge pattern? This price action forms a cone that slopes down as the reaction highs and reaction lows converge. The patterns may be considered rising or falling wedges depending on their direction.. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. The pattern indicates the end of a bullish trend and is a frequently occurring pattern in financial markets. After waning volume in the wedge, there's a good increase on the breakout. There are 2 types of wedges indicating price is in. It is considered a bullish chart formation but can indicate both reversal and continuation patterns. It means that the magnitude of price movement within the wedge pattern is decreasing. This price action forms a cone that slopes down as the reaction highs and reaction lows converge. Wedge patterns are a subset of chart patterns, formed when an asset’s price moves. Rising wedges typically signal a bearish reversal, while falling wedges suggest a bullish continuation. Eventually a breakthrough occurs to end the pattern. It suggests a potential reversal in the trend. Web the rising wedge chart pattern is a recognisable price move that’s formed when a market consolidates between two converging support and resistance lines. Wedge patterns are a subset of. The angled lines resemble the sides of a wedge or a slice of pie. The patterns may be considered rising or falling wedges depending on their direction. This price action forms a cone that slopes down as the reaction highs and reaction lows converge. Web wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods.. It suggests a potential reversal in the trend. In the technical wedge formation, the two trend lines run in the same direction, but with different slopes. Eventually a breakthrough occurs to end the pattern. A wedge emerges on charts when there is a conflict between directional price movement and contracting volatility. Falling wedge in a downtrend (bullish) falling wedge in. In the technical wedge formation, the two trend lines run in the same direction, but with different slopes. There are 2 types of wedges indicating price is in consolidation. A wedge emerges on charts when there is a conflict between directional price movement and contracting volatility. Web this pattern was able to reverse the downtrend nicely. This price action forms. Web wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods. Eventually a breakthrough occurs to end the pattern. The rising wedge is a bearish chart pattern that occurs at the end of a bullish uptrend and usually represents a trend reversal. To form a rising wedge, the support and resistance lines both have to. The main difference between them is in the slope of the trend lines from which the pattern arises. The pattern is more reliable if the wedge is in an uptrend. Updated 9/7/2023 11 min read. *written by ai, edited by humans. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. Web in a wedge chart pattern, two trend lines converge. The target of a rising wedge breakout can be calculated by adding the height of the wedge’s widest apex to the breakout zone. When you encounter this formation, it signals that forex traders are still deciding where to take the pair next. After waning volume in the wedge, there's a good increase on the breakout. Web a wedge pattern is a popular trading chart pattern that indicates possible price direction changes or continuations. Volume drops off in the wedge and then comes back as the market moves out of the pattern. Web the rising wedge is a technical chart pattern used to identify possible trend reversals. Web that advance broke out of a prior descending bullish wedge and expanded the top boundary line of the pattern. What is the rising wedge pattern? Web the wedge trading strategy is a price action trading method that focuses on the wedge chart pattern. The angled lines resemble the sides of a wedge or a slice of pie.

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Wedge Patterns How Stock Traders Can Find and Trade These Setups

How to Trade the Rising Wedge Pattern Warrior Trading

5 Chart Patterns Every Beginner Trader Should Know Brooksy

Falling & Rising Wedge Chart Patterns with OctaFX The Complete Guide

Analyzing Chart Patterns The Wedge

The Rising Wedge Pattern Explained With Examples

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

Simple Wedge Trading Strategy For Big Profits

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

In Contrast To Symmetrical Triangles, Which Have No Definitive Slope And No Bias, Falling Wedges Definitely Slope Down And Have A Bullish Bias.

There Are 2 Types Of Wedges Indicating Price Is In Consolidation.

The Wedge Pattern Is A Chart Formation Used In Technical Analysis To Predict Price Movements.

In A Wedge Pattern Two Trend Lines Are Moving In The Same Direction But Narrowing In Width.

Related Post: