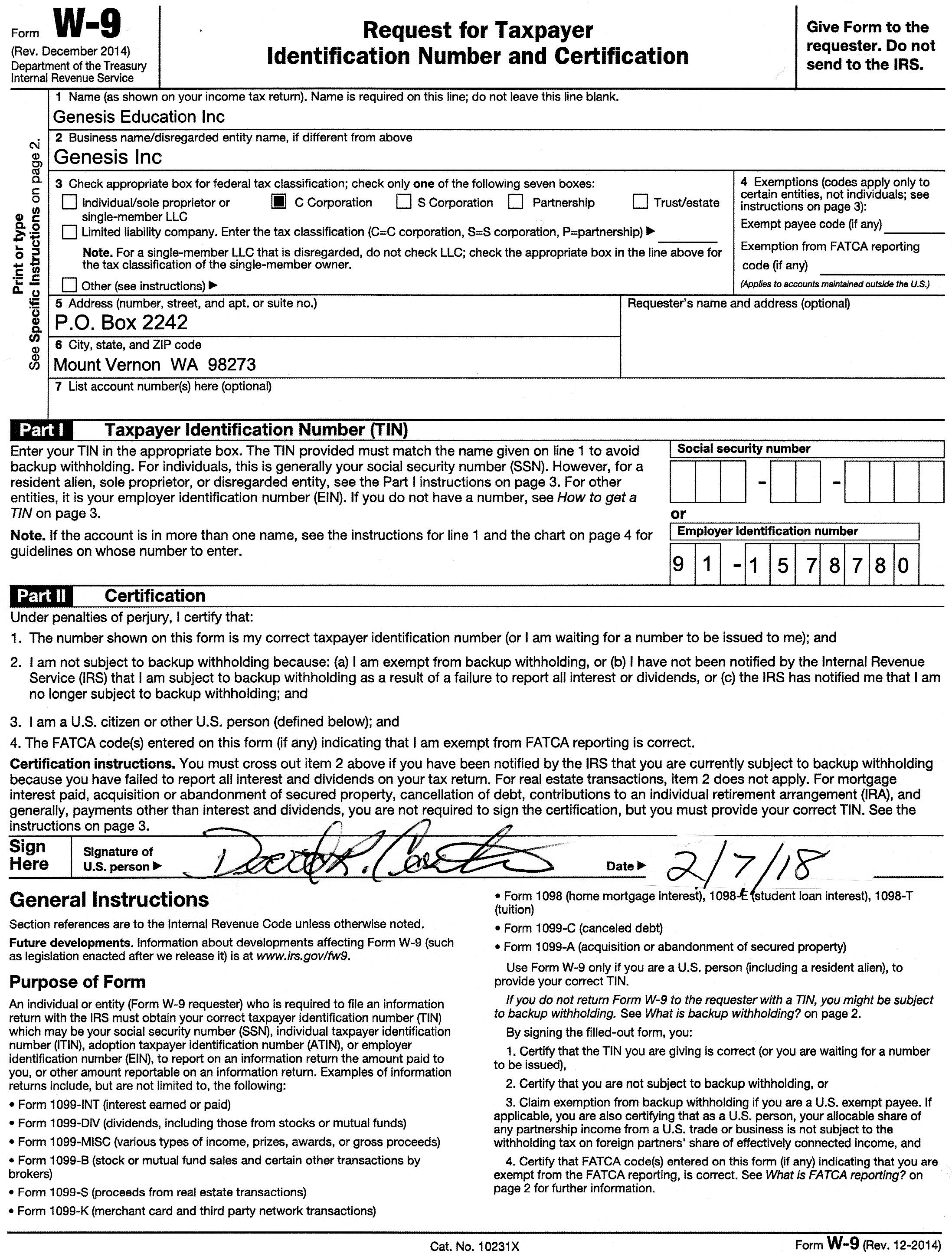

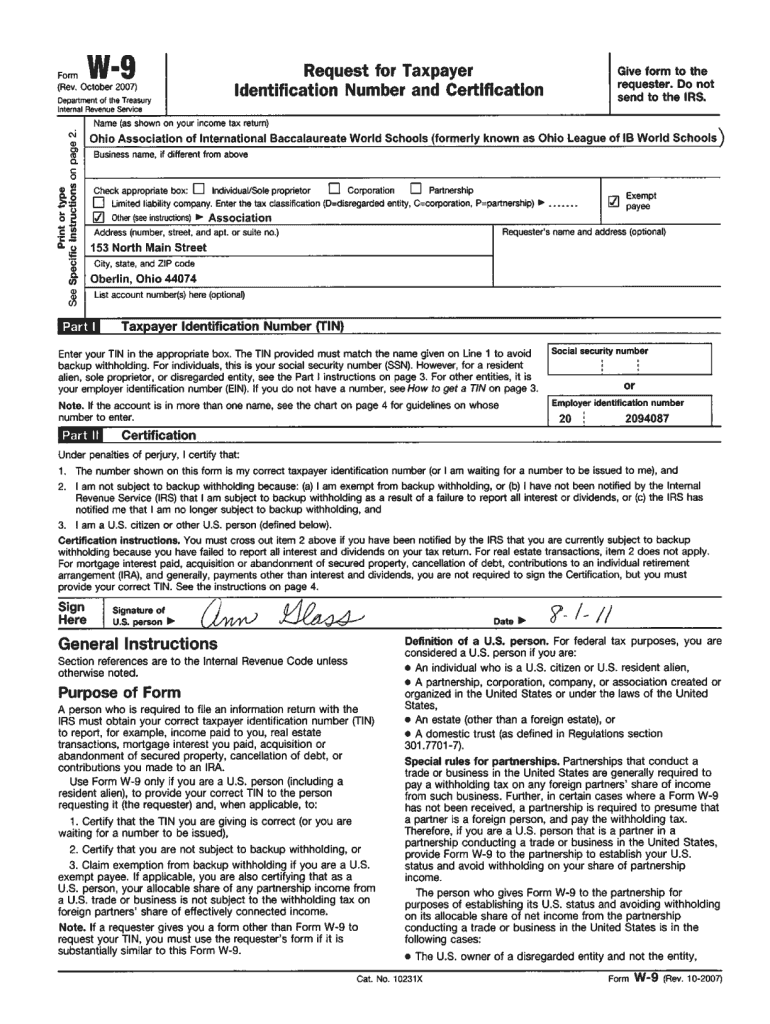

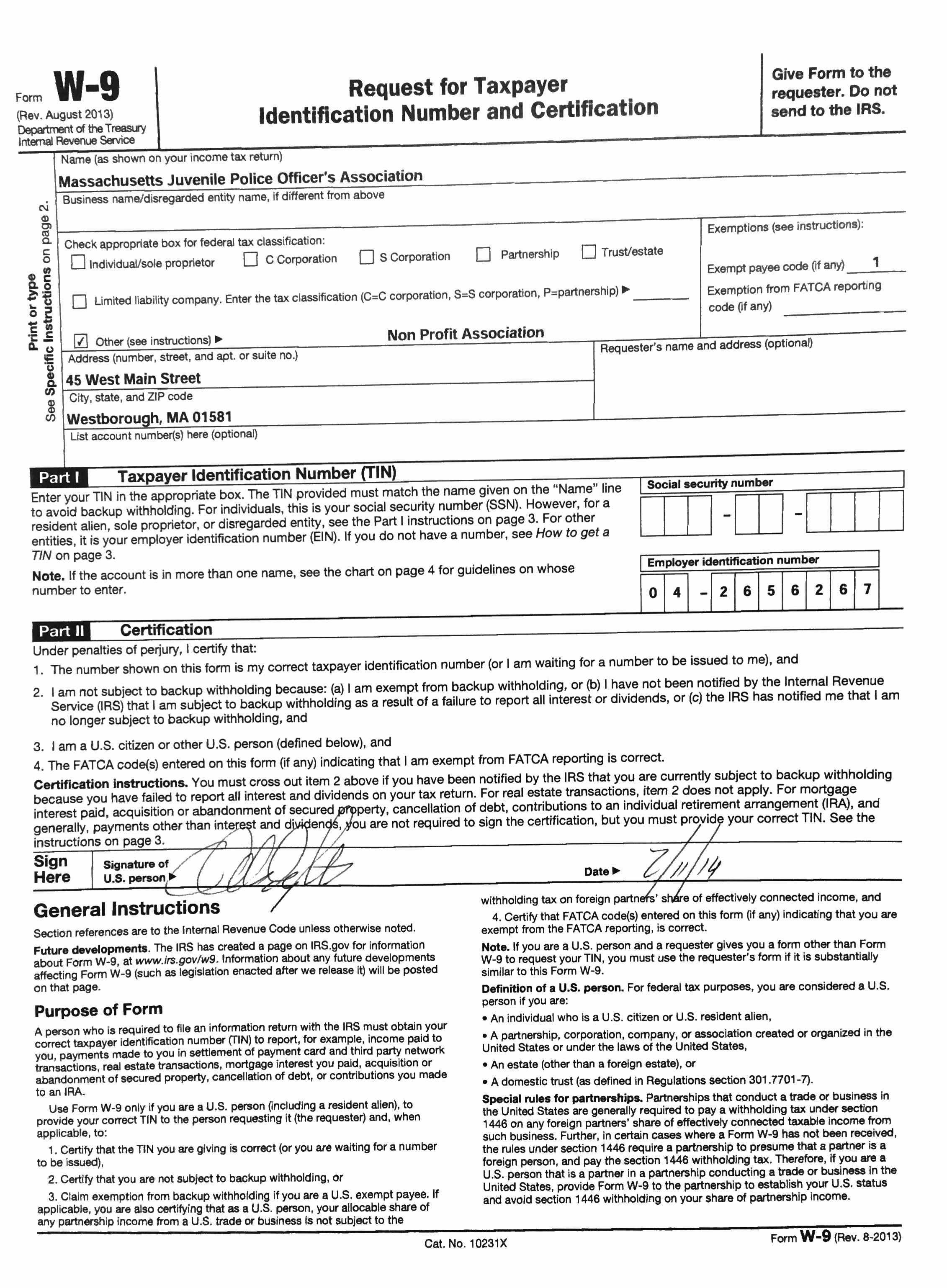

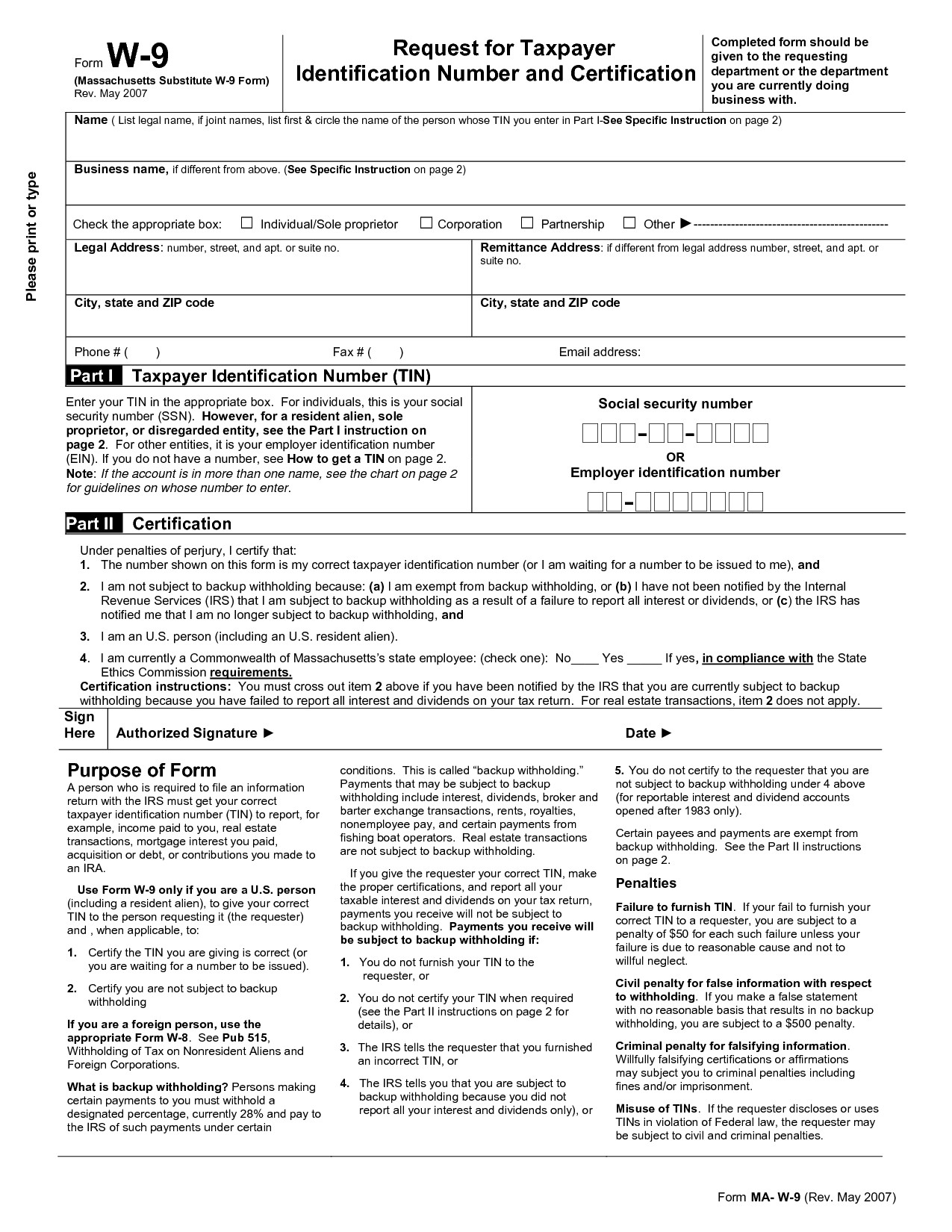

W9 Printable Form

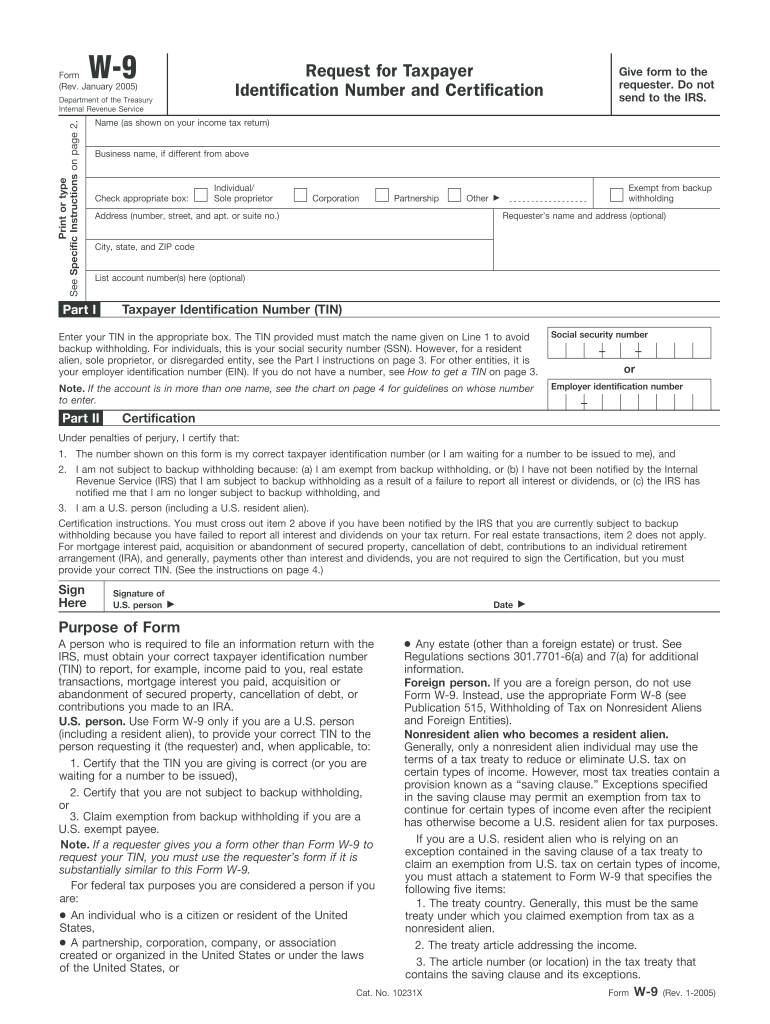

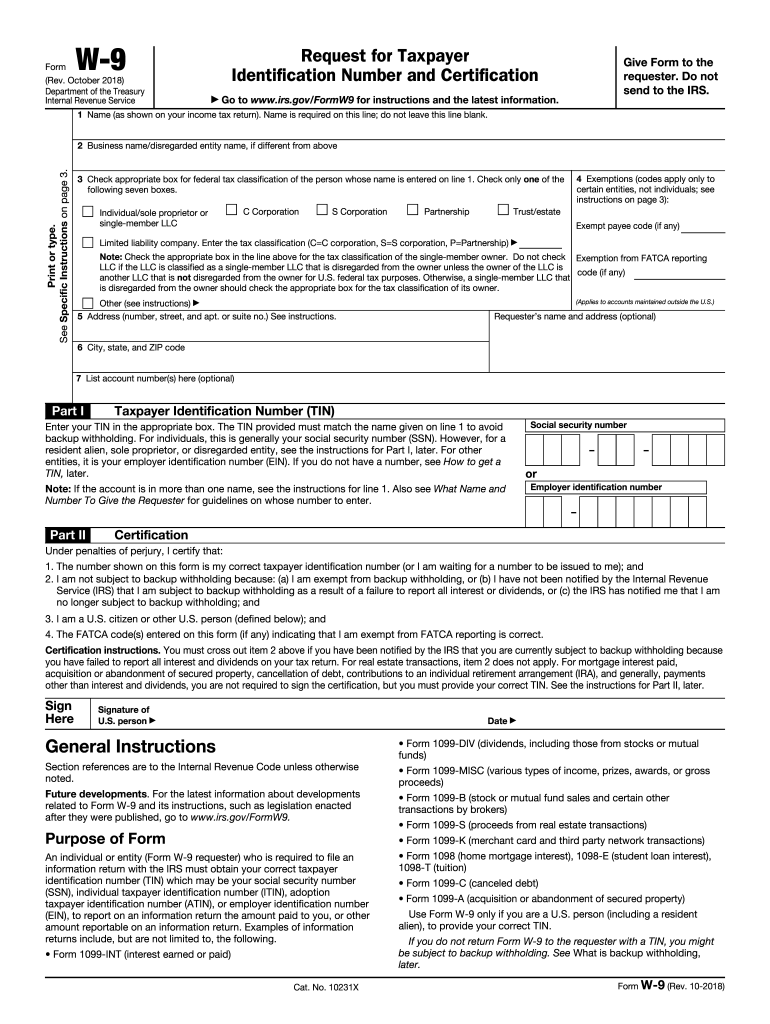

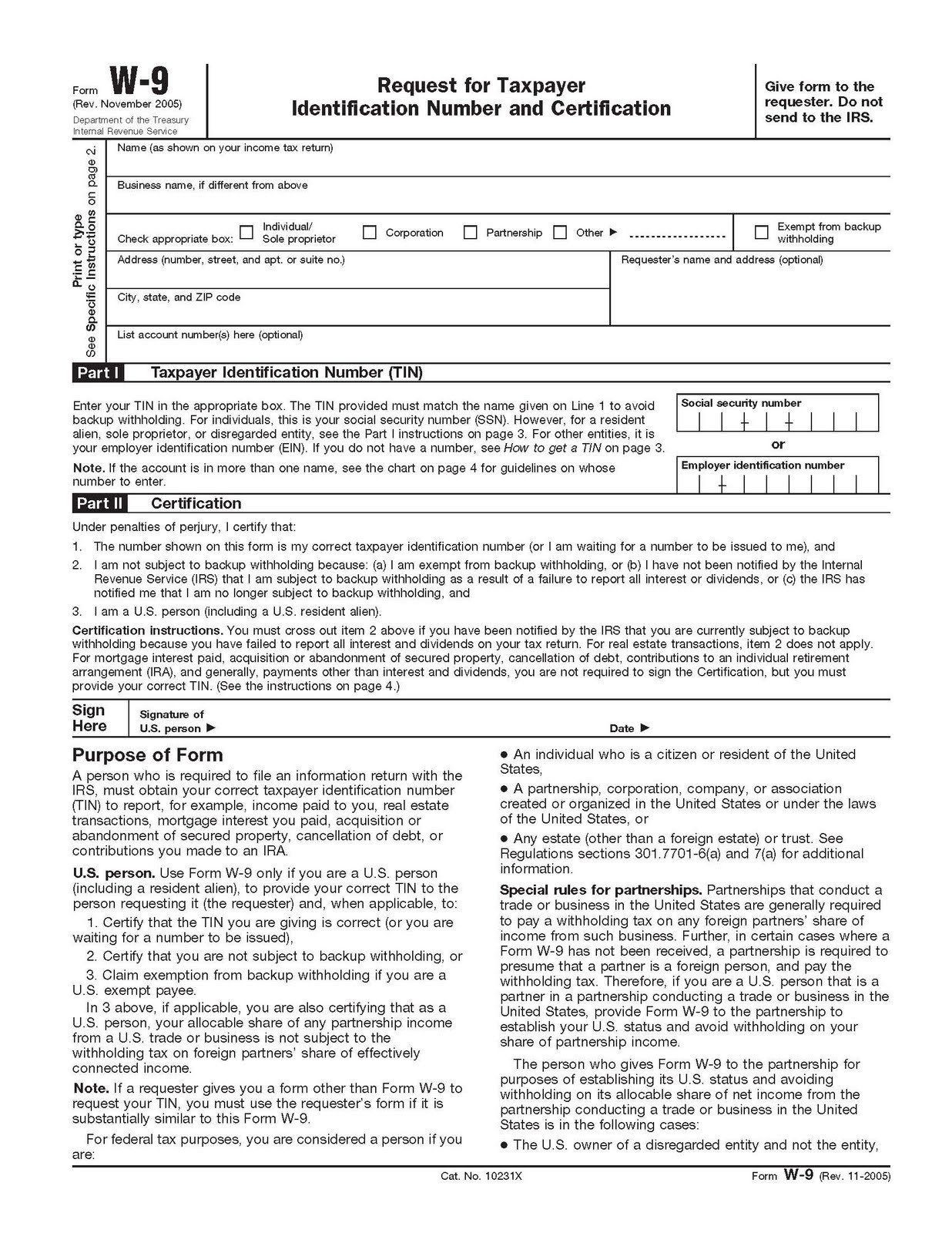

W9 Printable Form - If an account holder fails to provide its tin, then the withholding rate is 30%. Learn when and how to fill out a w9, and what to do if a w9 is not collected or incorrect. Edit on any devicecompliant and securepaperless solutionsfree mobile app Name (as shown on your income tax return) business name/disregarded entity name, if different. Web the 150th running of the illustrious horse race is set to occur saturday, with the 20 horses taking their posts at approximately 6:57 p.m. August 2013) department of the treasury internal revenue service. Free mobile app30 day free trial24/7 tech supporttrusted by millions Learn how to fill out the form, what information to provide, and what changes have been made since the previous version. Request for taxpayer identification number and certification. Web download a free pdf of irs form w9, a document used to obtain the tax identification number of an individual or business entity. Learn when and how to fill out a w9, and what to do if a w9 is not collected or incorrect. Request for taxpayer identification number and certification. Learn the purpose, instructions, and special rules for u.s. Do not send to the irs. Web enter your ssn, ein or individual taxpayer identification as appropriate. Web enter your ssn, ein or individual taxpayer identification as appropriate. Request for taxpayer identification number and certification. August 2013) department of the treasury internal revenue service. The form helps businesses obtain important information from payees to prepare information returns for the irs. For individuals, the tin is. Learn the purpose, instructions, and special rules for u.s. Learn when and how to fill out a w9, and what to do if a w9 is not collected or incorrect. Give form to the requester. The form helps businesses obtain important information from payees to prepare information returns for the irs. August 2013) department of the treasury internal revenue service. Name (as shown on your income tax return) business name/disregarded entity name, if different. Web enter your ssn, ein or individual taxpayer identification as appropriate. Free mobile app30 day free trial24/7 tech supporttrusted by millions Web the 150th running of the illustrious horse race is set to occur saturday, with the 20 horses taking their posts at approximately 6:57 p.m.. Web download a free pdf of irs form w9, a document used to obtain the tax identification number of an individual or business entity. Learn how to fill out the form, what information to provide, and what changes have been made since the previous version. If an account holder fails to provide its tin, then the withholding rate is 30%.. Learn how to fill out the form, what information to provide, and what changes have been made since the previous version. The form helps businesses obtain important information from payees to prepare information returns for the irs. Web enter your ssn, ein or individual taxpayer identification as appropriate. Name (as shown on your income tax return) business name/disregarded entity name,. Free mobile app30 day free trial24/7 tech supporttrusted by millions If an account holder fails to provide its tin, then the withholding rate is 30%. Web enter your ssn, ein or individual taxpayer identification as appropriate. Learn how to fill out the form, what information to provide, and what changes have been made since the previous version. For individuals, the. Learn when and how to fill out a w9, and what to do if a w9 is not collected or incorrect. Edit on any devicecompliant and securepaperless solutionsfree mobile app Learn the purpose, instructions, and special rules for u.s. Do not send to the irs. August 2013) department of the treasury internal revenue service. Give form to the requester. Learn the purpose, instructions, and special rules for u.s. Free mobile app30 day free trial24/7 tech supporttrusted by millions Do not send to the irs. If an account holder fails to provide its tin, then the withholding rate is 30%. For individuals, the tin is. If an account holder fails to provide its tin, then the withholding rate is 30%. Web solved•by turbotax•1237•updated december 14, 2023. Give form to the requester. The form helps businesses obtain important information from payees to prepare information returns for the irs. Learn how to fill out the form, what information to provide, and what changes have been made since the previous version. Name (as shown on your income tax return) business name/disregarded entity name, if different. Edit on any devicecompliant and securepaperless solutionsfree mobile app Web solved•by turbotax•1237•updated december 14, 2023. August 2013) department of the treasury internal revenue service. The form helps businesses obtain important information from payees to prepare information returns for the irs. For individuals, the tin is. Request for taxpayer identification number and certification. Web enter your ssn, ein or individual taxpayer identification as appropriate. Free mobile app30 day free trial24/7 tech supporttrusted by millions Give form to the requester. Learn the purpose, instructions, and special rules for u.s. Do not send to the irs.

Printable W9 Form for W9 Tax Form 2016

2022 W9 Form Printable W9 Form 2022 (Updated Version)

USBCI W9 Form by Utah Governor's Office of Economic Opportunity Issuu

Ohio W9 Form 2023 Complete with ease airSlate SignNow

How to Submit Your W 9 Forms Pdf Free Job Application Form

W9 Blank Form 2020 Example Calendar Printable

W 9 Printable Form Example Calendar Printable

Free Blank W 9 Form Example Calendar Printable

W 9 20182024 Form Fill Out and Sign Printable PDF Template

Free Printable Blank W9 Form 2021 Calendar Template Printable

Web Download A Free Pdf Of Irs Form W9, A Document Used To Obtain The Tax Identification Number Of An Individual Or Business Entity.

If An Account Holder Fails To Provide Its Tin, Then The Withholding Rate Is 30%.

Learn When And How To Fill Out A W9, And What To Do If A W9 Is Not Collected Or Incorrect.

Web The 150Th Running Of The Illustrious Horse Race Is Set To Occur Saturday, With The 20 Horses Taking Their Posts At Approximately 6:57 P.m.

Related Post: