W2 Templates

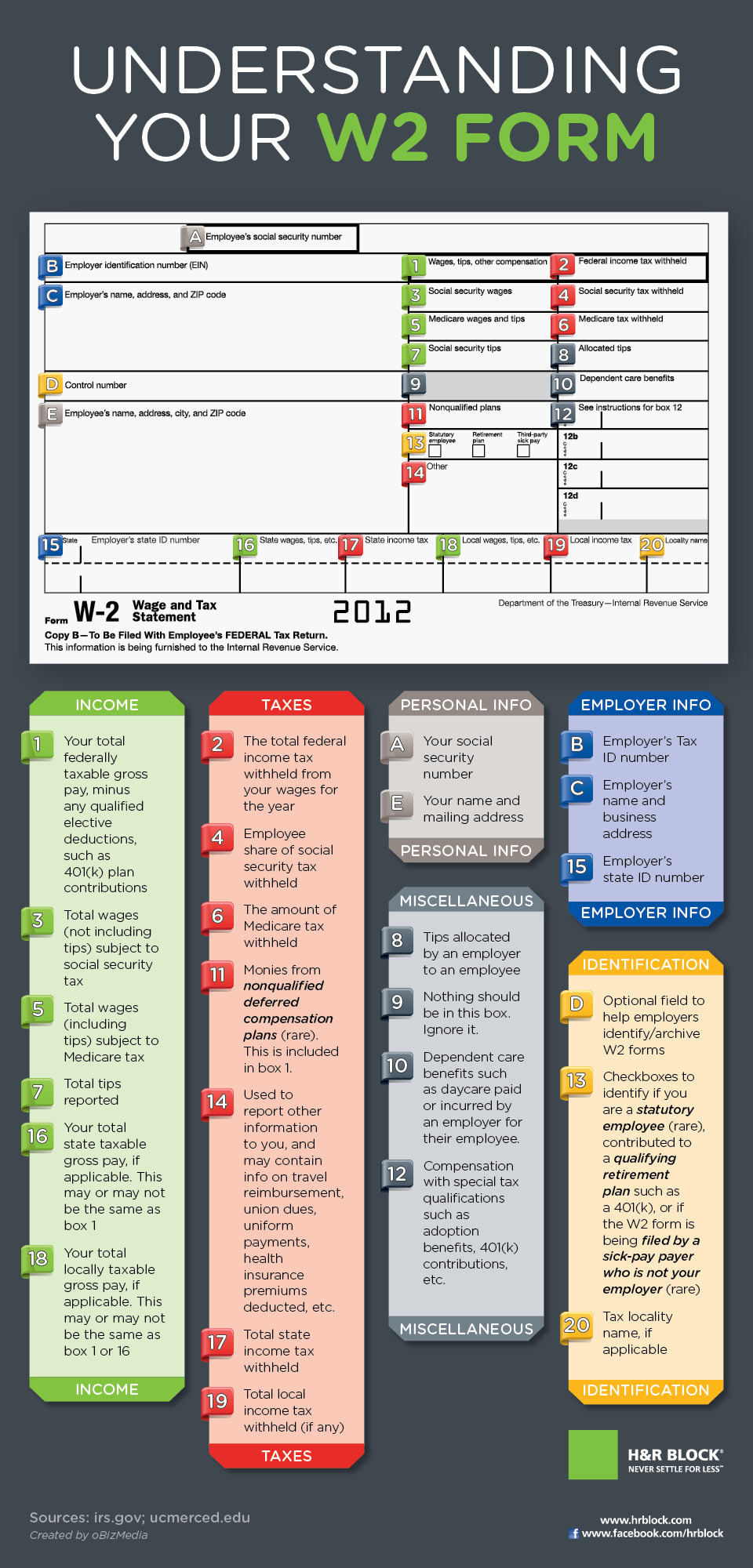

W2 Templates - Forms are submitted to the ssa (social security administration) and the information is shared with the irs. Shows how much federal income tax was withheld from your pay by your employer. Web updated december 15, 2023. Send it to your state, city, or local tax department (check their website for specifics). With a customizable template, just input specific details of the employer and the employee’s wages details like total gross income, adjusted gross income, and local and state taxes such as the federal income tax, local state tax, social security tax, etc. Instead, you can create and submit them online. How do i delete the templates we no longer need? Web many online w2 templates use the irs’ “information only” copy, which has the second page printed in red. Copies b, c, and 2: Having a clear training schedule and objectives can help the transition go smoothly, and also provides a document for both the new employee and manager to refer to with questions and updates. Shows how much federal income tax was withheld from your pay by your employer. With a customizable template, just input specific details of the employer and the employee’s wages details like total gross income, adjusted gross income, and local and state taxes such as the federal income tax, local state tax, social security tax, etc. It also includes other deductions.. Simply download the template, fill in the gaps, and share it with your workers. See the form 1040 instructions to determine if you are required to complete form 8959. Instead, you can create and submit them online. Personal information for each employee, including name, address, and social security number. Forms are submitted to the ssa (social security administration) and the. Box b—employer identification number (ein): How do i delete the templates we no longer need? Our team have been practising building their own quiz templates (book pages). How can i delete all our test practice quiz. Simply download the template, fill in the gaps, and share it with your workers. Hand these over to your employees for their records. Providing your company information, as well as the employee information and wage details is all you need to. Web updated december 15, 2023. With a customizable template, just input specific details of the employer and the employee’s wages details like total gross income, adjusted gross income, and local and state taxes. Enter this amount on the federal income tax withheld line of your tax return. Web enter this amount on the wages line of your tax return. Keep it for at least four years as a record. Having a clear training schedule and objectives can help the transition go smoothly, and also provides a document for both the new employee and. Box b—employer identification number (ein): Web instead, you can create and submit them online. After the introductory training period is. You may be required to report this amount on form 8959, additional medicare tax. But there is a fee of $126 per request if you need them for an unrelated reason. Copies b, c, and 2: This copy will have all pages printed in black, and is. With a customizable template, just input specific details of the employer and the employee’s wages details like total gross income, adjusted gross income, and local and state taxes such as the federal income tax, local state tax, social security tax, etc. Instead, you can. By january 31, 2025, furnish copies b, c, and 2 to each person who was your employee during 2024. See the form 1040 instructions to determine if you are required to complete form 8959. This copy will have all pages printed in black, and is. Providing your company information, as well as the employee information and wage details is all. Copies b, c, and 2: Web this employee training plan template is designed for new hires to help facilitate the onboarding process. Having a clear training schedule and objectives can help the transition go smoothly, and also provides a document for both the new employee and manager to refer to with questions and updates. Web download your printable w2 form.. Our team have been practising building their own quiz templates (book pages). Web instead, you can create and submit them online. Details how much you were paid in wages, tips, bonuses and other compensation. This document shows the total earnings of an employee for the year, as well as the amount of taxes withheld from their paychecks. Web the iowa. Copies b, c, and 2: This document shows the total earnings of an employee for the year, as well as the amount of taxes withheld from their paychecks. By january 31, 2025, furnish copies b, c, and 2 to each person who was your employee during 2024. It includes information about the income and benefits you received during the tax year, so you’ll. Instead, you can create and submit them online. Forms are submitted to the ssa (social security administration) and the information is shared with the irs. Having a clear training schedule and objectives can help the transition go smoothly, and also provides a document for both the new employee and manager to refer to with questions and updates. How can i delete all our test practice quiz. Personal information for each employee, including name, address, and social security number. How do i delete the templates we no longer need? Web updated december 15, 2023. For example, in the template drop down menu of the quiz question component (multiple choice as an example) we can see all the test templates we created. What is a w2 form? Total amount of wages and/or tips paid for each employee. Web instead, you can create and submit them online. By january 31, 2022, furnish copies b, c, and 2 to each person who was your employee during 2021.

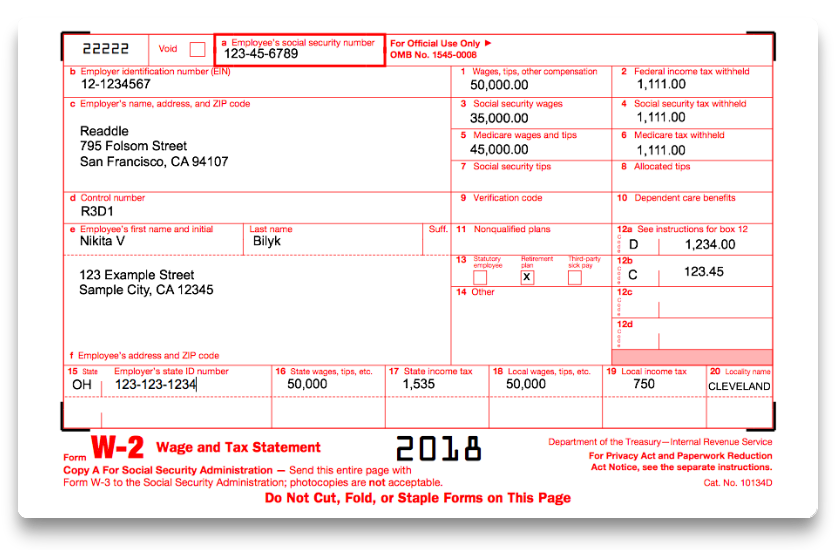

W2 Form Copy C or Copy 2 (LW2CLW22)

How to fill out IRS Form W2 20172018 PDF Expert

W2 Printable Forms

How to Read Your W2 When Filing Taxes for the First Time Chime

2021 Form IRS W2 Fill Online, Printable, Fillable, Blank pdfFiller

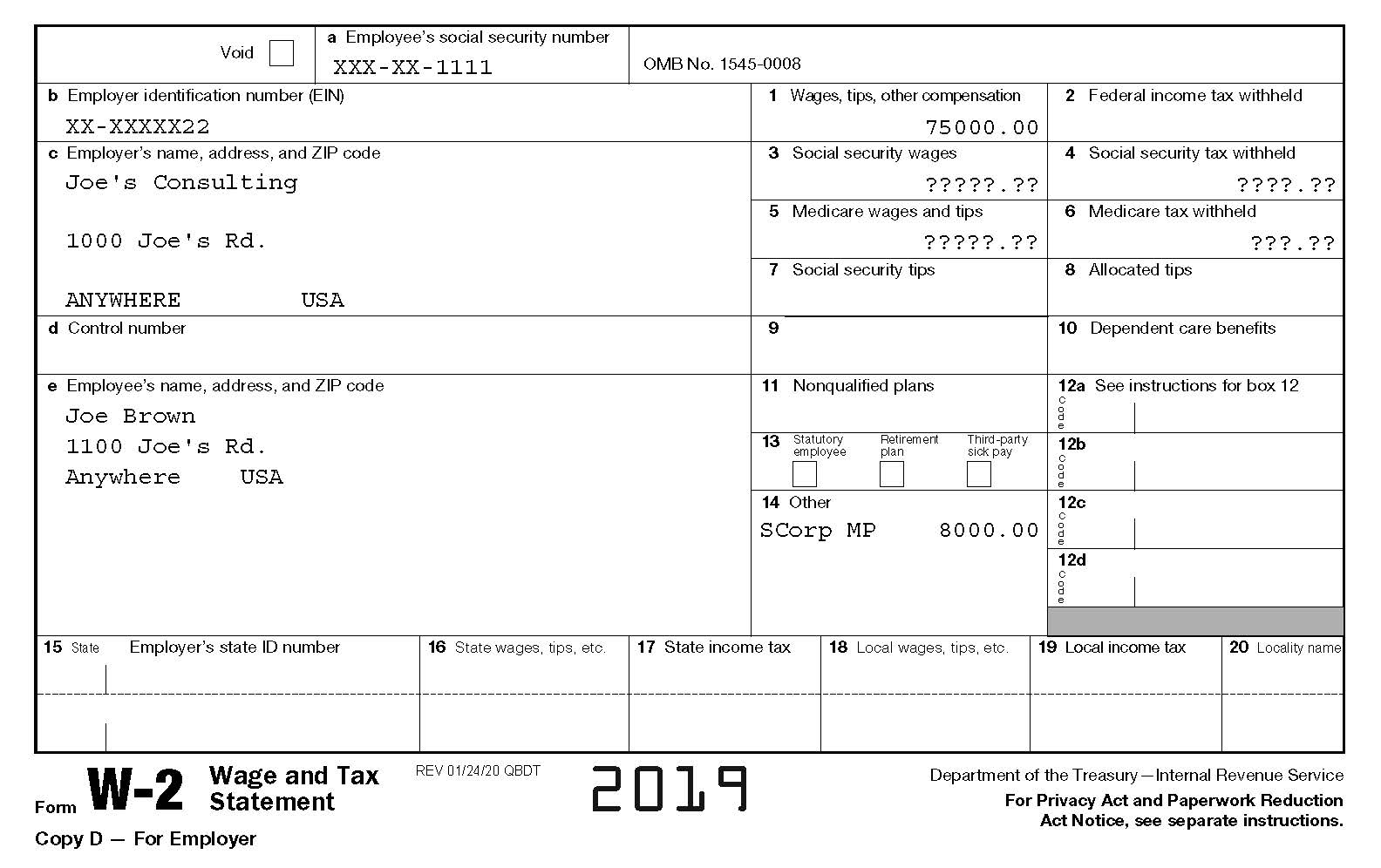

W2 Form Sample Tax Year 2019 CPA, Certified Public Accountant,

Understanding Your IRS Form W2

The Complete Guide To The W2 Form Visual.ly

How To Fill Out Form W2 Detailed guide for employers (2023)

How to fill out IRS W2 form PDF 20222023 PDF Expert

Do Not File This Red Version With The Irs Or You Will Be Subjected To Penalties.

Web This Employee Training Plan Template Is Designed For New Hires To Help Facilitate The Onboarding Process.

Shows How Much Federal Income Tax Was Withheld From Your Pay By Your Employer.

It Also Includes Other Deductions.

Related Post: