W Stock Pattern

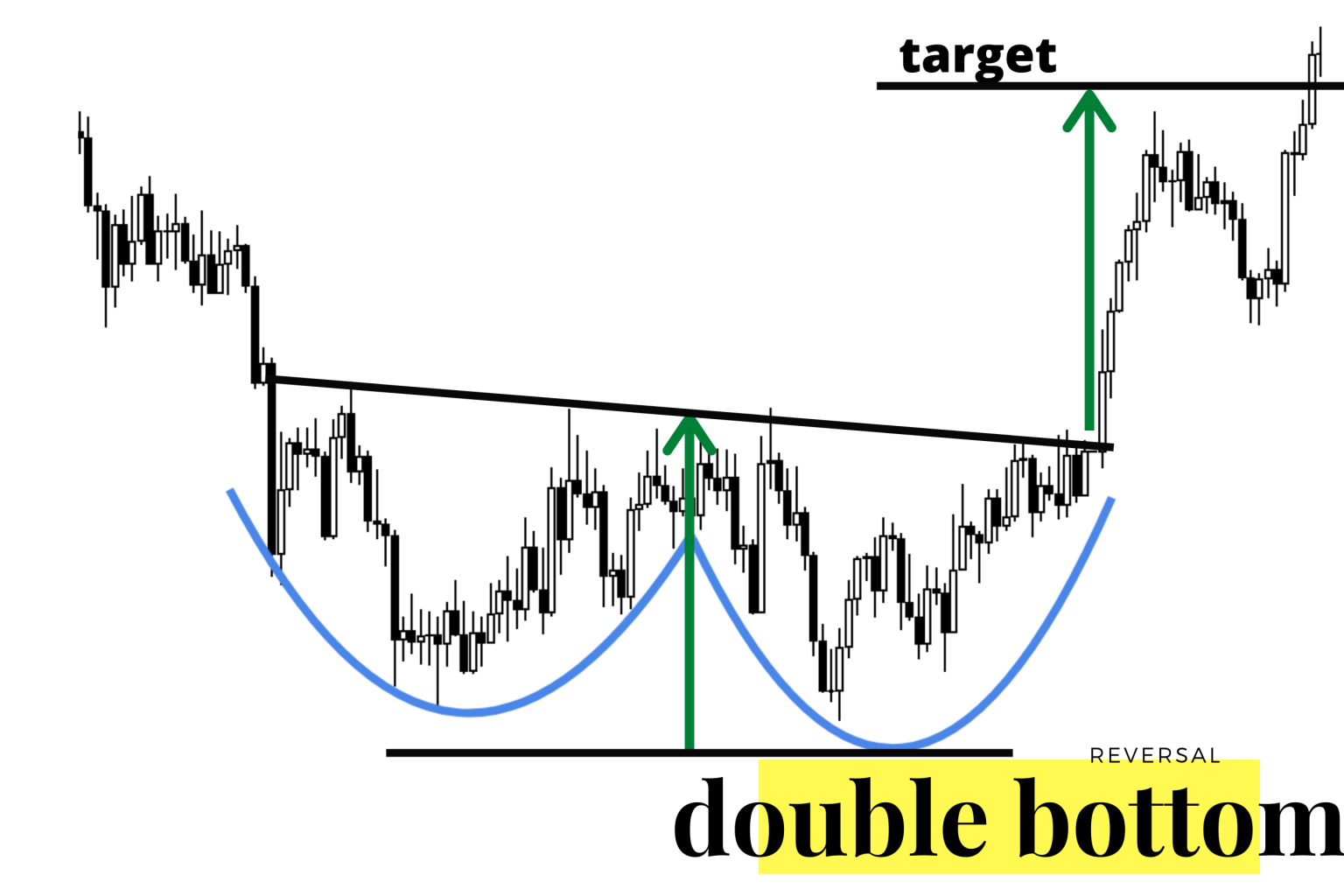

W Stock Pattern - Prematurely entering a trade before the breakout can result in losses if the pattern fails to complete. A pattern is identified by a line. The w chart pattern is a reversal pattern that is bullish as a downtrend holds support after the second test and rallies back higher. It helps in forecasting market direction with greater accuracy. Scanner guide scan examples feedback. Web the “w” pattern comes in various forms, but here are two variations. A w pattern is a double bottom chart pattern that has tall sides with a strong trend before and after the w on the chart. 12 views 1 month ago india. Web how does a w pattern chart relate to the overall trend of a stock? Greater than 1 week ago. The lower low point where the second leg bottoms out. Pattern trading is one of the technical analyses applicable in predicting reoccurring patterns. A favorite of swing traders, the w pattern can be formed over a period. Each has a proven success rate of over 85%, with an average gain of 43%. Web updated june 28, 2021. A double top is a pattern for two successive peaks, which may or may not be of the same price levels. Understanding the pattern’s implications is vital for both bullish and bearish traders. Web how does a w pattern chart relate to the overall trend of a stock? “w” pattern with a double bottom. For a “w” pattern to be. Many patterns fall under “ pattern trading ;” however, w and m pattern trading is an essential tool. The support level of where the w pattern stocks began forming during the bearish trend. This pattern indicates that the asset has faced support twice at a similar level and may be due for a reversal in trend. Using double top and. ☆ research you can trust ☆. Patterns are the distinctive formations created by the movements of security prices on a chart and are the foundation of technical analysis. Web trading the w pattern involves identifying the pattern formation, waiting for the breakout, and then executing a trade. Pattern trading is one of the technical analyses applicable in predicting reoccurring patterns.. ☆ research you can trust ☆. The renko charts must be in an uptrend. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. It helps in forecasting market direction with greater accuracy. It’s important to note that patience is key when trading this pattern. Web the w pattern is a chart formation that appears as two consecutive lows separated by a peak. Web published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and descending triangle. Greater than 1 week ago. It resembles the letter “w”. It is considered a continuation pattern, indicating. Web trading the w pattern involves identifying the pattern formation, waiting for the breakout, and then executing a trade. A w pattern is a double bottom chart pattern that has tall sides with a strong trend before and after the w on the chart. Double top and bottom patterns are chart. Each has a proven success rate of over 85%,. A double top is a pattern for two successive peaks, which may or may not be of the same price levels. Web updated june 28, 2021. Stock passes all of the below filters in cash segment: Understanding the pattern’s implications is vital for both bullish and bearish traders. It is considered a continuation pattern, indicating that the prevailing trend is. Stock passes all of the below filters in cash segment: Are there any specific industries or sectors where w pattern charts are particularly effective? Web weekly w pattern, technical analysis scanner. Web consequently, the double bottom chart pattern resembles the letter “w.” this “w” pattern forms when prices register two distinct lows on a chart. It resembles the letter “w”. Web w pattern trading is a technical trading strategy using stock market indicators to help locate entry and exit points. “w” pattern with the right bottom being lower than the previous bottom. Pattern trading is one of the technical analyses applicable in predicting reoccurring patterns. How do you know when a stock has stopped going up? Web trading the w. Using double top and bottom patterns in a profitable way: The peak of the bounce back up. The renko charts must be in an uptrend. Stock passes all of the below filters in cash segment: Greater than 1 week ago. A double top is a pattern for two successive peaks, which may or may not be of the same price levels. Web trading the w pattern involves identifying the pattern formation, waiting for the breakout, and then executing a trade. This pattern indicates that the asset has faced support twice at a similar level and may be due for a reversal in trend. These patterns typically form when a stock’s price rises to a high point before dropping, then rises again to a lower high point before dropping once more. Scanner guide scan examples feedback. It’s important to note that patience is key when trading this pattern. However, the definition of a true double bottom is achieved only when prices rise above the highest point of the entire formation, leaving the entire pattern behind. Understanding the pattern’s implications is vital for both bullish and bearish traders. Are there any specific industries or sectors where w pattern charts are particularly effective? What are some common mistakes traders make when interpreting w pattern charts? Renowned for its demonstrative signal of a bullish reversal, w in stock charts is a primary focus for investors and traders alike.

W Pattern Trading The Forex Geek

Stock Market Chart Analysis FORD Bullish W pattern

MAKING " W ' PATTERN ON DAILY CHART LOOKING BULLISH สำหรับ NSEEXIDEIND

W Forex Pattern Fast Scalping Forex Hedge Fund

Three Types of W Patterns MATI Trader

W Pattern Trading YouTube

Three Types of W Patterns MATI Trader

W Pattern Trading New Trader U

W pattern forex

Wpattern — TradingView

The Support Level Of Where The W Pattern Stocks Began Forming During The Bearish Trend.

The W Chart Pattern Is A Reversal Pattern That Is Bullish As A Downtrend Holds Support After The Second Test And Rallies Back Higher.

“W” Pattern With The Right Bottom Being Lower Than The Previous Bottom.

Web Big W Is A Double Bottom Chart Pattern With Talls Sides.

Related Post: