W Pattern

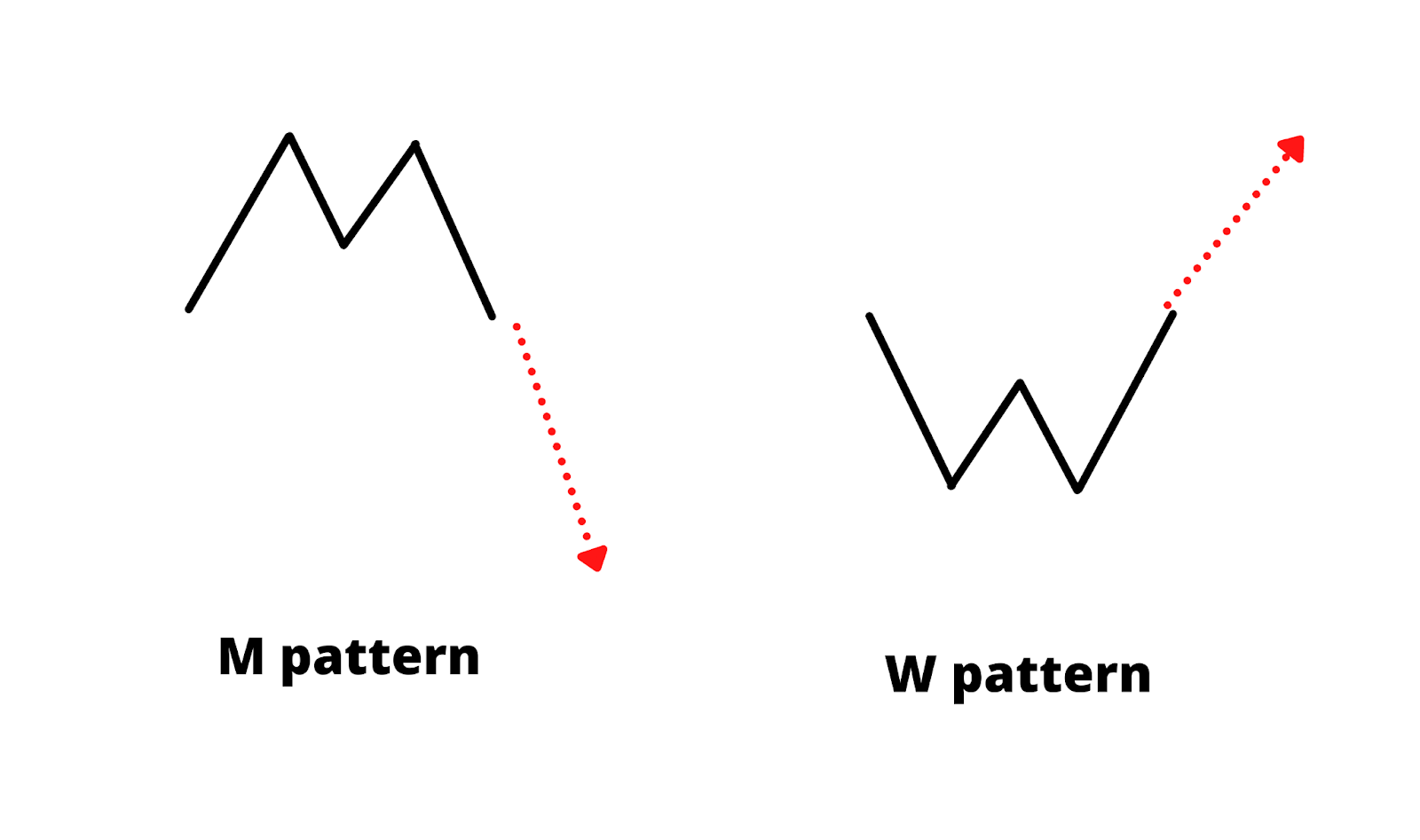

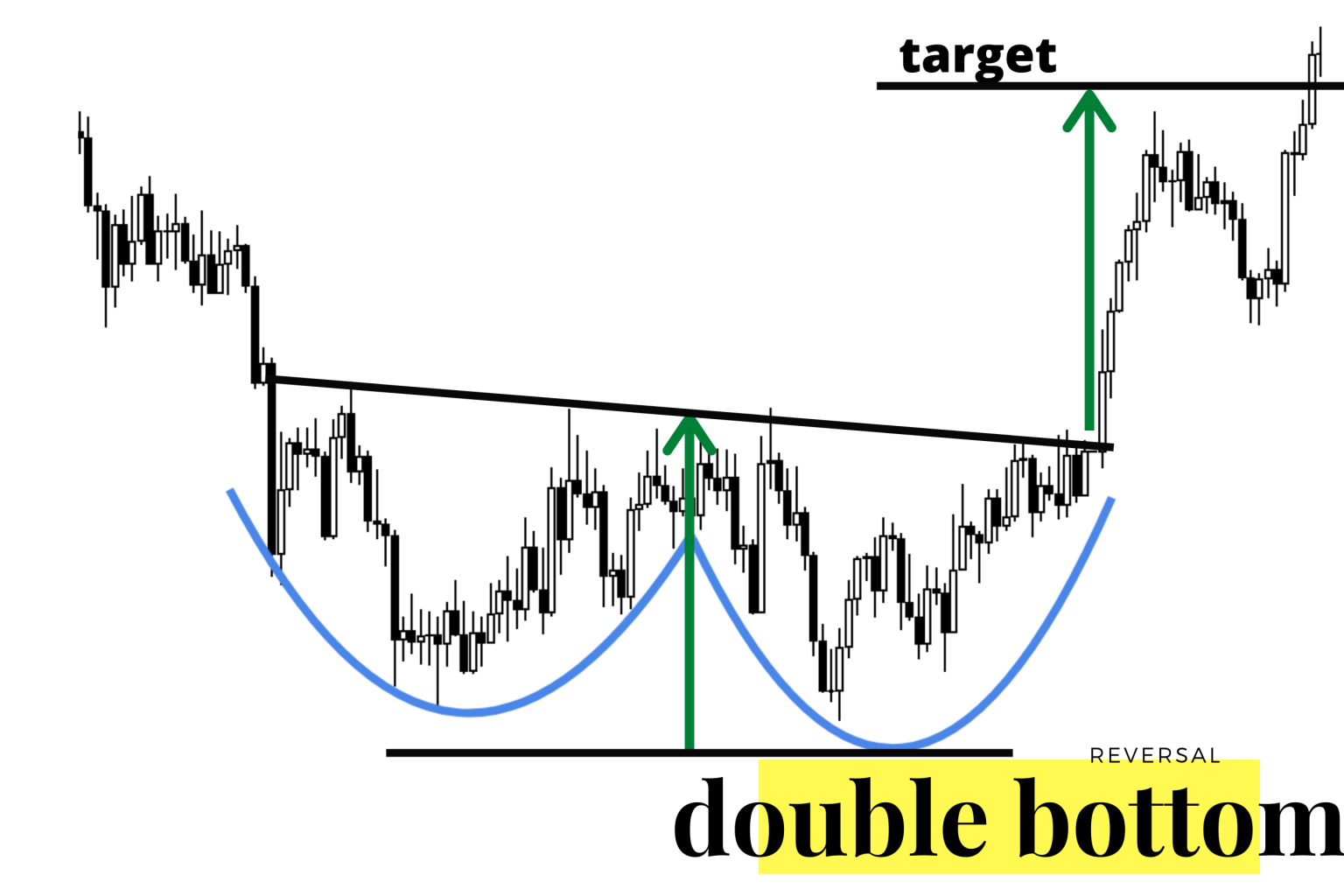

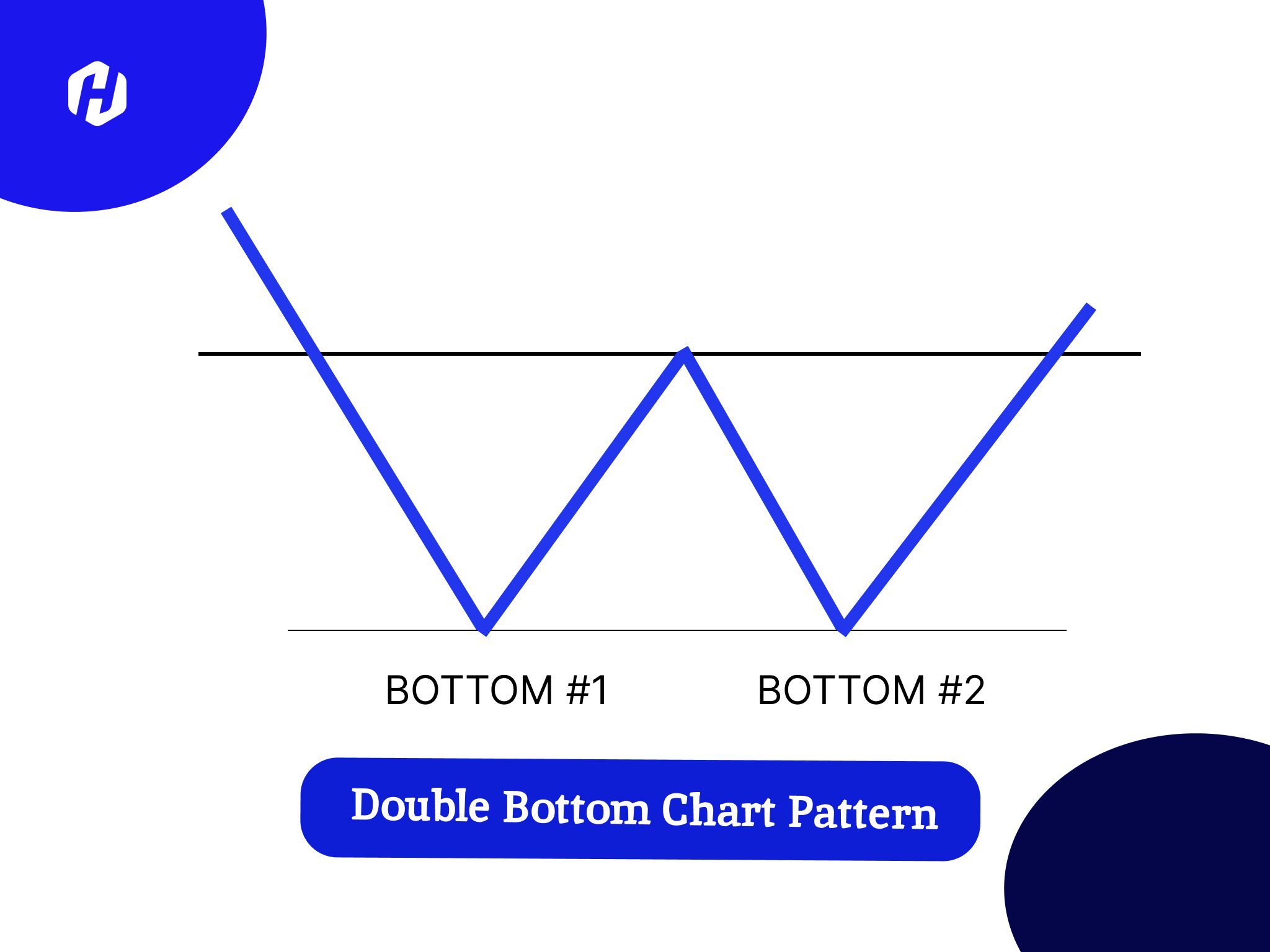

W Pattern - Web big w is a double bottom chart pattern with talls sides. 📈 whether you're a beginner or an experienced trader, understanding this double bottom formation. How to crochet the herringbone double crochet stitch with any yarn and hook. Web learn how to identify and interpret the w and m patterns, two classic reversal chart patterns that signal a change from a bearish to a bullish trend. Web w patterns, recognized as double bottoms, suggest a bullish reversal following a drop in a security’s price. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. The w chart pattern is a. Web yarn over and pull through the remaining 2 loops on your hook. Make summertime all about relaxation and adventure! Here are my favorite free sewing. Web by steve burns. Make summertime all about relaxation and adventure! Understanding the fundamentals of w pattern chart in the stock market. The w chart pattern is a. Educational ideas 149 scripts 71. It is called the w pattern because it forms a distinct shape that resembles. Web big w is a double bottom chart pattern with talls sides. Educational ideas 149 scripts 71. Make summertime all about relaxation and adventure! Web the w pattern, also known as the double bottom pattern, is formed when the price creates two distinct lows with a. Web the “w” pattern is indicative of a corrective or reversal move. Web by steve burns. Don't miss the entry of a lifetime. See live alerts, backtest results, and examples of w pattern formation. Web overview of w bottoms and tops chart patterns. Identifying double bottoms and reversals. Web learn what a w pattern is, how to spot it on price charts, and how to use it for trading strategies. Web scan stocks based on the w pattern, a bullish reversal pattern in technical analysis. Web the w pattern, as the name suggests, resembles the letter “w” and is formed by two successive. Web w pattern is a technical analysis tool that predicts bearish or bullish reversals based on the shape of the peaks and troughs of a security's price movement. Don't miss the entry of a lifetime. Identifying double bottoms and reversals. The article includes identification guidelines, trading tactics, and performance statistics, by internationally known author. Understanding the fundamentals of w pattern. Web by steve burns. 📈 whether you're a beginner or an experienced trader, understanding this double bottom formation. Web triple zipper bag pattern. A w pattern is a chart formation that signals a potential bullish. Web learn what a w pattern is, how to spot it on price charts, and how to use it for trading strategies. Web scan stocks based on the w pattern, a bullish reversal pattern in technical analysis. Understanding the fundamentals of w pattern chart in the stock market. Web learn how to identify and interpret the w and m patterns, two classic reversal chart patterns that signal a change from a bearish to a bullish trend. Web technical & fundamental stock screener,. It is called the w pattern because it forms a distinct shape that resembles. Web triple zipper bag pattern. This handbag pattern is a reader’s favorite. Web by steve burns. A w pattern is a chart formation that signals a potential bullish. Web w patterns, recognized as double bottoms, suggest a bullish reversal following a drop in a security’s price. The article includes identification guidelines, trading tactics, and performance statistics, by internationally known author. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Here are my favorite free. Web yarn over and pull through the remaining 2 loops on your hook. Educational ideas 149 scripts 71. Web in the realm of market analysis, the w trading pattern emerges as a critical indicator for traders looking to capture bullish reversal signals. See live alerts, backtest results, and examples of w pattern formation. Understanding the fundamentals of w pattern chart. Web big w is a double bottom chart pattern with talls sides. Web learn how to identify and interpret the w and m patterns, two classic reversal chart patterns that signal a change from a bearish to a bullish trend. It is called the w pattern because it forms a distinct shape that resembles. The structure of w pattern: Therefore, when a “w” renko chart pattern is spotted, we always take a short position as described. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. The clever triple zipper bag has three zippers on the outside and another coin pocket inside! Web the w pattern, as the name suggests, resembles the letter “w” and is formed by two successive downward price movements followed by an upward. W pattern trading is a technical strategy to identify trend reversals on stock charts. See live alerts, backtest results, and examples of w pattern formation. Web by steve burns. This handbag pattern is a reader’s favorite. Web explore the power of the w pattern in this comprehensive chart analysis video. Web the “w” pattern is indicative of a corrective or reversal move. The w chart pattern is a. Web triple zipper bag pattern.

W Pattern Trading The Forex Geek

W Pattern Trading vs. M Pattern Strategy Choose One or Use Both? • FX

Wpattern — TradingView

W pattern forex

Three Types of W Patterns MATI Trader

Three Types of W Patterns MATI Trader

w pattern in trading indepth guide for beginner

W Pattern Trading New Trader U

W Forex Pattern Fast Scalping Forex Hedge Fund

Panduan Lengkap Mengenai Pola W Trading Pattern HSB Investasi

A W Pattern Is A Double Bottom Chart Pattern That Has Tall Sides With A Strong Trend Before And After The W On The Chart.

Here Are My Favorite Free Sewing.

Web Yarn Over And Pull Through The Remaining 2 Loops On Your Hook.

Educational Ideas 149 Scripts 71.

Related Post: