W Pattern Trading

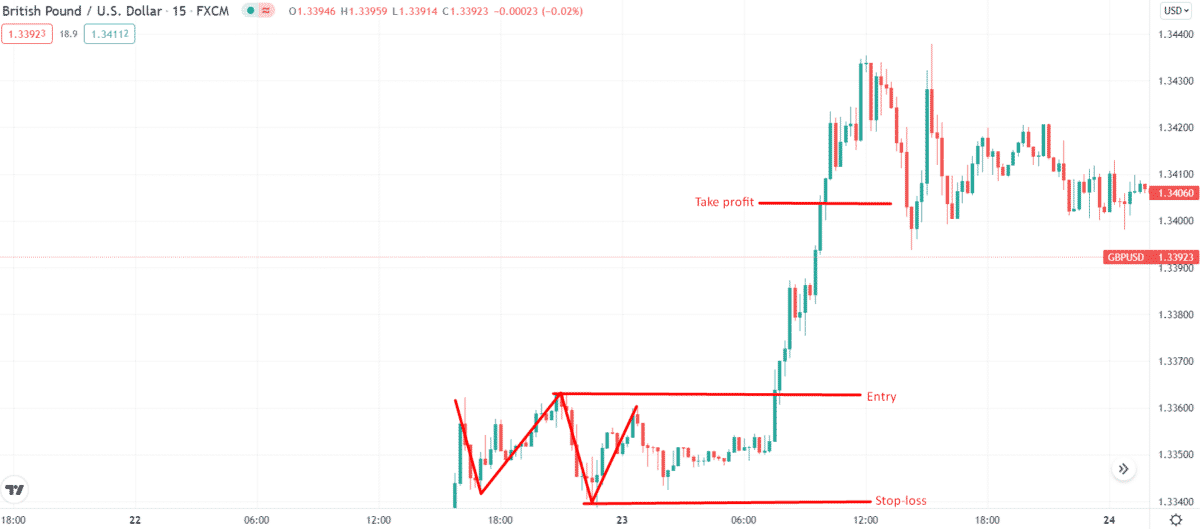

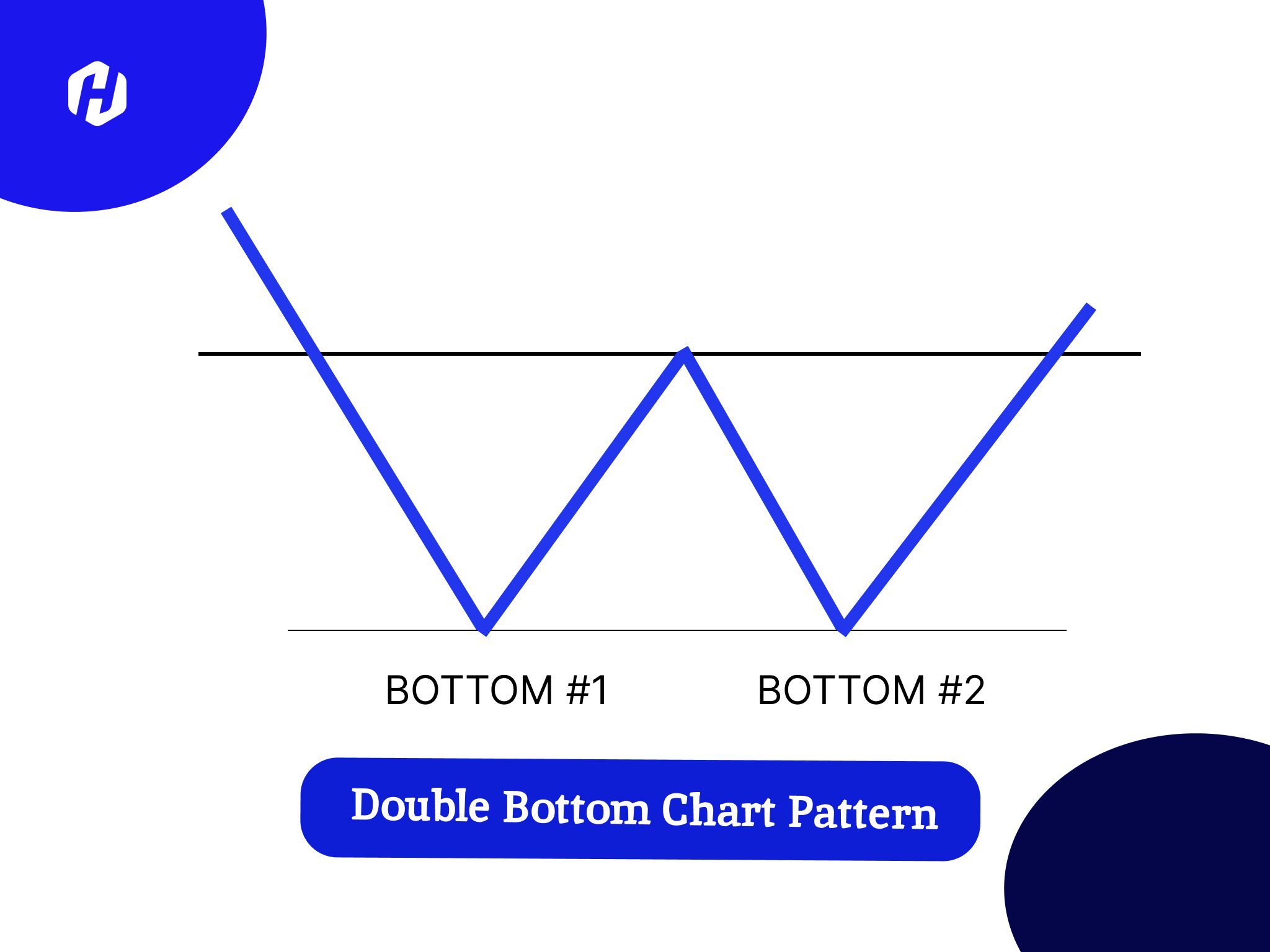

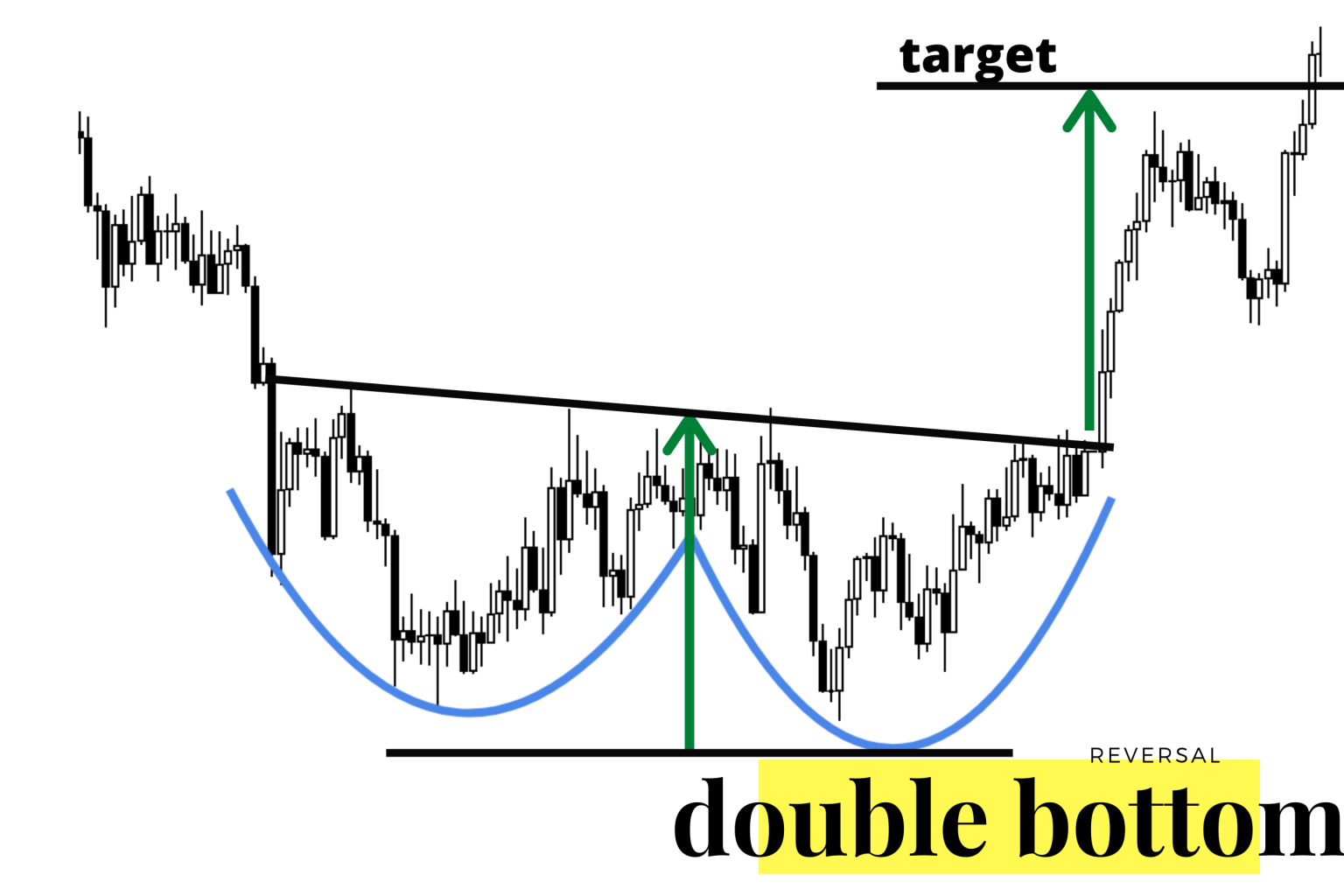

W Pattern Trading - The article includes identification guidelines, trading tactics, and performance statistics, by internationally known author. The best time frame depends on. Web the “w” pattern is bullish in nature. Best time frame to trade. Web overview of w bottoms and tops chart patterns. Web trading the w pattern involves identifying the pattern formation, waiting for the breakout, and then executing a trade. Web the w pattern is a technical analysis pattern that resembles the letter “w” and is formed by two consecutive troughs followed by a higher peak. Find out the steps to spot the w. Web learn how to identify and trade the “w” pattern, a reliable reversal indicator on renko charts. Compare ira optionslow cost online brokersactive trading providers Interpreting the complexities of the stock market can be compared to solving a. Web the w trading pattern: Its appearance suggests traders are increasingly uncertain, potentially. A w pattern is a bullish reversal formation that resembles the. It’s important to note that patience is key when. Web trading the w pattern involves identifying the pattern formation, waiting for the breakout, and then executing a trade. A bullish trend reversal indicator. W pattern bullish trade setup. Web explore the power of the w pattern in this comprehensive chart analysis video. Web the w pattern strategy is a technical analysis pattern used in trading to identify potential trend. Web the w pattern is a technical analysis pattern that resembles the letter “w” and is formed by two consecutive troughs followed by a higher peak. Web the “w” pattern is bullish in nature. Dm me link in bio. See examples, videos and other educational resources on tradingview. This script detects w and m patterns in price action and alerts. Web trading the w pattern involves identifying the pattern formation, waiting for the breakout, and then executing a trade. W pattern trading is a technical strategy to identify trend reversals on stock charts. Web trading_charts_50 on may 11, 2024: A w pattern is a bullish reversal formation that resembles the. How to trade so many patterns? Its appearance suggests traders are increasingly uncertain, potentially. W pattern trading is a technical strategy to identify trend reversals on stock charts. Web scan stocks based on the w pattern, a technical analysis indicator that signals a possible reversal or continuation of a trend. Web the w trading pattern: Web explore the power of the w pattern in this comprehensive. Find out the steps to spot the w. The article includes identification guidelines, trading tactics, and performance statistics, by internationally known author. Web learn how to identify and trade the w pattern, a chart pattern that signals a potential trend reversal from bearish to bullish in forex. Web april 11, 2024. Web scan stocks based on the w pattern, a. The history of arthur merrill patterns. Web the w trading pattern embodies a cornerstone concept in market analysis, spotlighting a crucial turn in the tides of investor sentiment. Find out the steps to spot the w. See live alerts, backtest results, and examples of w. Web learn what a w pattern is, how to spot it on price charts, and. Web big w is a double bottom chart pattern with talls sides. Web the concepts of trading zones (galison, 2010), boundary objects (star and griesemer, 1989), and interactional expertise (collins and evans, 2007) are particularly. Web overview of w bottoms and tops chart patterns. Dm me link in bio. Web trading the w pattern involves identifying the pattern formation, waiting. So let’s explore how to find one. Traders may use w bottoms and tops chart patterns as powerful indicators for buying and selling decisions. Trading lovers follow this page. The best time frame depends on. Web trading_charts_50 on may 11, 2024: Similar to the double bottom pattern, the w trading pattern is a bullish trend reversal indicator that emerges after a. A bullish trend reversal indicator. A w pattern is a bullish reversal formation that resembles the. The article includes identification guidelines, trading tactics, and performance statistics, by internationally known author. Web learn how to identify and trade the “w” pattern,. Web the concepts of trading zones (galison, 2010), boundary objects (star and griesemer, 1989), and interactional expertise (collins and evans, 2007) are particularly. Double bottom mastery for effective trading. The article includes identification guidelines, trading tactics, and performance statistics, by internationally known author. A w pattern is a bullish reversal formation that resembles the. Similar to the double bottom pattern, the w trading pattern is a bullish trend reversal indicator that emerges after a. A bullish trend reversal indicator. The history of arthur merrill patterns. Web the w pattern is a technical analysis pattern that resembles the letter “w” and is formed by two consecutive troughs followed by a higher peak. So let’s explore how to find one. W pattern bullish trade setup. Trading lovers follow this page. See examples, videos and other educational resources on tradingview. How to trade so many patterns? Web april 11, 2024. W pattern trading is a technical strategy to identify trend reversals on stock charts. Dm me link in bio.

Technical Analysis 101 A Pattern Forms the W Breakout Pattern!!

Trading the W Pattern & M Timing Solutions for Swing Traders • Top FX

Panduan Lengkap Mengenai Pola W Trading Pattern HSB Investasi

Swing Trade cycles Patterns and cycles the "W" pattern

W Pattern Trading New Trader U

W Pattern Trading The Forex Geek

Pattern Trading Unveiled Exploring M and W Pattern Trading

W Forex Pattern Fast Scalping Forex Hedge Fund

W PATTERN TRADING STRATEGY DOUBLE BOTTOM CHART PATTERN Price Action

W Pattern Trading YouTube

Web The W Trading Pattern Embodies A Cornerstone Concept In Market Analysis, Spotlighting A Crucial Turn In The Tides Of Investor Sentiment.

Web Learn What A W Pattern Is, How To Spot It On Price Charts, And How To Use It For Trading Strategies.

Web The W Trading Pattern:

Best Time Frame To Trade.

Related Post: