W Pattern Stocks

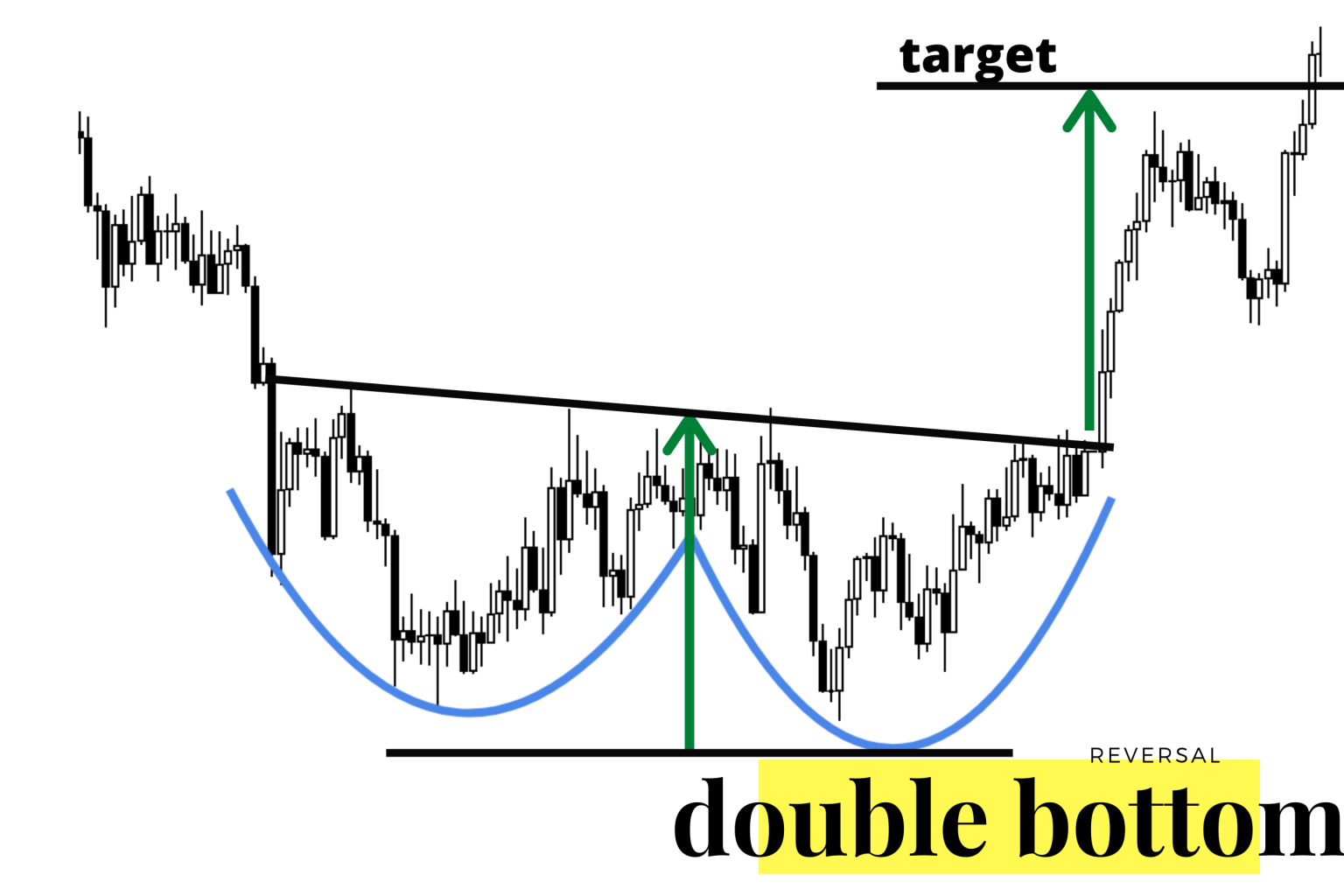

W Pattern Stocks - Using double top and bottom patterns in a profitable way: It’s important to note that patience is key when. Web trading the w pattern involves identifying the pattern formation, waiting for the breakout, and then executing a trade. Web big w is a double bottom chart pattern with talls sides. Web these patterns, also known as double tops (m) and double bottoms (w), are reflected in the price charts of financial instruments like stocks, currencies, and. Learn how to read stock charts and analyze trading chart patterns, including spotting trends,. Web explore the power of the w pattern in this comprehensive chart analysis video. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. The w chart pattern is a reversal pattern that. It resembles the letter ‘w’ due to its. By the end of this article, you'll. 📈 whether you're a beginner or an experienced trader, understanding this double bottom formation. One popular pattern that traders often look out for is the double. Web learn how to identify and trade the “w” pattern, a reliable reversal indicator on renko charts. Web these patterns, aptly named the w pattern and m. Web in the world of forex trading, understanding patterns and trends can make all the difference between profit and loss. Find out the key takeaways, limitations, and examples of double tops and bottoms, and how to. Using double top and bottom patterns in a profitable way: Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts,. The “w” pattern has various forms and occurs at the top or bottom of a. Web “m” and “w” patterns (see figure 3.18) are also known as double tops and double bottoms, respectively. Web w pattern trading is a technical trading strategy using stock market indicators to help locate entry and exit points. Web w pattern in 15 mins. Web. It resembles the letter ‘w’ due to its. Web the w pattern, frequently observed in stock charts, offers invaluable insights into market behavior. Web “m” and “w” patterns (see figure 3.18) are also known as double tops and double bottoms, respectively. Web explore the power of the w pattern in this comprehensive chart analysis video. It’s important to note that. A favorite of swing traders, the w pattern. Find out the key takeaways, limitations, and examples of double tops and bottoms, and how to. It resembles the letter ‘w’ due to its. Web a w pattern is a double bottom chart pattern that has tall sides with a strong trend before and after the w on the chart. Web these. One popular pattern that traders often look out for is the double. Find out the key takeaways, limitations, and examples of double tops and bottoms, and how to. Pattern trading is one of the technical analyses applicable in. Web these patterns, aptly named the w pattern and m stock pattern, are classic chart formations that technical traders watch for. Using. A double top is a pattern for two successive peaks, which may or. Web a double bottom chart pattern is a chart pattern used in technical analysis to describe the fall in price of a stock or index, followed by a rebound, then another drop to. Using double top and bottom patterns in a profitable way: Web these patterns, also. Web in the world of forex trading, understanding patterns and trends can make all the difference between profit and loss. The w and m patterns trading. Pattern trading is one of the technical analyses applicable in. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. 📈. Web w pattern in 15 mins. Web big w is a double bottom chart pattern with talls sides. The w and m patterns trading. By the end of this article, you'll. Web learn how to identify and trade the “w” pattern, a reliable reversal indicator on renko charts. The “w” pattern has various forms and occurs at the top or bottom of a. Web a double bottom chart pattern is a chart pattern used in technical analysis to describe the fall in price of a stock or index, followed by a rebound, then another drop to. Find out the key takeaways, limitations, and examples of double tops and. Web a w pattern is a double bottom chart pattern that has tall sides with a strong trend before and after the w on the chart. Web wwwww pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web how to read stock charts and trading patterns. Renowned for its demonstrative signal of a bullish reversal, w in. By the end of this article, you'll. Web these patterns, aptly named the w pattern and m stock pattern, are classic chart formations that technical traders watch for. One popular pattern that traders often look out for is the double. Pattern trading is one of the technical analyses applicable in. A favorite of swing traders, the w pattern. It resembles the letter ‘w’ due to its. Web the w pattern, frequently observed in stock charts, offers invaluable insights into market behavior. Find out the key takeaways, limitations, and examples of double tops and bottoms, and how to. Learn how to identify and interpret double top and bottom patterns in stock charts, which are technical analysis patterns that occur when the underlying investment moves in a similar shape to the letter w or m. Web inside outside with bollinger band technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap,. The w chart pattern is a reversal pattern that.

W Pattern Trading YouTube

Wpattern — TradingView

Wpattern — TradingView

Three Types of W Patterns MATI Trader

W Pattern Trading The Forex Geek

Wpattern — TradingView

Three Types of W Patterns MATI Trader

Three Types of W Patterns MATI Trader

W Pattern Trading New Trader U

W Forex Pattern Fast Scalping Forex Hedge Fund

Web Technical & Fundamental Stock Screener, Scan Stocks Based On Rsi, Pe, Macd, Breakouts, Divergence, Growth, Book Vlaue, Market Cap, Dividend Yield Etc.

Web These Patterns, Also Known As Double Tops (M) And Double Bottoms (W), Are Reflected In The Price Charts Of Financial Instruments Like Stocks, Currencies, And.

Learn How To Read Stock Charts And Analyze Trading Chart Patterns, Including Spotting Trends,.

📈 Whether You're A Beginner Or An Experienced Trader, Understanding This Double Bottom Formation.

Related Post: