W Pattern Chart

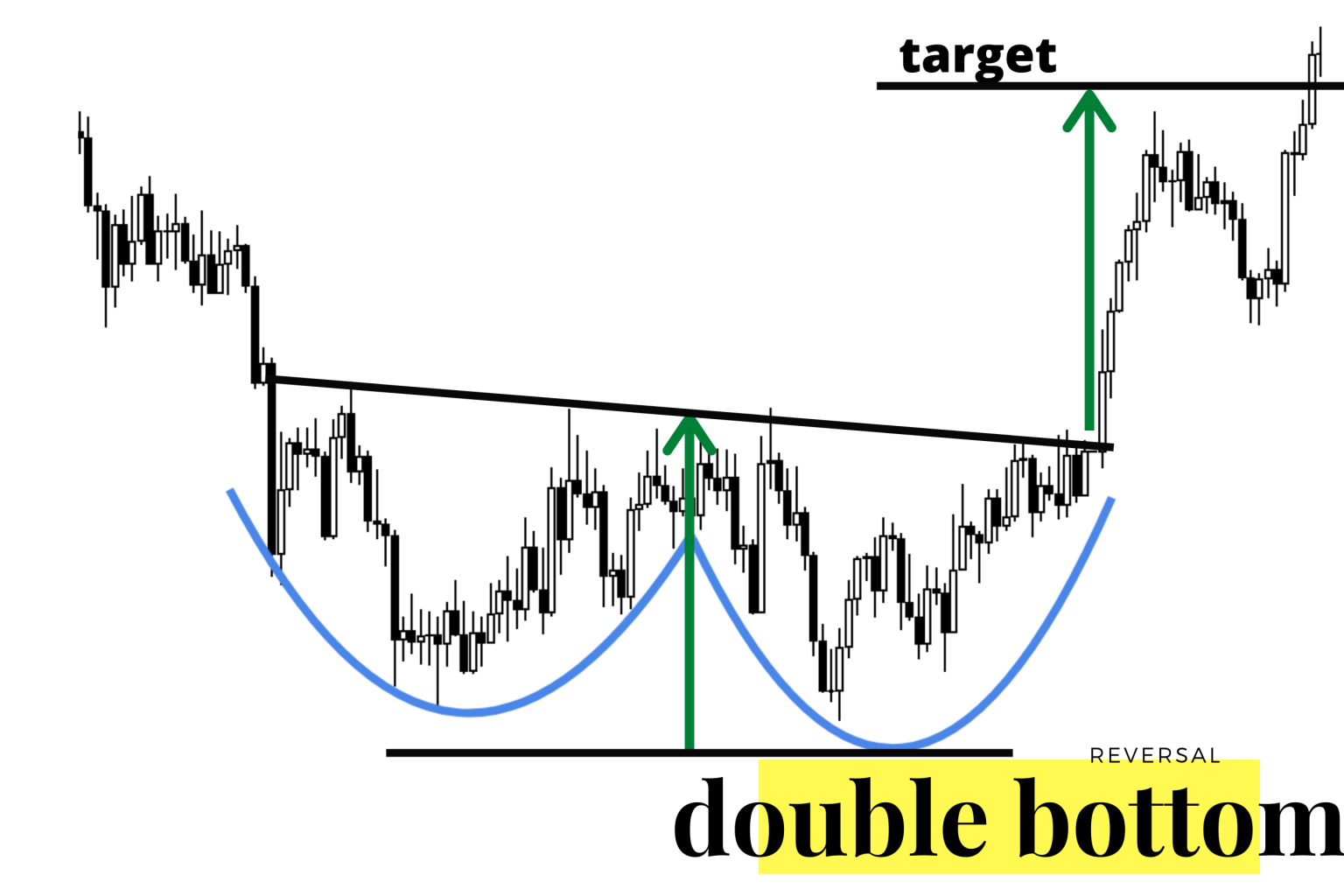

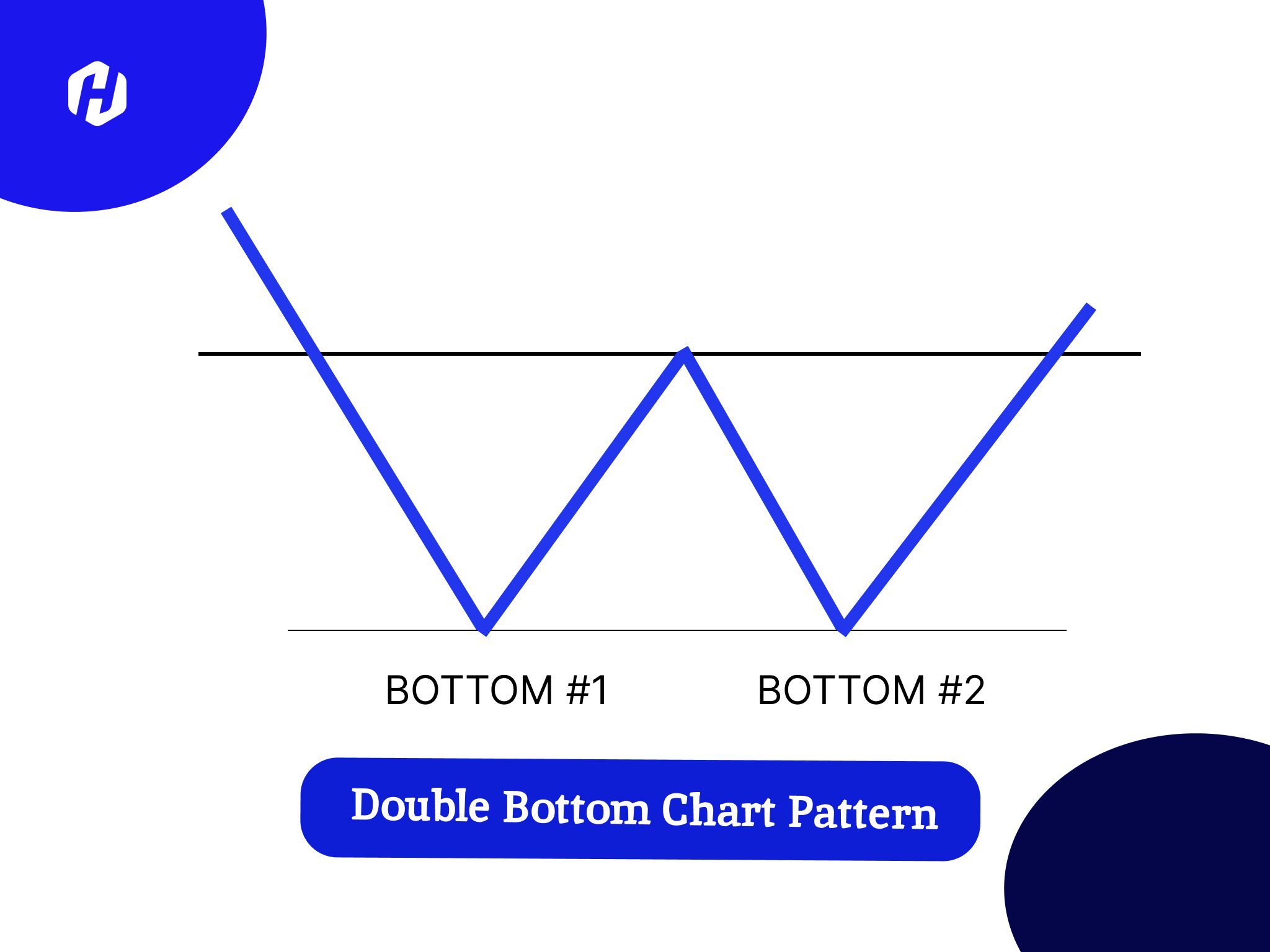

W Pattern Chart - Initial drop in price, establishing the first bottom. A w pattern is a double bottom chart pattern that has tall sides with a strong trend before and after the w on the chart. Double bottom mastery for effective trading. Web the w pattern strategy is a technical analysis tool used to identify potential trend reversals in the market. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. It resembles the letter “w”. A double bottom pattern consists of three parts: Double top and bottom patterns are chart. Lower wicks are bearish when close is lower than open price. Solid fabric jelly rolls, sold in many colors, are also. Web introduction wick % is a simple indicator to compare wick size with body size (mode 1) and to compare wick size with candle size (mode 2). Web big w is a double bottom chart pattern with talls sides. Initial drop in price, establishing the first bottom. It is called the w pattern because it forms a distinct shape that. Initial drop in price, establishing the first bottom. Solid fabric jelly rolls, sold in many colors, are also. Renowned for its demonstrative signal of a bullish reversal, w in stock charts is a primary focus for investors and traders alike. Web big w is a double bottom chart pattern with talls sides. Wwwww pattern technical & fundamental stock screener, scan. Wick theory in general, big wick and. This pattern indicates that the asset has faced support twice at a similar level and may be due for a reversal in trend. Initial drop in price, establishing the first bottom. This pattern is typically observed during downtrends and indicates a possible reversal to an uptrend. Web a jelly roll is a bundle. Web $binance:1000pepe (1d chart) technical analysis update pepe is currently trading at $0.0081162 and showing overall bullish sentiment after the breakout, if this breakout hold then we have good chance a price pumping. Web many patterns fall under “ pattern trading ;” however, w and m pattern trading is an essential tool. What is double top and bottom? Web a. However, the pattern supersedes many other pattern tradings. Stock passes all of the below filters in cash segment: Block patterns (“patterns,” for short) are one of the most powerful features at a theme author’s disposal. Web many patterns fall under “ pattern trading ;” however, w and m pattern trading is an essential tool. This pattern indicates that the asset. This pattern is typically observed during downtrends and indicates a possible reversal to an uptrend. Lower wicks are bearish when close is lower than open price. Web by steve burns. Solid fabric jelly rolls, sold in many colors, are also. Wwwww pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market. 📈 whether you're a beginner or an experienced trader, understanding this double bottom formation is crucial. Most fabric companies, including moda fabrics, riley blake, free spirit, robert kaufman, and qt fabrics, release fabric collections in jelly roll strip sets. Web w tops are a bearish reversal chart pattern that can provide traders with valuable insights into the potential direction of. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Solid fabric jelly rolls, sold in many colors, are also. Web a double bottom pattern is a classic technical analysis charting formation that represents a major change in trend and a momentum reversal from a prior down. 📈 whether you're a beginner or an experienced trader, understanding this double bottom formation is crucial. A w pattern is a double bottom chart pattern that has tall sides with a strong trend before and after the w on the chart. However, the pattern supersedes many other pattern tradings. It is formed by drawing two downward legs followed by an. A double bottom pattern consists of three parts: Therefore, when a “w” renko chart pattern is spotted, we always take a short position as described below. Stock passes all of the below filters in cash segment: Web the w chart pattern is a reversal chart pattern that signals a potential change from a bearish trend to a bullish trend. Double. Interpreting the complexities of the stock market can be compared to solving a convoluted cipher, where the w pattern chart plays a key role. It resembles the letter “w”. Web w tops are a bearish reversal chart pattern that can provide traders with valuable insights into the potential direction of a stock’s price movements. These patterns typically form when a stock’s price rises to a high point before dropping, then rises again to a lower high point before dropping once more. When the “w” pattern is qualified after noticing. Web explore the power of the w pattern in this comprehensive chart analysis video. Upper wicks are bullish when close is higher than open pricen. Delayed data as of 11:04 am, get realtime scans in our premium subscription. Double bottom mastery for effective trading. 📈 whether you're a beginner or an experienced trader, understanding this double bottom formation is crucial. Lower wicks are bearish when close is lower than open price. Web a double bottom pattern is a classic technical analysis charting formation that represents a major change in trend and a momentum reversal from a prior down move in market trading. Renowned for its demonstrative signal of a bullish reversal, w in stock charts is a primary focus for investors and traders alike. Web by steve burns. Therefore, when a “w” renko chart pattern is spotted, we always take a short position as described below. Web april 11, 2024.

Bank Nifty Double Bottom Chart Pattern or W Chart Pattern YouTube

Wpattern — TradingView

Pattern Trading Unveiled Exploring M and W Pattern Trading

Types Of W Pattern In Chart Chart Pattern Technical Analysis

W Pattern Trading New Trader U

W Pattern Trading YouTube

Panduan Lengkap Mengenai Pola W Trading Pattern HSB Investasi

Three Types of W Patterns MATI Trader

W Pattern Trading The Forex Geek

Three Types of W Patterns MATI Trader

Now Cryptocap:btc Next Target Towards $80K Before #Halving, And Many Chances To Reach Out Around $75K To.

Web The W Pattern Is A Chart Formation That Appears As Two Consecutive Lows Separated By A Peak.

Solid Fabric Jelly Rolls, Sold In Many Colors, Are Also.

What Is Double Top And Bottom?

Related Post: