W Chart Pattern

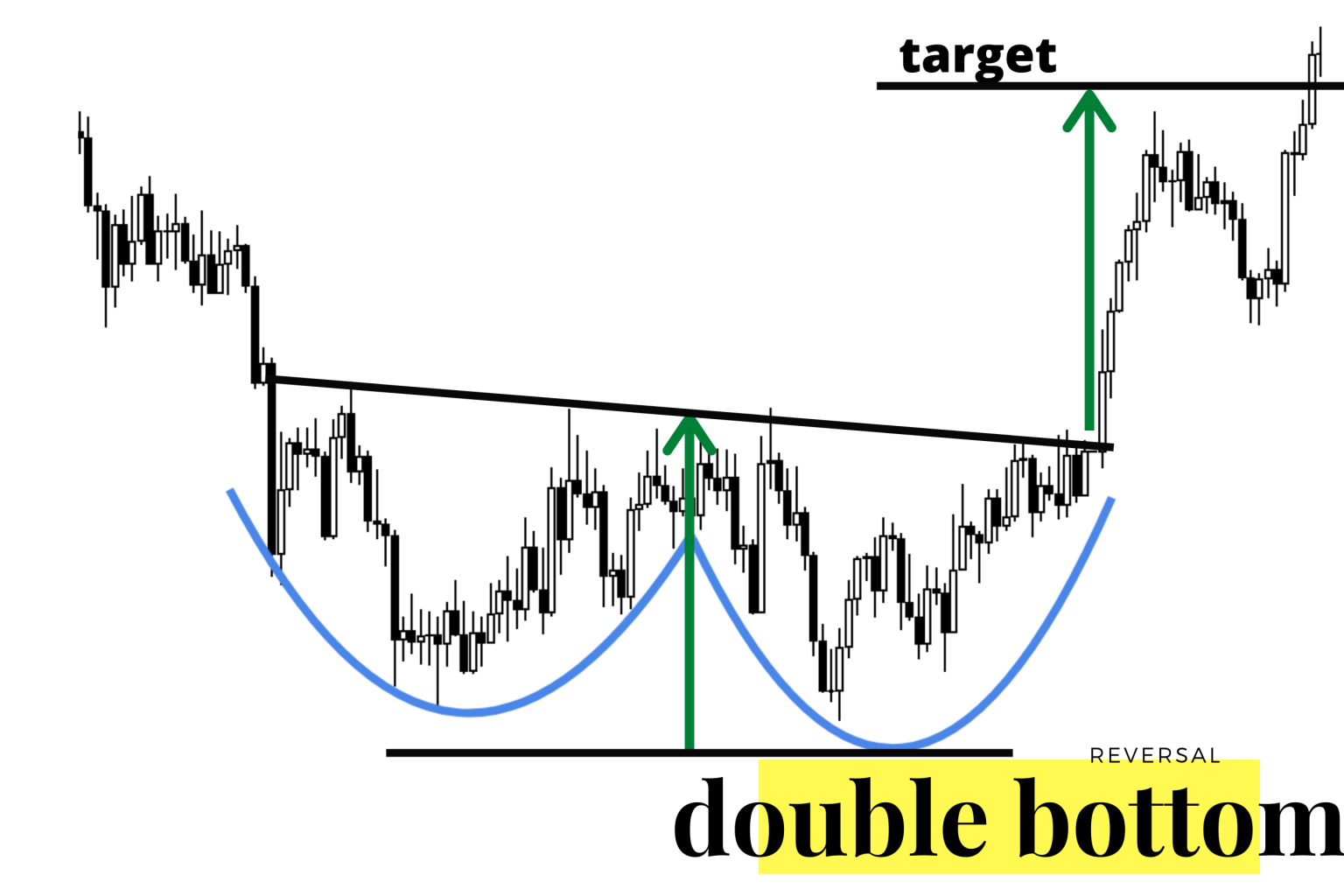

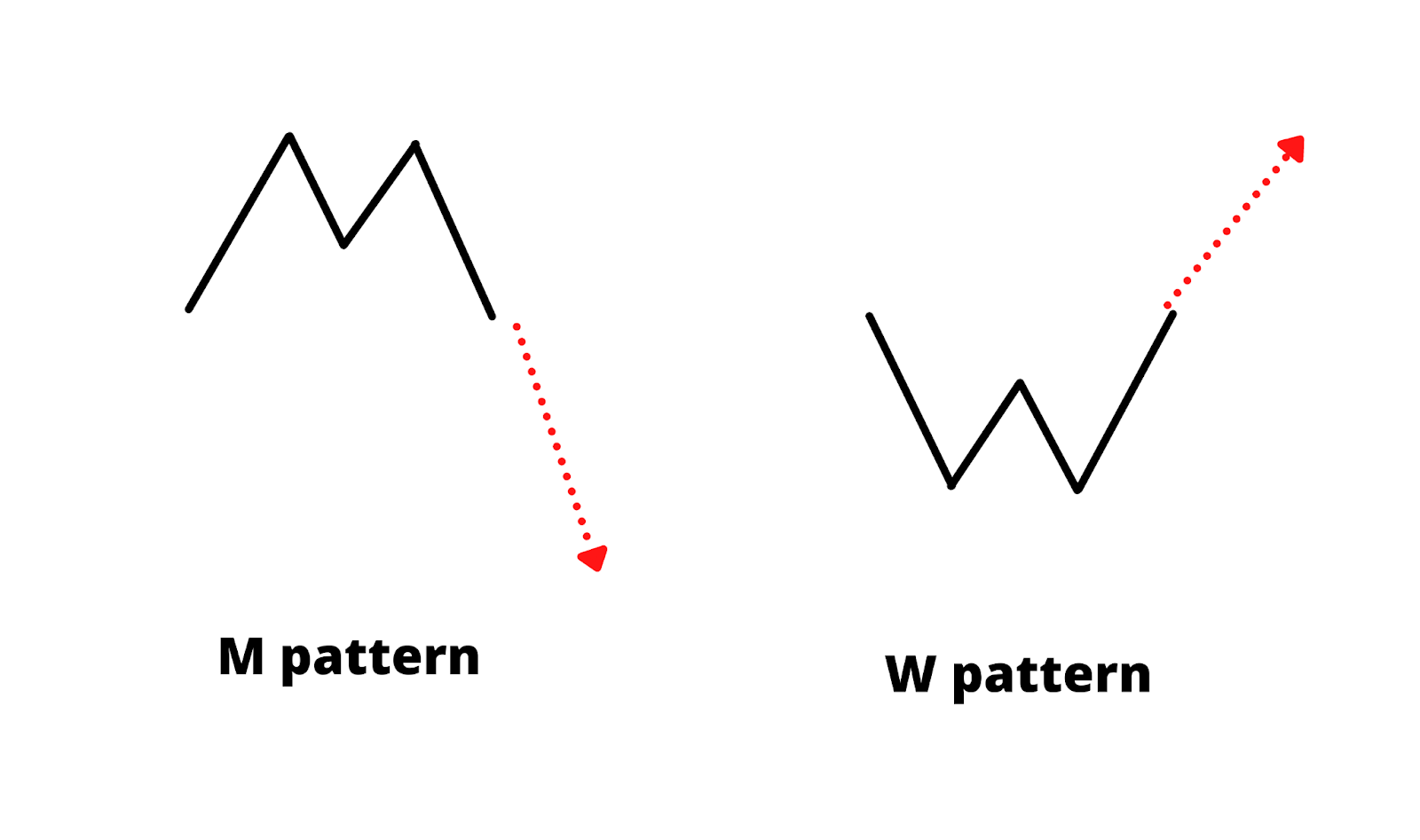

W Chart Pattern - The w chart pattern is a. A bullish trend reversal indicator. Web m and w patterns are chart formations in technical analysis that resemble the letters ‘m’ and ‘w’. Web the w pattern strategy is a technical analysis tool used to identify potential trend reversals in the market. The “w” pattern is a corrective move that occurs at the top or bottom. Web a big w chart pattern. Web the w trading pattern: Similar to the double bottom pattern, the w trading pattern is a bullish trend reversal indicator that emerges after a. A w pattern is a double bottom chart pattern that has tall sides with a strong trend before and after the w on the chart. Delayed data as of 11:04 am, get realtime scans in our. Web w pattern trading is a technical analysis tool that predicts bearish and bullish reversals based on the shape of peaks and troughs in a chart. Web the w chart pattern is read as a bullish turnaround where prices are expected to increase after weeks or months of price decline. A bullish trend reversal indicator. Web the w trading pattern. It is called the w pattern because it forms a distinct shape that resembles. Web learn how to identify and trade the “w” pattern, a reliable reversal indicator on renko charts. Don't miss the entry of a lifetime. Educational ideas 149 scripts 71. The pattern starts emerging when the prices first. Double top and bottom patterns are chart patterns that occur when the underlying investment moves in a similar pattern to the letter w or m. Learn how to identify, confirm, and. Web w tops are a bearish reversal chart pattern that can provide traders with valuable insights into the potential direction of a stock’s price movements. A w pattern is. A bullish trend reversal indicator. Web learn how to identify and trade the “w” pattern, a reliable reversal indicator on renko charts. Price falls to a new low and then rallies. The “w” pattern is a corrective move that occurs at the top or bottom. The w chart pattern is a. Web a chart pattern is a shape within a price chart that helps to suggest what prices might do next, based on what they have done in the past. 📈 whether you're a beginner or an experienced trader, understanding this double bottom formation. Web a new w pattern. Web m and w patterns are chart formations in technical analysis that. Web w pattern trading is a technical strategy to identify trend reversals on stock charts. Delayed data as of 11:04 am, get realtime scans in our. The m pattern, also known as the double top, indicates a bearish. Web learn what a w pattern is, how to spot it on price charts, and how to use it for trading strategies.. Web by steve burns. Web explore the power of the w pattern in this comprehensive chart analysis video. Web the w trading pattern embodies a cornerstone concept in market analysis, spotlighting a crucial turn in the tides of investor sentiment. See live alerts, backtest results, and examples of w pattern formation. A w pattern is a double bottom chart pattern. Web scan stocks based on the w pattern, a bullish reversal pattern in technical analysis. Price falls to a new low and then rallies. Web w pattern trading is a technical strategy to identify trend reversals on stock charts. Web the double bottom chart pattern is found at the end of a downtrend and resembles the letter w (see chart. Web the w trading pattern embodies a cornerstone concept in market analysis, spotlighting a crucial turn in the tides of investor sentiment. Web the w pattern strategy is a technical analysis tool used to identify potential trend reversals in the market. Educational ideas 149 scripts 71. Price falls to a new low and then rallies. Web learn what a w. Web by steve burns. Web the w pattern strategy is a technical analysis tool used to identify potential trend reversals in the market. Web the w chart pattern is read as a bullish turnaround where prices are expected to increase after weeks or months of price decline. The m pattern, also known as the double top, indicates a bearish. Educational. Web a chart pattern is a shape within a price chart that helps to suggest what prices might do next, based on what they have done in the past. The pattern starts emerging when the prices first. 📈 whether you're a beginner or an experienced trader, understanding this double bottom formation. Chart patterns are the basis of. See live alerts, backtest results, and examples of w pattern formation. The “w” pattern is a corrective move that occurs at the top or bottom. Web learn what a w pattern is, how to spot it on price charts, and how to use it for trading strategies. A w pattern is a double bottom chart pattern that has tall sides with a strong trend before and after the w on the chart. Web learn how to use w pattern chart to spot double bottoms and bullish reversals in the stock market. Web the w pattern strategy is a technical analysis tool used to identify potential trend reversals in the market. The m pattern, also known as the double top, indicates a bearish. It is called the w pattern because it forms a distinct shape that resembles. Web the double bottom chart pattern is found at the end of a downtrend and resembles the letter w (see chart below). A bullish trend reversal indicator. Web the w chart pattern is read as a bullish turnaround where prices are expected to increase after weeks or months of price decline. Web a big w chart pattern.

Technical Analysis 101 A Pattern Forms the W Breakout Pattern!!

W Pattern Trading New Trader U

Wpattern — TradingView

W Pattern Trading The Forex Geek

Stock Market Chart Analysis FORD Bullish W pattern

Three Types of W Patterns MATI Trader

Three Types of W Patterns MATI Trader

W pattern forex

W Pattern Trading vs. M Pattern Strategy Choose One or Use Both? • FX

W Forex Pattern Fast Scalping Forex Hedge Fund

Web Scan Stocks Based On The W Pattern, A Bullish Reversal Pattern In Technical Analysis.

Web Explore The Power Of The W Pattern In This Comprehensive Chart Analysis Video.

Web W Tops Are A Bearish Reversal Chart Pattern That Can Provide Traders With Valuable Insights Into The Potential Direction Of A Stock’s Price Movements.

Find Out The Key Indicators, Signs, And Strategies For Effective Trading.

Related Post: