Volatility Contraction Pattern

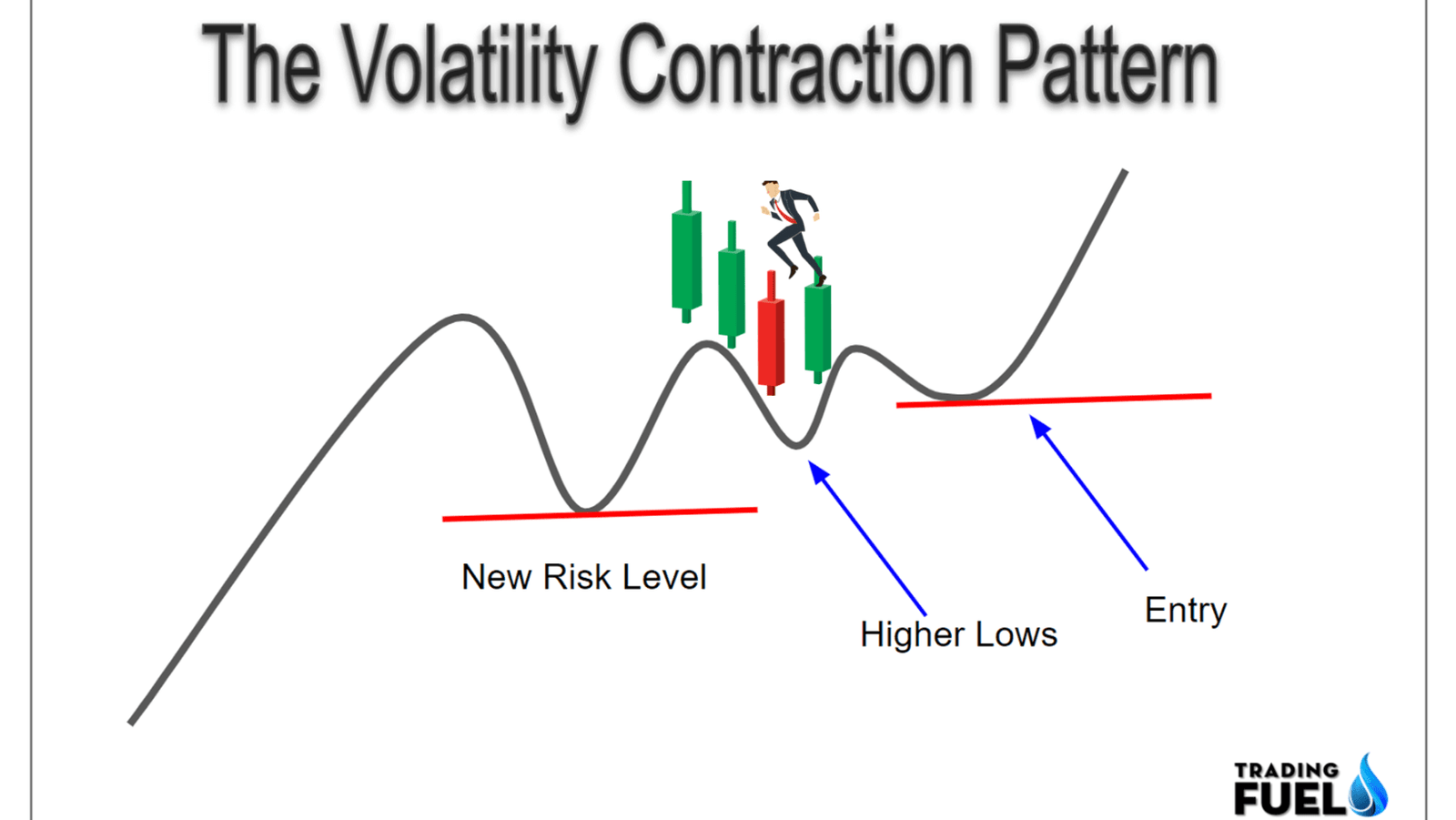

Volatility Contraction Pattern - In such a chart pattern, the price of a stock goes through. Web learn how to trade the volatility contraction pattern (vcp) in stocks, a market cycle that moves from low to high volatility and vice versa. Web volatility contraction patterns are often found in stocks before an explosive share price gain. Web to identify the optimal points of entry for stocks, minervini developed the volatility contraction pattern. This tutorial covers the criteria of a vcp base, how to filte. The pattern’s assumption is that. Find out the criteria, types, and. Tool to calculate stock value based on rule one principle. Download the free ultimate screening guide here: Web learn how to identify and use the vcp, a trading pattern that occurs in stocks in long term up trends. Find out the criteria, types, and. Web quite the contrary — even john maynard keynes would agree — it calls for fiscal contraction. Web psg balanced fund has a volatility of 13.7% and a maximum drawdown of minus 8% over this period, and therefore could be seen as risky from a volatility. The vcp is based on strong underlying demand,. Web what is the volatility contraction pattern (vcp pattern)? In this video, we will be discussing how to go about using candlestick patterns during volatility. This pattern occurs during a consolidation period when prices decrease in. Web quite the contrary — even john maynard keynes would agree — it calls for fiscal contraction. Web to identify the optimal points of. In such a chart pattern, the price of a stock goes through. Web learn how to identify and trade volatility contraction patterns (vcps), which are chart formations that signal potential breakouts in stock prices. Web learn how to identify and trade the volatility contraction pattern (vcp), a powerful pattern that captures explosive price movements. Web the volatility contraction pattern (vcp). Web what is the volatility contraction pattern (vcp pattern)? Web learn what a volatility contraction pattern is and how to use it to trade stocks. Web learn how to identify and trade the volatility contraction pattern (vcp), a powerful pattern that captures explosive price movements. Web learn how to identify and profit from the volatility contraction pattern, a reliable trading. Web learn how to identify and catch a volatility contraction pattern (vcp), a chart consolidation that tightens from left to right within a price base. This pattern occurs during a consolidation period when prices decrease in. The vcp pattern is one of mark minervini trading strategy which he follows and practice regularly. What are the two market periods. The vcp. Web what is the volatility contraction pattern (vcp pattern)? Download the free ultimate screening guide here: Find out the key factors, steps. Web learn how to use the volatility contraction pattern (vcp) coined by mark minervini, a professional investor, to trade stocks in india. Web mark minervini's volatility contraction pattern detection. Web learn how to identify and use the vcp, a trading pattern that occurs in stocks in long term up trends. The vcp involves a decrease in volatility and volume as. Web volatility contraction patterns are often found in stocks before an explosive share price gain. Web learn how to use the volatility contraction pattern (vcp) coined by mark minervini,. Web © 2024 google llc. Web learn how to identify and profit from the volatility contraction pattern, a reliable trading strategy that occurs during a consolidation period. Web the volatility contraction pattern (vcp) allows us to find stocks which are getting ready to form a very specific low risk entry point at which the potential reward of our trades. Tool. Tool to calculate stock value based on rule one principle. Web learn how to trade the volatility contraction pattern (vcp) in stocks, a market cycle that moves from low to high volatility and vice versa. Web learn how to use the volatility contraction pattern (vcp) coined by mark minervini, a professional investor, to trade stocks in india. The pattern’s assumption. The vcp involves a decrease in volatility and volume as. Download the free ultimate screening guide here: Web psg balanced fund has a volatility of 13.7% and a maximum drawdown of minus 8% over this period, and therefore could be seen as risky from a volatility. Find out the criteria, types, and. Web volatility contraction patterns are often found in. Find out the criteria, types, and. Web learn how to identify and profit from the volatility contraction pattern, a reliable trading strategy that occurs during a consolidation period. Web learn how to identify and trade the volatility contraction pattern (vcp), a powerful pattern that captures explosive price movements. In such a chart pattern, the price of a stock goes through. This pattern occurs during a consolidation period when prices decrease in. Find out the key factors, steps. Web learn how to identify and trade volatility contraction patterns (vcps), which are chart formations that signal potential breakouts in stock prices. Web quite the contrary — even john maynard keynes would agree — it calls for fiscal contraction. This tutorial covers the criteria of a vcp base, how to filte. The vcp pattern is one of mark minervini trading strategy which he follows and practice regularly. In this video, we will be discussing how to go about using candlestick patterns during volatility. Tool to extract news from yahoofinance. Web psg balanced fund has a volatility of 13.7% and a maximum drawdown of minus 8% over this period, and therefore could be seen as risky from a volatility. See scan description, examples, backtest results and links to more resources. The pattern’s assumption is that. Web learn what a volatility contraction pattern is and how to use it to trade stocks.

Volatility Contraction Pattern (VCP) for MYXPRLEXUS by yccho22

How to Day Trade with the Volatility Contraction Pattern (VCP)?

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

How to Day Trade with the Volatility Contraction Pattern (VCP)?

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

Volatility Contraction Pattern (VCP Pattern) Mark Minervini Trading

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

Download The Free Ultimate Screening Guide Here:

The Vcp Involves A Decrease In Volatility And Volume As.

Web Mark Minervini's Volatility Contraction Pattern Detection.

Web Learn How To Use The Volatility Contraction Pattern (Vcp) Coined By Mark Minervini, A Professional Investor, To Trade Stocks In India.

Related Post: