Venture Capital Term Sheet Template

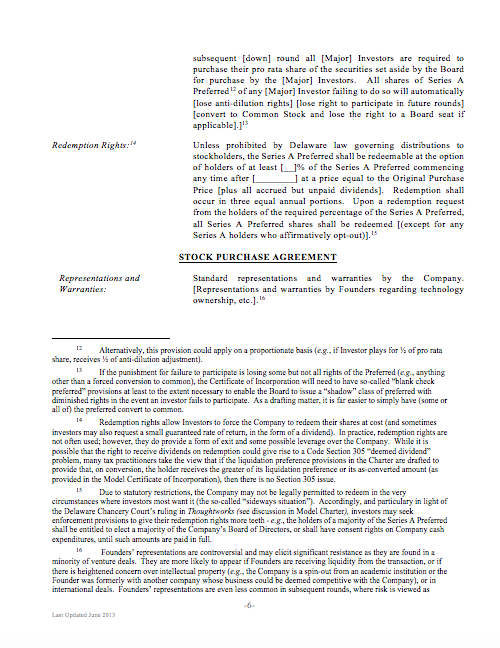

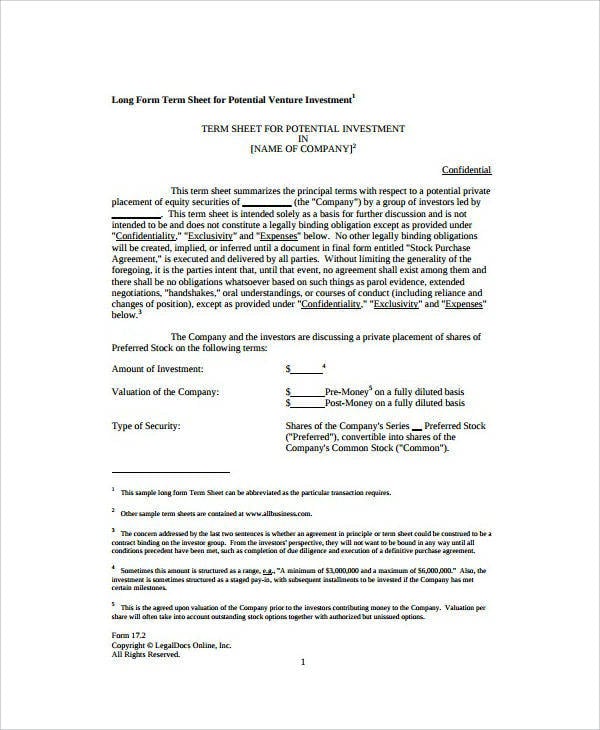

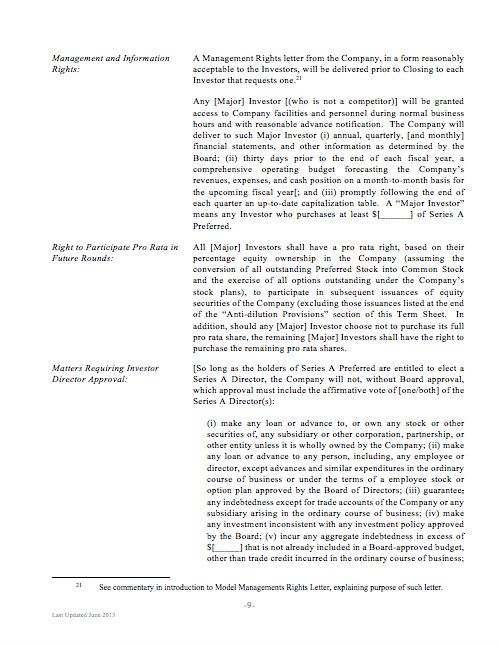

Venture Capital Term Sheet Template - In this article, we discuss the various aspects of vc. Thus, it is in the founder interest to take a fresh look at the nuances of this document. These nvca forms reduce the cost and time of financing. Web the venture capital term sheet is a pivotal document that shapes the dynamics of a startup's growth journey. The loss of board control is most significant because it means the founders. Whether the initial agreement as to terms is structured as a term sheet or a letter of intent is merely a technicality; Funding, corporate governance and liquidation. Web to this end is the concept of venture capital term sheet template.angel investors might have issued a similar document, but vc funding is several notches higher in value as well as complexities in terms and conditions. For simplicity, in this section we use the. In this way, a vc term sheet can be thought of as the road map for what an eventual deal could look like. In this article, we discuss the various aspects of vc. The term sheet is the document that outlines the terms by which an investor (angel or venture capital investor) will make a financial investment in your company. These nvca forms reduce the cost and time of financing. It governs the key terms of a deal between a startup and its. The loss of board control is most significant because it means the founders. Below are tips from founders, investors, and lawyers. In this article, we discuss the various aspects of vc. Most recently, nvca revised the model documents to reflect evolving market norms on key deal terms, address updates to the delaware general corporation law (dgcl), and recent case law.. We also plan to post a similar template. Although every company and investment. By delving into its intricacies, understanding the potential impact of each term, and approaching negotiations with a strategic mindset, entrepreneurs can navigate the vc landscape with confidence. Thus, it is in the founder interest to take a fresh look at the nuances of this document. The loss. The choice of designation is largely one of personal preference with no substantive effect. By focusing on the term sheet, the attention of the company seeking the investment (the “company”) and the venture capital investor (the “investor”) is directed to the major business The enhanced model term sheet. 1.4 [the investment will be made in full at completion.]/. Nonetheless, the. This venture capital term sheet (hereinafter referred to as “term sheet) summarizes the terms concerning an investment (hereinafter referred to as “investment”) in the company of [company name]. It serves as a template for the more detailed and legally binding documents that follow. For simplicity, this article uses the phrase “term sheet” to describe the initial agreement as to the. Web term sheet language pre money valuation and option pool “pre money valuation: A term sheet is the most important document that a founder may ever sign. The loss of board control is most significant because it means the founders. 2 founders, 2 investors and an independent board member. Term sheets tend to consist of three sections: It serves as a template for the more detailed and legally binding documents that follow. This venture capital term sheet (hereinafter referred to as “term sheet) summarizes the terms concerning an investment (hereinafter referred to as “investment”) in the company of [company name]. 1.4 [the investment will be made in full at completion.]/. For simplicity, in this section we use. Web this is the web version of term sheet, a daily newsletter on the biggest deals and dealmakers in venture capital and private equity. It governs the key terms of a deal between a startup and its investors. A term sheet is the most important document that a founder may ever sign. By delving into its intricacies, understanding the potential. Web term sheet language pre money valuation and option pool “pre money valuation: Thus, it is in the founder interest to take a fresh look at the nuances of this document. These standard terms will be customized as may be required by the jurisdiction in force. The term sheet is the document that outlines the terms by which an investor. In this way, a vc term sheet can be thought of as the road map for what an eventual deal could look like. For simplicity, in this section we use the. 1.4 [the investment will be made in full at completion.]/. We also plan to post a similar template. Below are tips from founders, investors, and lawyers. The loss of board control is most significant because it means the founders. By focusing on the term sheet, the attention of the company seeking the investment (the “company”) and the venture capital investor (the “investor”) is directed to the major business The parties involved may have different understandings of what the terms mean. Below are tips from founders, investors, and lawyers. These terms do not constitute a contract and are not legally binding upon the parties, except for the clause of. Although every company and investment. Web the “term sheet” or “letter of intent” is a key document in a venture capital transaction. Web 1.3 the investment will be made in the form of convertible participating [redeemable] preferred shares (“preferred shares”) at a price of £• per preferred share (the “original issue price”) the terms of which are set out in appendix 2. Web to this end is the concept of venture capital term sheet template.angel investors might have issued a similar document, but vc funding is several notches higher in value as well as complexities in terms and conditions. Since this article will assume an basic understanding of the terminology used in venture capital (vc), we recommend reading our guide on term sheets prior to going through this one. Although term sheets have a set of formalized components, terms are generally undefined. Web round terms and term sheets. These standard terms will be customized as may be required by the jurisdiction in force. The choice of designation is largely one of personal preference with no substantive effect. Whether the initial agreement as to terms is structured as a “term sheet” or a “letter of intent” is a technical difference, and the choice of designation is largely one of personal preference with no substantive effect. By delving into its intricacies, understanding the potential impact of each term, and approaching negotiations with a strategic mindset, entrepreneurs can navigate the vc landscape with confidence.

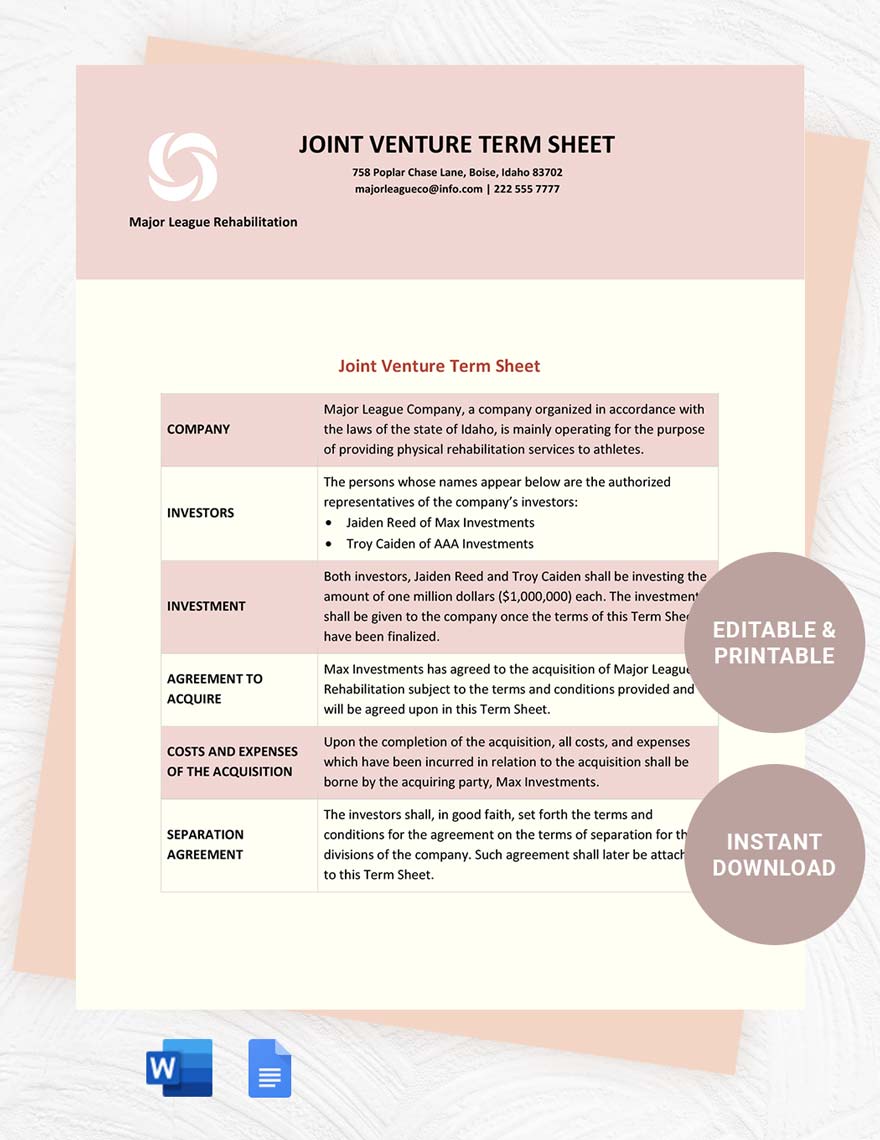

Venture Capital Term Sheet Template Get Free Templates

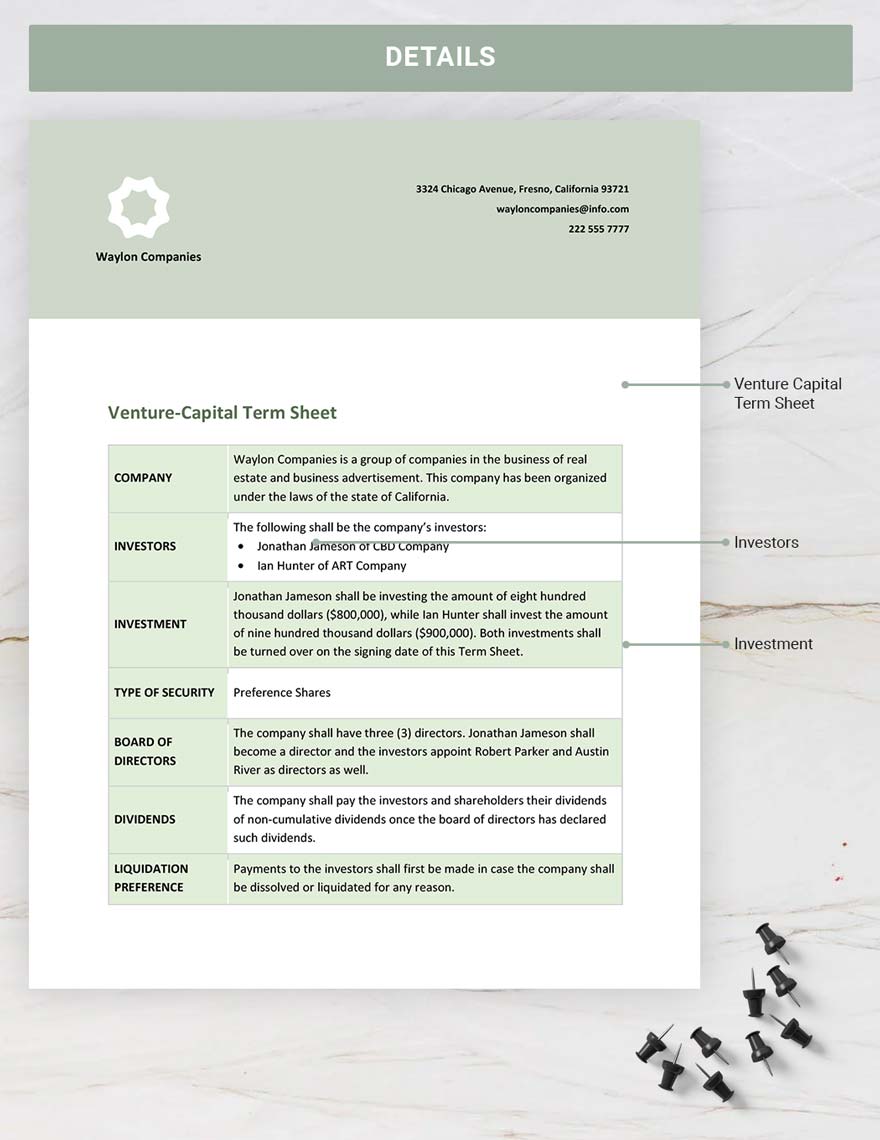

VC Venture Capital Term Sheet Template NVCA Model Eloquens

Understanding a startup term sheet for venture capital

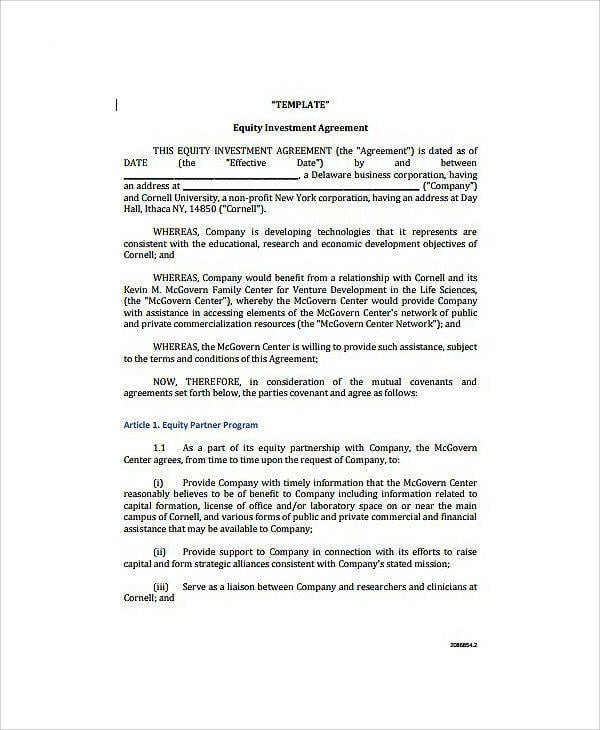

9+ Venture Capital Agreement Templates Word, PDF, Google Docs

Free Venture Capital Term Sheet Templates Revv

Free Venture Capital Term Sheet Templates Revv

VentureCapital Term Sheet Template Google Docs, Word

9+ Venture Capital Agreement Templates Word, PDF, Google Docs

VentureCapital Term Sheet Template Download in Word, Google Docs

VC Venture Capital Term Sheet Template NVCA Model Eloquens

Web This Is The Web Version Of Term Sheet, A Daily Newsletter On The Biggest Deals And Dealmakers In Venture Capital And Private Equity.

Web A Term Sheet Is A Document Commonly Used In Venture Capital And Private Equity Investing To Outline The Terms Of An Investment Agreement Between A Company, Investor, Or Syndicate Of Investors.

Web The Purpose Of The Term Sheet.

Funding, Corporate Governance And Liquidation.

Related Post: