Two Candlestick Reversal Patterns

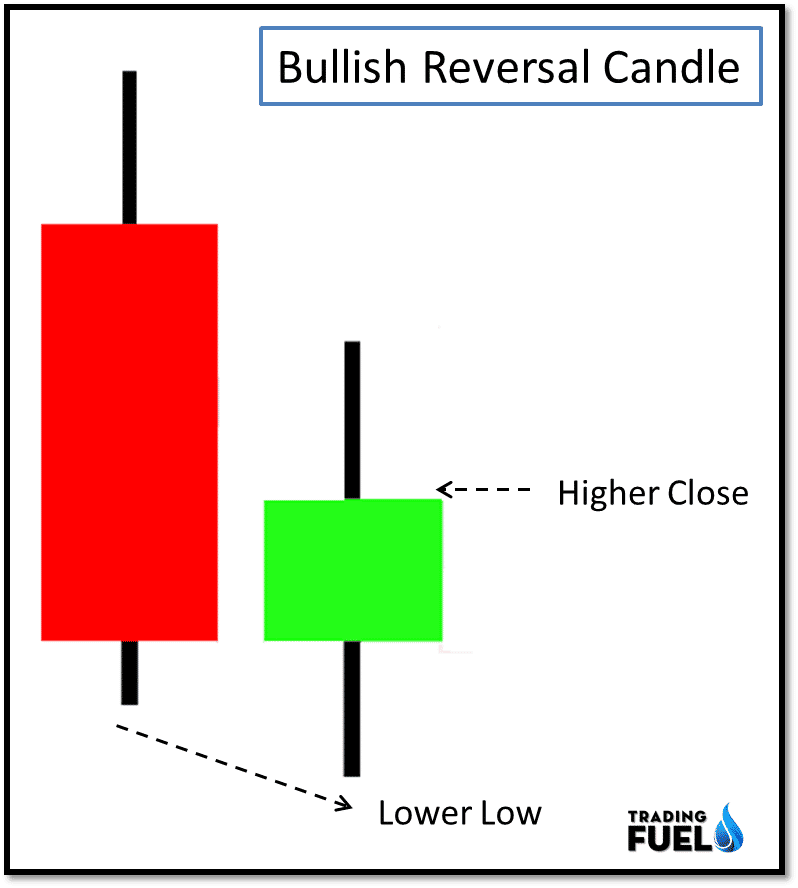

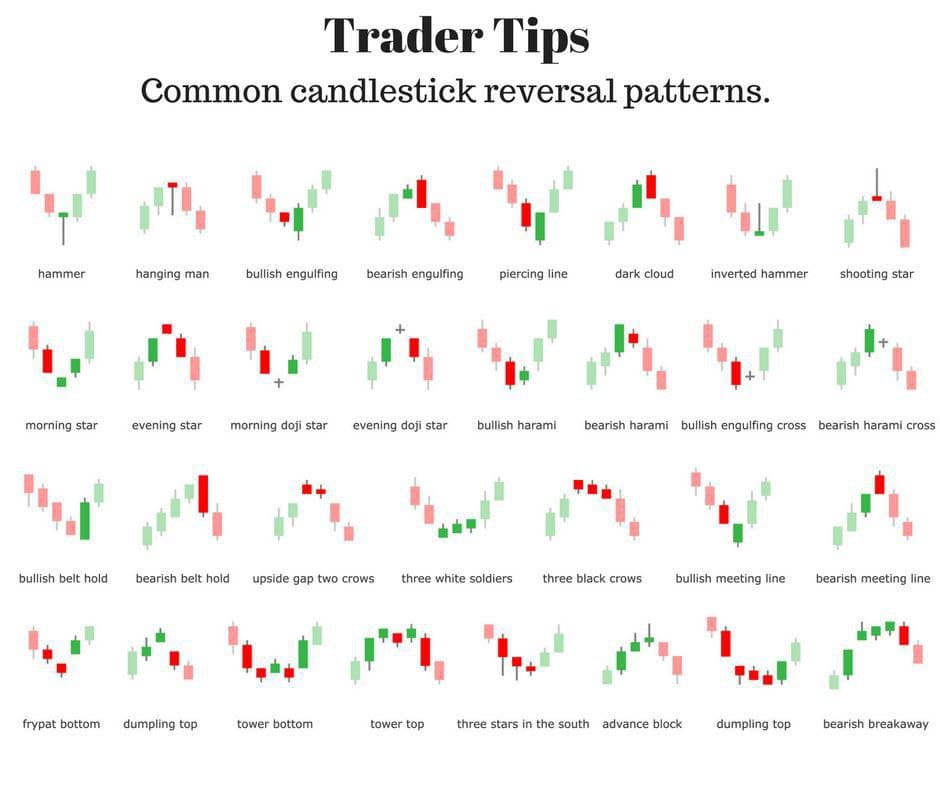

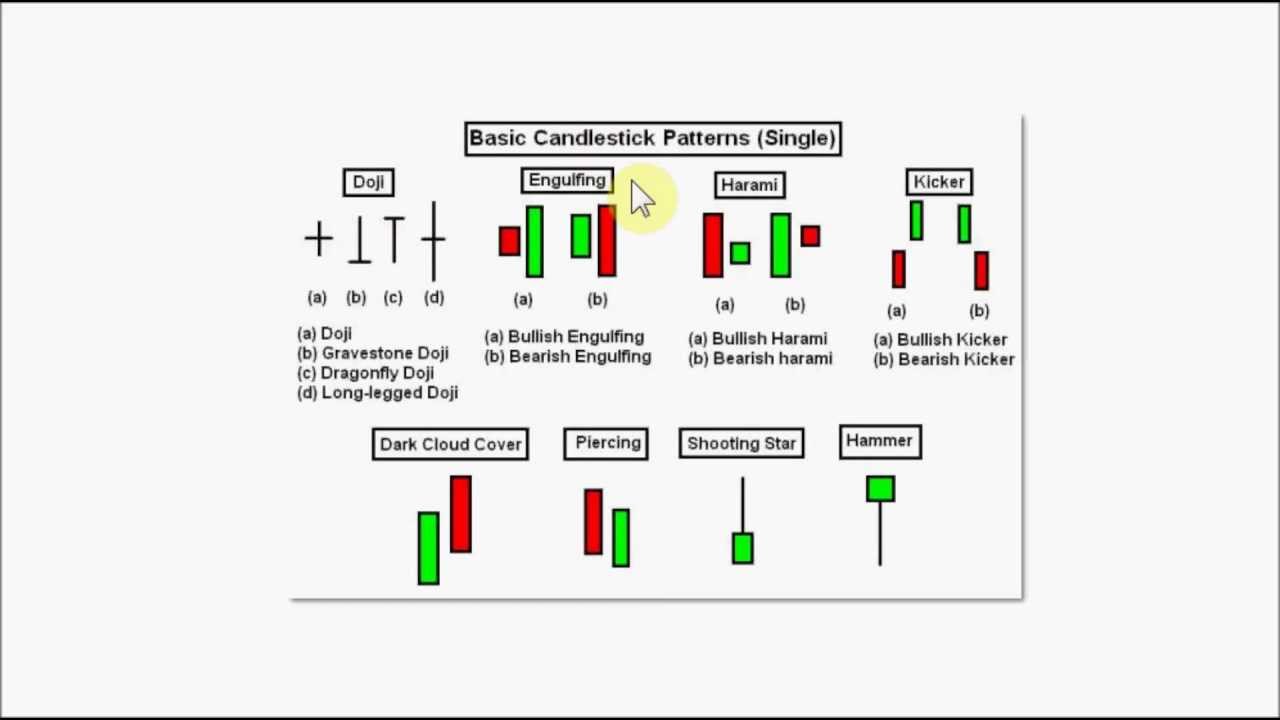

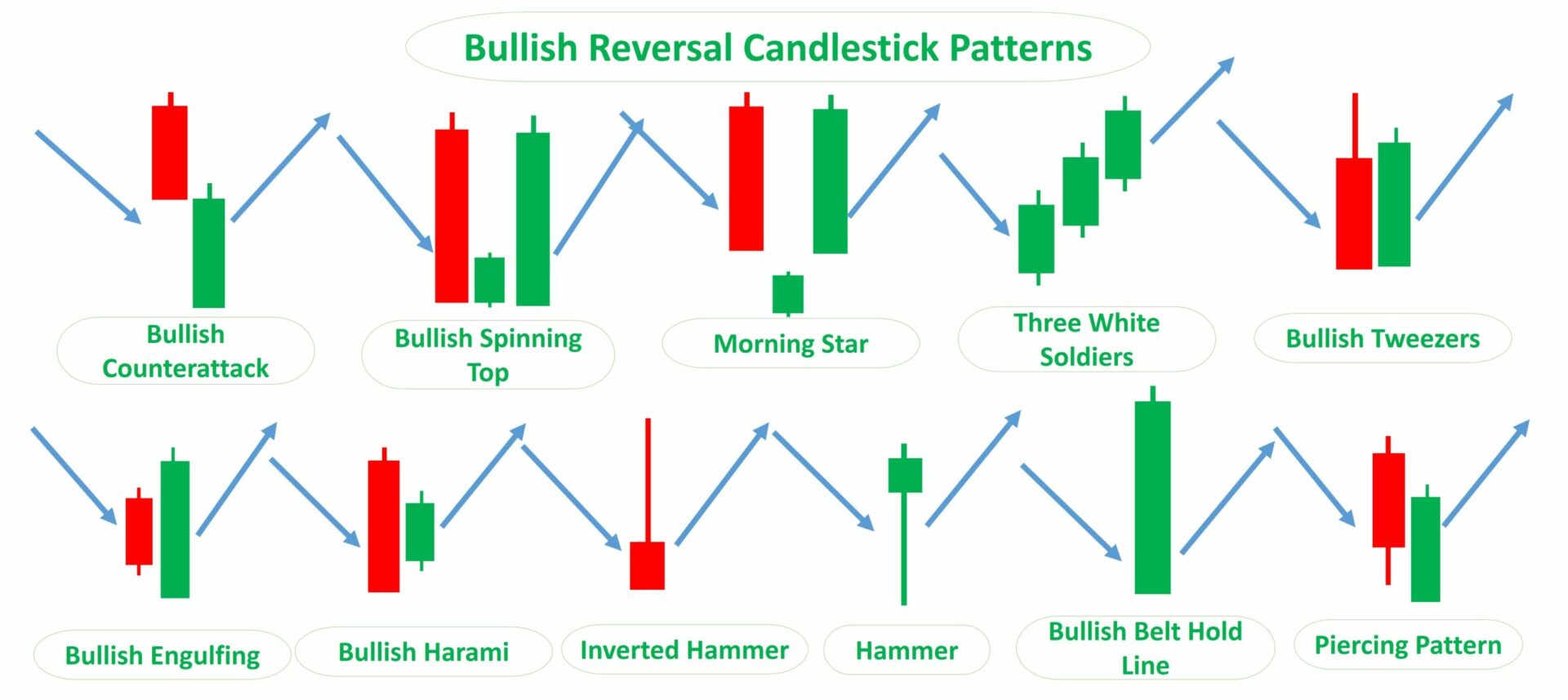

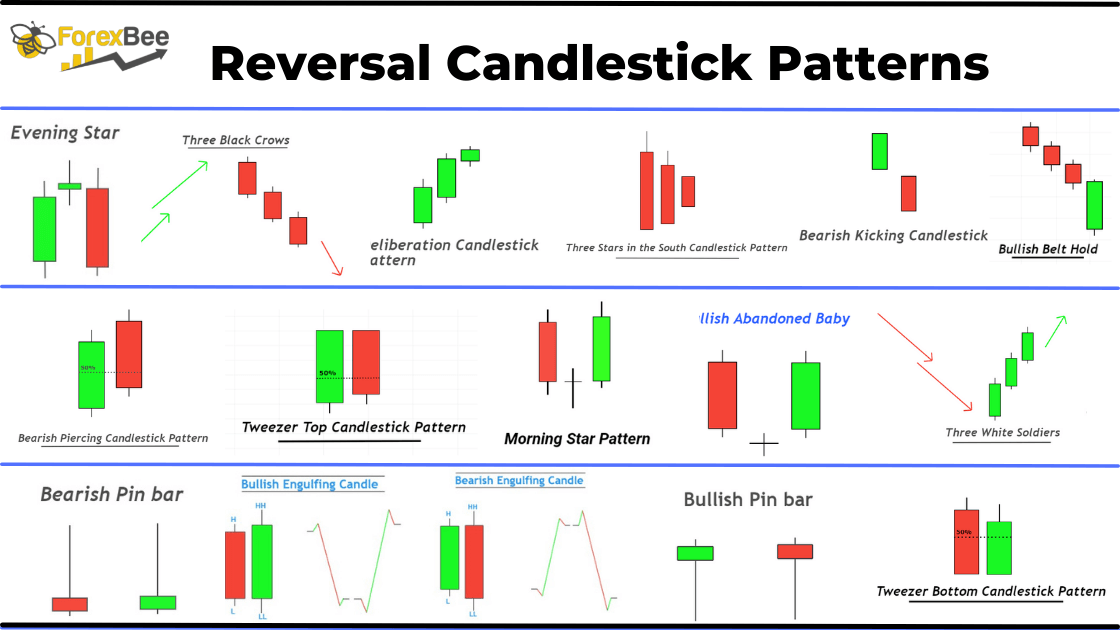

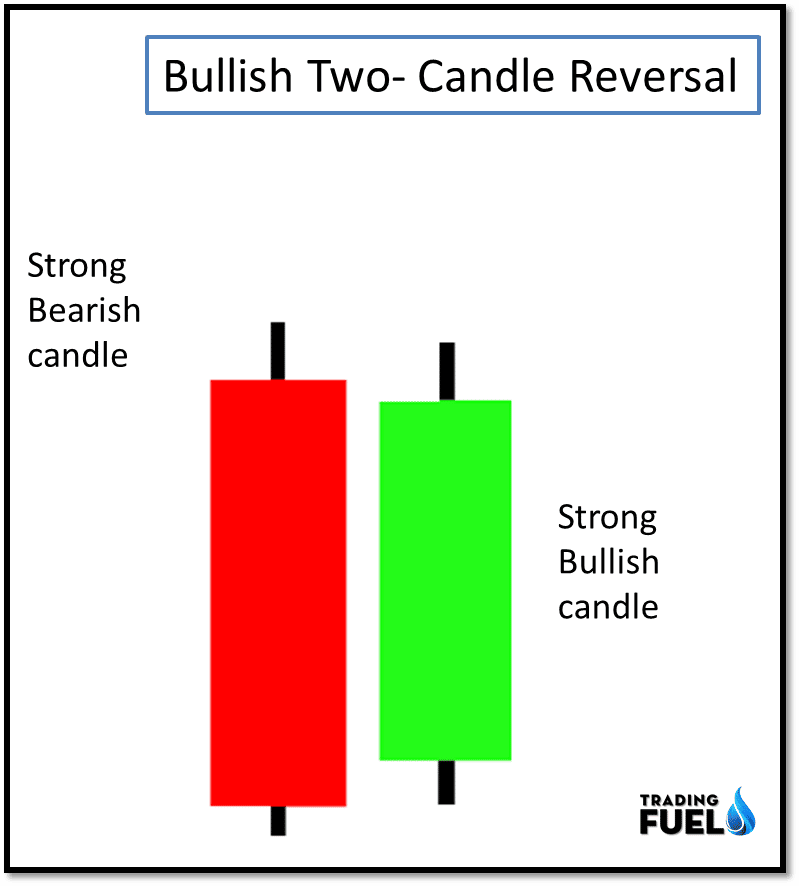

Two Candlestick Reversal Patterns - Let’s get something straight here, these reversal patterns cannot be used as. Web 📍 bullish reversal candlestick patterns : The idea behind it is that the first candle is. Web the dark cloud cover candlestick pattern is a bearish reversal pattern that is formed by two candlesticks, a long bullish candlestick followed by a long bearish candlestick. Web let’s take a look at some of the common candlestick chart reversal patterns. Web a candlestick reversal pattern is a series of one to three candlesticks in a specific order. In the picture you can see the basics of a candlestick made up of a high,. Each pattern has its own characteristics and provides better insights into the market trends. Double candlestick patterns, composed of two specific candlesticks, are used in technical analysis to signal potential trend reversals or. Web candlesticks patterns are used by traders to gauge the psychology of the market and as potential indicators of whether price will rise, fall or move sideways. Web the main double candlestick patterns are of two types: Web let’s take a look at some of the common candlestick chart reversal patterns. Web morning doji star. It is characterized by a very sharp reversal in price during the. They can indicate that the stock may change — or reverse — direction. Web the dark cloud cover candlestick pattern is a bearish reversal pattern that is formed by two candlesticks, a long bullish candlestick followed by a long bearish candlestick. In the picture you can see the basics of a candlestick made up of a high,. Web candlesticks patterns are used by traders to gauge the psychology of the market and as. Web a candlestick reversal pattern is a series of one to three candlesticks in a specific order. Web candlesticks patterns are used by traders to gauge the psychology of the market and as potential indicators of whether price will rise, fall or move sideways. Web the following charts are example of some important candlestick reversal patterns, as described by steve. The idea behind it is that the first candle is. The second candlestick opens with a gap down, below the closing level of the first one. The first candlestick is long and bearish. Web here’s a complete list of reversal candlestick patterns, including both bullish and bearish reversals: A doji is a candle where the opening price and closing price. Web morning doji star. They can indicate that the stock may change — or reverse — direction. The second candlestick opens with a gap down, below the closing level of the first one. A doji is a candle where the opening price and closing price are the same, meaning there’s no real body—just a. The first candlestick is long and. Web the dark cloud cover candlestick pattern is a bearish reversal pattern that is formed by two candlesticks, a long bullish candlestick followed by a long bearish candlestick. They can indicate that the stock may change — or reverse — direction. Web here’s a complete list of reversal candlestick patterns, including both bullish and bearish reversals: The kicker pattern is. Web here’s a complete list of reversal candlestick patterns, including both bullish and bearish reversals: Web a candlestick reversal pattern is a series of one to three candlesticks in a specific order. Web candlesticks patterns are used by traders to gauge the psychology of the market and as potential indicators of whether price will rise, fall or move sideways. Web. Each pattern has its own characteristics and provides better insights into the market trends. Web morning doji star. Web candlesticks patterns are used by traders to gauge the psychology of the market and as potential indicators of whether price will rise, fall or move sideways. Web a reversal candlestick pattern is a formation on a candlestick chart that signals a. It is characterized by a very sharp reversal in price during the. Web 📍 bullish reversal candlestick patterns : Let’s get something straight here, these reversal patterns cannot be used as. Web the candlestick reversal patterns are helpful tools for identifying the way of fluctuation. Web a reversal candlestick pattern is a formation on a candlestick chart that signals a. It is characterized by a very sharp reversal in price during the. Web morning doji star. Each pattern has its own characteristics and provides better insights into the market trends. Web a reversal candlestick pattern is a formation on a candlestick chart that signals a potential change in the direction of a trend. The second candlestick opens with a gap. The second candlestick opens with a gap down, below the closing level of the first one. Each pattern has its own characteristics and provides better insights into the market trends. Web reversal candlestick patterns. Web a reversal candlestick pattern is a formation on a candlestick chart that signals a potential change in the direction of a trend. Web the candlestick reversal patterns are helpful tools for identifying the way of fluctuation. They can indicate that the stock may change — or reverse — direction. The kicker pattern is one of the strongest and most reliable candlestick patterns. Over time, groups of daily candlesticks fall into recognizable patterns with descriptive names like three white. Web 📍 bullish reversal candlestick patterns : Web the following charts are example of some important candlestick reversal patterns, as described by steve nison on candlecharts.com and in his book, “japanese. The idea behind it is that the first candle is. Web the main double candlestick patterns are of two types: Web morning doji star. Web let’s take a look at some of the common candlestick chart reversal patterns. Web the dark cloud cover candlestick pattern is a bearish reversal pattern that is formed by two candlesticks, a long bullish candlestick followed by a long bearish candlestick. In the picture you can see the basics of a candlestick made up of a high,.

10 Price Action Candlestick Patterns Trading Fuel Research Lab

Candlestick Patterns Reversal Candlestick Pattern Tekno

Candlestick Patterns The Definitive Guide (2021)

Trader Tips Common candlestick reversal patterns Profit Myntra

Candlestick Charts Part Two Single Candlestick Reversal Signals

Bearish Reversal Candlestick Patterns The Forex Geek

Top Reversal Candlestick Patterns

Reversal Candlestick Patterns Complete Guide ForexBee

10 Price Action Candlestick Patterns Trading Fuel Research Lab

Candlestick Reversal Patterns 18 Examples to Learn

The First Candlestick Is Long And Bearish.

Web A Candlestick Reversal Pattern Is A Series Of One To Three Candlesticks In A Specific Order.

Web Candlesticks Patterns Are Used By Traders To Gauge The Psychology Of The Market And As Potential Indicators Of Whether Price Will Rise, Fall Or Move Sideways.

Web Here’s A Complete List Of Reversal Candlestick Patterns, Including Both Bullish And Bearish Reversals:

Related Post: