Tweezer Top Pattern

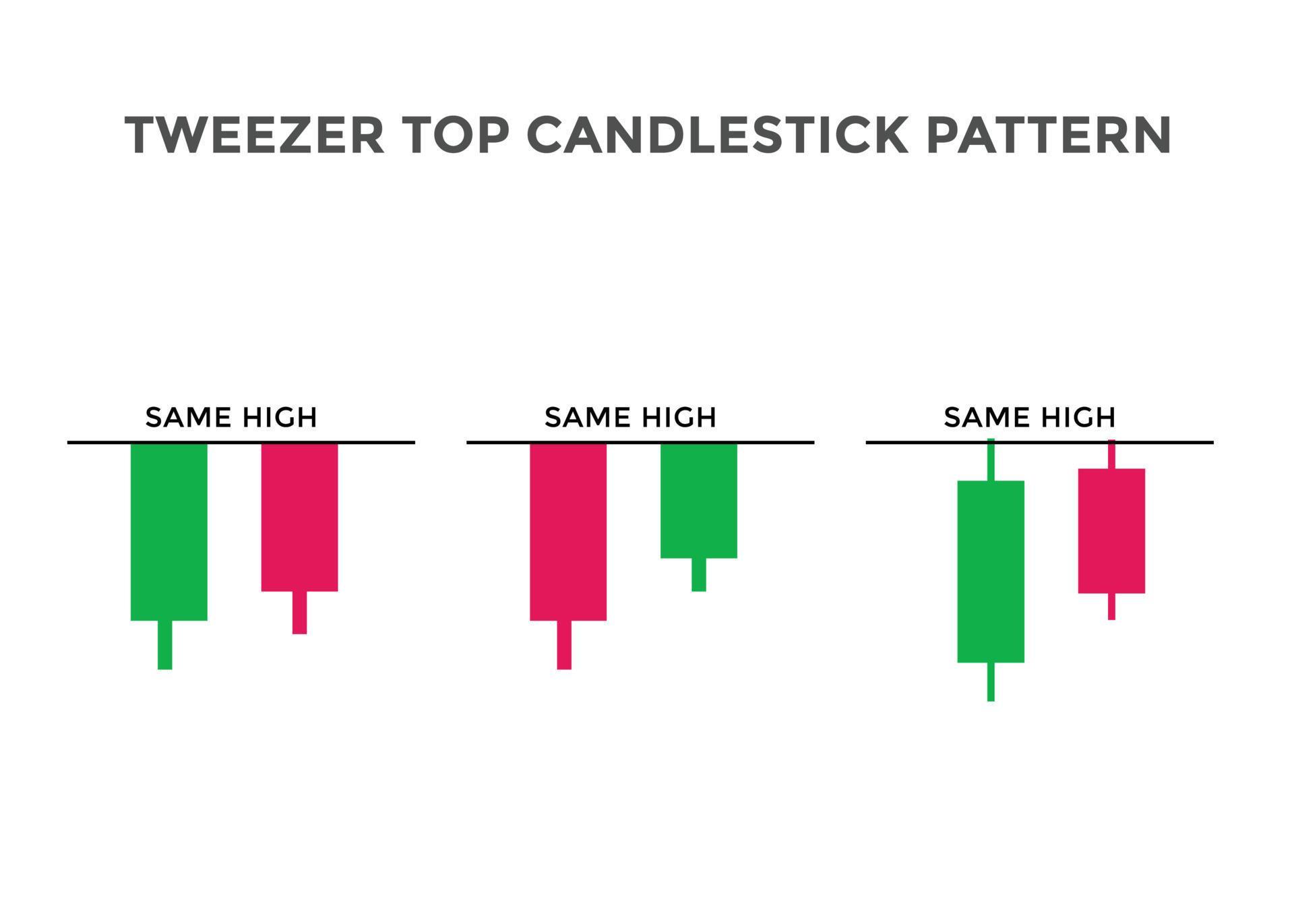

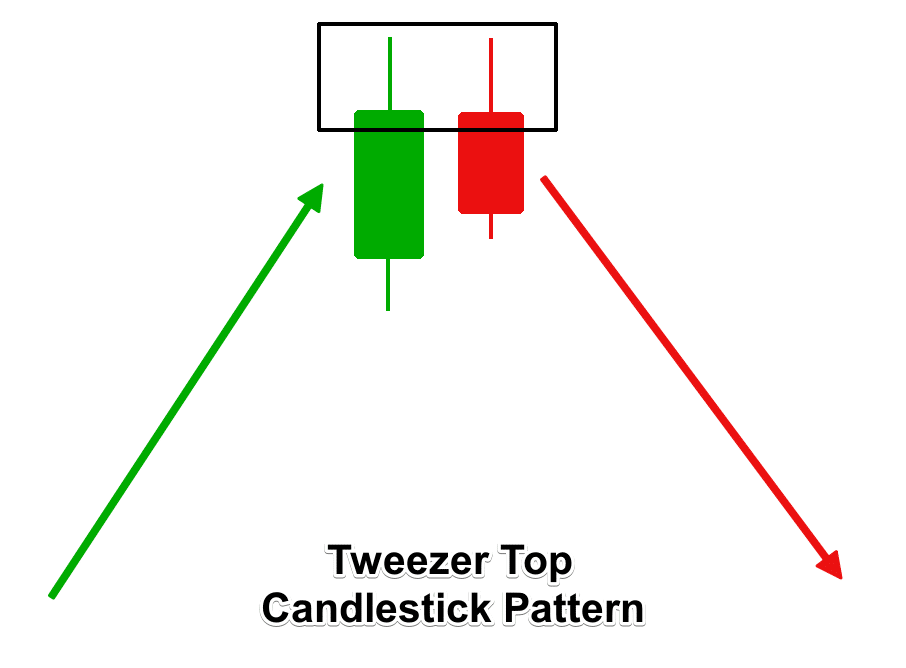

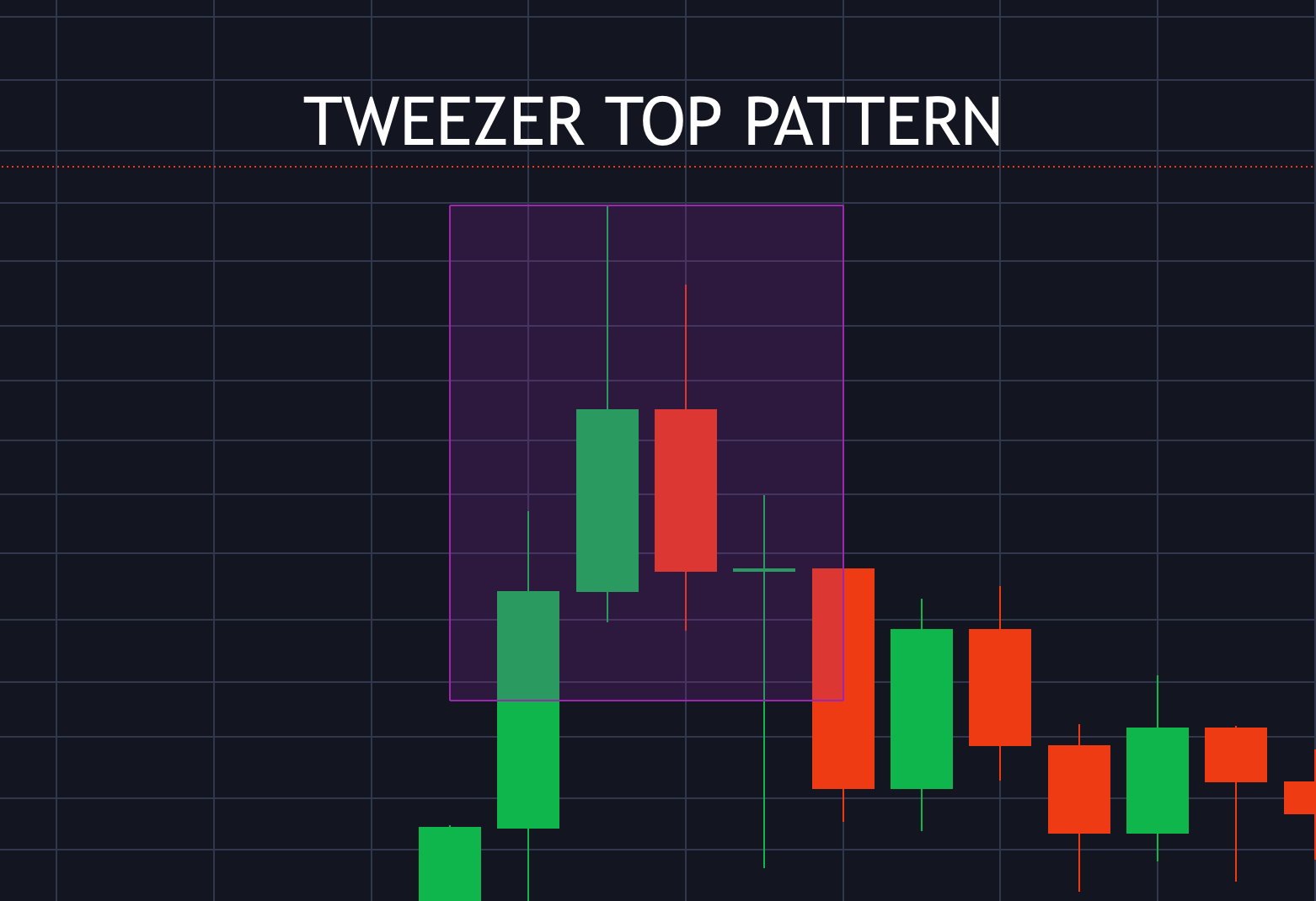

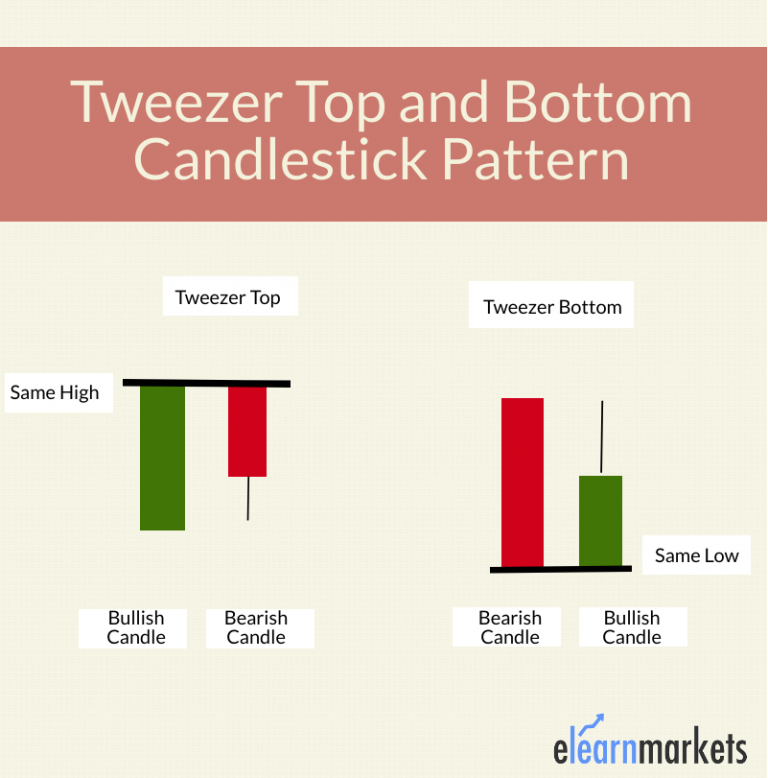

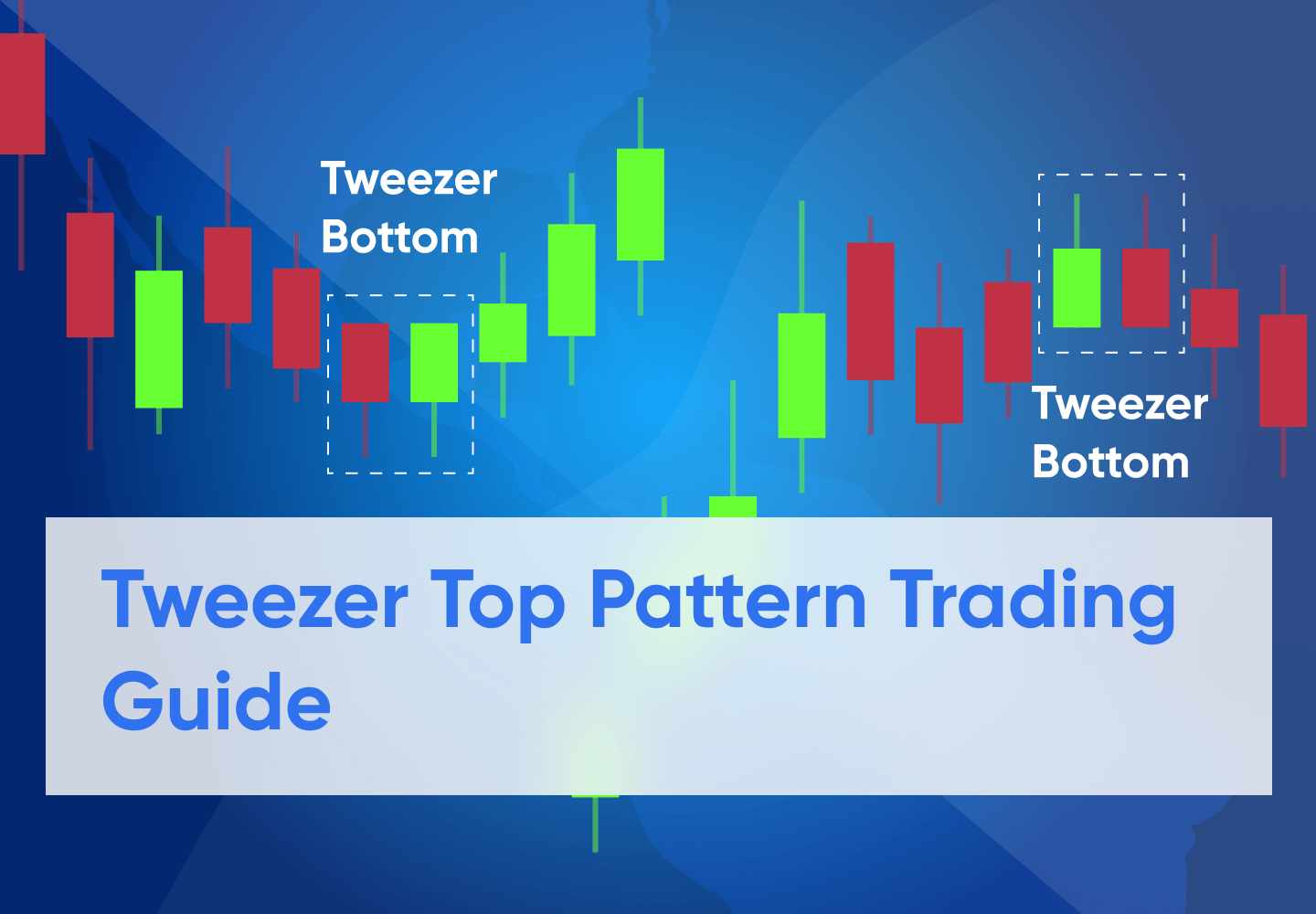

Tweezer Top Pattern - Web the tweezer top pattern is a minor trend reversal pattern and does not necessarily indicate the immediate transition to a downtrend. The pattern is found during an uptrend. To execute a trade, place a sell order beneath the second candle, a stop loss above the pattern’s high, and a profit target under the entry point. Web a tweezer is a technical analysis pattern, commonly involving two candlesticks, that can signify either a market top or bottom. Web what the tweezer top pattern is. Unlike the bullish tweezer bottom, the tweezer top formation’s first candlestick shows a potential bullish trend that tops out without a wick. Web what is a tweezer top candlestick? As such, the tweezer pattern should be used more to protect an existing long position rather than entering a short position. Web tweezer top and bottom, also known as tweezers, are reversal candlestick patterns that signal a potential change in the price direction. Web tweezer top candlestick || tweezer top pattern || how to trade tweezer top || tweezer top candle || hello guys 🤗 👋 welcome to my youtube channel the dynami. It consists of two candlesticks, the first one being bullish and the second one being bearish candlestick. It consists of two candles, where the first is bullish, followed by a bearish or bullish candle with the same high as the previous bar. It forms when two or more consecutive candlesticks have matching highs or nearly the same price level at. Second, a clear uptrend should be present. Web a tweezer is a technical analysis pattern, commonly involving two candlesticks, that can signify either a market top or bottom. Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket press copyright. Intensity gradients in the converging beam draw. How to confidently navigate the market with precision. Web a tweezer top pattern is a candlestick pattern that occurs when the highs of two consecutive candlesticks are almost identical, following an uptrend. It is characterized by two adjacent candlesticks that share almost identical high points, visually creating a level line appearance at the top. Web tweezer top candlestick || tweezer. A strongly focused beam of light creates an optical tweezer. Both formations consist of two candles that occur at the end of a trend, which is in its dying stages. It is classified as a bearish reversal chart pattern. How to trade the tweezer top for trend reversal. Web what is the tweezer top pattern? How to trade the tweezer top for trend reversal. Contact us for custom sewing. The tweezer top is a bearish reversal candlestick pattern that occurs after an uptrend. Typically, when the second candle forms, it can’t break above the first candle and causes a tweezer top failure. To execute a trade, place a sell order beneath the second candle, a. Typically, when the second candle forms, it can’t break above the first candle and causes a tweezer top failure. Showroom hours are by appointment. Sewing masks for essential workers. Web tweezer top and bottom, also known as tweezers, are reversal candlestick patterns that signal a potential change in the price direction. Usually, it appears after a price move to the. It acts as a bearish reversal. Web a tweezer is a technical analysis pattern, commonly involving two candlesticks, that can signify either a market top or bottom. First, there must be two or more adjacent candles of either color. Web the tweezer top is a japanese candlestick pattern. Typically, when the second candle forms, it can’t break above the first. It is characterized by two adjacent candlesticks that share almost identical high points, visually creating a level line appearance at the top. The pattern is considered a bearish signal, as it indicates the possibility of. It forms when two or more consecutive candlesticks have matching highs or nearly the same price level at the top, resembling a pair of tweezers.. Web among the various candlestick patterns, the tweezer top and bottom patterns hold significance due to their ability to signal possible trend reversals. It’s a bearish reversal pattern. The pattern is bearish because we expect to have a bear move after the tweezer top appears at the right location. It consists of two candles, where the first is bullish, followed. We're also happy to come to you! Contact us for custom sewing. Both formations consist of two candles that occur at the end of a trend, which is in its dying stages. The tweezer top is a bearish reversal candlestick pattern that occurs after an uptrend. A tweezers top is when two candles occur back to back with very similar. Web the tweezer top candlestick pattern is a prominent bearish reversal indicator, commonly identified at the pinnacle of an uptrend in price charts. Web a tweezer top occurs during an uptrend when buyers push prices higher, often ending the session near the highs, but were not able to push the top any further. The pattern is considered a bearish signal, as it indicates the possibility of. Web what is the tweezer top pattern? Trading the tweezer top is simple. First, there must be two or more adjacent candles of either color. Unlike the bullish tweezer bottom, the tweezer top formation’s first candlestick shows a potential bullish trend that tops out without a wick. It consists of two candles, where the first is bullish, followed by a bearish or bullish candle with the same high as the previous bar. A strongly focused beam of light creates an optical tweezer. Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket press copyright. The pattern is bearish because we expect to have a bear move after the tweezer top appears at the right location. Web tweezer top and bottom, also known as tweezers, are reversal candlestick patterns that signal a potential change in the price direction. Third, those candles must reach the same high point. Web among the various candlestick patterns, the tweezer top and bottom patterns hold significance due to their ability to signal possible trend reversals. How to trade the tweezer top in an already trending market. Web the tweezer top pattern in trading is a bearish reversal signal that suggests a potential downward move in the price.

Tweezer top candlestick chart pattern. best Bearish Candlestick chart

What Are Tweezer Tops & Tweezer Bottoms? Meaning And How To Trade

Tweezer Top Candlestick ForexBoat Trading Academy

What Are Tweezer Tops & Tweezer Bottoms? Meaning And How To Trade

Tweezer Top Pattern A Guide To Trading The Technical Analysis Pattern

Candlestick Patterns The Definitive Guide (2021)

What are Top & Bottom Tweezer Candlestick Explained ELM

How To Trade The Tweezer Top Chart Pattern (In 3 Easy Steps)

Tweezer Top Pattern A Guide To Trading The Technical Analysis Pattern

Trading the Tweezer Top and Bottom Candlestick Patterns

Web The Tweezer Top Pattern Is A Minor Trend Reversal Pattern And Does Not Necessarily Indicate The Immediate Transition To A Downtrend.

Web A Tweezer Top Pattern Is A Candlestick Pattern That Occurs When The Highs Of Two Consecutive Candlesticks Are Almost Identical, Following An Uptrend.

How To Trade The Tweezer Top For Trend Reversal.

Web A Tweezer Is A Type Of Technical Analysis Pattern Involving Two Candlesticks That Is Used By Traders.

Related Post: