Tweezer Bottom Pattern

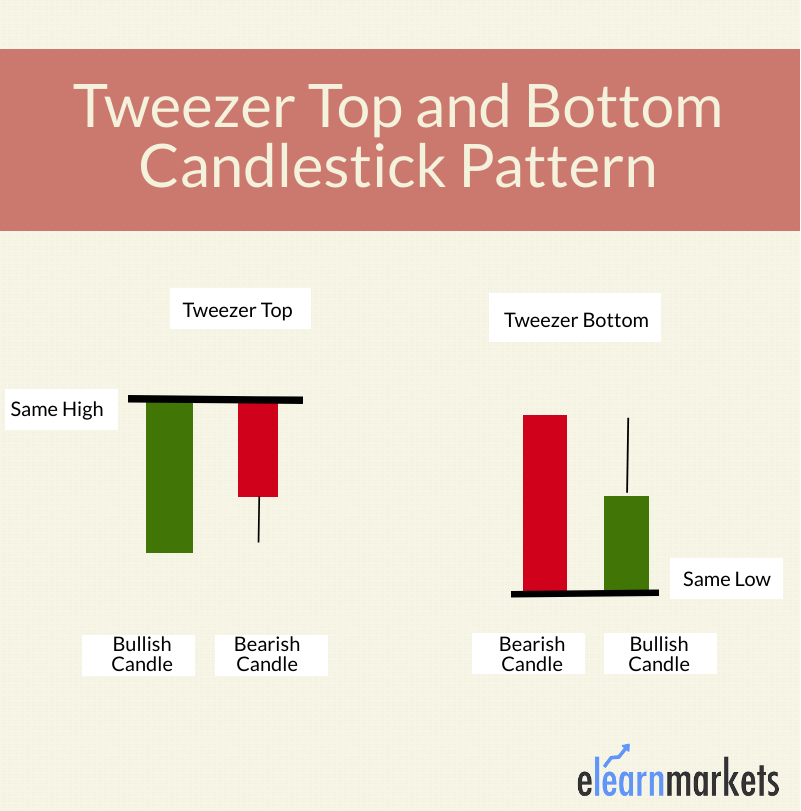

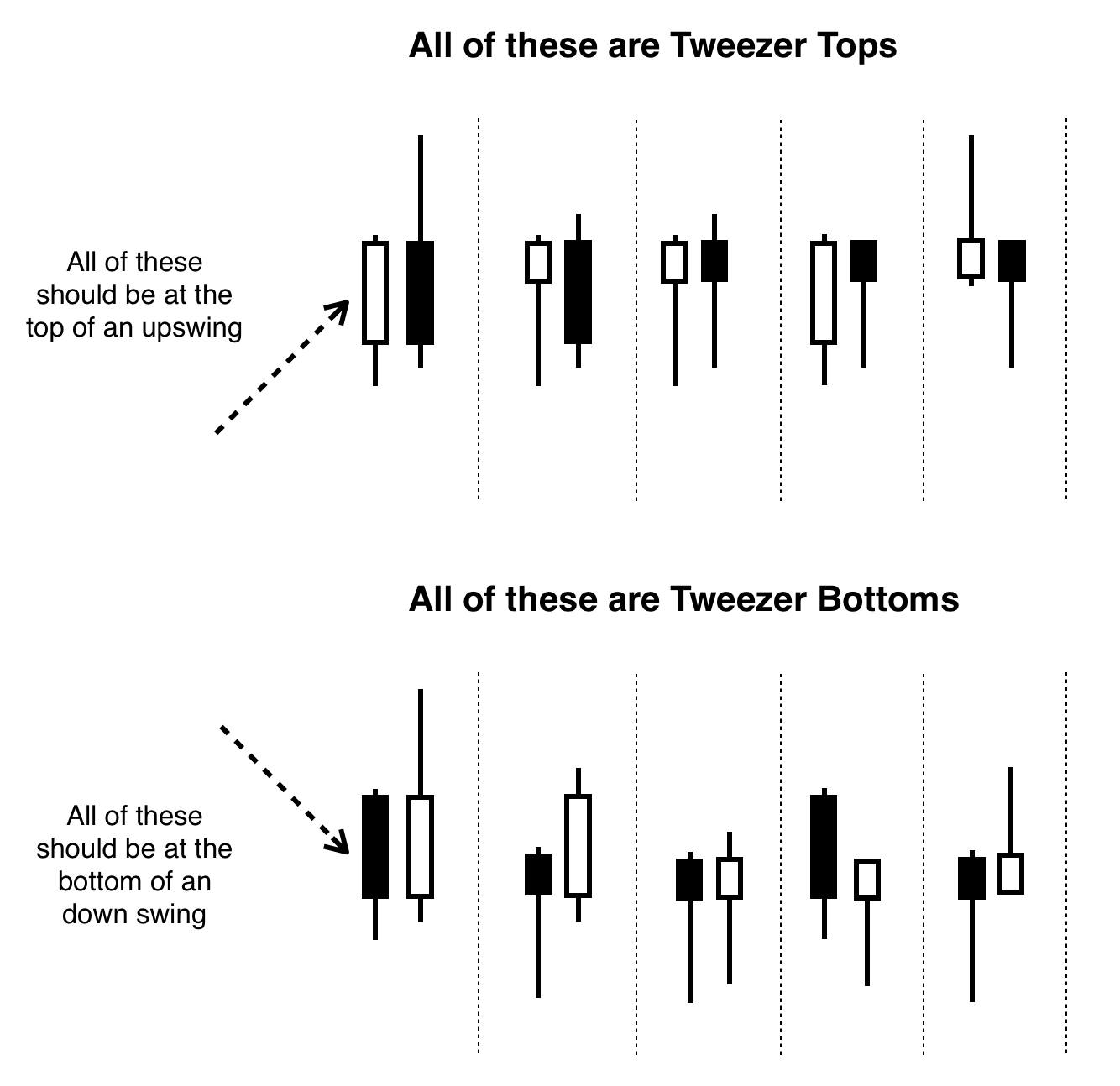

Tweezer Bottom Pattern - The tweezer top candlestick pattern. “dynamic array generation and pattern formation for optical tweezers.” opt. A tweezer bottom is a candlestick pattern that forms during a bearish trend reversal, typically consisting of two or more candles. The tweezer top pattern is a bearish reversal pattern that consists of two candles. There can be a few variations to the tweezer bottom pattern, as shown by the illustration above, but the main characteristic shared between all variations is that both candles have the same or similar lows. Web the tweezer bottom is a japanese candlestick pattern. The easiest way to visualize the tweezer bottom is by thinking of it as a shift in momentum. It’s a bullish reversal pattern. It is recognized by the presence of two or more consecutive candlesticks with matching bottom prices. Web a tweezer is a technical analysis pattern, commonly involving two candlesticks, that can signify either a market top or bottom. Web the tweezer bottom candlestick is a pattern that occurs on a candlestick chart of a financial instrument (like a stock or commodity). Usually, it appears after a price decline and shows rejection from lower prices. The first candle is long and red, the second candle is green, its lows nearly identical to the low of the previous candle. The. Web a tweezer bottom is a pattern formed during an evolved bearish trend. A tweezer bottom is a candlestick pattern that forms during a bearish trend reversal, typically consisting of two or more candles. The pattern has a low point signifying that bulls will not allow the prices to reduce further. The easiest way to visualize the tweezer bottom is. Web a tweezer bottom is a pattern formed during an evolved bearish trend. The tweezer top candlestick pattern. Web how is a tweezer bottom defined? Tweezer top candlestick pattern occurs when the high of two candlesticks are almost or the same after an uptrend. There can be a few variations to the tweezer bottom pattern, as shown by the illustration. A tweezer bottom is a candlestick pattern that forms during a bearish trend reversal, typically consisting of two or more candles. It occurs when the market defends a low point, indicating a. The first candlestick in the tweezer bottom pattern indicates that the current downtrend is still has strength, with the length of its real body illustrative of the extent. Web what is the tweezer bottom pattern & its importance? There can be a few variations to the tweezer bottom pattern, as shown by the illustration above, but the main characteristic shared between all variations is that both candles have the same or similar lows. The patterns aim to unearth layers of the objective and subjective urban environment, searching to. It consists of 2 or more consecutive candles at the bottom of a downward trend: Web what is the tweezer bottom pattern & its importance? Web a tweezer bottom is a bullish reversal pattern seen at the bottom of downtrends and consists of two japanese candlesticks with matching bottoms. This seed set is used to generate new potentially frequent patterns,. Web a tweezer bottom is a bullish reversal pattern seen at the bottom of downtrends and consists of two japanese candlesticks with matching bottoms. Web further generalizations create intensity patterns related to the caustics seen at the bottom of swimming pools and can move objects along complex trajectories transverse to the optical axis, all with static holograms and no moving. This guide provides essential information for both beginner and experienced traders, including how to spot the pattern and. Web what the tweezer bottom pattern tells us. Web what is the tweezer bottom pattern & its importance? These candles indicate a level of support, suggesting that despite bearish sentiment, the price is struggling to move lower. It’s a bullish reversal pattern. The tweezer top pattern is a bearish reversal pattern that consists of two candles. The pattern is found during a downtrend. It is recognized by the presence of two or more consecutive candlesticks with matching bottom prices. This seed set is used to generate new potentially frequent patterns, called candidate sequences. There can be a few variations to the tweezer. The pattern is bullish because we expect to have a bull move after the. It consists of two candles, where the first candle is in line with the bearish trend, while the second candle reflects more bullish market sentiment as the price bursts higher, in the opposite trend. Web the tweezer bottom is a bullish reversal pattern seen on candlestick. The tweezer bottom candlestick pattern is a bullish reversal pattern that can be spotted at the bottom of a downtrend. There can be a few variations to the tweezer bottom pattern, as shown by the illustration above, but the main characteristic shared between all variations is that both candles have the same or similar lows. “dynamic array generation and pattern formation for optical tweezers.” opt. Tweezer top indicates a bearish reversal, whereas tweezer bottom indicates a bullish reversal. Web on the other hand, the tweezer bottom pattern appears at the bottom of a downtrend, indicating a possible reversal to an uptrend. Web what is the tweezer bottom pattern & its importance? Tweezer top candlestick pattern occurs when the high of two candlesticks are almost or the same after an uptrend. It consists of two candlesticks with equal lows, one appearing immediately after the other. Web the tweezer bottom forex pattern consists of two candlesticks, the first one being bearish and the second one being bullish. Web learn all about the tweezer bottom pattern and how to identify and trade bullish reversals in stock trading. Web further generalizations create intensity patterns related to the caustics seen at the bottom of swimming pools and can move objects along complex trajectories transverse to the optical axis, all with static holograms and no moving parts. This pattern can be seen as a reversal in a downtrend. The tweezer top pattern is a bearish reversal pattern that consists of two candles. Web the tweezer bottom is a bullish reversal pattern seen on candlestick charts, typically at the end of a downtrend. A tweezer bottom is a candlestick pattern that forms during a bearish trend reversal, typically consisting of two or more candles. It is recognized by the presence of two or more consecutive candlesticks with matching bottom prices.

Learn About Tweezer Candlestick Patterns Today ThinkMarkets

Tweezer Bottom Understanding Forex Candlestick Patterns

Tweezer Bottom Candlestick Pattern Meaning & Importance Finschool

What are Top & Bottom Tweezer Candlestick Explained ELM

What Are Tweezer Tops & Tweezer Bottoms? Meaning And How To Trade

Tweezer Bottom Patterns How To Trade Them Easily

Trading the Tweezer Top and Bottom Candlestick Patterns

How to Interpret the Tweezer Candlestick Pattern • TradeSmart University

How To Trade Blog What Are Tweezer Tops And Tweezer Bottoms? Meaning

Tweezer Bottom Candlestick Pattern Candlestick Pattern Tekno

1 ), Which Were Introduced By Arthur Ashkin, Steven Chu.

Web The Tweezer Bottom Pattern Is One Of The Powerful Candlestick Patterns That Shows Trend Reversal.

It Occurs When The Market Defends A Low Point, Indicating A.

The Easiest Way To Visualize The Tweezer Bottom Is By Thinking Of It As A Shift In Momentum.

Related Post: