Tripple Top Pattern

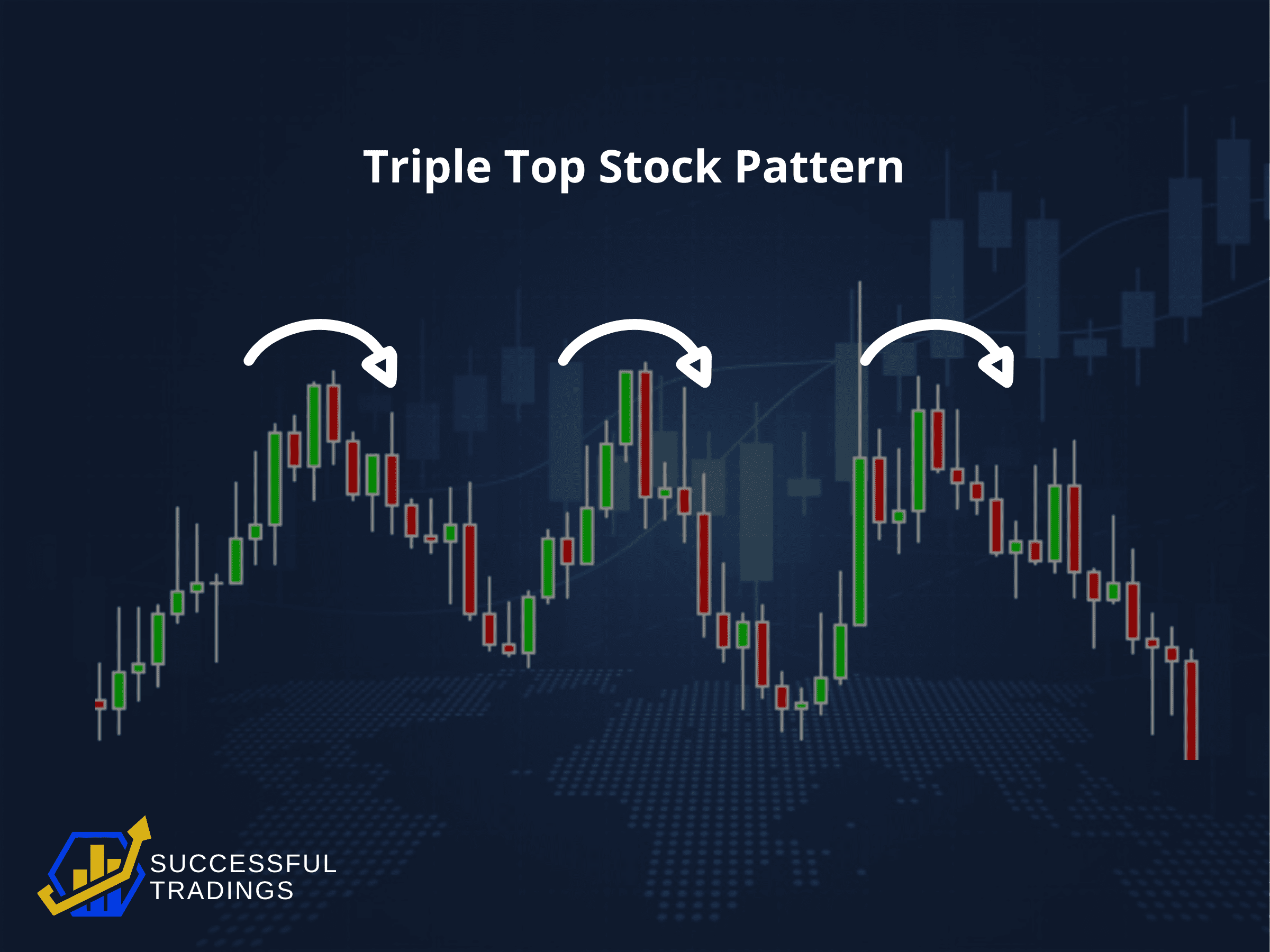

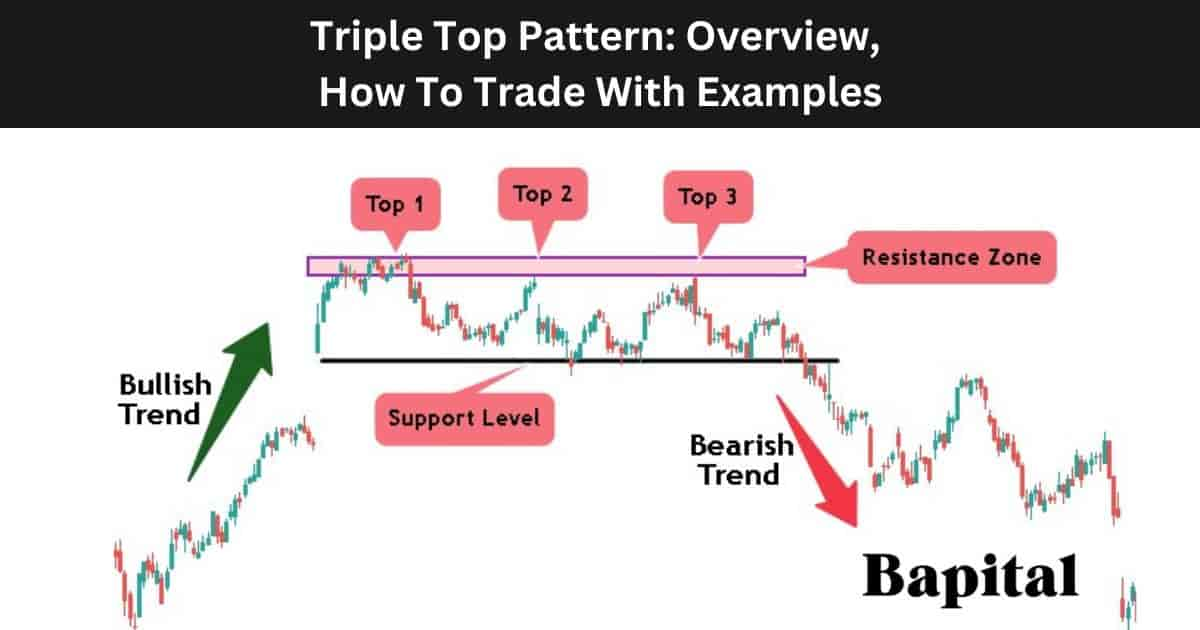

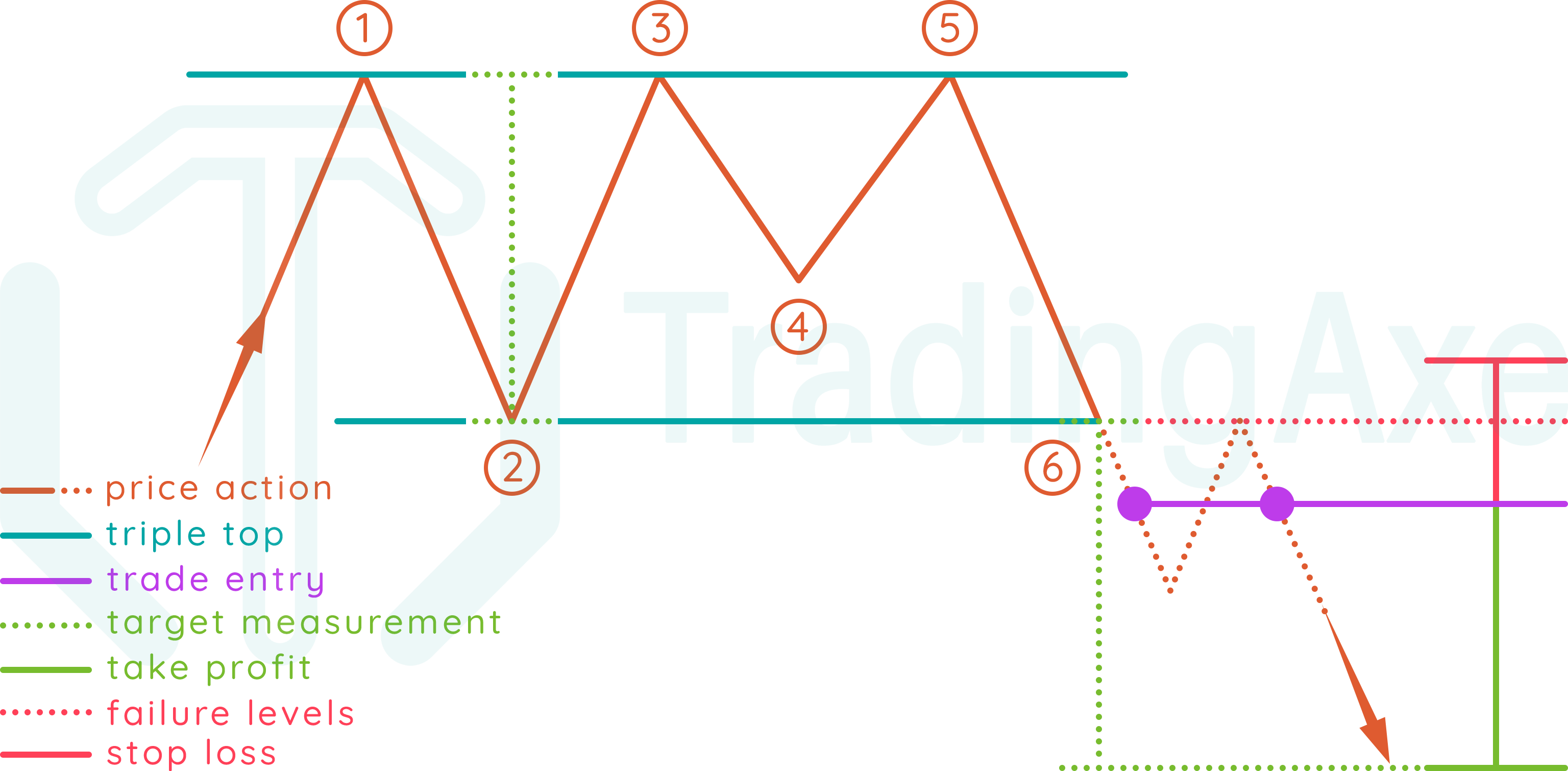

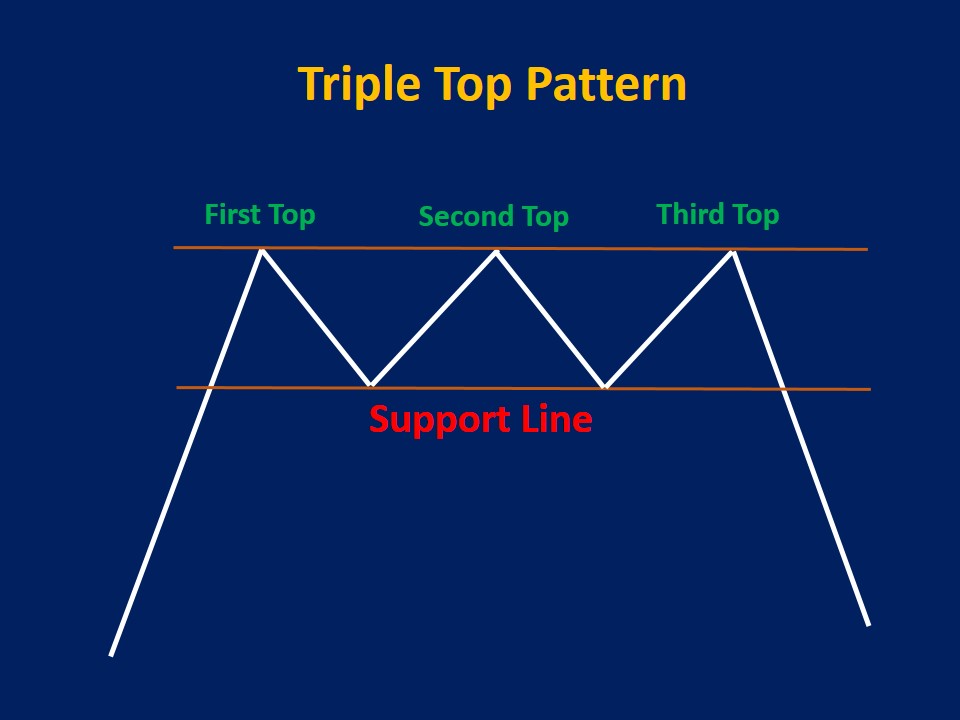

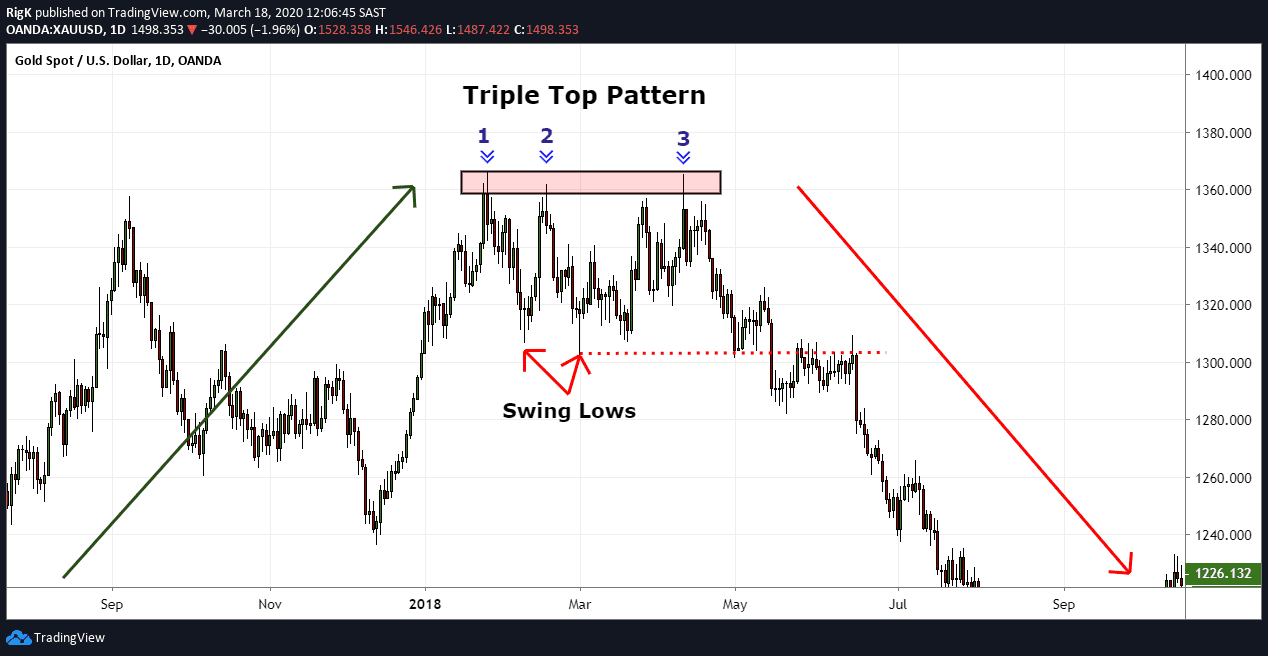

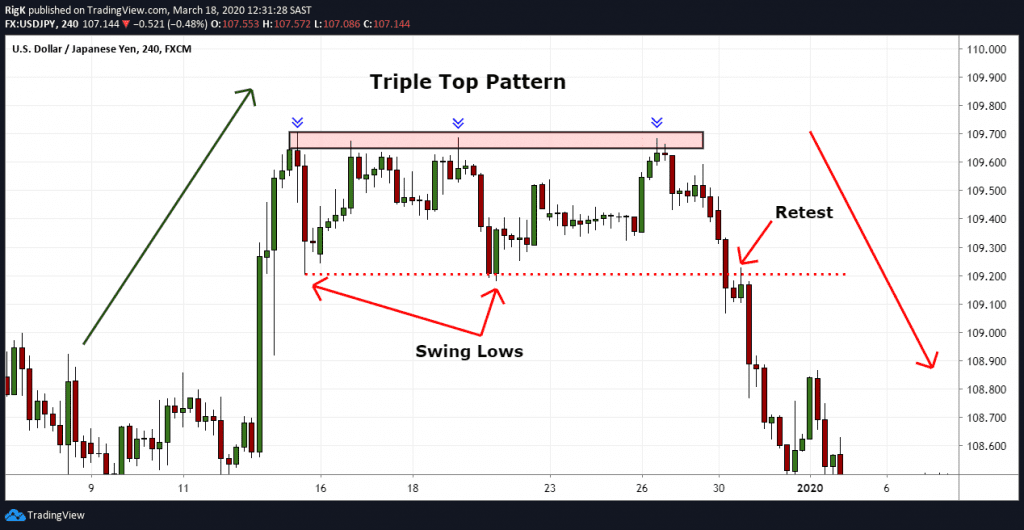

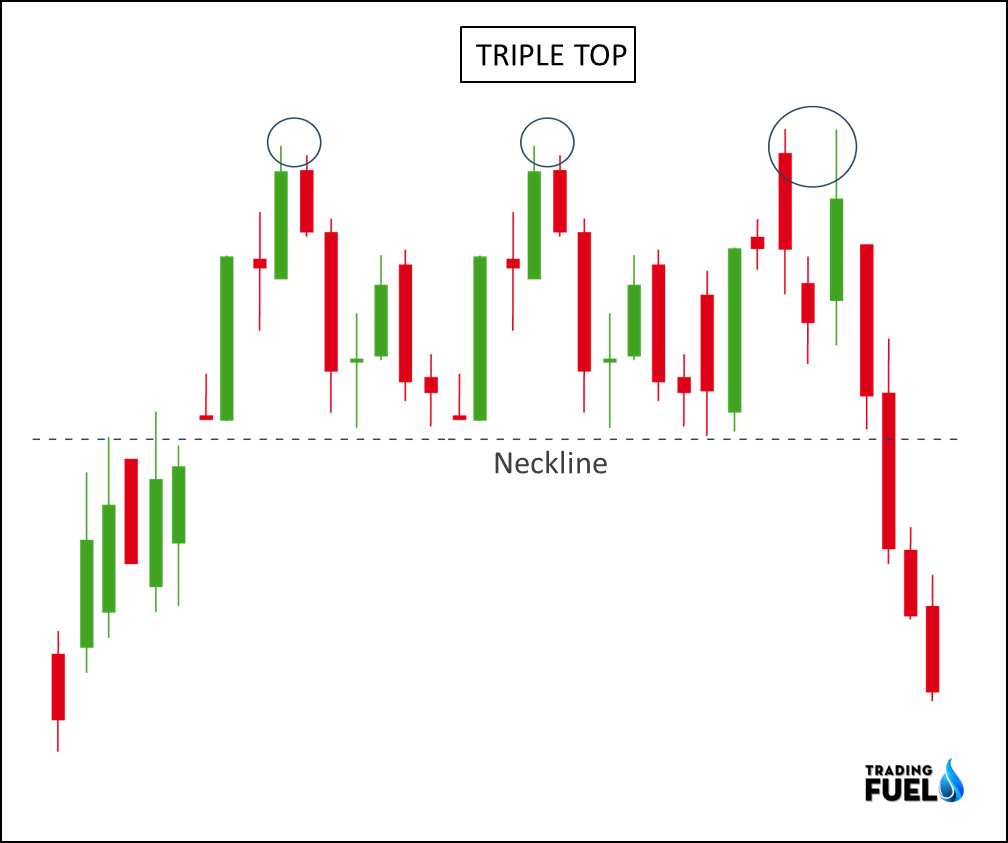

Tripple Top Pattern - Stronger reversals tend to happen to stronger trends: Web a triple top is a bearish reversal chart pattern that signals the sellers are in control (the opposite is called a triple bottom pattern). Web the triple top is a bearish candlestick pattern that occurs at the end of an uptrend. Web the triple top is a type of chart pattern used in technical analysis to predict the reversal in the movement of an asset's price. Web triple top is a reversal pattern formed by three consecutive highs that are at the same level (a slight difference in price values is allowed) and two intermediate lows between them. It signifies a potential shift in market sentiment from bullish to bearish. After that, the price returns to the first peak level, failing that first resistance level, thus creating a double top. Next, the first peak level is formed, the price decreases quickly or gradually. Here’s how it looks like… let me explain… #1: The pattern consists of three consecutive peaks at approximately the same price level, with two minor pullbacks in between. Web triple top pattern is a bearish reversal pattern that forms after an extended uptrend. This pattern is formed with three peaks above a support level/neckline. Upon completion, it resembles the shape of the letter m. Web the triple top pattern is used by technical analysts to predict a reversal after an uptrend and consists of three peaks that are. The triple top pattern consists of three similar price highs with price pullbacks between the peaks. The success rate of a triple top pattern is 41%. The pattern holds significant importance in digital assets due to their volatile nature. Example of a triple top. The decline will be the greater, the greater was the rise that led to the pattern. Web the triple top pattern is one of the price action chart patterns that can be used to formulate a trend reversal trading strategy. The success rate of a triple top pattern is 41%. Web the triple top pattern is a bearish reversal pattern that occurs at the end of an uptrend and consists of three consecutive tops along with. It signifies a potential shift in market sentiment from bullish to bearish. In this complete guide to the triple top pattern, you’ll learn the common interpretation of the pattern, as well as how you may go about to improve its performance. Next, the first peak level is formed, the price decreases quickly or gradually. Web put simply, the triple top. Web the triple top pattern is a reversal chart pattern that is formed when the price of security hits the same resistance level three times before breaking down. The pattern consists of three consecutive peaks at approximately the same price level, with two minor pullbacks in between. Price patterns are seen in identifiable sequences of price bars shown in. In. In fact, it is a potent bearish reversal chart pattern that can help you get into a new downtrend from the very beginning of the trend, while the opposite, the triple bottom, can help you get into an uptrend quite early. It consists of three peaks or resistance levels. What is the triple top pattern? A triple top emerging after. Example of a triple top. It consists of three peaks or resistance levels. Web the triple top pattern is a bearish reversal chart pattern that emerges after a prolonged uptrend, signaling that the market may be about to turn bearish. Next, the first peak level is formed, the price decreases quickly or gradually. Web the triple top is a bearish. Web triple top is commonly regarded as a bearish reversal pattern. Buyers are in control as the price makes a. It signifies a potential shift in market sentiment from bullish to bearish. Web a triple top chart pattern is a bearish technical analysis formation often used in crypto trading and other financial markets. Web the triple top pattern is one. As major reversal patterns, these patterns usually form over a 3 to 6 month period. Web the triple top pattern is a bearish reversal pattern that occurs at the end of an uptrend and consists of three consecutive tops along with the same resistance level. Here, in this article, we’ll show you how to trade triple top patterns, including some. Web the triple top pattern is a reversal chart pattern that is formed when the price of security hits the same resistance level three times before breaking down. A triple top emerging after an intensive uptrend might be expected to result in a steep decline. Web triple top is commonly regarded as a bearish reversal pattern. Consisting of three peaks,. Stronger reversals tend to happen to stronger trends: Preceding trend intensity is also important: The chart pattern is categorized as a bearish reversal pattern. The pattern consists of three consecutive peaks at approximately the same price level, with two minor pullbacks in between. The decline will be the greater, the greater was the rise that led to the pattern. Web a triple top is a chart pattern that consists of three equal highs followed by a break below support. Web triple top is commonly regarded as a bearish reversal pattern. Web the triple top pattern is a reversal chart pattern that is formed when the price of security hits the same resistance level three times before breaking down. Consisting of three peaks, a triple top signals that the. Web triple top pattern is a bearish reversal pattern that forms after an extended uptrend. Price patterns are seen in identifiable sequences of price bars shown in. Web the triple top pattern is used by technical analysts to predict a reversal after an uptrend and consists of three peaks that are similar in height. Here, in this article, we’ll show you how to trade triple top patterns, including some useful tips, and more. As major reversal patterns, these patterns usually form over a 3 to 6 month period. A triple top emerging after an intensive uptrend might be expected to result in a steep decline. It signifies a potential shift in market sentiment from bullish to bearish.

Triple Top Stock Pattern Explained In Simple Terms

The Monster Guide To Triple Top Trading Pattern Pro Trading School

Triple Top Pattern Overview, How To Trade With Examples

What Are Triple Top and Bottom Patterns in Crypto Trading? Bybit Learn

How To Trade Triple Top Chart Pattern TradingAxe

The Complete Guide to Triple Top Chart Pattern

Triple Top Pattern How to Trade and Examples

Triple Top Pattern A Guide by Experienced Traders

Triple Top Pattern A Guide by Experienced Traders

Double Top Pattern Definition How to Trade Double Tops & Bottoms?

After That, The Price Returns To The First Peak Level, Failing That First Resistance Level, Thus Creating A Double Top.

Web The Triple Top Is A Type Of Chart Pattern Used In Technical Analysis To Predict The Reversal In The Movement Of An Asset's Price.

Web Triple Top Is A Reversal Pattern Formed By Three Consecutive Highs That Are At The Same Level (A Slight Difference In Price Values Is Allowed) And Two Intermediate Lows Between Them.

Web Triple Tops Consist Of A Left Swing High Price, Middle Swing High Price Peak, Right Swing High Price Peak, And A Support Level.

Related Post: