Triple Top Stock Pattern

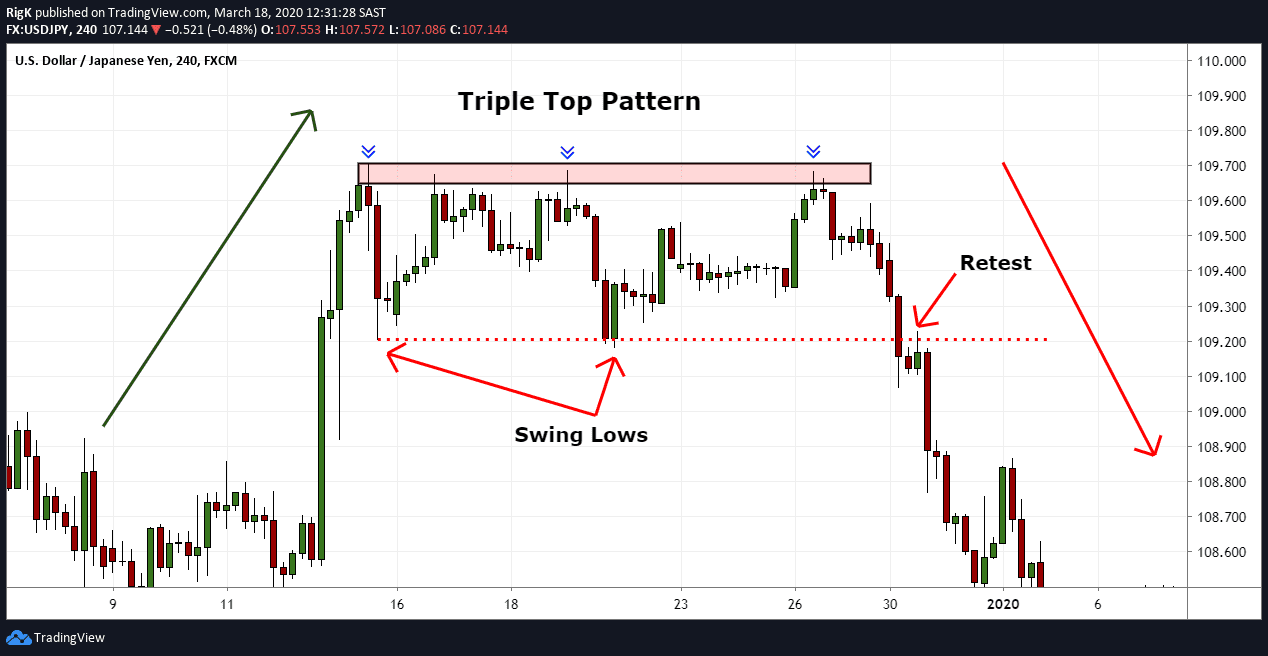

Triple Top Stock Pattern - This marks a reversal will. Failure to again cross them (for the 4rd time), could result in some downside. This was 1.81% worse than the analyst. Constellation energy reported earnings per share of $1.82. A trader will either exit long positions or enter short positions when the pattern completes. Ceg) just reported results for the first quarter of 2024. Web himax technologies (nasdaq: The peaks are separated by two troughs or valleys. Web remember, the triple top is a bearish reversal pattern that stems from an uptrend. Buyers are in control as the price makes a higher high, followed by a pullback. Ceg) just reported results for the first quarter of 2024. A pattern used in technical analysis to predict the reversal of a prolonged uptrend. The first sign of selling pressure appears as the price fails to break out of the prior high. Three swing high price peaks form and a horizontal support price level indicating the pattern. At first, the. As you can see from the example below, the stock wmgi just formed a triple bottom pattern. Constellation energy reported earnings per share of $1.82. Three bottoms will come in succession, reflecting an important resistance. Web the triple top pattern is a bearish reversal chart pattern that forms after a strong uptrend, signaling that the sellers are gaining control. The. Ceg) just reported results for the first quarter of 2024. Web 1.the first top. Web a triple top stock pattern is formed by three peaks moving into the same area, with pullbacks in between. Web a triple top pattern (tt) is a bearish stock market technical analysis charts reversal pattern that is found at market tops. Web the pattern is. Web here’s how it looks like…. Ggr) just reported results for the first quarter of 2024. This was 1.81% worse than the analyst. In the chart below, we have a usd/cad on a 4h chart moving aggressively higher on the left side of the chart. A pattern is identified by a line. A triple top pattern consists of several candlesticks that form three peaks or resistance levels that are either equal or near equal height. To identify the triple top pattern, keep these critical points in mind: It is considered complete, indicating a further price slide, once the price moves below support level. Web 1.the first top. Below the triple top shows. Patterns are the distinctive formations created by the movements of security prices on a chart and are the foundation of technical analysis. At first, the market is in an uptrend which means that bullish market sentiment is dominant. Ggr) just reported results for the first quarter of 2024. Web here’s how it looks like…. After reaching its 3rd bottom at. Ggr) just reported results for the first quarter of 2024. Top 3 technical picks for may 14 there is a bullish butterfly pattern seen on hourly scale so based on these signals, we advise. Three bottoms will come in succession, reflecting an important resistance. As major reversal patterns, these patterns usually form over a 3 to 6 month period. Primo. A triple top is one of the most reliable stock chart patterns found in technical analysis charts. The peaks are separated by two troughs or valleys. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web 4m ago · by investorplace earnings. This was above the. Api) saw a 5% rise in sales from the previous quarter to rmb 148.3 million in q4 2023. Web remember, the triple top is a bearish reversal pattern that stems from an uptrend. It is considered complete, indicating a further price slide, once the price moves below support level. Triple top offers one of the bets methods to have a. The first sign of selling pressure appears as the price fails to break out of the prior high. This pattern is identified when the price of an asset creates three peaks at nearly the same price. Its formation is as follows: It is a straight forward formation defined by three clear peaks in the market at about the same price. This was above the analyst estimate for eps of 5. Failure to again cross them (for the 4rd time), could result in some downside. Web the triple top pattern is a bearish reversal chart pattern that forms after a strong uptrend, signaling that the sellers are gaining control. Web the triple top reversal is a bearish reversal pattern typically found on bar charts, line charts and candlestick charts. In the chart below, we have a usd/cad on a 4h chart moving aggressively higher on the left side of the chart. These levels act as a resistance level. Its formation is as follows: Web 4m ago · by investorplace earnings. At first, the market is in an uptrend which means that bullish market sentiment is dominant. Web the shengwang business of agora (nasdaq: Web triple top pattern example. A trader will either exit long positions or enter short positions when the pattern completes. Web remember, the triple top is a bearish reversal pattern that stems from an uptrend. Web a triple top stock pattern is formed by three peaks moving into the same area, with pullbacks in between. Ggr) just reported results for the first quarter of 2024. This was above the analyst estimate for eps of 13 cents.

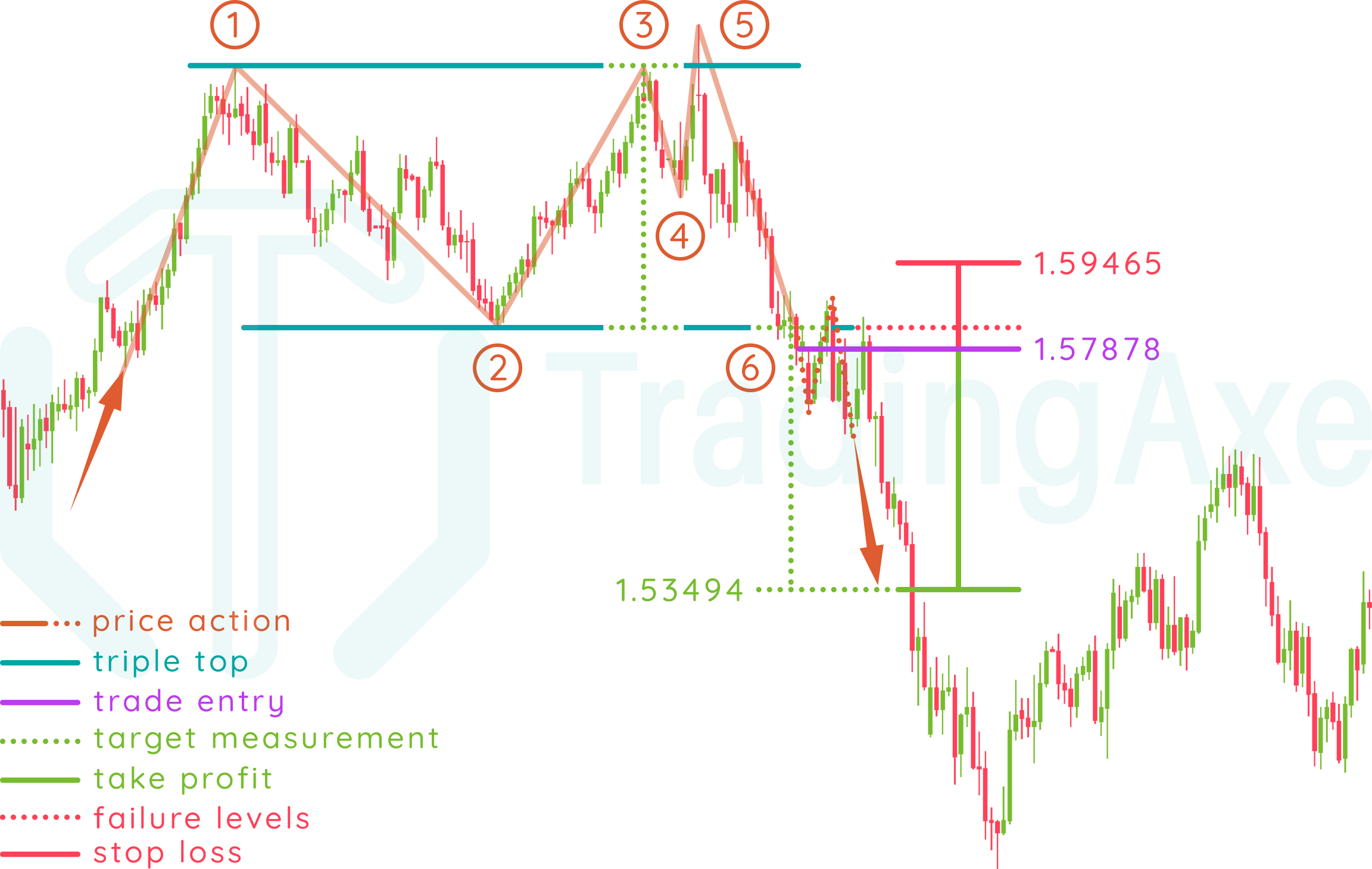

How To Trade Triple Top Chart Pattern TradingAxe

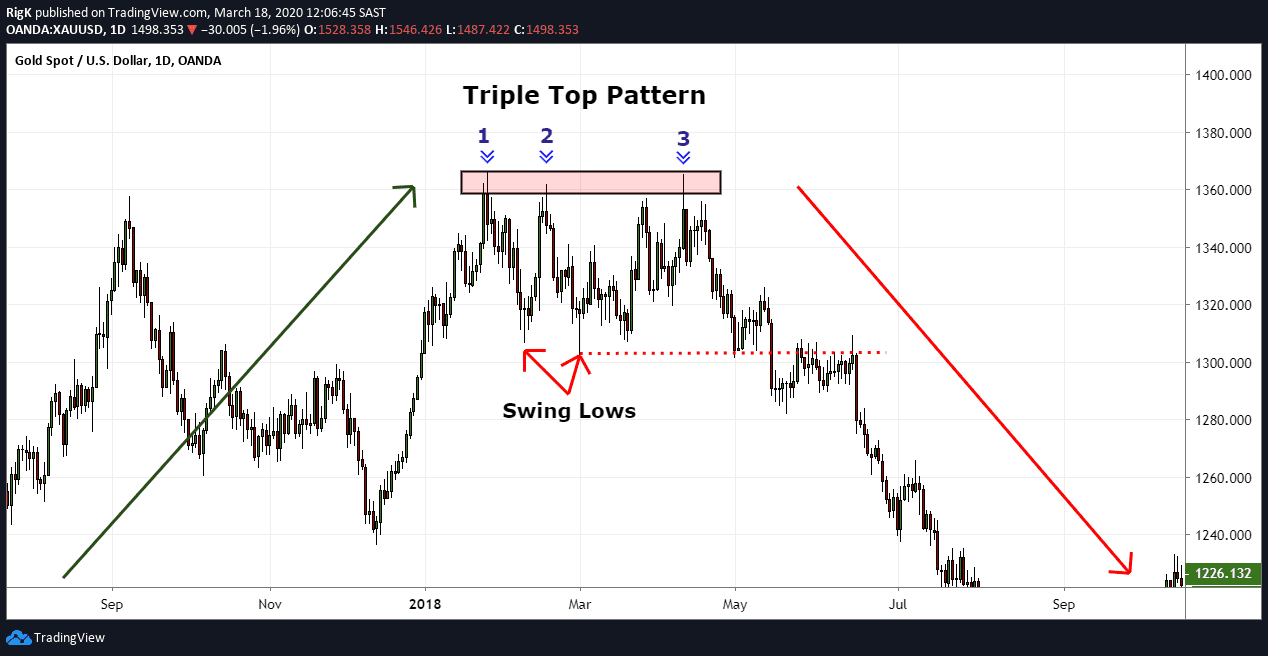

Triple Top Pattern How to Trade and Examples

The Complete Guide to Triple Top Chart Pattern

Triple Top Stock Chart Pattern 3D Illustration Stock Photo Alamy

Triple Top Pattern A Guide by Experienced Traders

:max_bytes(150000):strip_icc()/dotdash_Final_Triple_Top_Dec_2020-01-78a37beca8574d169c2cccd1fc18279d.jpg)

Triple Top What It Is, How It Works, and Examples

How to Trade Triple Top and Triple Bottom Patterns

Triple Top Stock Pattern Explained In Simple Terms

Triple Top Pattern A Guide by Experienced Traders

Triple Top Pattern Explained Stock Chart Patterns

Web Technical & Fundamental Stock Screener, Scan Stocks Based On Rsi, Pe, Macd, Breakouts, Divergence, Growth, Book Vlaue, Market Cap, Dividend Yield Etc.

The Price Action Then Hits A $1.29 Horizontal Resistance And Fails To Clear It, Causing The First Bigger Correction Since The Trend Was Initiated.

Once Again, The Stock Is Pushed Back From Resistance As Supply Overwhelms Demand.

Himax Technologies Reported Earnings Per Share Of 7.1 Cents.

Related Post: