Triple Top Stock Chart Pattern

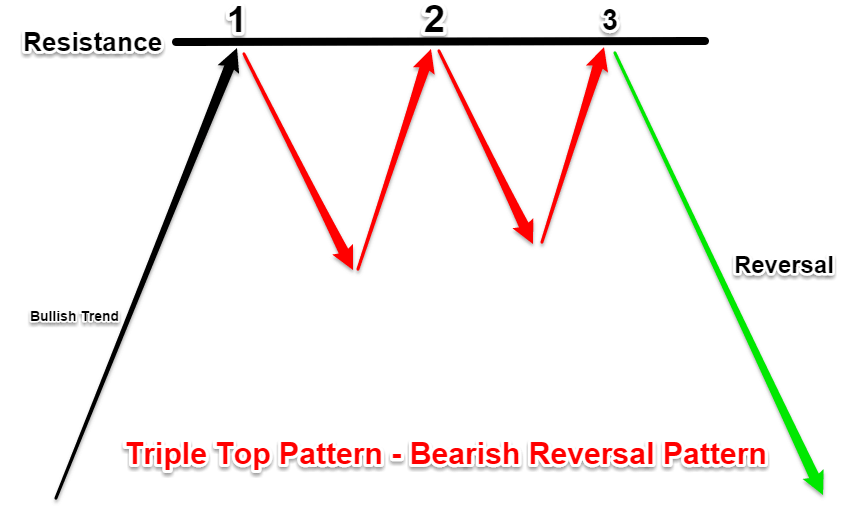

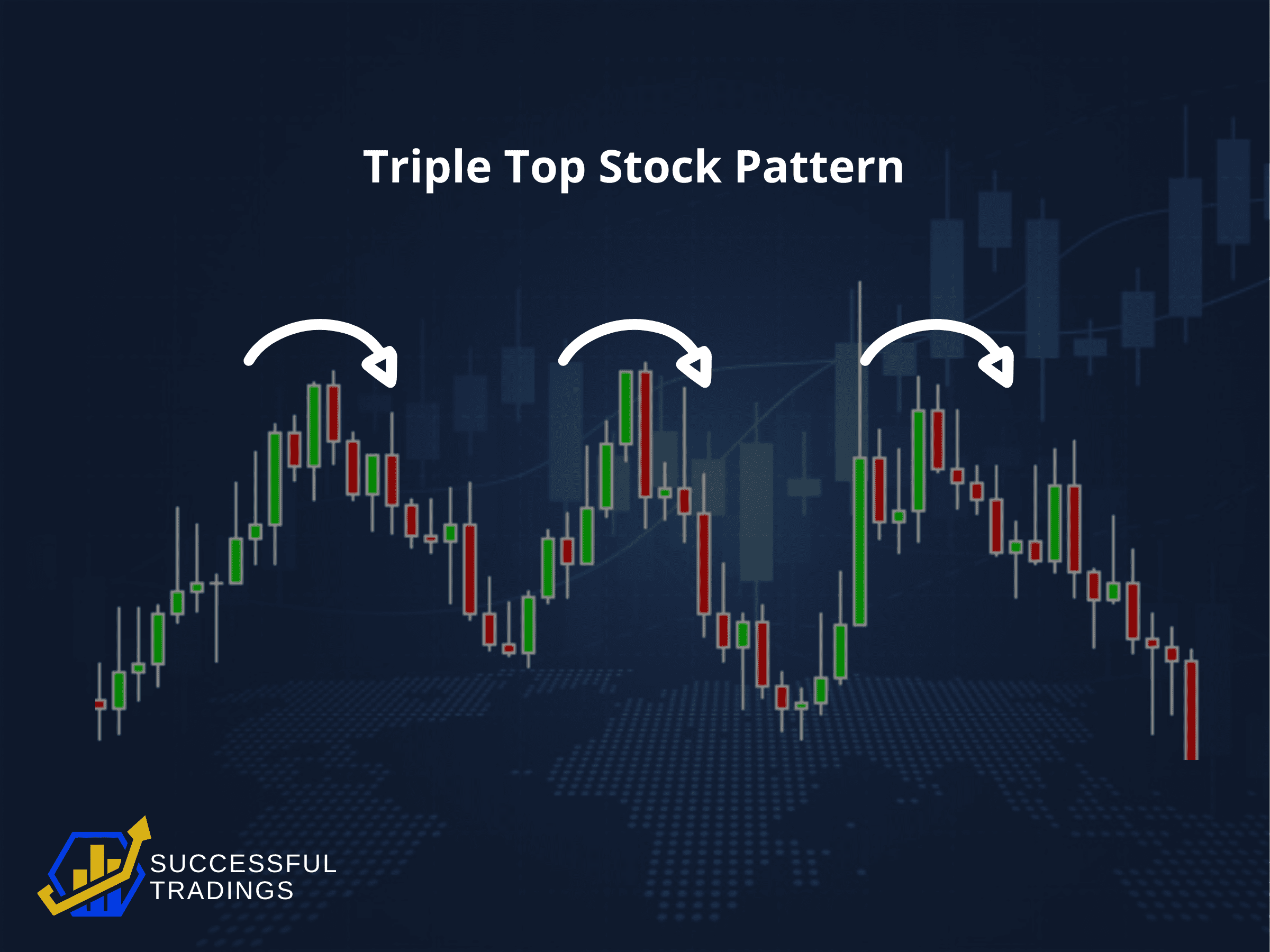

Triple Top Stock Chart Pattern - Web the triple top pattern is a reversal chart pattern that is formed when the price of security hits the same resistance level three times before breaking down. The triple top is a type of chart pattern used in technical analysis to predict the reversal in the movement of an asset's price. Web the triple top pattern is quite a straightforward formation. Three peaks follow one another, showing significant resistance. Web triple top is a reversal pattern formed by three consecutive highs that are at the same level (a slight difference in price values is allowed) and two intermediate lows between. Web put simply, the triple top stock pattern indicates a potential shift from an uptrend to a downtrend, signaling that bullish momentum may be ending. The list for youfasttopjust right A triple top pattern is a bearish pattern. 78k views 9 years ago technical analysis & charts. Triple top chart pattern is formed when the buyers have faith in the stock and take the price to a new high (top1) but fails. Web updated april 4, 2024. Consisting of three peaks, a triple top signals that the asset may no longer be rallying, and that lower prices may be on the way. A triple top pattern is a bearish pattern. This pattern is formed with three. Web the triple top pattern is quite a straightforward formation. The triple top is a type of chart pattern used in technical analysis to predict the reversal in the movement of an asset's price. It consists of three consecutive highs/tops recorded at, or near, the same level. A triple top pattern is a bearish pattern. Entry 1 at the third. Web understanding triple top chart pattern: This pattern is formed with three. Triple top chart pattern is formed when the buyers have faith in the stock and take the price to a new high (top1) but fails. This is a sign of a. Web the triple top pattern is a bearish reversal chart pattern that forms after a strong uptrend, signaling that the sellers are gaining. 78k views 9 years ago technical analysis & charts. Triple top or triple bottom. Web updated april 4, 2024. Web what is the triple top pattern? Web a triple top is one of the most reliable stock chart patterns found in technical analysis charts. Web understanding triple top chart pattern: Triple tops (or bottoms) are identified by three peaks (or troughs). To identify the triple top. Consisting of three peaks, a triple top signals that the asset may no longer be rallying, and that lower prices may be on the way. Web the triple top pattern is a reversal chart pattern that is formed. Web a triple peak or triple top is a bearish chart pattern in the form of an mn. This is a sign of a. Web what is the triple top pattern? This pattern is formed with three. Triple top or triple bottom. Web the triple top chart pattern used in technical analysis consists of three compulsory elements: The triple top is a type of chart pattern used in technical analysis to predict the reversal in the movement of an asset's price. In order for the pattern to be considered a triple top, it must. Cash settledpotential tax savingstrade nearly 24x5european exercise Triple. This pattern is formed with three. Web the triple top chart pattern used in technical analysis consists of three compulsory elements: It is a straight forward formation defined by three clear peaks in the market at. 78k views 9 years ago technical analysis & charts. Web the triple top pattern is quite a straightforward formation. Entry 1 at the third. Web understanding triple top chart pattern: Three peaks follow one another, showing significant resistance. Web triple top is a reversal pattern formed by three consecutive highs that are at the same level (a slight difference in price values is allowed) and two intermediate lows between. It is a straight forward formation defined by three clear. Web the triple top pattern is a reversal chart pattern that is formed when the price of security hits the same resistance level three times before breaking down. To identify the triple top. Web a triple peak or triple top is a bearish chart pattern in the form of an mn. Entry 1 at the third. Triple tops (or bottoms). Web the triple top chart pattern used in technical analysis consists of three compulsory elements: This pattern is formed with three. Web what is the triple top pattern? 78k views 9 years ago technical analysis & charts. Web updated april 4, 2024. Consisting of three peaks, a triple top signals that the asset may no longer be rallying, and that lower prices may be on the way. Web a triple top is one of the most reliable stock chart patterns found in technical analysis charts. To identify the triple top. Fact checked by lucien bechard. An a++ triple top reversal is composed of three rounded tops. Entry 1 at the third. Triple tops (or bottoms) are identified by three peaks (or troughs). The list for youfasttopjust right Cash settledpotential tax savingstrade nearly 24x5european exercise Three peaks follow one another, showing significant resistance. Web triple tops chart pattern.

Triple Top Pattern Explained Stock Chart Patterns

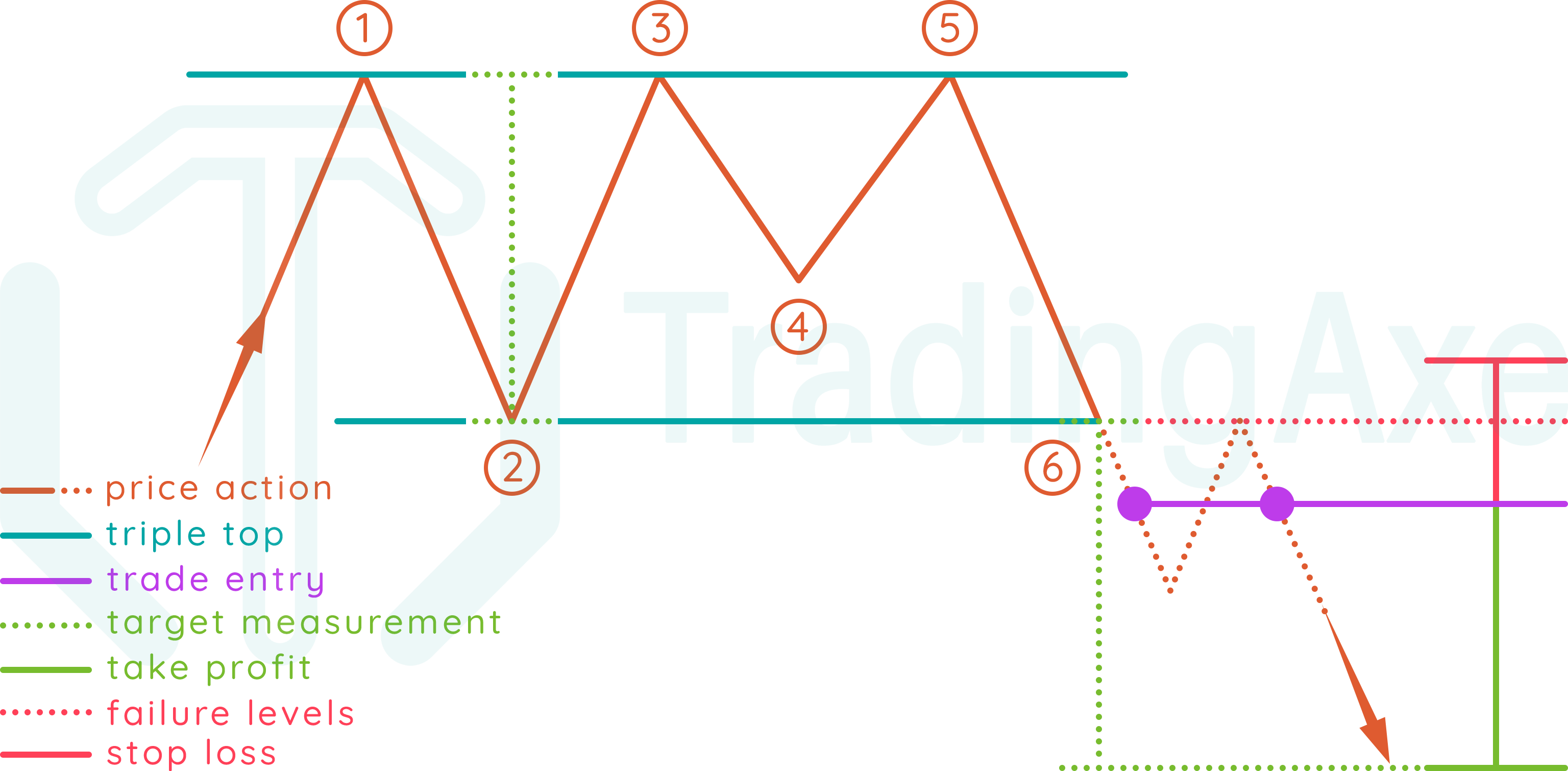

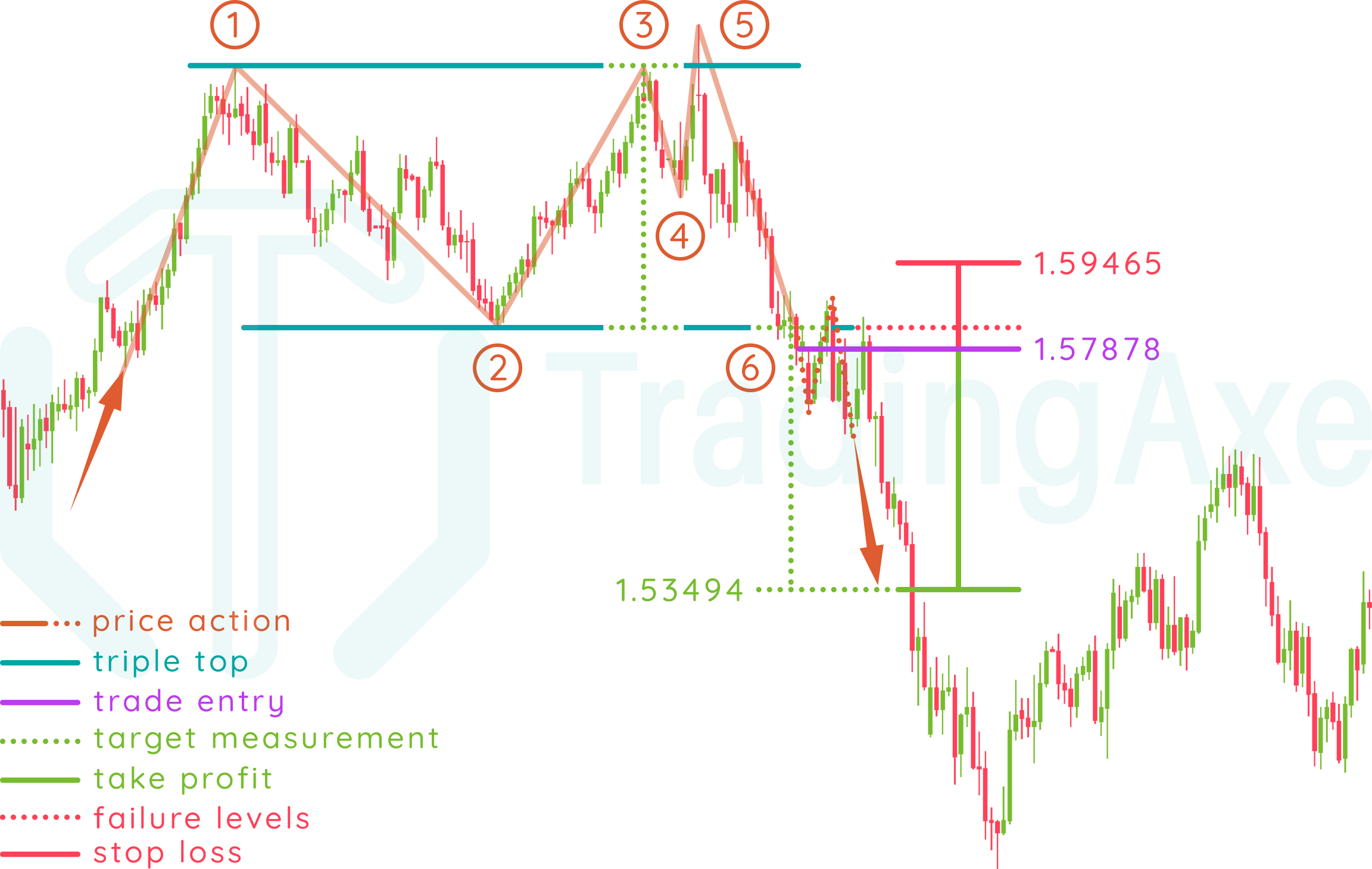

How To Trade Triple Top Chart Pattern TradingAxe

:max_bytes(150000):strip_icc()/dotdash_Final_Triple_Top_Dec_2020-01-78a37beca8574d169c2cccd1fc18279d.jpg)

Triple Top Definition

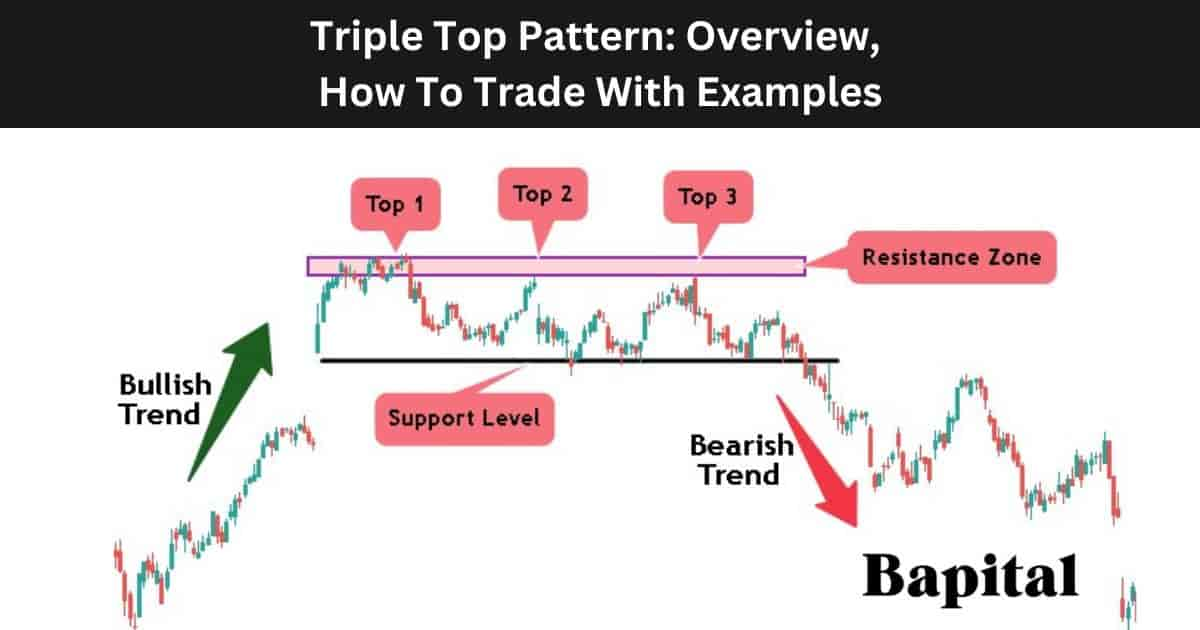

Triple Top Pattern Overview, How To Trade With Examples

How To Trade Triple Top Chart Pattern TradingAxe

The Complete Guide to Triple Top Chart Pattern

Triple Top Pattern A Guide by Experienced Traders

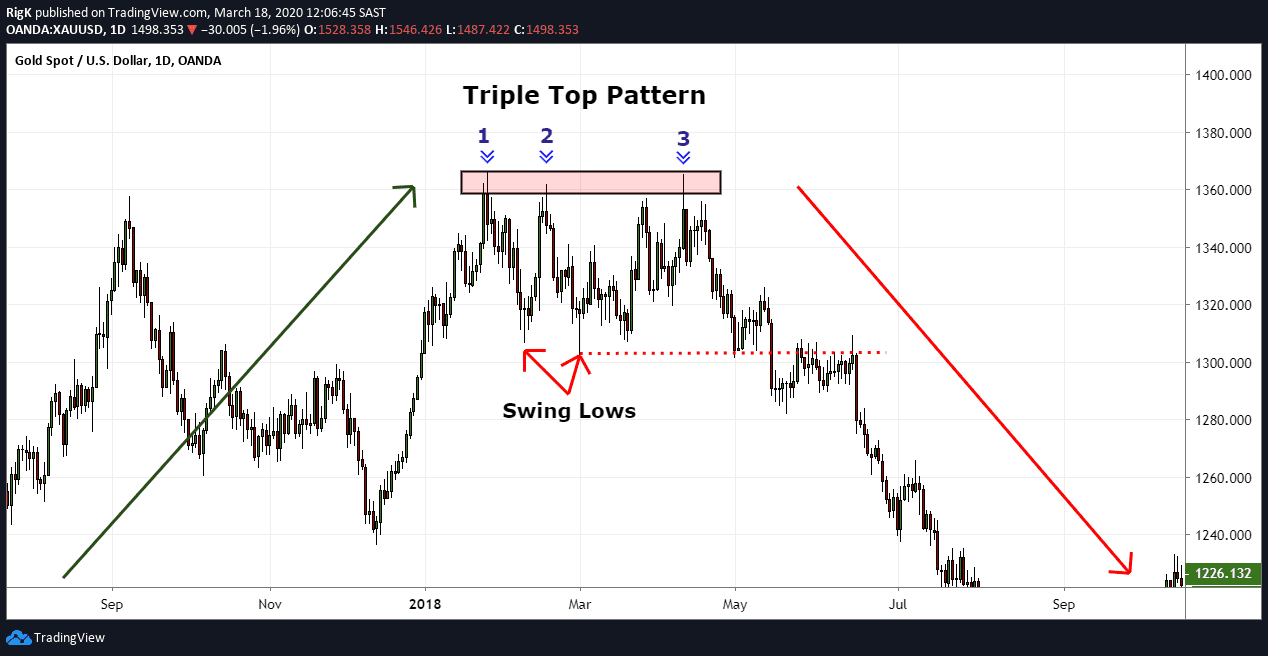

Chart Pattern Triple Top — TradingView

Trading the Triple Top Stock Chart Pattern India Dictionary

Triple Top Stock Pattern Explained In Simple Terms

Triple Top Chart Pattern Is Formed When The Buyers Have Faith In The Stock And Take The Price To A New High (Top1) But Fails.

Triple Top Or Triple Bottom.

The Triple Top Is A Type Of Chart Pattern Used In Technical Analysis To Predict The Reversal In The Movement Of An Asset's Price.

It Is A Straight Forward Formation Defined By Three Clear Peaks In The Market At.

Related Post: