Triple Top Pattern

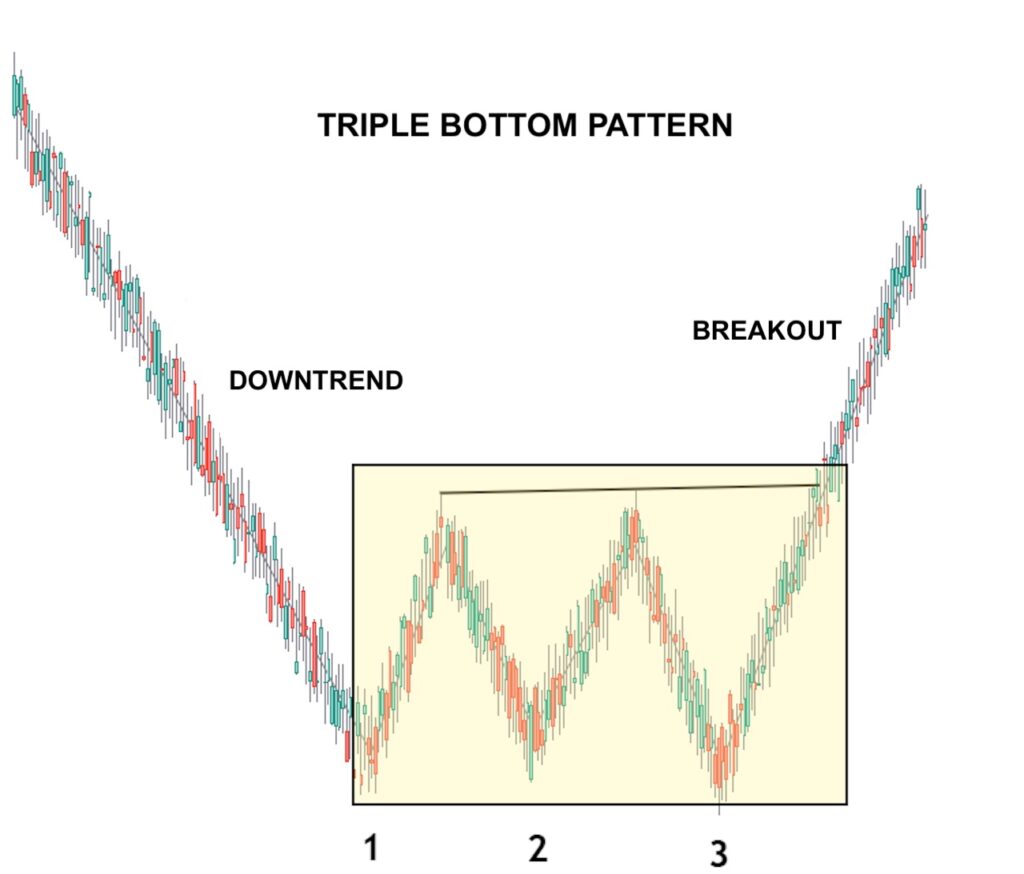

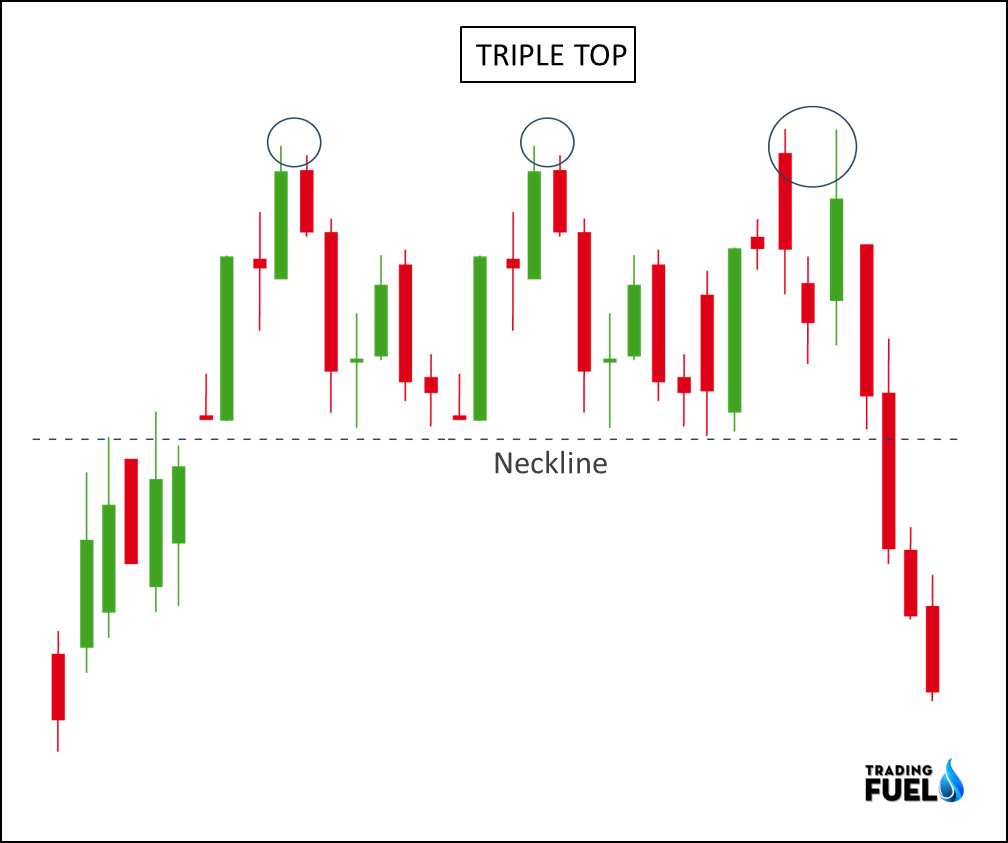

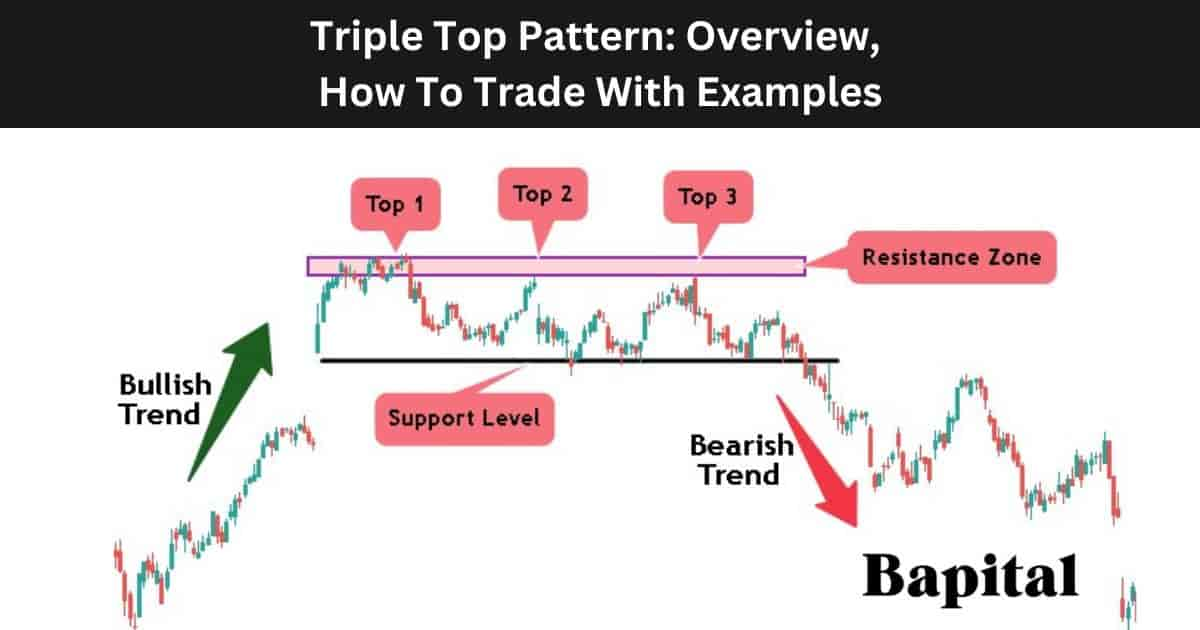

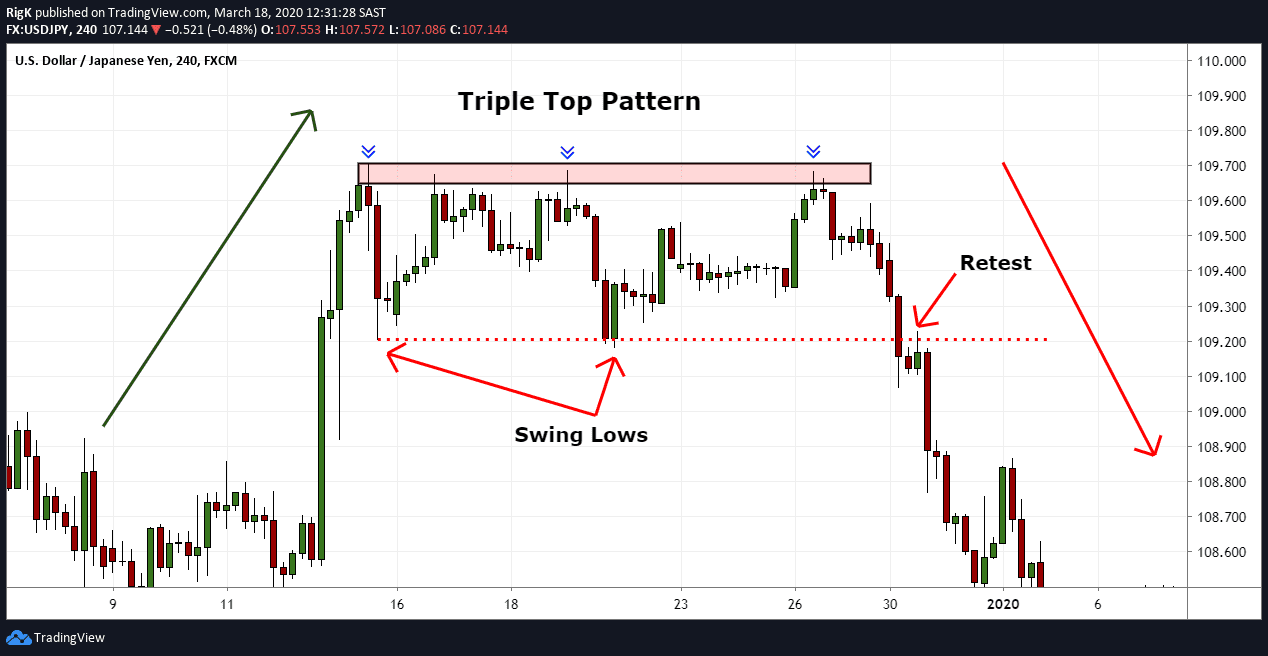

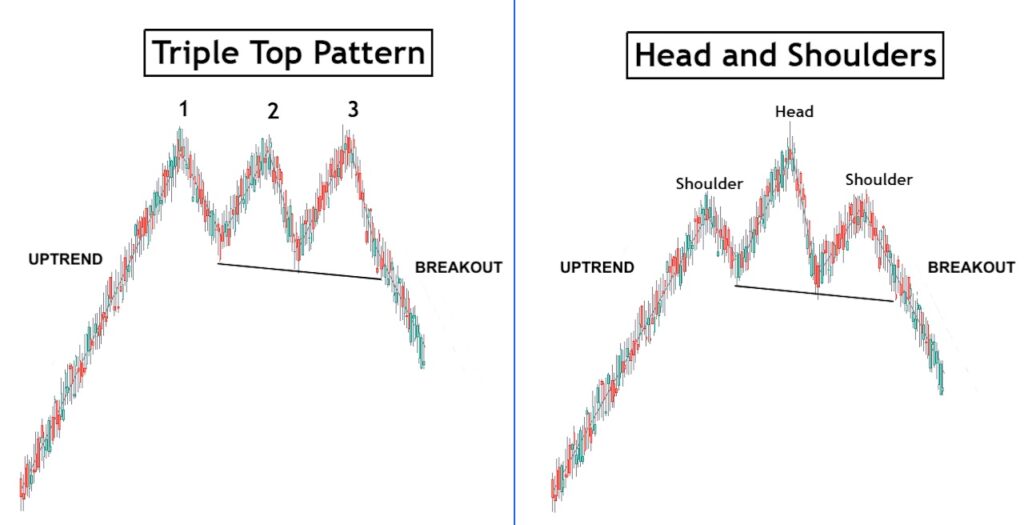

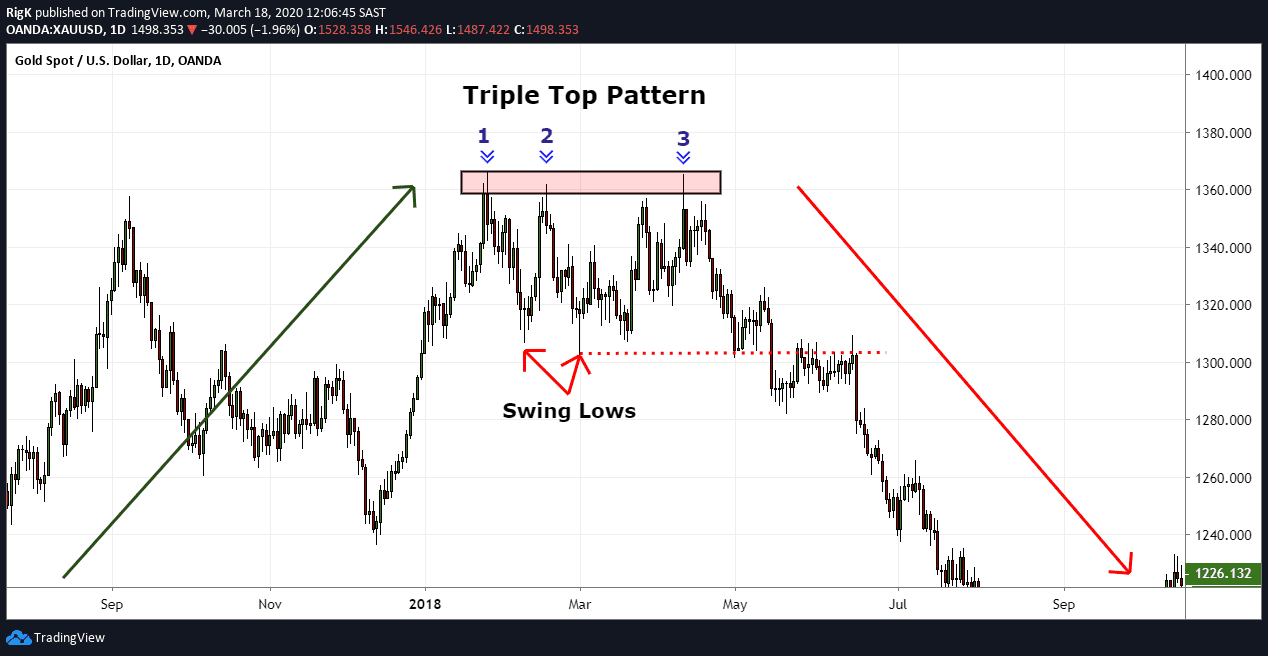

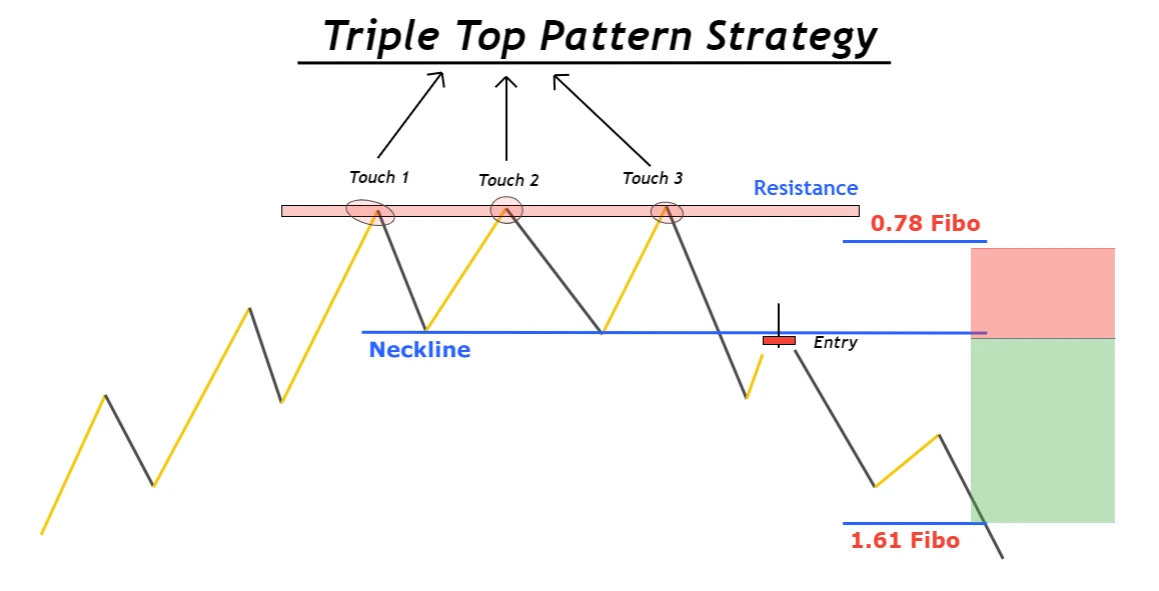

Triple Top Pattern - This pattern is identified when the price of an asset creates three peaks at nearly the same price. Web the triple top is a bearish candlestick pattern that occurs at the end of an uptrend. Web a triple top pattern occurs when an asset reaches a certain resistance level and cannot move above it. Web the first triple top pattern trading step is to identify the triple top in a market. Enter a short trade position when the asset price falls below the support price trendline. Web the triple top pattern is a reversal formation that technical analysts use to identify potential trend changes on financial charts. As a reversal pattern, the triple top formation suggests a likely change in the trend direction, after the buyers failed to clear the horizontal resistance in three consecutive attempts, the scenario opposite of the triple bottom pattern. There are three equal highs followed by a break below support. Don’t chase the breakdown of a triple top pattern as the market is likely to make a. Web the triple top reversal is a bearish reversal pattern typically found on bar charts, line charts and candlestick charts. Each high should be equal, have good space, and mark clear turning. Web the first triple top pattern trading step is to identify the triple top in a market. Triple top patterns have three highs, hence the name triple top. As major reversal patterns, these patterns usually form over a 3 to 6 month period. Scan for triple tops using. Triple top patterns have three highs, hence the name triple top. As major reversal patterns, these patterns usually form over a 3 to 6 month period. Web the triple top is a bearish candlestick pattern that occurs at the end of an uptrend. Its formation is as follows: The difference is that the triple top does not have the bearish. Web a triple top pattern occurs when an asset reaches a certain resistance level and cannot move above it. Web the triple top pattern is a crucial chart pattern in technical analysis that helps traders predict price reversals in financial markets. A pattern used in technical analysis to predict the reversal of a prolonged uptrend. The difference is that the. The difference is that the triple top does not have the bearish volume, so the bulls can come in once more to try and break the highs. Web the triple top reversal is a bearish reversal pattern typically found on bar charts, line charts and candlestick charts. Web the triple top pattern is also similar to the double top pattern.. Don’t chase the breakdown of a triple top pattern as the market is likely to make a. When this happens twice, the chart pattern is known as the double top pattern, but when the price tests the highest level three consecutive times, the pattern is known as a triple top pattern and it provides a stronger trend reversal. Triple top. Web a triple top pattern occurs when an asset reaches a certain resistance level and cannot move above it. The triple top pattern consists of three peaks or tops that are formed around the same price level, with troughs or pullbacks in between. As major reversal patterns, these patterns usually form over a 3 to 6 month period. Web the. Web a triple top is a bearish reversal chart pattern that signals the sellers are in control (the opposite is the triple bottom pattern) it’s not a good idea to short a triple top pattern when it’s obvious as you’re likely coming into an area of support. There are three equal highs followed by a break below support. The triple. Web the triple top pattern is a crucial chart pattern in technical analysis that helps traders predict price reversals in financial markets. Note that a triple top reversal on a bar or line chart is completely different. Web the first triple top pattern trading step is to identify the triple top in a market. As a reversal pattern, the triple. As a reversal pattern, the triple top formation suggests a likely change in the trend direction, after the buyers failed to clear the horizontal resistance in three consecutive attempts, the scenario opposite of the triple bottom pattern. Web the triple top reversal is a bearish reversal pattern typically found on bar charts, line charts and candlestick charts. There are three. The difference is that the triple top does not have the bearish volume, so the bulls can come in once more to try and break the highs. Web the triple top reversal is a bearish reversal pattern typically found on bar charts, line charts and candlestick charts. As a result, the pattern signifies that the bullish momentum is weakening, and.. The difference is that the triple top does not have the bearish volume, so the bulls can come in once more to try and break the highs. Scan for triple tops using a pattern scanner or browse the price charts manually for the pattern formation. Its formation is as follows: Web a triple top pattern occurs when an asset reaches a certain resistance level and cannot move above it. Web the triple top reversal is a bearish reversal pattern typically found on bar charts, line charts and candlestick charts. As a result, the pattern signifies that the bullish momentum is weakening, and. As major reversal patterns, these patterns usually form over a 3 to 6 month period. This pattern is identified when the price of an asset creates three peaks at nearly the same price. When this happens twice, the chart pattern is known as the double top pattern, but when the price tests the highest level three consecutive times, the pattern is known as a triple top pattern and it provides a stronger trend reversal. This bearish reversal pattern occurs when an asset’s price reaches a resistance level three times before eventually declining. The triple top pattern consists of three peaks or tops that are formed around the same price level, with troughs or pullbacks in between. Note that a triple top reversal on a bar or line chart is completely different. Triple top patterns have three highs, hence the name triple top. Enter a short trade position when the asset price falls below the support price trendline. A pattern used in technical analysis to predict the reversal of a prolonged uptrend. Web the triple top pattern is a reversal formation that technical analysts use to identify potential trend changes on financial charts.

What Are Triple Top and Bottom Patterns in Crypto Trading? Bybit Learn

Double Top Pattern Definition How to Trade Double Tops & Bottoms?

Triple Top Pattern Overview, How To Trade With Examples

Triple Top Pattern A Guide by Experienced Traders

:max_bytes(150000):strip_icc()/dotdash_Final_Triple_Top_Dec_2020-01-78a37beca8574d169c2cccd1fc18279d.jpg)

Triple Top Definition

What Are Triple Top and Bottom Patterns in Crypto Trading? Bybit Learn

What Are Triple Top and Bottom Patterns in Crypto Trading? Bybit Learn

Chart Pattern Triple Top — TradingView

Triple Top Pattern A Guide by Experienced Traders

Triple Top Pattern A Technical Analyst's Guide ForexBee

Web The Triple Top Pattern Is Also Similar To The Double Top Pattern.

Each High Should Be Equal, Have Good Space, And Mark Clear Turning.

Web The First Triple Top Pattern Trading Step Is To Identify The Triple Top In A Market.

There Are Three Equal Highs Followed By A Break Below Support.

Related Post: