Triple Top Chart Pattern

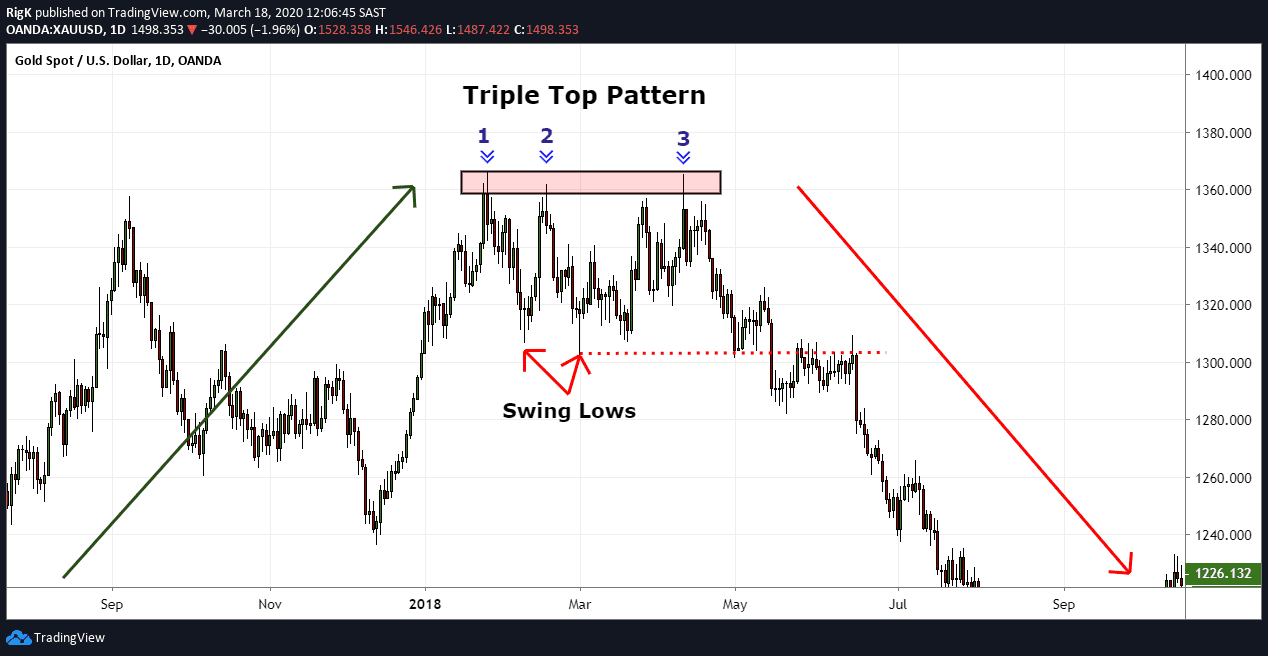

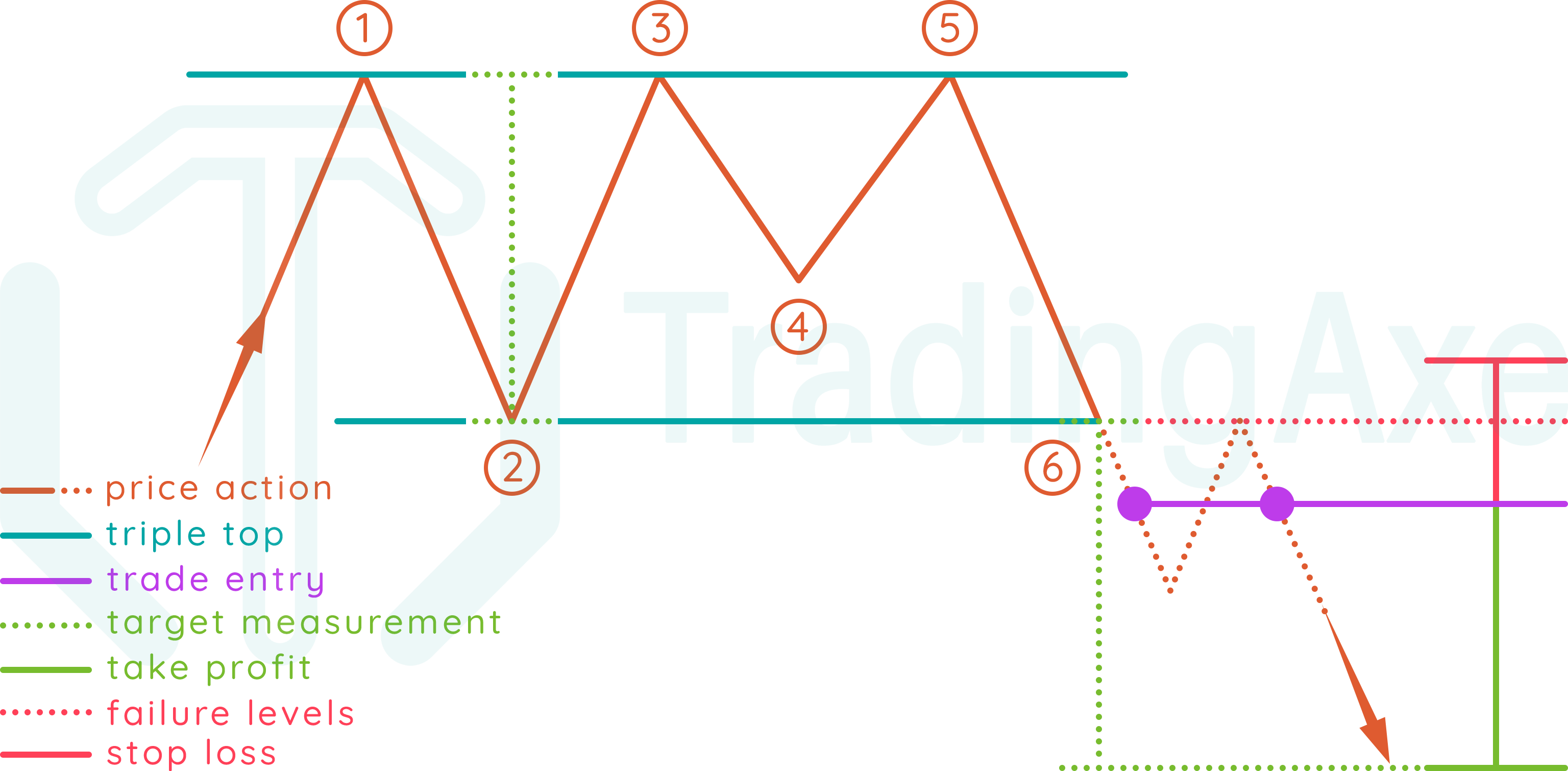

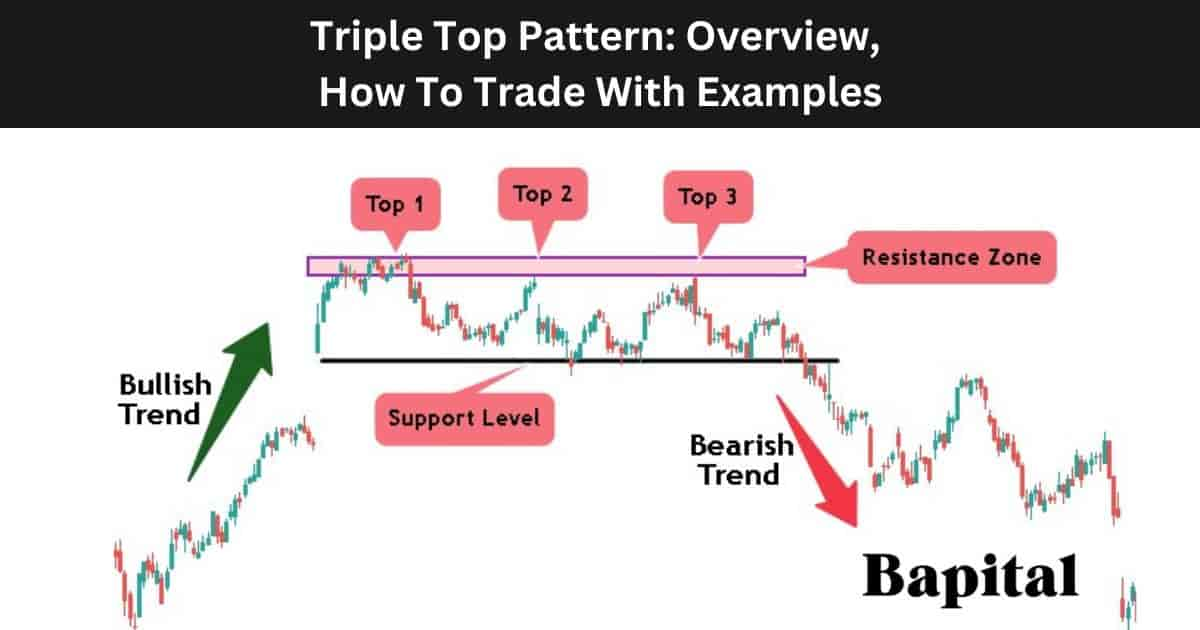

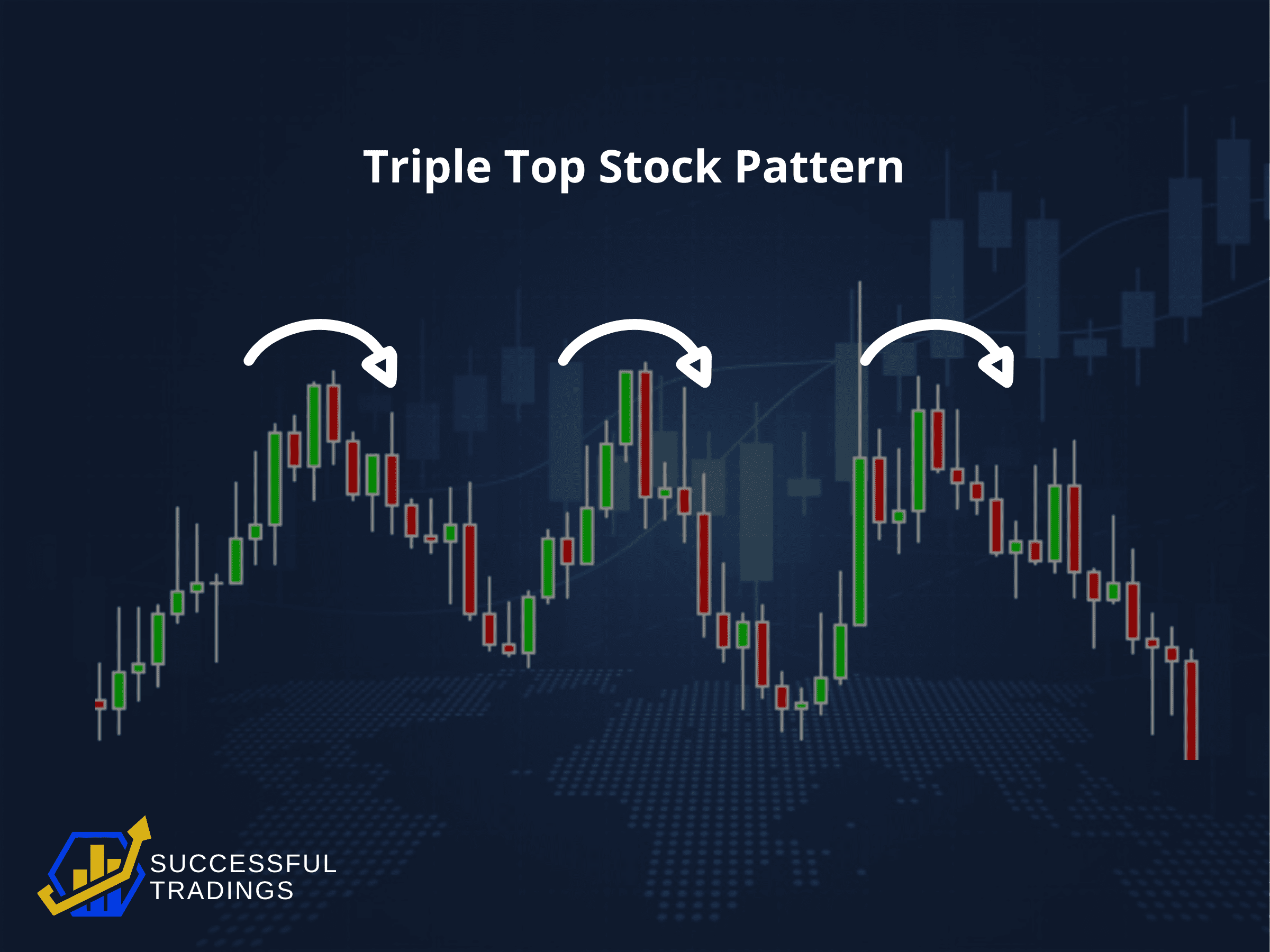

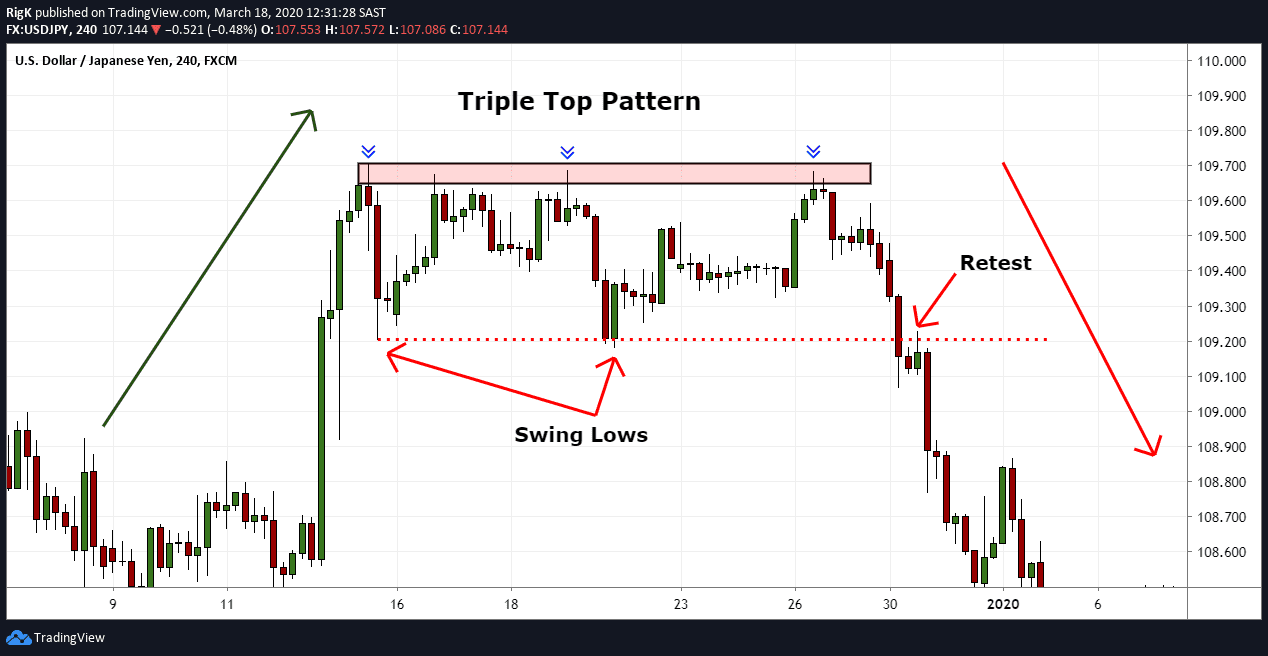

Triple Top Chart Pattern - Web learn about a triple top pattern which is a bearish reversal pattern that forms on charts when the price forms three prominent swing high resistance levels and reverses. Web the triple top reversal is a bearish reversal pattern typically found on bar charts, line charts and candlestick charts. Three peaks follow one another, showing significant resistance. Thus, it’s commonly interpreted as a sign of a coming bearish trend. The triple top pattern consists of three peaks or tops that are formed around the same price level, with troughs or pullbacks in between. A triple top chart pattern is a bearish technical analysis formation often used in crypto trading and other financial markets. The chart above shows a great example of a triple top that formed on gold back in 2018. How to trade when you spot this potential bearish triple top chart; Web in this beginner's guide, we'll cover everything you need to know about the triple top chart pattern and its predictive power, including: Web triple top is a reversal pattern formed by three consecutive highs that are at the same level (a slight difference in price values is allowed) and two intermediate lows between them. The peaks are separated by two troughs or valleys. For this chart pattern to take place in the first place, the price action has to trade in a clear uptrend. It is formed by three consecutive highs that reach approximately the same price level, each followed by a pullback. Web a triple peak or triple top is a bearish chart. The psychology behind stocks triple top; In fact, it is a potent bearish reversal chart pattern that can help you get into a new downtrend from the very beginning of the trend, while the opposite, the triple bottom, can help you get into an uptrend quite early. The neckline is a horizontal line connecting the two lowest lows of the. Web learn how to trade the triple top patterns as bearish technical analysis chart pattern, including some useful tips, pros and cons and much more. Web in this beginner's guide, we'll cover everything you need to know about the triple top chart pattern and its predictive power, including: There are three equal highs followed by a break below support. For. This is a sign of a tendency towards a reversal. For a triple top, volume is high on the first peak and low on the third. The peaks are separated by two troughs or valleys. These patterns are bearish reversal patterns found on stock charts. Web triple tops (or bottoms) are identified by three peaks (or troughs) of similar height. How to trade when you spot this potential bearish triple top chart; Three peaks follow one another, showing significant resistance. In fact, it is a potent bearish reversal chart pattern that can help you get into a new downtrend from the very beginning of the trend, while the opposite, the triple bottom, can help you get into an uptrend quite. Web learn how to trade the triple top patterns as bearish technical analysis chart pattern, including some useful tips, pros and cons and much more. Web triple top is a reversal pattern formed by three consecutive highs that are at the same level (a slight difference in price values is allowed) and two intermediate lows between them. Web the triple. As major reversal patterns, these patterns usually form over a 3 to 6 month period. Web a triple top is formed by three peaks moving into the same area, with pullbacks in between, while a triple bottom consists of three troughs with rallies in the middle. Three peaks follow one another, showing significant resistance. The peaks are separated by two. Web a triple top is a bearish reversal chart pattern that signals the sellers are in control (the opposite is called a triple bottom pattern). This strategy isn’t just an everyday method but a journey through the peaks and valleys of market trends. A triple top chart pattern is a bearish technical analysis formation often used in crypto trading and. Web the triple top pattern is one of the price action chart patterns that can be used to formulate a trend reversal trading strategy. For the triple top below, the resistance zone. Web the triple top pattern is a bearish reversal chart pattern that forms after a strong uptrend, signaling that the sellers are gaining control. Web a triple top. Technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. In fact, it is a potent bearish reversal chart pattern that can help you get into a new downtrend from the very beginning of the trend, while the opposite, the triple bottom, can help you get into an. Web a triple top is a bearish reversal chart pattern that signals that buyers are losing control to the sellers. In fact, it is a potent bearish reversal chart pattern that can help you get into a new downtrend from the very beginning of the trend, while the opposite, the triple bottom, can help you get into an uptrend quite early. Upon completion, it resembles the shape of the letter m. Web a triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way. Web a triple top is a chart pattern that consists of three equal highs followed by a break below support. Targets are measured in a similar fashion to double tops and double bottoms and they are traded in the same manner. The chart above shows a great example of a triple top that formed on gold back in 2018. The peaks are separated by two troughs or valleys. It signals the potential end of an uptrend and the beginning of a downtrend. The triple top pattern consists of three peaks or tops that are formed around the same price level, with troughs or pullbacks in between. To identify the triple top pattern, keep these critical points in mind: This strategy isn’t just an everyday method but a journey through the peaks and valleys of market trends. Three peaks follow one another, showing significant resistance. Web what is a triple top chart pattern? The triple top pattern meaning; Technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc.

Triple Top Pattern A Guide by Experienced Traders

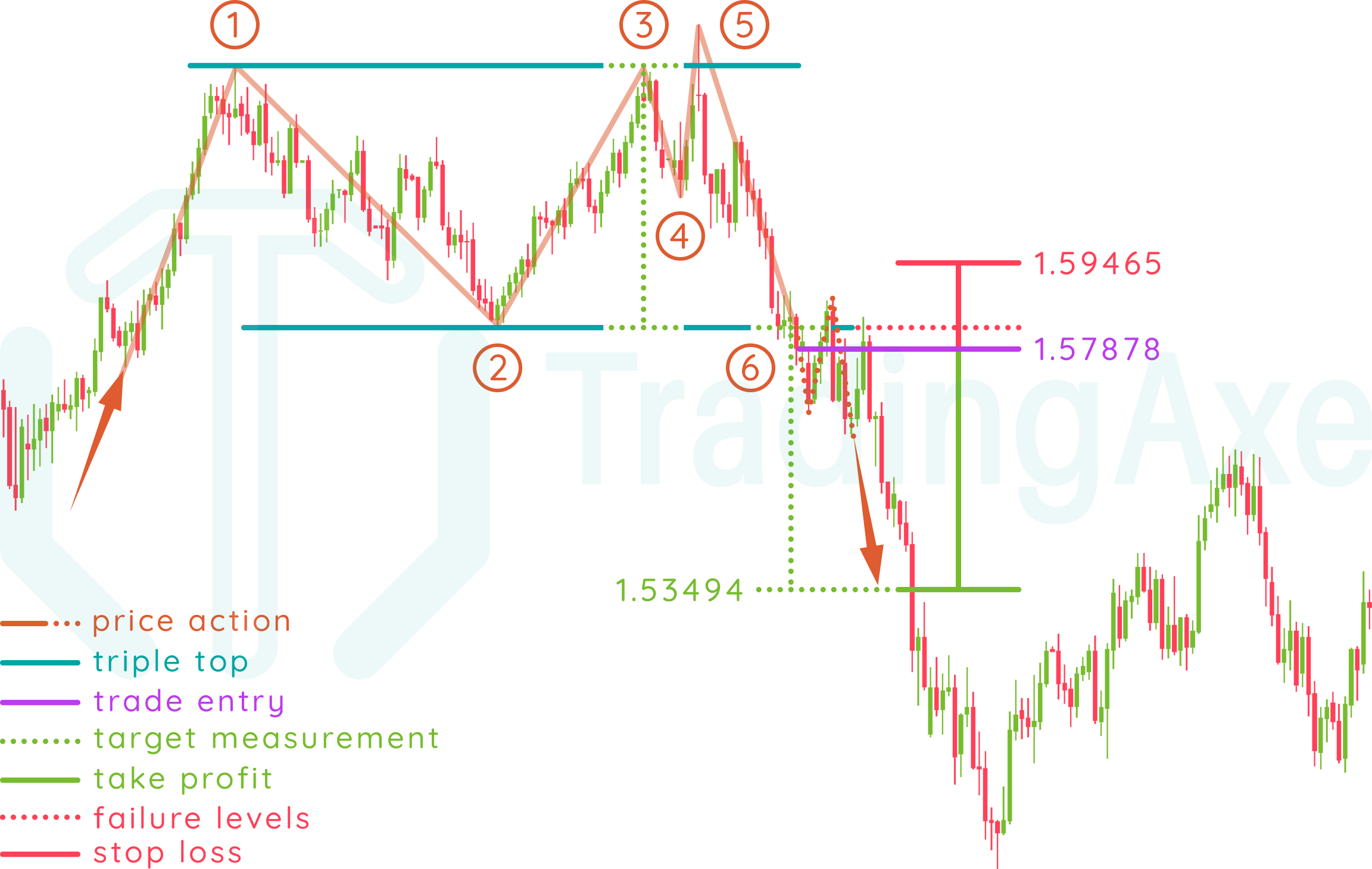

How To Trade Triple Top Chart Pattern TradingAxe

Triple Top Pattern Overview, How To Trade With Examples

Triple Top Pattern How to Trade and Examples

How To Trade Triple Top Chart Pattern Breakout Like a Pro Success

What Are Triple Top and Bottom Patterns in Crypto Trading? Bybit Learn

The Complete Guide to Triple Top Chart Pattern

Triple Top Stock Pattern Explained In Simple Terms

How To Trade Triple Top Chart Pattern TradingAxe

Triple Top Pattern A Guide by Experienced Traders

Web A Triple Top Is A Bearish Reversal Chart Pattern That Signals The Sellers Are In Control (The Opposite Is Called A Triple Bottom Pattern).

The Neckline Is A Horizontal Line Connecting The Two Lowest Lows Of The Pullbacks.

Web The Triple Top Pattern Is A Reversal Formation That Technical Analysts Use To Identify Potential Trend Changes On Financial Charts.

For The Triple Top Below, The Resistance Zone.

Related Post: