Triple Bottom Pattern

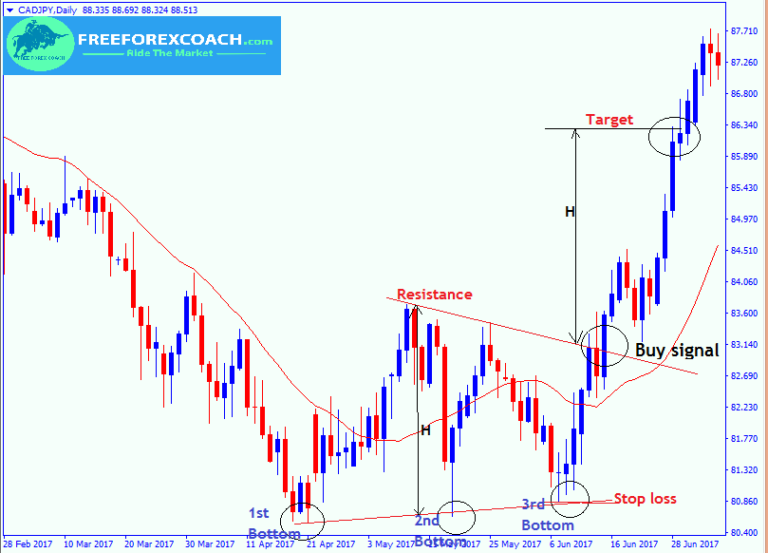

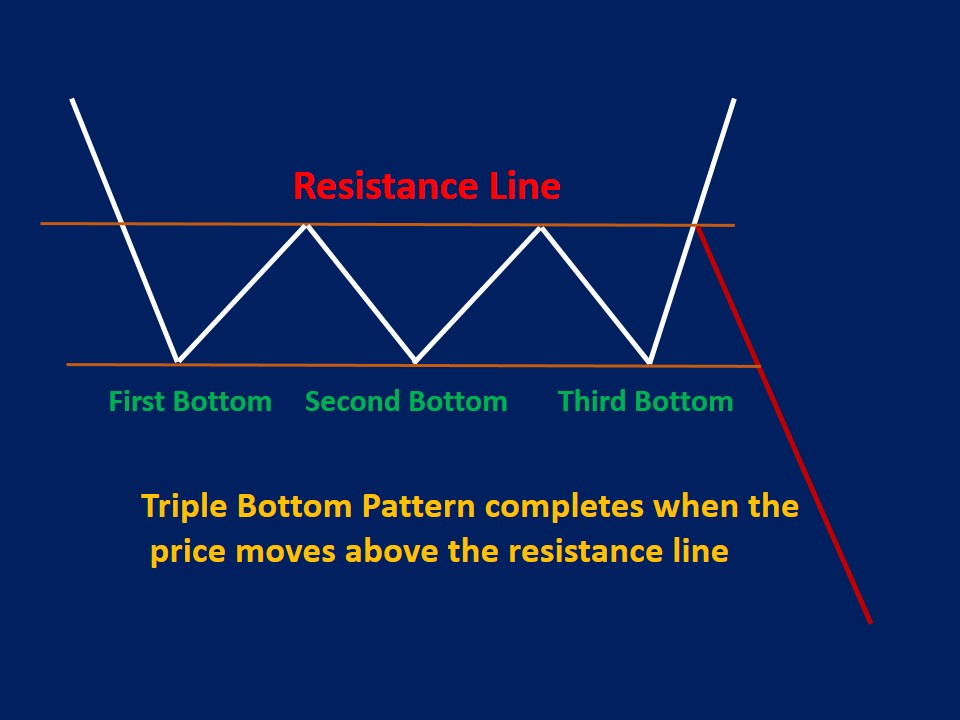

Triple Bottom Pattern - There are three equal lows followed by a break above resistance. Web the triple bottom pattern is a strategy used by traders to capitalize on bullish momentum. This pattern is characterized by three consecutive swing lows that occur nearly at the same price level followed by a breakout of the resistance level. It consists of 3 swing low levels in the price and it signals that a bearish trend may be ending. Web the triple bottom is a bullish reversal pattern that occurs at the end of a downtrend. Like its twin, the triple top pattern, it is considered one of the. Web spokane valley city councilman al merkel will continue to be sequestered from most city staffers after an independent investigation found a pattern of disrespectful behavior toward city staff. Secondly, bullish divergences in both the rsi and macd (green) accompanied the most recent bounces. Web a triple bottom pattern occurs at the termination of a downtrend. The pattern appears on a price chart as three equal low levels followed by an uptrend that breaks through the. Web a triple bottom pattern is a visual pattern that shows the buyers (bulls) taking control of the price action from the sellers (bears). This candlestick pattern suggests an impending change in the trend direction after the sellers failed to break the support in three consecutive attempts. Web a triple bottom pattern is a bullish reversal chart pattern that is. It’s characterized by three equal lows bouncing off support followed by the price action breaching resistance. Read our guide to discover what it is, how to identify it and how to apply it in your trading in 2024. Web the triple bottom reversal is a bullish reversal pattern typically found on bar charts, line charts and candlestick charts. The triple. Web a triple bottom pattern is a visual pattern that shows the buyers (bulls) taking control of the price action from the sellers (bears). Web a triple bottom pattern occurs at the termination of a downtrend. The triple bottom pattern appears after price corrections have been moving lower. It appears rarely, but it always warrants consideration, as it is a. 1 what is the triple bottom pattern? Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Web the triple bottom is a bullish reversal pattern that occurs at the end of a downtrend. Web firstly, shib has created what resembles a triple bottom pattern. Web the triple bottom pattern is a strategy used by traders to capitalize on bullish momentum. Web a triple bottom pattern is a bullish pattern that has three support levels that bears fail to break. Web state regulators plan to nearly triple battery capacity by 2035. It is characterized by three consecutive swing lows that occur nearly at the same. The pattern appears on a price chart as three equal low levels followed by an uptrend that breaks through the. Like its twin, the triple top pattern, it is considered one of the. The triple bottom pattern appears after price corrections have been moving lower. Read our guide to discover what it is, how to identify it and how to. The triple bottom chart pattern is formed after a prolonged downtrend where bears are in control of the market. Web triple top and triple bottom patterns. Web the triple bottom pattern offers a second chance for traders who missed the double bottom opportunity. 1 what is the triple bottom pattern? Web what is the triple bottom pattern? Web firstly, shib has created what resembles a triple bottom pattern inside the $0.000022 support area. The triple bottom pattern is a hot topic in technical analysis, signaling potential market reversals from a downward trend. Web triple top and triple bottom patterns. Web what is a triple bottom pattern? Web a triple bottom is a bullish chart pattern used in. This pattern is characterized by three consecutive swing lows that occur nearly at the same price level followed by a breakout of the resistance level. Web the triple bottom pattern is a strategy used by traders to capitalize on bullish momentum. “the future is bright for energy storage,” said andrés gluski, chief executive of aes corporation, one of the world’s.. The triple bottom pattern is one of the bullish reversal chart patterns in technical analysis. Web what is a triple bottom pattern? This candlestick pattern suggests an impending change in the trend direction after the sellers failed to break the support in three consecutive attempts. Web a triple bottom is a bullish reversal chart pattern found at the end of. Much like its twin, the triple top pattern, it is considered one of the most reliable and accurate chart patterns and is fairly easy to identify on trading charts. Web the triple bottom chart pattern is a technical analysis trading strategy in which the trader attempts to identify a reversal point in the market. It’s a sign the buyers are coming in the market to avoid the security price to drop lower. A triple top or triple bottom pattern is a chart feature which traders of an asset, such as bitcoin (btc), ethereum (eth) or other cryptoassets, can use to catch major trend changes. The pattern appears on a price chart as three equal low levels followed by an uptrend that breaks through the. Web what is the triple bottom pattern? The triple bottom pattern is one of the bullish reversal chart patterns in technical analysis. Web a triple bottom is a bullish reversal chart pattern found at the end of a bearish trend and signals a shift in momentum. The triple bottom chart pattern is formed after a prolonged downtrend where bears are in control of the market. Web the triple bottom pattern is a strategy used by traders to capitalize on bullish momentum. Web the triple bottom pattern is a bullish reversal pattern. Web state regulators plan to nearly triple battery capacity by 2035. Secondly, bullish divergences in both the rsi and macd (green) accompanied the most recent bounces. The triple bottom pattern appears after price corrections have been moving lower. 1 what is the triple bottom pattern? Web in technical analysis, a triple bottom is a bullish reversal chart pattern that forms on the price charts of financial markets.

Triple Bottom Pattern A Bullish Reversal Chart Pattern — HaiKhuu Trading

Best Method To Use Triple Bottom Pattern YouTube

Chart Patterns Triple Bottom Trade Invest Insure

How to trade Triple Bottom chart pattern EASY TRADES

Triple Bottom Pattern In Forex Identify & Trade Free Forex Coach

The Triple Bottom Candlestick Pattern ThinkMarkets EN

Triple Bottom Pattern A Reversal Chart Pattern InvestoPower

How To Trade Triple Bottom Chart Pattern TradingAxe

Triple Bottom Pattern How to Trade & Examples

Chart Pattern Triple Bottom — TradingView

This Pattern Is Characterized By Three Consecutive Swing Lows That Occur Nearly At The Same Price Level Followed By A Breakout Of The Resistance Level.

Web The Triple Bottom Trading Pattern Is A Measure Of The Amount Of Control Buyers Have Over The Market Price In Relation To The Sellers.

Web The Triple Bottom Pattern Is A Bullish Reversal Chart Pattern In Technical Analysis That Indicates A Shift From A Downtrend To An Uptrend.

It’s Characterized By Three Equal Lows Bouncing Off Support Followed By The Price Action Breaching Resistance.

Related Post: