Triple Bottom Pattern Meaning

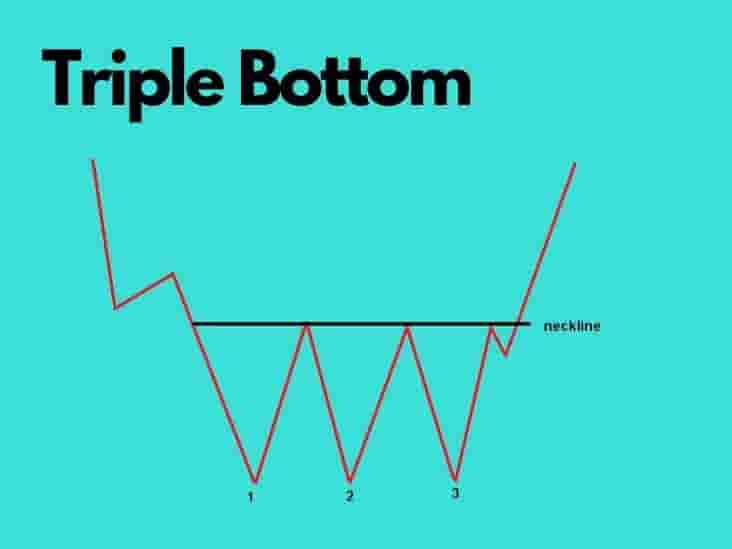

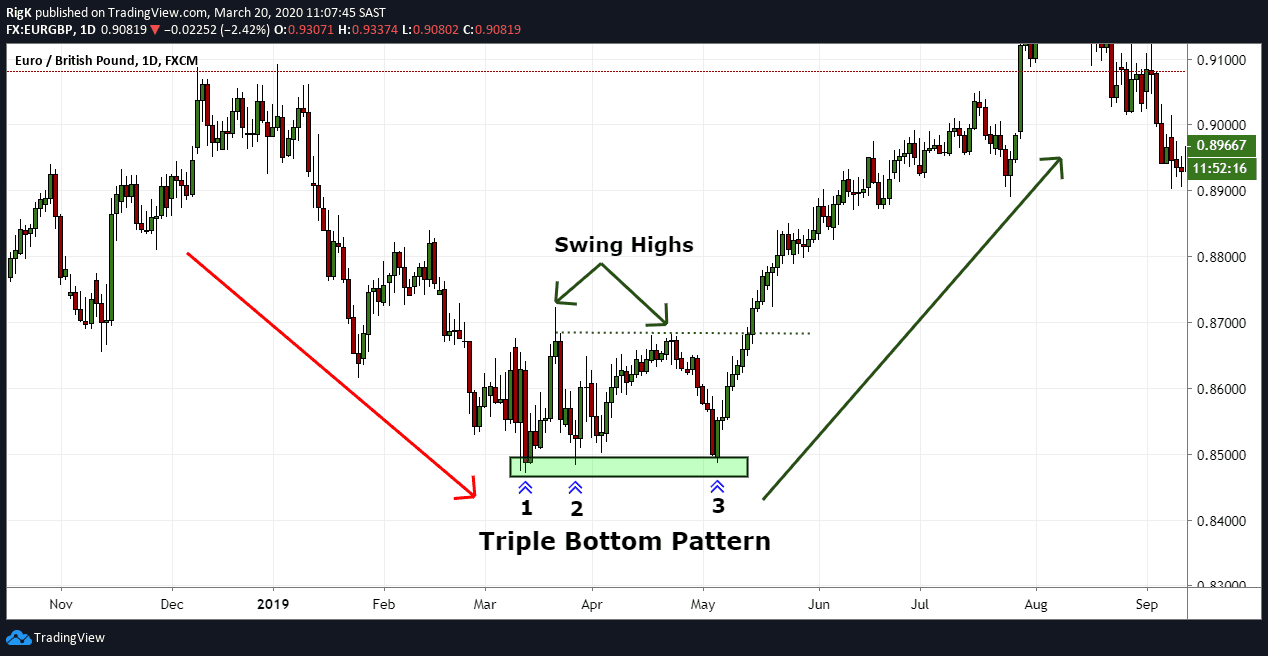

Triple Bottom Pattern Meaning - Traders look for three consecutive. Web the triple bottom pattern is a powerful tool in the trader’s arsenal by offering a second (or even a third) chance for those who may have missed the double bottom opportunity. It appears rarely, but it always warrants consideration, as it is a strong. The pattern appears on a price chart as. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. The triple bottom pattern is a strategy used by traders to capitalize on bullish momentum. This candlestick pattern suggests an impending change in the trend direction after the. This pattern is characterized by. Web the triple bottom is a bullish reversal pattern that occurs at the end of a downtrend. It’s characterized by three equal lows. Web table of content show. Web triple bottom pattern meaning triple bottom patterns consist of several candlesticks that form three valleys or support levels that are either equal or near equal height. Web the triple bottom pattern is a powerful tool in the trader’s arsenal by offering a second (or even a third) chance for those who may have missed. Web the triple bottom pattern is a hot topic in technical analysis, signaling potential market reversals from a downward trend. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Web a triple bottom pattern is a bullish reversal chart pattern that is formed at. Web written by timothy sykes. Web the triple bottom is a bullish reversal pattern that occurs at the end of a downtrend. Web a triple bottom pattern is a bullish reversal chart pattern that is formed at the end of a downtrend. Web a triple bottom is a bullish reversal chart pattern found at the end of a bearish trend. The pattern appears on a price chart as. A triple bottom is a visual pattern that shows the buyers (bulls) taking control of the price action from the sellers (bears). Web written by timothy sykes. Web triple bottom is a reversal pattern formed by three consecutive lows that are at the same level (a slight difference in price values is. Web table of content show. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Traders look for three consecutive. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers.. Web the triple bottom chart pattern is a technical analysis trading strategy in which the trader attempts to identify a reversal point in the market. Web the triple bottom pattern occurs as a part of the accumulation phase of the market cycle, but more specifically, it visually represents the battle between demand and supply —. Web a triple bottom is. Web the triple bottom pattern is a bullish reversal chart pattern in technical analysis that indicates a shift from a downtrend to an uptrend. Web in technical analysis, a triple bottom is a bullish reversal chart pattern that forms on the price charts of financial markets. A triple bottom is a visual pattern that shows the buyers (bulls) taking control. It consists of 3 swing low levels in the price and it. Much like its twin, the triple top pattern, it is. Web the triple bottom pattern is a hot topic in technical analysis, signaling potential market reversals from a downward trend. It appears rarely, but it always warrants consideration, as it is a strong. Think of this pattern like. This candlestick pattern suggests an impending change in the trend direction after the. Web the triple bottom pattern is a bullish reversal chart pattern in technical analysis that indicates a shift from a downtrend to an uptrend. Web a triple bottom pattern is a bullish reversal chart pattern that is formed at the end of a downtrend. The pattern appears. It’s characterized by three equal lows. Traders look for three consecutive. Web the triple bottom pattern is a hot topic in technical analysis, signaling potential market reversals from a downward trend. Web a triple top or triple bottom pattern is a chart feature which traders of an asset, such as bitcoin (btc), ethereum (eth) or other cryptoassets, can use to. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Web a triple top or triple bottom pattern is a chart feature which traders of an asset, such as bitcoin (btc), ethereum (eth) or other cryptoassets, can use to catch major trend. Updated 9/17/2023 19 min read. Web a triple bottom pattern is a bullish reversal chart pattern that is formed at the end of a downtrend. Web written by timothy sykes. Traders look for three consecutive. Web the triple bottom pattern is a bullish reversal chart pattern in technical analysis that indicates a shift from a downtrend to an uptrend. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Web in technical analysis, a triple bottom is a bullish reversal chart pattern that forms on the price charts of financial markets. The pattern appears on a price chart as. Web triple bottom pattern meaning triple bottom patterns consist of several candlesticks that form three valleys or support levels that are either equal or near equal height. Web the triple bottom is a bullish reversal chart pattern that could be an indication that sellers (bears) are losing control of a downtrend and that buyers (bulls) are taking. Web a triple bottom is a bullish reversal chart pattern found at the end of a bearish trend and signals a shift in momentum. Web table of content show. It consists of 3 swing low levels in the price and it. Web it is a bullish reversal chart pattern that represents three failed attempts at new lows close to the same price and is verified once the price breaks above the resistance.

Triple Bottom Pattern What is It and How To Trade It [Forex Chart

How To Trade Triple Bottom Chart Pattern TradingAxe

Triple Bottom Pattern A Reversal Chart Pattern InvestoPower

Triple Bottom Chart Pattern Definition With Examples

Triple Top and Triple Bottom Chart Pattern YouTube

The Triple Bottom Candlestick Pattern ThinkMarkets AU

How To Trade Triple Bottom Chart Pattern TradingAxe

Triple Bottom Pattern Definition, Importance, How It Works

Triple Bottom Pattern Explanation and Examples

The Triple Bottom Pattern is a bullish chart pattern. Stock trading

Web A Triple Bottom Pattern Is A Visual Pattern That Shows The Buyers (Bulls) Taking Control Of The Price Action From The Sellers (Bears).

Web The Triple Bottom Pattern Is A Powerful Tool In The Trader’s Arsenal By Offering A Second (Or Even A Third) Chance For Those Who May Have Missed The Double Bottom Opportunity.

This Pattern Is Characterized By.

The Triple Bottom Pattern Is A Strategy Used By Traders To Capitalize On Bullish Momentum.

Related Post: