Triple Bottom Chart Pattern

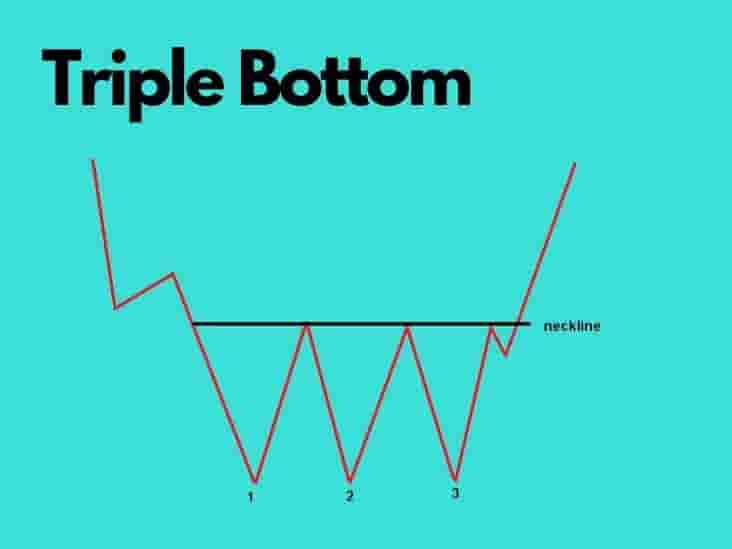

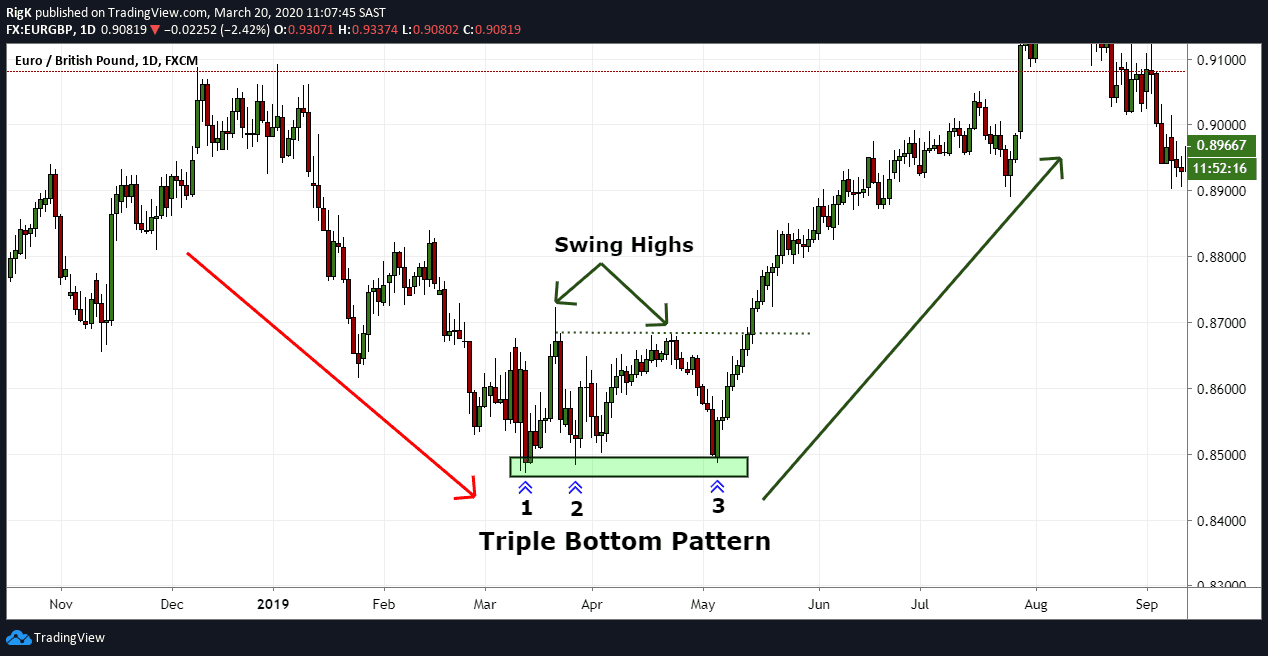

Triple Bottom Chart Pattern - Web what is a triple bottom pattern? Web triple bottom chart pattern. The triple trough or triple bottom is a bullish pattern in the shape of a wv. A triple bottom pattern is a bullish reversal chart pattern that is formed at the end of a downtrend. Three troughs follow one another, indicating strong support. Much like its twin, the triple top pattern, it is considered one of the most reliable and accurate chart patterns and is fairly easy to identify on trading charts. There are three equal lows followed by a break above resistance. Price patterns are seen in identifiable sequences of price bars shown in. Scanner guide scan examples feedback. Web firstly, shib has created what resembles a triple bottom pattern inside the $0.000022 support area. A triple bottom is a chart pattern used for technical analysis, which shows the buyers are taking control of the price action from the sellers. Web what is a triple bottom pattern? As the name suggests, it creates a distinct triple bottom visual on the chart. It consists of 3 swing low levels in the price and it signals that. Web the triple bottom pattern forms when the asset price tests the same support level three times without breaking below it. It appears rarely, but it always warrants consideration, as it is a strong signal for a significant uptrend in price. The “triple bottom” name comes from the chart’s shape before the price spikes. Web the triple bottom chart pattern. There are three equal lows followed by a break above resistance. Web the triple bottom pattern is the bullish trend reversal counterpart to the triple top pattern. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Web the triple bottom chart pattern is a. Stock passes all of the below filters in cash segment: Scanner guide scan examples feedback. Three troughs follow one another, indicating strong support. Support and resistance lines connect the lows and the tops respectively. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Traders look for three consecutive low points separated by intervening peaks, creating a. It is a bullish reversal chart pattern that represents three failed attempts at new lows close to the same price and is verified once the price breaks above the resistance. The triple trough or triple bottom is a bullish pattern in the shape of a wv. Web. Greater than 1 day ago. There are three equal lows followed by a break above resistance. It involves monitoring price action to find a distinct pattern before the price launches higher. Support and resistance lines connect the lows and the tops respectively. A triple bottom pattern is a bullish reversal chart pattern that is formed at the end of a. It is a bullish reversal chart pattern that represents three failed attempts at new lows close to the same price and is verified once the price breaks above the resistance. Web in technical analysis, a triple bottom is a bullish reversal chart pattern that forms on the price charts of financial markets. It consists of 3 swing low levels in. A triple bottom is a chart pattern used for technical analysis, which shows the buyers are taking control of the price action from the sellers. Besides being a bullish pattern, the triple bottom is combined with long lower wicks (green icons). The pattern appears on a price chart as three equal low levels followed by an uptrend that breaks through. Stocks hitting triple bottom in daily candle with increasing volume and cost. Web in technical analysis, a triple bottom is a bullish reversal chart pattern that forms on the price charts of financial markets. Greater than 1 day ago. Web a triple bottom chart pattern is a type of reversal chart pattern that’s formed when a stock falls to a. Web a triple bottom chart pattern is a type of reversal chart pattern that’s formed when a stock falls to a new low and then bounces off the same low point three times. Support and resistance lines connect the lows and the tops respectively. It consists of 3 swing low levels in the price and it signals that a bearish. Web triple bottom chart pattern. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. A triple bottom is a chart pattern used for technical analysis, which shows the buyers are taking control of the price action from the sellers. The triple trough or triple bottom is a bullish pattern in the shape of a wv. Price patterns are seen in identifiable sequences of price bars shown in. Overall performance rank (1 is best): Traders look for three consecutive low points separated by intervening peaks, creating a. Web updated 9/17/2023 19 min read. 65% percentage meeting price target: It involves monitoring price action to find a distinct pattern before the price launches higher. As the name suggests, it creates a distinct triple bottom visual on the chart. Web a triple bottom chart pattern is a type of reversal chart pattern that’s formed when a stock falls to a new low and then bounces off the same low point three times. This type of pattern is more reliable than other reversal chart patterns because it signals that the selling pressure has been exhausted and buyers are willing to step in. Web a triple bottom is a bullish reversal chart pattern found at the end of a bearish trend and signals a shift in momentum. Web the triple bottom pattern is a bullish reversal chart pattern in technical analysis that indicates a shift from a downtrend to an uptrend. Secondly, bullish divergences in both the rsi and macd (green) accompanied the most recent bounces.

Triple Bottom Chart Pattern Definition With Examples

Triple Bottom Pattern A Reversal Chart Pattern InvestoPower

How To Trade Triple Bottom Chart Pattern TradingAxe

The Complete Guide to Triple Bottom Trading Pattern Pro Trading School

Triple Bottom Pattern Explanation and Examples

How To Trade Triple Bottom Chart Pattern TradingAxe

The Triple Bottom Candlestick Pattern ThinkMarkets AU

Triple Bottom Pattern, Triple Bottom Chart Pattern

Triple Bottom Pattern A Reversal Chart Pattern InvestoPower

Chart Pattern Triple Bottom — TradingView

74% The Above Numbers Are Based On More Than 2,500 Perfect Trades.

Web A Triple Bottom Is A Visual Pattern That Shows The Buyers (Bulls) Taking Control Of The Price Action From The Sellers (Bears).

Scanner Guide Scan Examples Feedback.

This Pattern Is Characterized By Three Consecutive Swing Lows That Occur Nearly At The Same Price Level Followed By A Breakout Of The Resistance Level.

Related Post: