Triangle Trading Patterns

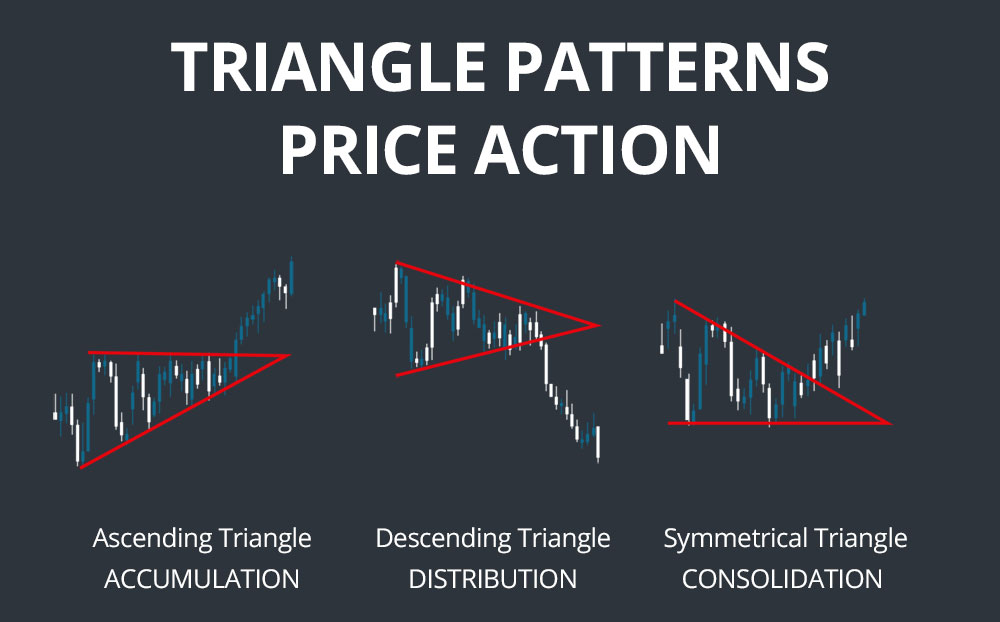

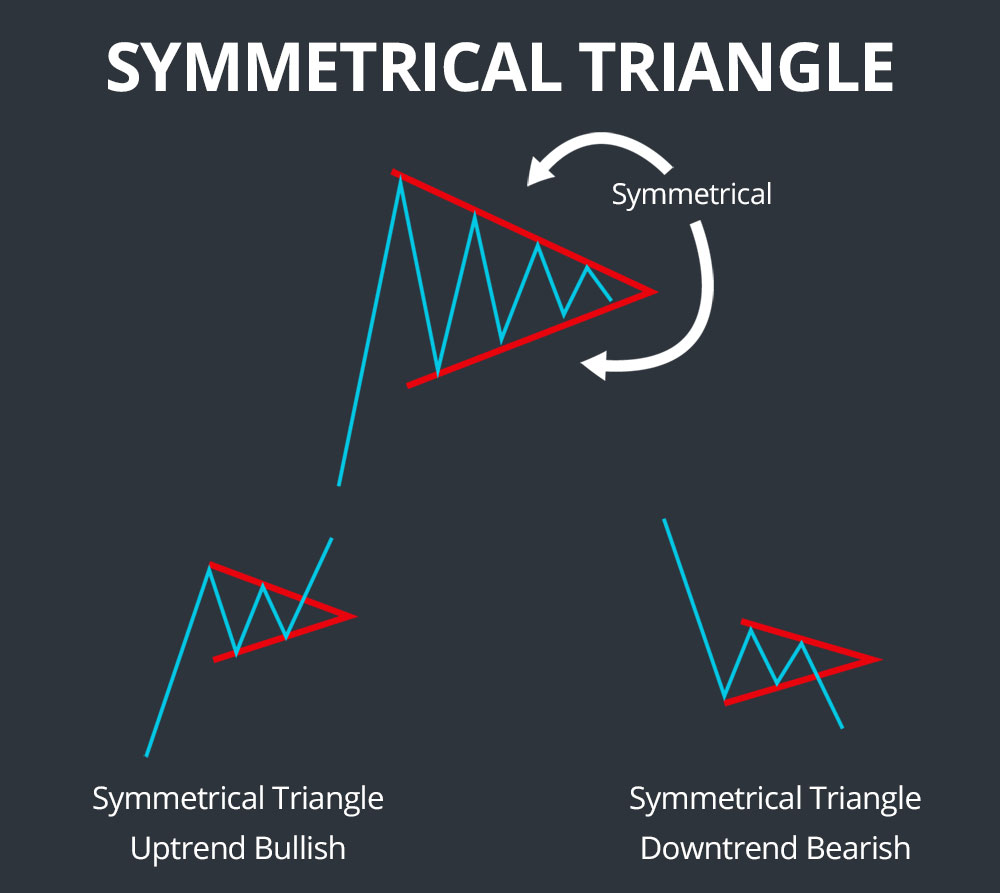

Triangle Trading Patterns - A bearish chart pattern used in technical analysis that is created by drawing one trendline that connects a series of lower highs and a second trendline that has historically. Web the ascending triangle is a bullish trading pattern. Typically, a security’s price will bounce back and forth between the two trendlines, moving toward the apex of the triangle, eventually breaking out in one direction or the. Traders use triangle patterns to identify when the trading range of security becomes. So you want to learn about popular trading patterns. Symmetrical (price is contained by 2 converging trend lines with a similar slope), ascending (price is contained by a horizontal trend line acting. Web triangle patterns are similar to chart patterns, such as wedges and pennants. Symmetrical (price is contained by 2 converging trend lines with a similar slope), ascending (price is contained by a horizontal trend line acting. A triangle is a technical analysis pattern created by drawing trendlines along a price range that gets narrower over time because of lower tops and higher bottoms. It is confirmed once the asset price falls below a support level equal to the low between the two prior highs. An understanding of these three forms will give you an ability to develop breakout or anticipation strategies to use in your day trading, while allowing you to manage your risk and position size. Web spotting chart patterns is a popular activity amongst traders of all skill levels, and one of the easiest patterns to spot is a triangle pattern. Exposure. As implied in its name, a triangle pattern looks like a. Make use of upper and lower trendlines to help identify. You will be able to implement all three triangles into the system, giving you the ability to trade bullish, bearish and consolidating markets. How to become a professional trader : So you want to learn about popular trading patterns. How to become a professional trader : Web types of triangle charts. Prices rise to and fall away from a horizontal resistance line at least twice (two minor highs). Web the ascending triangle is a bullish trading pattern. When using the strategy, a buy signal occurs when the price. An ascending triangle is a type of triangle chart pattern that occurs when there is a resistance level and a slope of higher lows. When using the strategy, a buy signal occurs when the price. Watch for breakouts above or below the upper trendline and lower trendlines. Increased trading volumes confirm the breakout. An ascending triangle is a bullish chart. Web what is a symmetrical triangle pattern? Exposure to it is being trimmed by bulls and bears. A bullish signal is created once the price breaks out of the triangle and. You will be able to implement all three triangles into the system, giving you the ability to trade bullish, bearish and consolidating markets. Asset managers and large speculators were. So you want to learn about popular trading patterns. Web the triangle pattern is used in technical analysis. The two lines join at the triangle apex.: As implied in its name, a triangle pattern looks like a. Web this triangle pattern has lower highs and higher lows, which is a sign of declining volatility and price stability. How to become a professional trader : A clear pattern has emerged on japanese yen futures; Web this triangle pattern is formed as gradually ascending support lines and descending resistance lines meet up as a security’s trading range becomes increasingly smaller. The end of the pattern is next week, so a decisive movement outside of it is likely. Shiba inu. Watch for breakouts above or below the upper trendline and lower trendlines. Web trading using triangle patterns. Asset managers and large speculators were much quicker to close short bets last week than the week prior, with a notable drop in long bets seen last week as well. A bearish chart pattern used in technical analysis that is created by drawing. An understanding of these three forms will give you an ability to develop breakout or anticipation strategies to use in your day trading, while allowing you to manage your risk and position size. Web trading using triangle patterns. It connects more distant highs and lows with closer highs and lows. The token is currently at a pivotal point, resting at. Trading forex, cfds and cryptocurrencies is highly speculative, carries a. It connects more distant highs and lows with closer highs and lows. As implied in its name, a triangle pattern looks like a. Web triangle patterns are similar to chart patterns, such as wedges and pennants. Rising triangle chart pattern signal bullish continuations while a falling triangle is a bearish. Web the triangle pattern also provides trading opportunities, both as it is forming and once it completes. When using the strategy, a buy signal occurs when the price. There are basically 3 types of triangles and they all point to price being in consolidation: An understanding of these three forms will give you an ability to develop breakout or anticipation strategies to use in your day trading, while allowing you to manage your risk and position size. Rising triangle chart pattern signal bullish continuations while a falling triangle is a bearish continuation pattern. Typically, a security’s price will bounce back and forth between the two trendlines, moving toward the apex of the triangle, eventually breaking out in one direction or the. There are 3 types of triangle patterns, which we will present below. Prices need not touch the trend line but should come reasonably close (say,. Web trading chart ebook double top pattern a double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times with a moderate decline between the two highs. It is confirmed once the asset price falls below a support level equal to the low between the two prior highs. Web may 13, 202405:46 pdt. Shiba inu has traded inside a descending triangle since its yearly high on march 5. Web trading using triangle patterns. A bullish signal is created once the price breaks out of the triangle and. The two lines join at the triangle apex.: The angle and the formation of highs and lows are a manifestation of the ( im )balance between bulls and bears.

Triangle Chart Patterns Complete Guide for Day Traders

Triangle Chart Patterns Complete Guide for Day Traders

3 Triangle Patterns Every Forex Trader Should Know

Triangle Pattern Characteristics And How To Trade Effectively How To

Triangle Pattern Characteristics And How To Trade Effectively How To

Triangle Chart Patterns Complete Guide for Day Traders

How to Trade Triangle Chart Patterns FX Access

Triangle Chart Patterns Complete Guide for Day Traders

Ascending & Descending Triangle Pattern Strategy Guide

Triangle Chart Patterns Complete Guide for Day Traders

Web Which Chart Pattern Is Best For Trading?

If You’re Trading A Breakout Strategy, Then The Triangle Pattern Will Be One You Want To Take Notice Of.

Web What Is A Symmetrical Triangle Pattern?

However, They Are Gradually Starting To Push The Price Up As Evidenced By The Higher Lows.

Related Post: