Triangle Trade Pattern

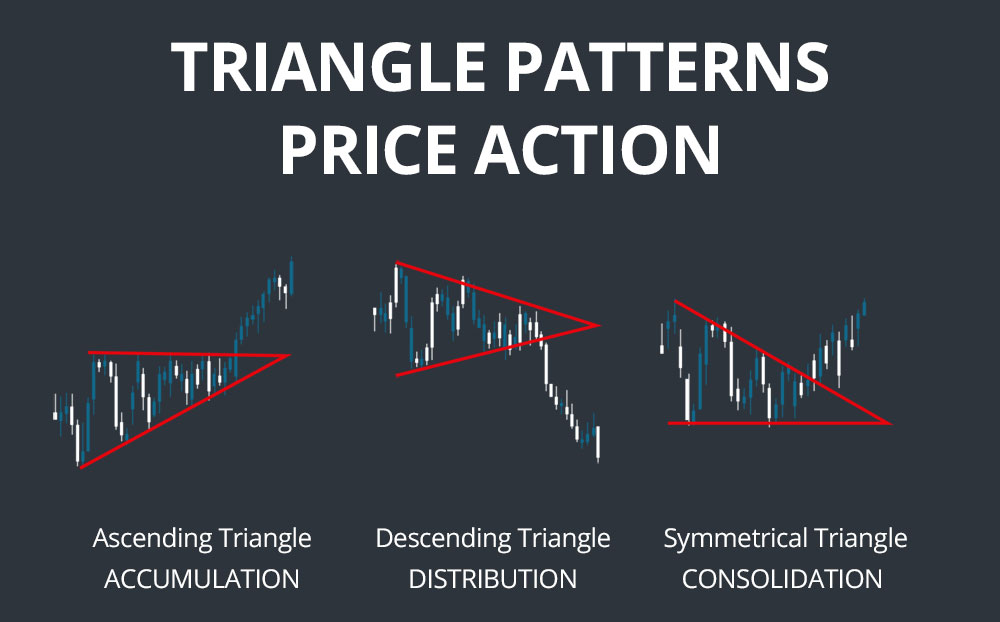

Triangle Trade Pattern - A trade pattern which evolved before the american revolutionary war among great britain, the colonies of british north america, and british colonies in the caribbean. Ensure the instrument is in an uptrend. Two trend lines, the top one horizontal and the bottom one sloping up, form a triangle pattern. Web so traders should look for the pattern while prices are in an uptrend and identify it using the triangle shape. Asset managers and large speculators were much quicker to close short bets last week than the week prior, with a notable drop in long bets seen last week as well. Heikin ashi charts visually stand out compared to. Confirm the pattern by waiting for the two lines to converge. A clear pattern has emerged on japanese yen futures; Prices need not touch the trend line but should come reasonably close (say,. A triangle typically shows losing momentum. ️ there should be an existing uptrend in the price. An understanding of these three forms will give you an ability to develop breakout or anticipation strategies to use in your day trading, while allowing you to manage your risk and position size. Web this simple volume based descending triangle pattern is easy to trade but requires lot of time. Descending triangles with heikin ashi charts. Web how to trade triangle chart patterns when trading an ascending triangle pattern, traders should: What happens during this time is that there is a certain level that the buyers cannot seem to exceed. A trade pattern which evolved before the american revolutionary war among great britain, the colonies of british north america, and. ️ the lower trend line must be a rising trend line. The pattern is identified by drawing two. Web honolulu (khon2) — gentle trade winds are expected to shift towards the southeast over the next few days, maintaining a familiar pattern of kona winds. Ensure the instrument is in an uptrend. Web how to trade triangle chart patterns when trading. Web to sum up, here are the steps you need to take in order to identify and trade the descending triangle candlestick pattern. An understanding of these three forms will give you an ability to develop breakout or anticipation strategies to use in your day trading, while allowing you to manage your risk and position size. ️ the lower trend. Draw the lower horizontal line with at least two failed attempts to. ️ there should be an existing uptrend in the price. This pattern will bring clouds and showers. Identify price consolidation during a bearish trend. Trading triangle patterns can be a profitable strategy for traders looking to capitalize on price breakouts and trend continuations. Like the ascending triangle, the pattern reflects a pause in a rally until the price reaches the apex of the two lines. Symmetrical (price is contained by 2 converging trend lines with a similar slope), ascending (price is contained by a horizontal trend line acting. Using heikin ashi charts along with the descending triangle pattern you can develop a powerful. Web honolulu (khon2) — gentle trade winds are expected to shift towards the southeast over the next few days, maintaining a familiar pattern of kona winds. Symmetrical (price is contained by 2 converging trend lines with a similar slope), ascending (price is contained by a horizontal trend line acting. Like the ascending triangle, the pattern reflects a pause in a. Heikin ashi charts visually stand out compared to. Web the triangle pattern also provides trading opportunities, both as it is forming and once it completes. A triangle is a technical analysis pattern created by drawing trendlines along a price range that gets narrower over time because of lower tops and higher bottoms. The descending triangle pattern is a bearish continuation. The angle and the formation of highs and lows are a manifestation of the ( im )balance between bulls and bears. Once you’ve determined the trend, it’s time to draw the triangle pattern on the price chart. A bearish chart pattern used in technical analysis that is created by drawing one trendline that connects a series of lower highs and. What happens during this time is that there is a certain level that the buyers cannot seem to exceed. Like the ascending triangle, the pattern reflects a pause in a rally until the price reaches the apex of the two lines. Analyze the slope and the angle of trendlines. It’s considered to be a neutral pattern, as two trend lines. Descending triangles with heikin ashi charts. Features that help to identify the ascending triangle: Ensure the instrument is in an uptrend. Once you’ve determined the trend, it’s time to draw the triangle pattern on the price chart. The formation of this pattern occurs as slowly. Web trade forex effectively with a triangle pattern for binary options. Identify the ascending triangle, noticeable by its rising lower trendline and flat upper trendline. A clear pattern has emerged on japanese yen futures; Web let us discuss how one can trade the above triangle patterns in detail. Web how to trade triangle patterns. Confirm the pattern by waiting for the two lines to converge. This pattern will bring clouds and showers. Web the ascending triangle pattern: Asset managers and large speculators were much quicker to close short bets last week than the week prior, with a notable drop in long bets seen last week as well. Trading triangle patterns can be a profitable strategy for traders looking to capitalize on price breakouts and trend continuations. The triangle chart pattern is formed by drawing two converging.

Triangle Chart Patterns Complete Guide for Day Traders

3 Triangle Patterns Every Forex Trader Should Know

Triangle Chart Patterns Complete Guide for Day Traders

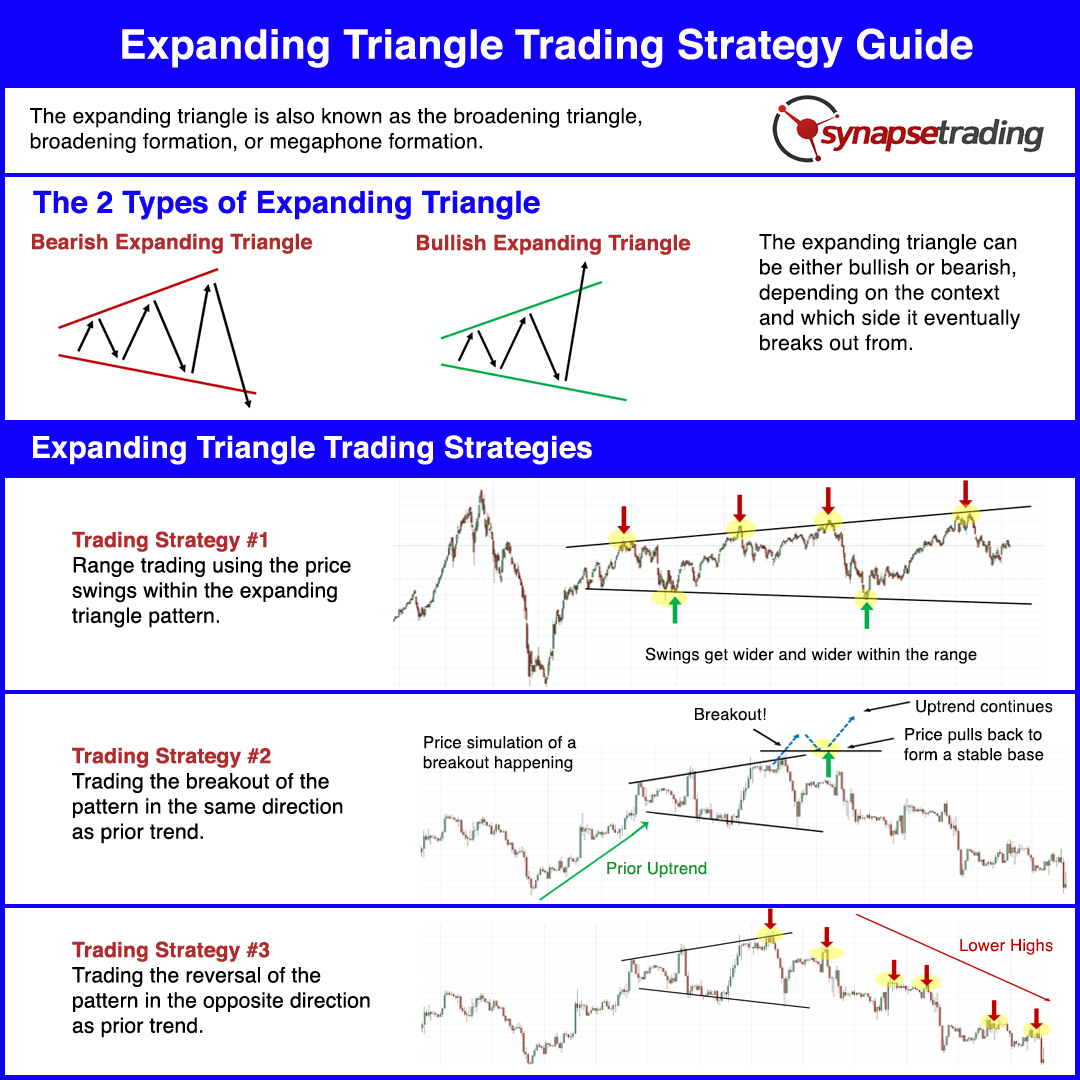

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

Triangle Pattern Characteristics And How To Trade Effectively How To

Triangle Chart Patterns Complete Guide for Day Traders

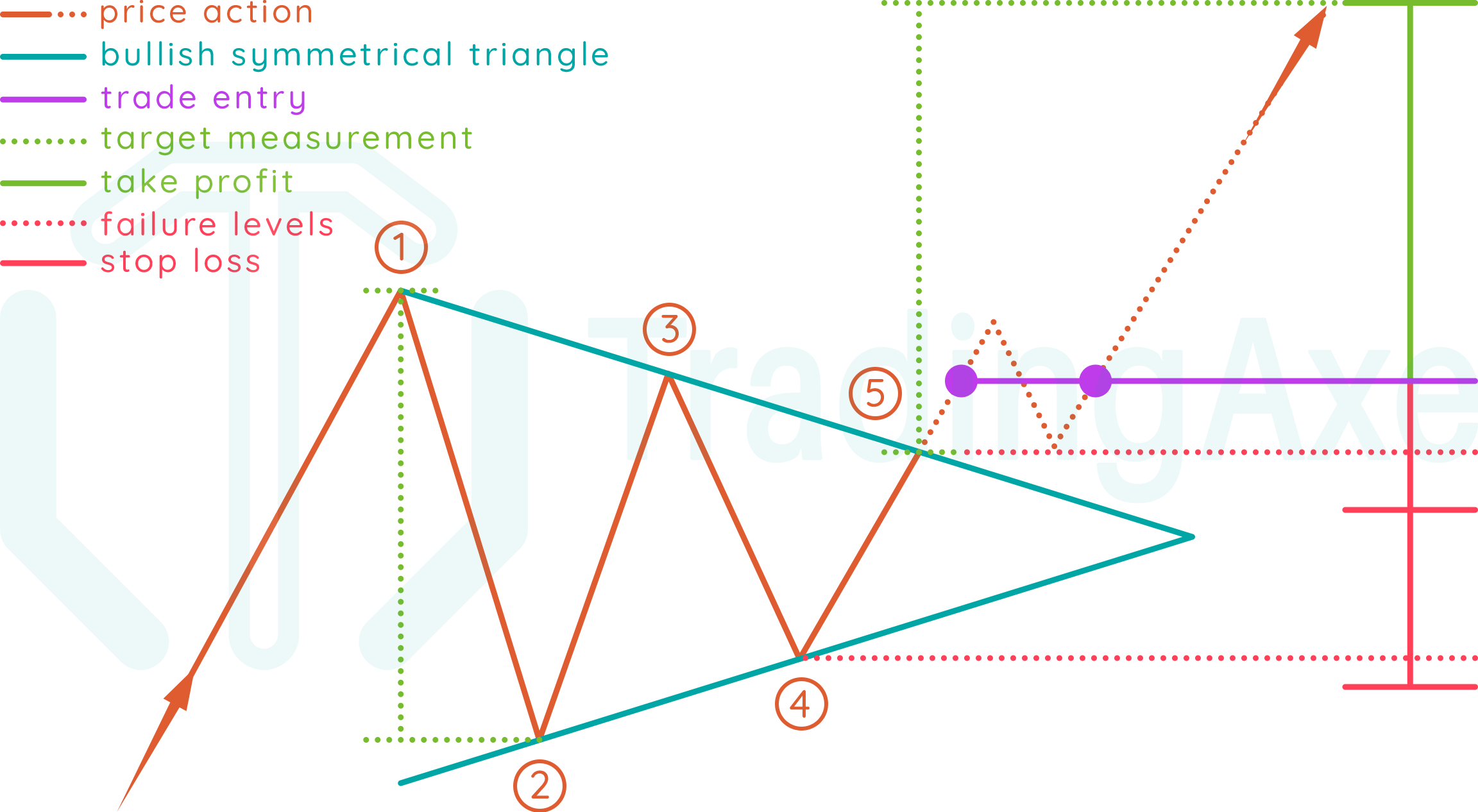

How To Trade Bullish Symmetrical Triangle Chart Pattern TradingAxe

How to Trade Triangle Chart Patterns FX Access

3 Triangle Patterns Every Forex Trader Should Know LiteFinance

Triangle Pattern Characteristics And How To Trade Effectively How To

Web How To Trade A Descending Triangle Pattern.

There Are Basically 3 Types Of Triangles And They All Point To Price Being In Consolidation:

Here Are The Most Important Points And Tips When It Comes To Understanding And Trading Triangles:

A Triangle Typically Shows Losing Momentum.

Related Post: