Triangle Pattern Chart

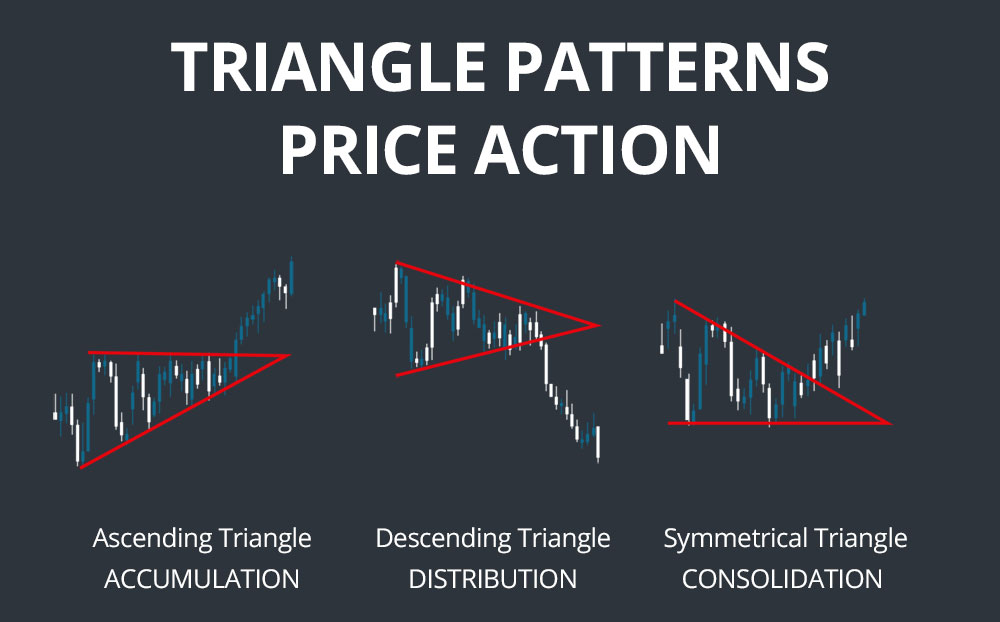

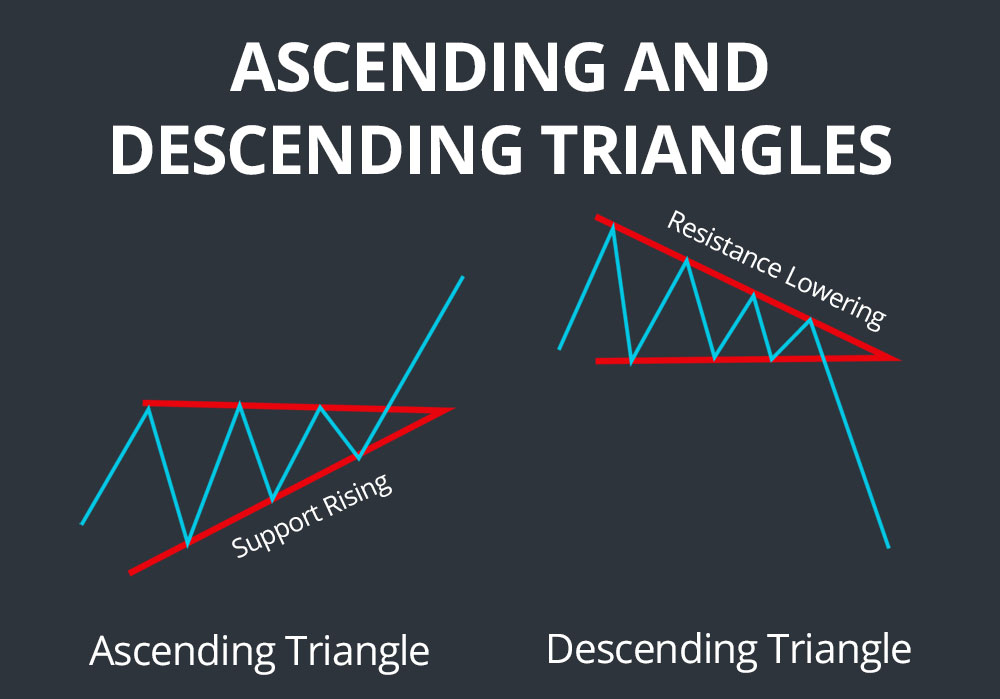

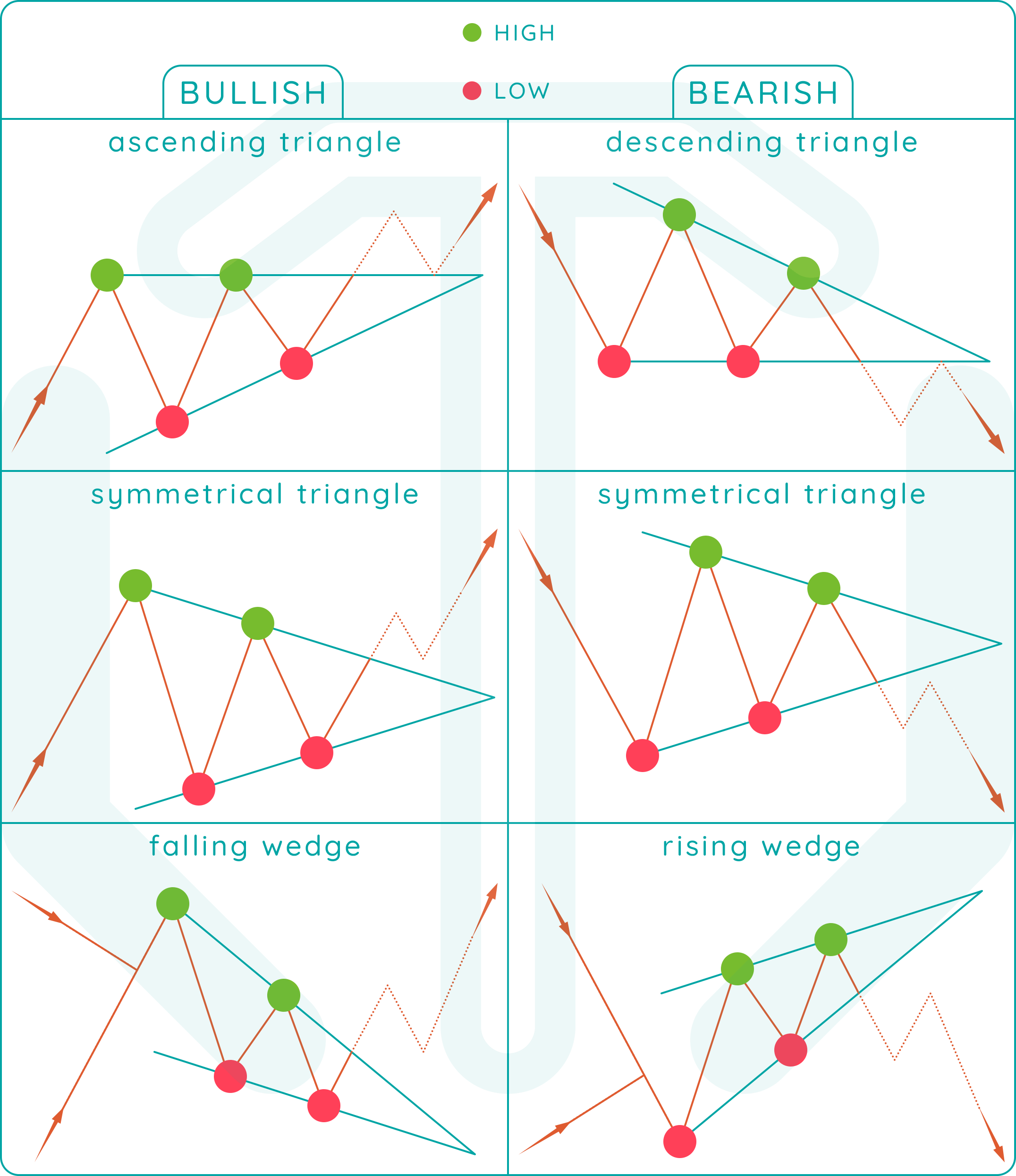

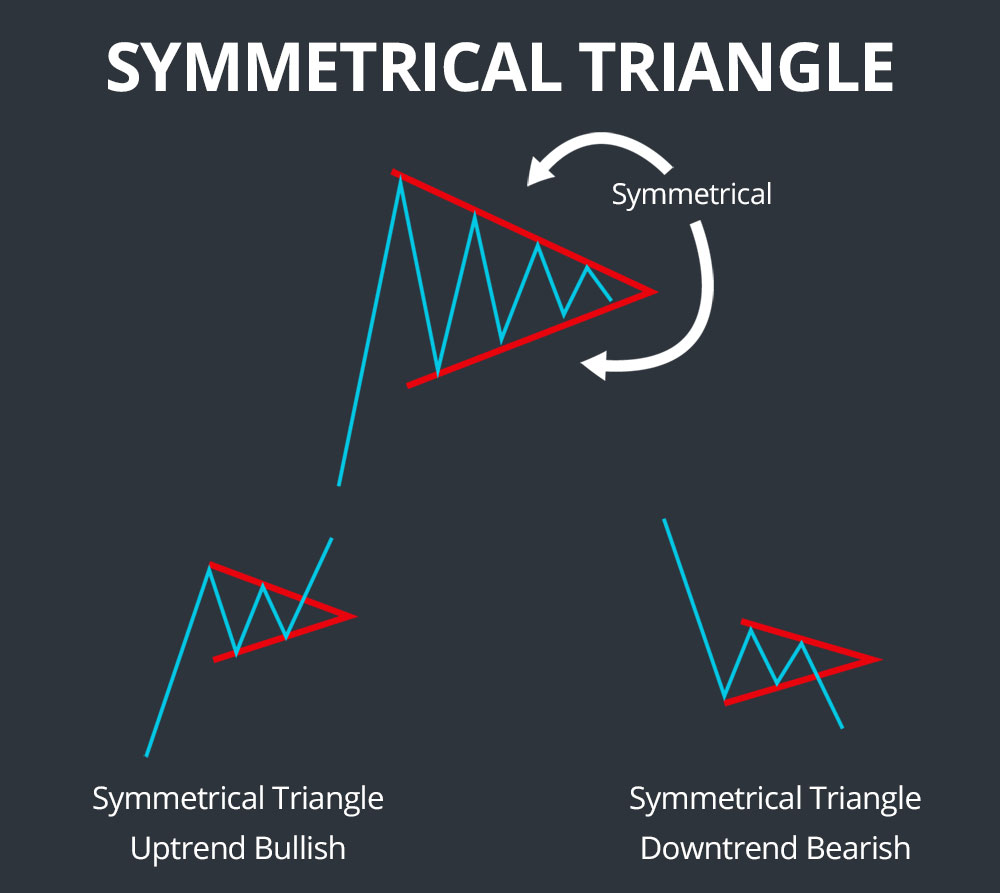

Triangle Pattern Chart - How to become a professional trader : Web there are three different types of triangle chart patterns: The price tends to consolidate for a while and allows the trader to draw a horizontal trend line on the upside. Web triangle chart patterns such as ascending triangle pattern, descending triangle pattern and symmetrical triangle pattern are some essential tools that are used by traders to determine the prices of assets while predicting the behavior of buyers and sellers. There are 3 triangles, ascending, descending, symmetrical that traders should learn. The pattern implies that the price is consolidating and. These patterns are often classified as continuation or neutral patterns, suggesting that the price is likely to persist in its existing trend after the pattern concludes. In a symmetrical triangle, this pattern occurs when the slope of both the support and resistance lines are converging, forming a triangle with roughly equal highs and lows. Web which chart pattern is best for trading? There are three main types of triangles: These patterns are often classified as continuation or neutral patterns, suggesting that the price is likely to persist in its existing trend after the pattern concludes. Web a triangle pattern in technical analysis is a price formation characterized by converging trend lines, forming the shape of a triangle on a price chart. Symmetrical (price is contained by 2 converging trend. There are three main types of triangles: Web triangle chart patterns offer valuable insights into market dynamics, symbolizing a clash between buyers and sellers within a contracting price range. This triangle pattern has lower highs and higher lows, which is a sign of declining volatility. Traders can use triangle patterns to identify potential entry and. Web the following diagram shows. The pattern implies that the price is consolidating and. Web there are basically 3 types of triangles and they all point to price being in consolidation: The ascending, descending, and symmetrical triangles. Triangle chart patterns are usually identified by traders when a financial instrument’s trading range narrows after a downtrend or an uptrend. Web there are three different types of. There are three main types of triangles: These are important patterns for a number of reasons: The pattern derives its name from the fact that it is characterized by a contraction in price range and converging trend lines, thus giving it a triangular shape. This triangle pattern has lower highs and higher lows, which is a sign of declining volatility.. The triangle pattern is traditionally categorized as a. These chart patterns can indicate a trend reversal or signal the continuation of a bearish or bullish market. We go into more detail about what they are and how they. After all, fomc officials still seem to be making up their minds when it comes to picking between easing. Web an ascending. The pattern derives its name from the fact that it is characterized by a contraction in price range and converging trend lines, thus giving it a triangular shape. Learn to identify the various triangle patterns that can appear on a forex chart and how you can use them in trading. Each pattern has distinct characteristics and provides valuable information about. Web triangle patterns are a chart pattern commonly identified by traders when a stock price’s trading range narrows following an uptrend or downtrend. A triangle chart pattern involves price moving into a tighter and tighter range as time goes by and provides a visual display of a battle between bulls and bears. Web triangles within technical analysis are chart patterns. What is an ascending triangle? Web triangle chart patterns such as ascending triangle pattern, descending triangle pattern and symmetrical triangle pattern are some essential tools that are used by traders to determine the prices of assets while predicting the behavior of buyers and sellers. We go into more detail about what they are and how they. Web the triangle pattern. These chart patterns can indicate a trend reversal or signal the continuation of a bearish or bullish market. Web triangles within technical analysis are chart patterns commonly found in the price charts of financially traded assets ( stocks, bonds, futures, etc.). The price tends to consolidate for a while and allows the trader to draw a horizontal trend line on. Inflation updates, as the ppi and cpi figures might have a strong impact on fed policy expectations. Web a descending triangle is a chart pattern used in technical analysis created by drawing one trend line connecting a series of lower highs and a second horizontal trend line connecting a series. Ascending triangles, descending triangles, and symmetrical triangles. Traders can use. Triangle chart patterns are usually identified by traders when a financial instrument’s trading range narrows after a downtrend or an uptrend. Web triangle chart patterns offer valuable insights into market dynamics, symbolizing a clash between buyers and sellers within a contracting price range. How to become a professional trader : Correctly identifying and subsequently trading the triangle chart pattern has benefitted many technical forex traders. Web a triangle pattern in technical analysis is a price formation characterized by converging trend lines, forming the shape of a triangle on a price chart. Spotting chart patterns is a popular hobby amongst traders of all skill levels, and one of. The triangle pattern is generally categorized as a “ continuation pattern ”, meaning that after the pattern completes, it’s assumed that. Web how to trade triangle chart patterns. Spotting chart patterns is a popular activity amongst traders of all skill levels, and one of the easiest patterns to spot is. It is created by price moves that allow for a horizontal line to be drawn along the swing highs and a rising trendline to be. Web a descending triangle is a chart pattern used in technical analysis created by drawing one trend line connecting a series of lower highs and a second horizontal trend line connecting a series. Web triangles within technical analysis are chart patterns commonly found in the price charts of financially traded assets ( stocks, bonds, futures, etc.). The triangle pattern is traditionally categorized as a. These patterns are often classified as continuation or neutral patterns, suggesting that the price is likely to persist in its existing trend after the pattern concludes. Unlike other chart patterns, which signal a clear directionality to the forthcoming price movement, triangle patterns can anticipate either a continuation of the previous trend or a reversal. The price tends to consolidate for a while and allows the trader to draw a horizontal trend line on the upside.

Triangle Chart Patterns Complete Guide for Day Traders

Triangle Chart Patterns Complete Guide for Day Traders

triangle chart pattern Archives Synapse Trading

Triangle Chart Patterns Complete Guide for Day Traders

How To Differentiate Triangle Chart Patterns TradingAxe

Ascending Triangle Chart Patterns A Complete Guide

Analyzing Chart Patterns Triangles

Triangle Chart Patterns Complete Guide for Day Traders

Triangle Chart Patterns Complete Guide for Day Traders

Triangle Chart Patterns Complete Guide for Day Traders

Simultaneously, It Allows The Trader To Draw A Rising Trend Line Downwards.

Triangles Are Similar To Wedges And Pennants And Can Be Either A Continuation.

Web On The Chart From Early 2020, A Triangle Formation Is Noticeable, With Convergence Around May 2024.

Web What Is Triangle Chart Pattern?

Related Post: