Trendline Patterns

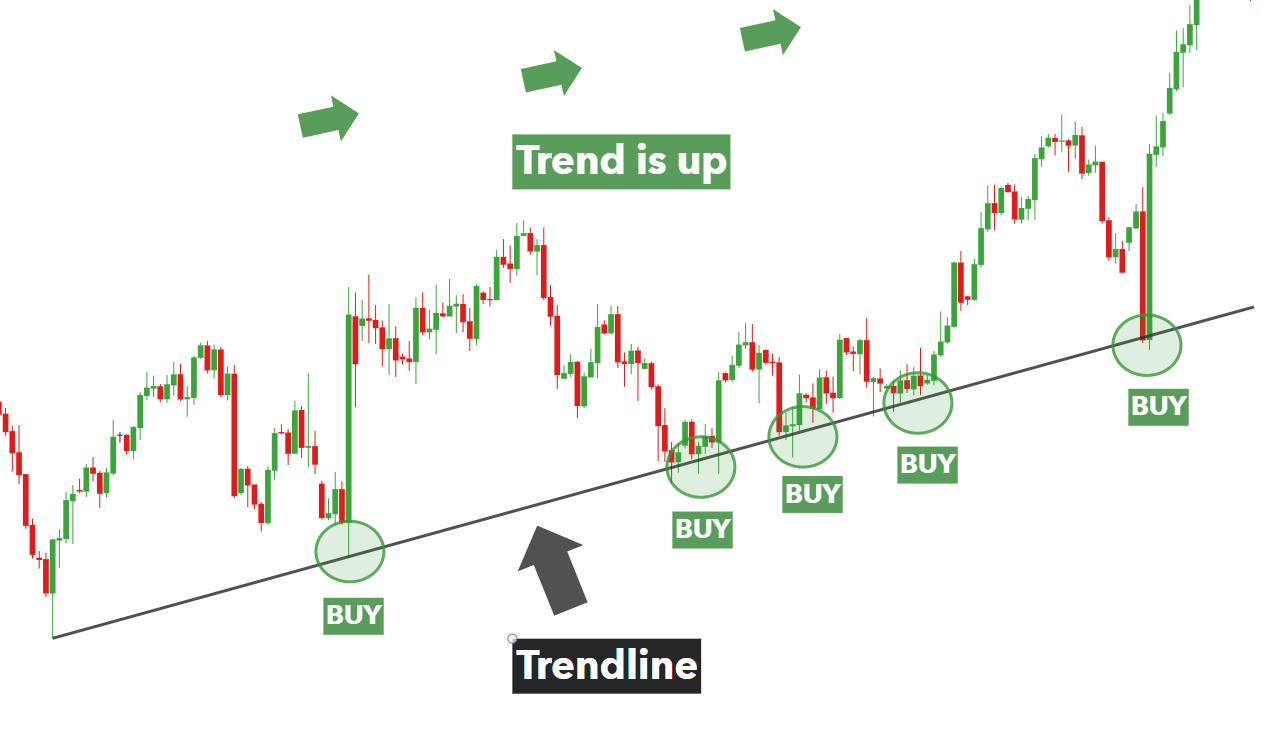

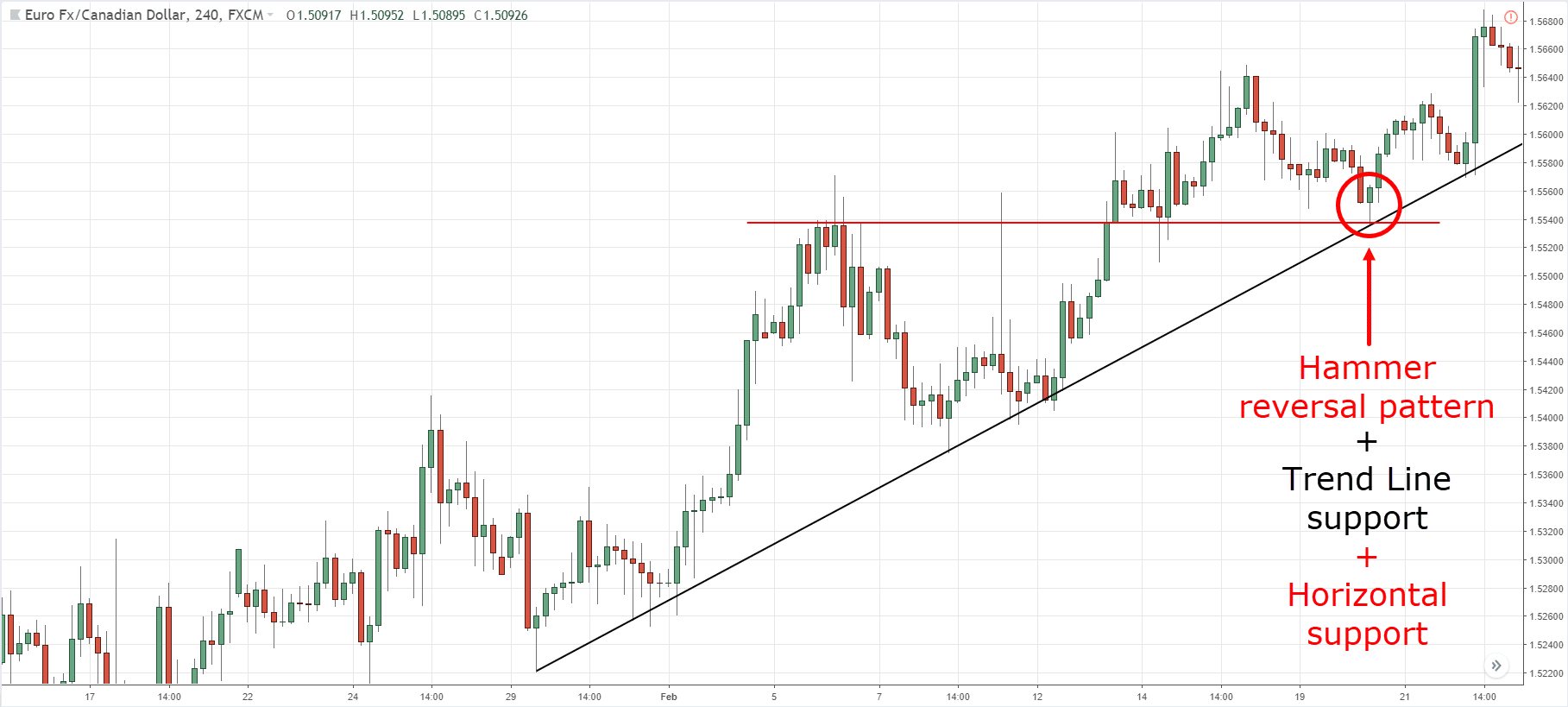

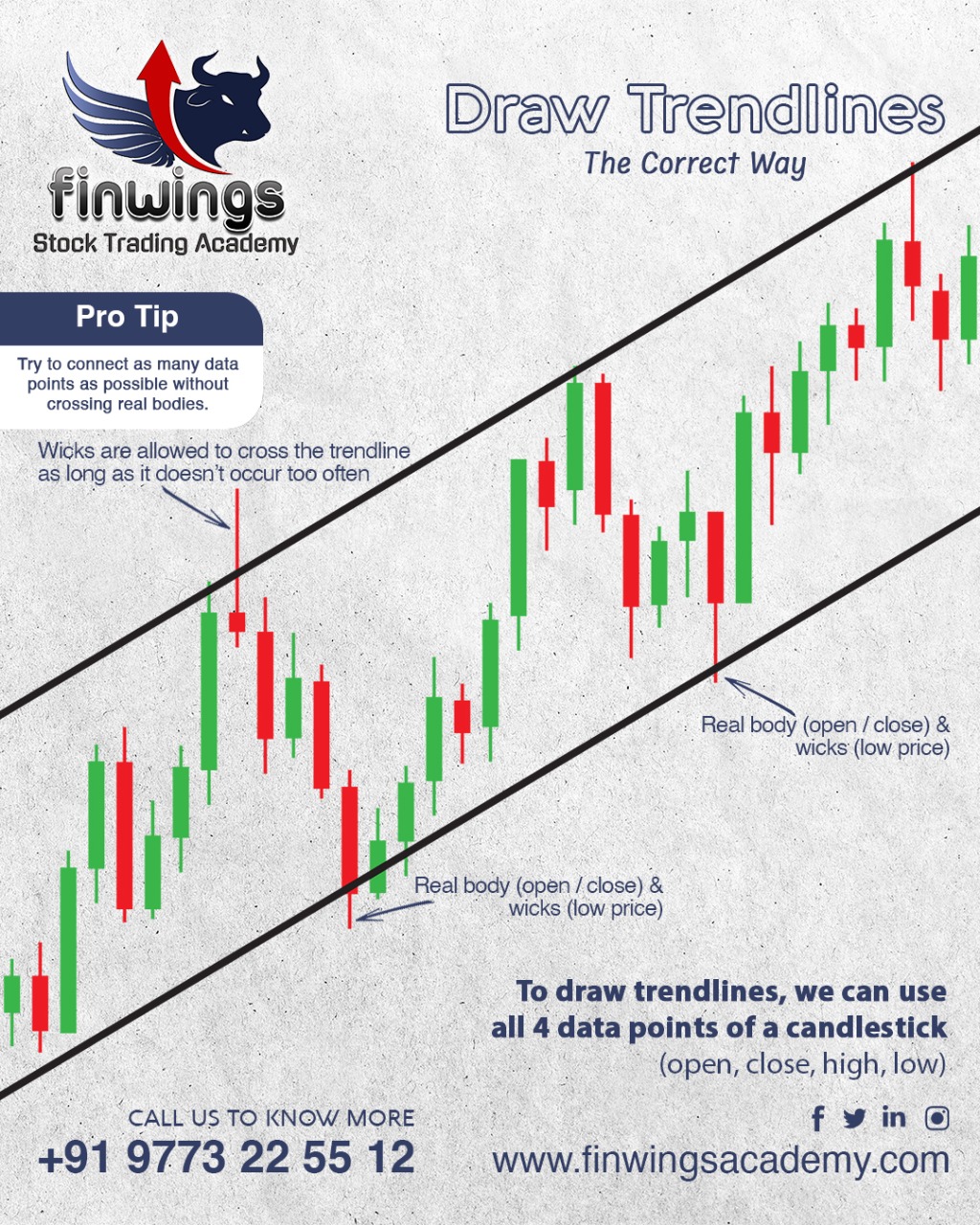

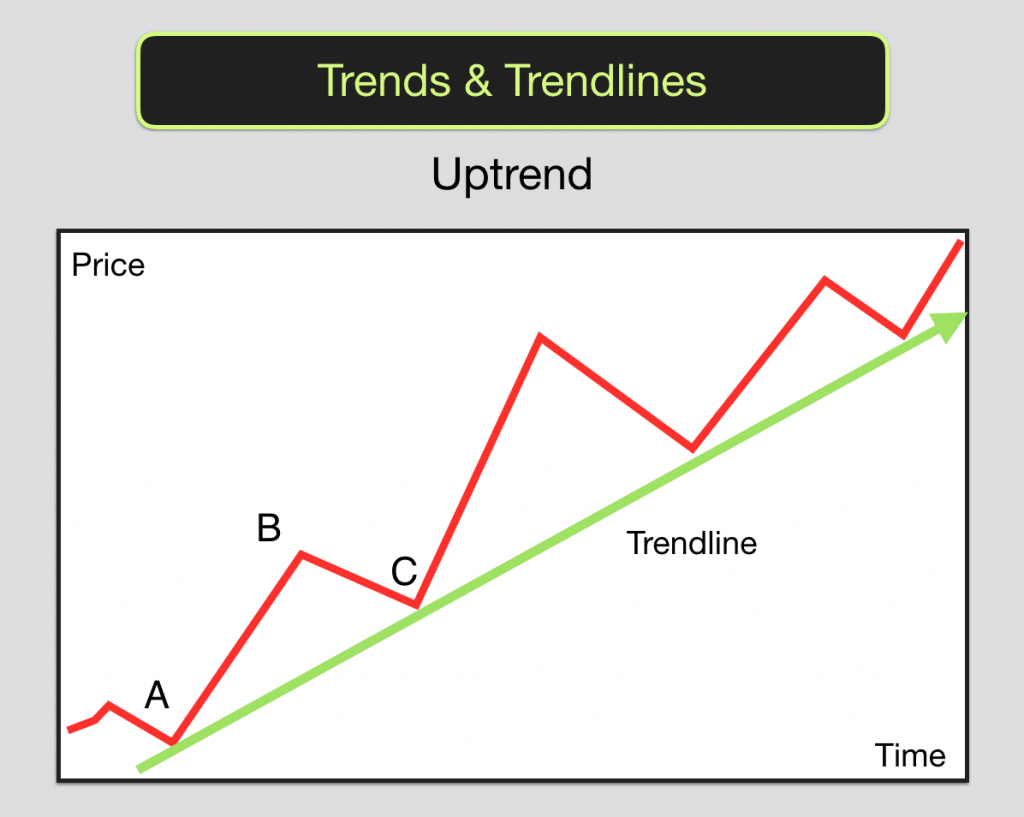

Trendline Patterns - The pennant chart pattern occurs when there is a sudden pause in the price movement during a strong uptrend or downtrend. Trend line is one of the most versatile tools in trading. ☆ research you can trust ☆. However, most traders get it wrong. Web using charts, technical analysts seek to identify price patterns and market trends in financial markets and attempt to exploit those patterns. Web trendlines are easily recognizable lines that traders draw on charts to connect a series of prices together. Determine where to place a stop loss. Retail traders widely use chart patterns to forecast the price using technical analysis. You can use it in day trading, swing trading or even position trading. An upward slope implies an uptrend. Add trendlines to your charts, considering support, resistance, and trend direction. Here are trend lines in action! Web trendlines are easily recognizable lines that traders draw on charts to connect a series of prices together. Chart patterns are created by connecting the asset’s price points on a chart, forming various shapes and patterns that can indicate potential future price movements.. Determine where to place a stop loss. The complete guide to trend line trading. Trend line is one of the most versatile tools in trading. Web triangle patterns are aptly named because the upper and lower trendlines ultimately meet at the apex on the right side, forming a corner. An upward slope implies an uptrend. How to use trend lines: Uptrend (higher lows) downtrend (lower highs) sideways trend (ranging) here are some important things to remember using trend lines in forex trading: Trend line is one of the most versatile tools in trading. The screenshot below shows an uptrend with steadily increasing angles of trendlines. The pennant chart pattern is a continuation pattern. In this article, you will get a short description of each chart pattern. The pattern is defined as local highs or local lows forming a straight line. These patterns are formed once the trading range of a. The resulting line is then used to give the trader a good idea of the direction in. Web trendline trading is a technical. Web trend lines are key elements of technical analysis and chart patterns as they indicate significant price levels where support of resistance could be expected to be encountered. Web a trendline is a line drawn over pivot highs or under pivot lows to show the prevailing direction of price. Your capital is at risk. In technical analysis, trend lines are. The screenshot below shows an uptrend with steadily increasing angles of trendlines. If the bulls push the price and repeat the recent breakout, the price might start another increase. Trend line is one of the most versatile tools in trading. However, most traders get it wrong. How to use the trend breaker strategy: Above here, 1.0890, the april high, comes into play. Only use this pattern recognition on a renko chart. Understanding patterns and their limits. Web triangle patterns are aptly named because the upper and lower trendlines ultimately meet at the apex on the right side, forming a corner. Web trendlines are easily recognizable lines that traders draw on charts to connect. Web trendline trading strategies are one of the most simple and powerful trading signals in the market. Study price charts to identify trends and determine entry and exit points. Web steps for drawing trendlines: An upward slope implies an uptrend. The pennant chart pattern occurs when there is a sudden pause in the price movement during a strong uptrend or. The screenshot below shows an uptrend with steadily increasing angles of trendlines. A pattern is bounded by at least two trend lines (straight or curved) all patterns have a combination of entry and exit points. You can use it in day trading, swing trading or even position trading. Thus an understanding of trend lines, and what they represent, is important. In this post, we take a look at the trendline trading strategy. Determine where to place a stop loss. Only use this pattern recognition on a renko chart. Immediate resistance is near the $2,950 level and another connecting bearish trend line on the same chart. It involves drawing a line on a price chart to connect a series of higher. The pennant chart pattern is a continuation pattern. It involves drawing a line on a price chart to connect a series of higher lows in an uptrend or lower highs in a downtrend. Thus an understanding of trend lines, and what they represent, is important for successful trading based on technical analysis. Here are trend lines in action! The complete guide to trend line trading. Open a trading chart and access the 'draw tools' tab. 3 background trendlines are easily recognizable lines that traders draw on charts to connect a series of prices together or show some data's best fit. Only use this pattern recognition on a renko chart. Web a trendline is a diagonal line drawn through a chart to show the trend in price. You can also learn the chart patterns with trading strategy by pressing the learn more button. Immediate resistance is near the $2,950 level and another connecting bearish trend line on the same chart. Web steps for drawing trendlines: In this post, we take a look at the trendline trading strategy. This line, known as the trendline, can help traders identify potential buying or selling opportunities. Web trendlines represent a basic yet the most popular chart pattern used by technical traders. Patterns can be continuation patterns or reversal patterns.

The Complete Guide On How To Use Trendlines

How to Identify and Draw Trend Lines Like A Pro?

The Most Comprehensive Guide On The Types of Trendlines And How To Use

![How To Draw Trend Lines Perfectly Every Time [2022 Update]](https://dailypriceaction.com/wp-content/uploads/2014/09/how-to-use-trend-lines.png)

How To Draw Trend Lines Perfectly Every Time [2022 Update]

The Complete Guide to Trend Line Trading

What is the Trendline indicator? How to use Trendline for long position

How to draw trend lines on Charts? Finwings Academy

Trading trends and trendlines

The Most Comprehensive Guide On The Types of Trendlines And How To Use

The Complete Guide On How To Use Trendlines

If The Bulls Push The Price And Repeat The Recent Breakout, The Price Might Start Another Increase.

A Similar Pattern (The Prior Pink) Happened Before, But The Difference This Time Is That The Price Broke Well Below And Pattern And Then Retraced To Resistance.

Study Price Charts To Identify Trends And Determine Entry And Exit Points.

However, Most Traders Get It Wrong.

Related Post: