Trading Flag Patterns

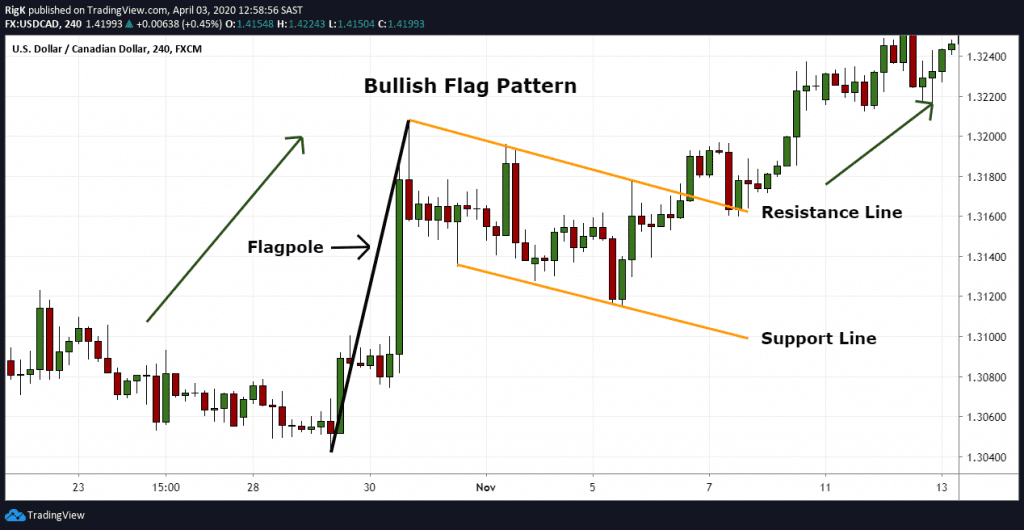

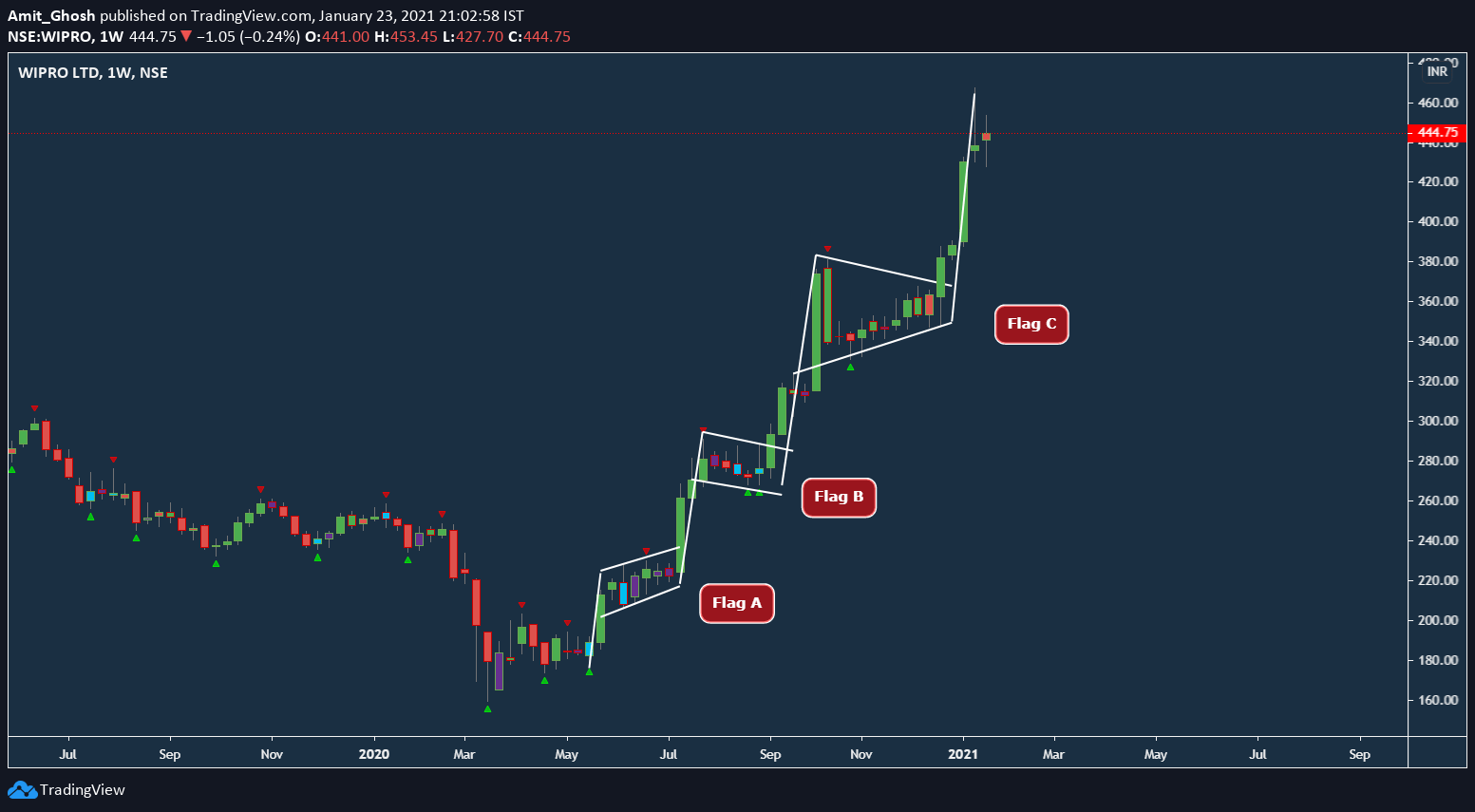

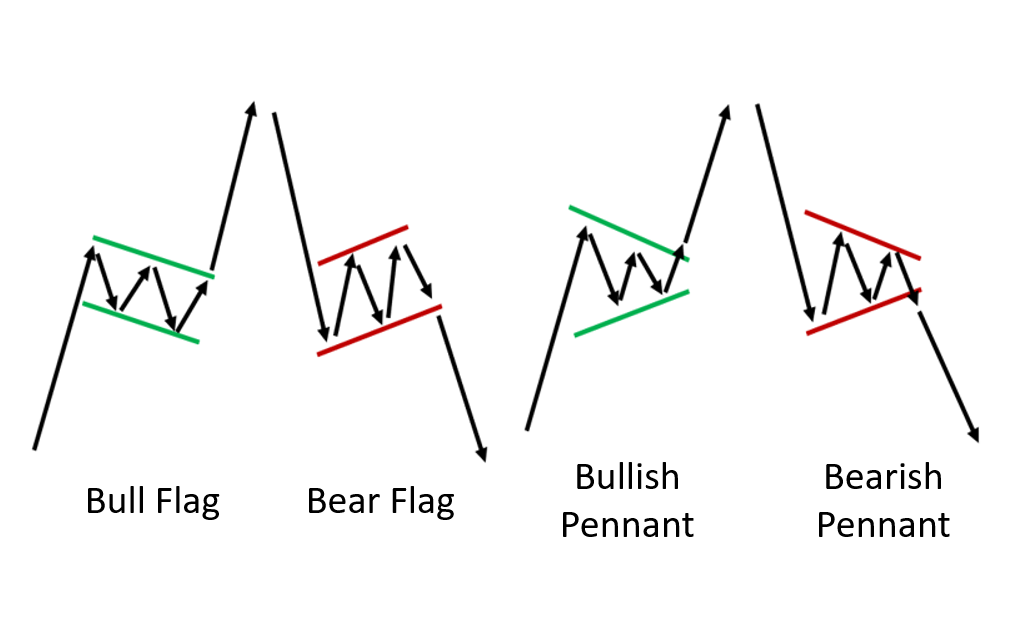

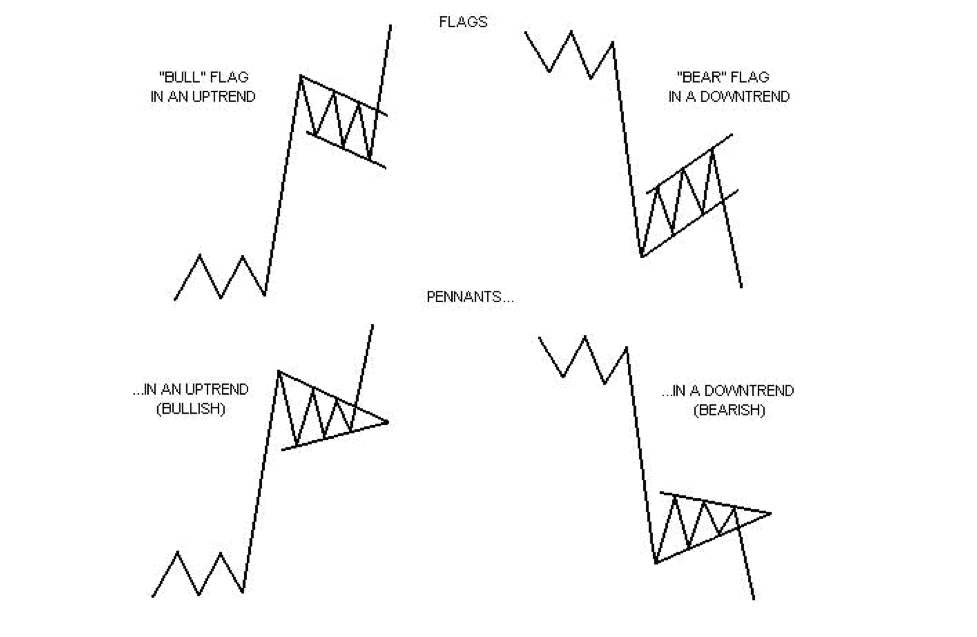

Trading Flag Patterns - A buy signal is considered as the upper boundary of the breakout above and. Web the web page you are looking for does not exist or has been removed. Stockstotrade is a platform for traders to make profitable trades since 2009. Web learn how to identify and trade flag patterns, a technical analysis tool that indicates a continuation of the prevailing trend after a brief pause. Web learn what a flag pattern is in trading and how to identify and trade it. Web learn what a flag is in technical analysis, a price pattern that indicates a possible continuation of a trend after a period of consolidation. These patterns are characterized by a. Here are some of the most common types of flags: Find out the criteria, str… See chart examples, volume analysis, and target. See chart examples, volume analysis, and target. As simple as it sounds but, most traders get it wrong. Bearish flag pattern for trading. Web the flag pattern is a simple but powerful chart pattern that i love to trade. Web there are many different types of flags that technical traders should keep an eye out for when analyzing chart patterns. A buy signal is considered as the upper boundary of the breakout above and. Web the “bull flag” or “bullish flag pattern” is a powerful indicator for trading uptrends or topside market breakouts. These patterns are characterized by a. Find out how to confirm, manage. See chart examples, volume analysis, and target. Web the flag pattern is a simple but powerful chart pattern that i love to trade. These patterns are characterized by a. It means that if you’re looking to enter a trade at a. Web in this article, we look at how to identify and trade bull and bear flag patterns, by looking for entries and exits through breakouts, proportionate. Web there are many different types of flags that technical traders should keep an eye out for when analyzing chart patterns. This pattern is pretty easy to. They “blindly” take every flag. A flag pattern is a continuation chart pattern that forms when the market consolidates in. See chart examples, volume analysis, and target. Web learn how to identify and trade flag patterns, a technical analysis tool that indicates a continuation of the prevailing trend after a brief pause. Find out the specifications, entry and exit rules,. Web flag patterns are a popular technical analysis tool used by traders to identify potential price movements in financial markets. Web the key way to trading flag. Web the flag pattern is a simple but powerful chart pattern that i love to trade. Find out the specifications, entry and exit rules,. These patterns are characterized by a. As simple as it sounds but, most traders get it wrong. Web the “bull flag” or “bullish flag pattern” is a powerful indicator for trading uptrends or topside market breakouts. Web the flag pattern is one of the most famous technical analysis patterns that help traders identify potential trend continuation. Here are some of the most common types of flags: It means that if you’re looking to enter a trade at a. Web learn how to identify and trade the flag pattern, a continuation formation that can appear in bullish. Find out the criteria, str… Web learn how to identify and trade flag patterns, a technical analysis tool that indicates a continuation of the prevailing trend after a brief pause. They “blindly” take every flag. These patterns are characterized by a. This pattern is pretty easy to. Web a bull flag chart pattern happens when a stock is in a strong uptrend but then has a slight consolidation period before continuing its trend up. Web the flag pattern is a simple but powerful chart pattern that i love to trade. Read on to learn more about the bull flag and its. These patterns are usually preceded by. A buy signal is considered as the upper boundary of the breakout above and. Web learn what a flag pattern is in trading and how to identify and trade it. These patterns are usually preceded by a sharp. Web the key way to trading flag patterns is to look for a breakout above or below the flag pattern. Find out. These patterns are usually preceded by a sharp. Web the flag pattern is one of the most famous technical analysis patterns that help traders identify potential trend continuation. 11 chart patterns for trading symmetrical triangle. Web learn how to identify and trade the flag pattern, a continuation formation that can appear in bullish or bearish trends. See chart examples, volume analysis, and target. Learn how to trade the flag pattern, a continuation formation that appears as a minor consolidation between impulsive legs of a trend. Web learn what a flag is in technical analysis, a price pattern that indicates a possible continuation of a trend after a period of consolidation. Here are some of the most common types of flags: It means that if you’re looking to enter a trade at a. These patterns are characterized by a. Web the key way to trading flag patterns is to look for a breakout above or below the flag pattern. Bearish flag pattern for trading. Find out the criteria, str… Web learn how to identify and trade the flag pattern, a continuation chart pattern that signals a brief pause before the price resumes its previous direction. Web the web page you are looking for does not exist or has been removed. Read on to learn more about the bull flag and its.

Flag Pattern Full Trading Guide with Examples

Bull Flag Chart Patterns The Complete Guide for Traders

How to use the flag chart pattern for successful trading

Flag Patterns Part I The Basics of Flag Pattern Unofficed

Bull Flag & Bear Flag Pattern Trading Strategy Guide (Updated 2023)

Chart Patterns Flags TrendSpider Learning Center

Flag Pattern Forex Trading

FLAG PATTERNS. Flag patterns are a popular technical… by Princeedesco

Stock Trading Training Flag Patterns

What Is Flag Pattern? How To Verify And Trade It Efficiently

A Buy Signal Is Considered As The Upper Boundary Of The Breakout Above And.

They “Blindly” Take Every Flag.

Find Out The Specifications, Entry And Exit Rules,.

This Pattern Is Pretty Easy To.

Related Post: