Trading Flag Pattern

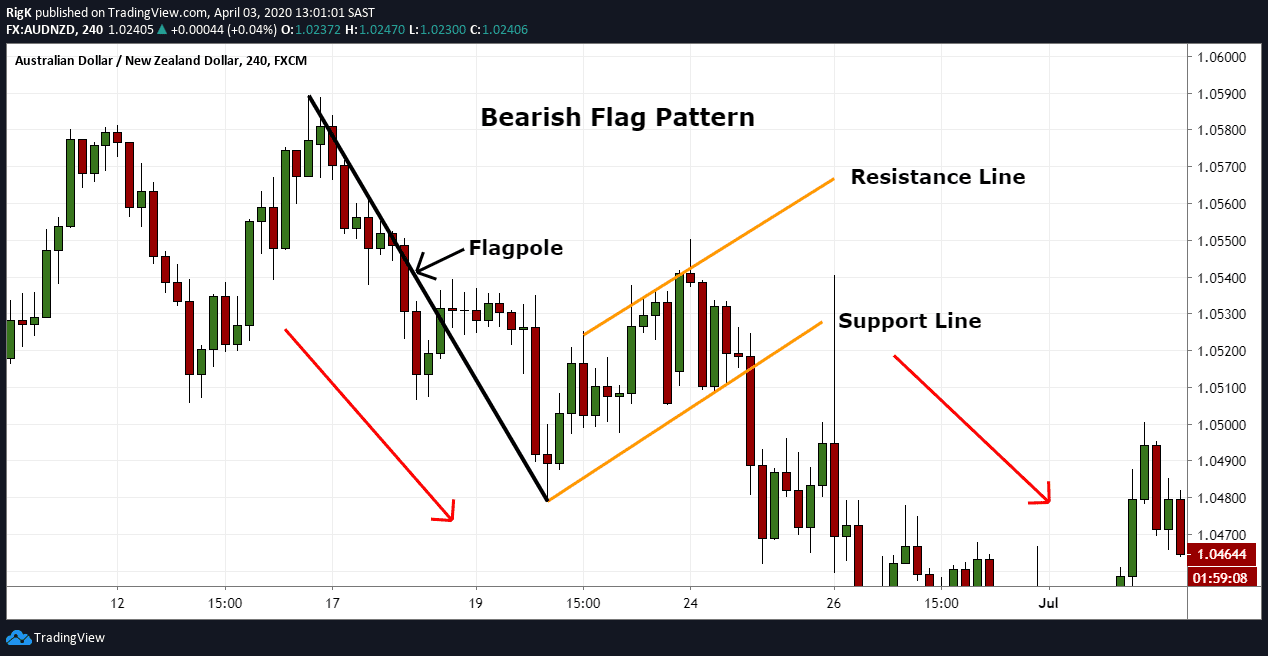

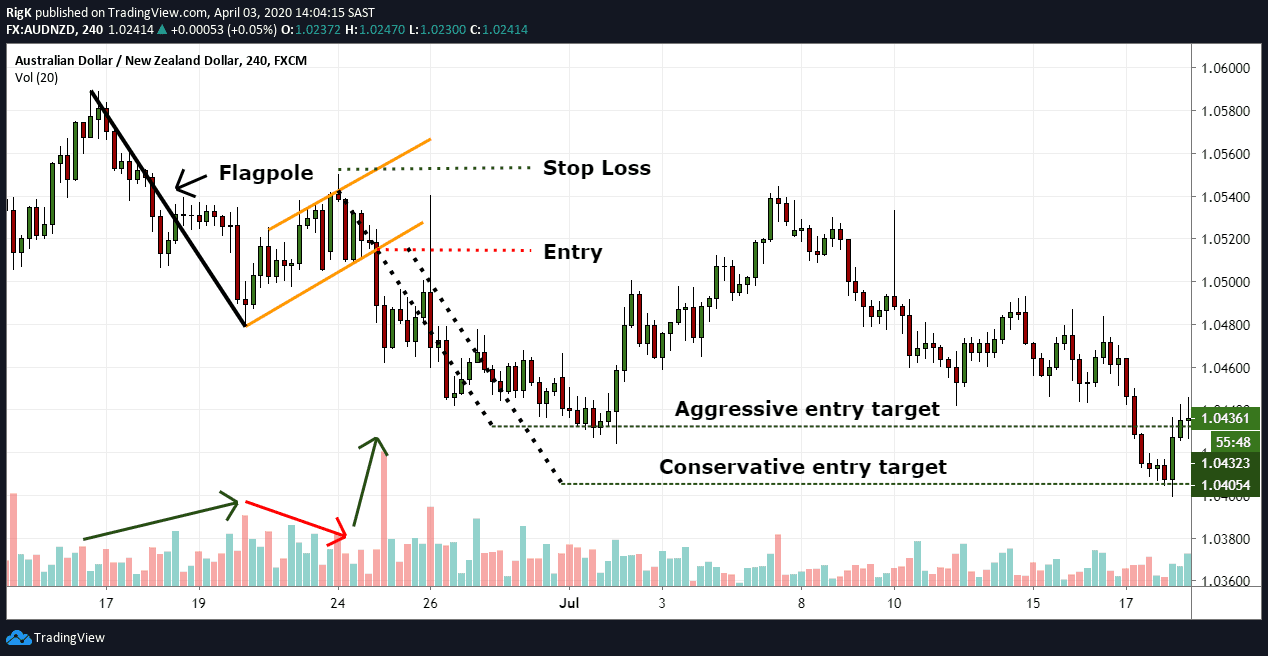

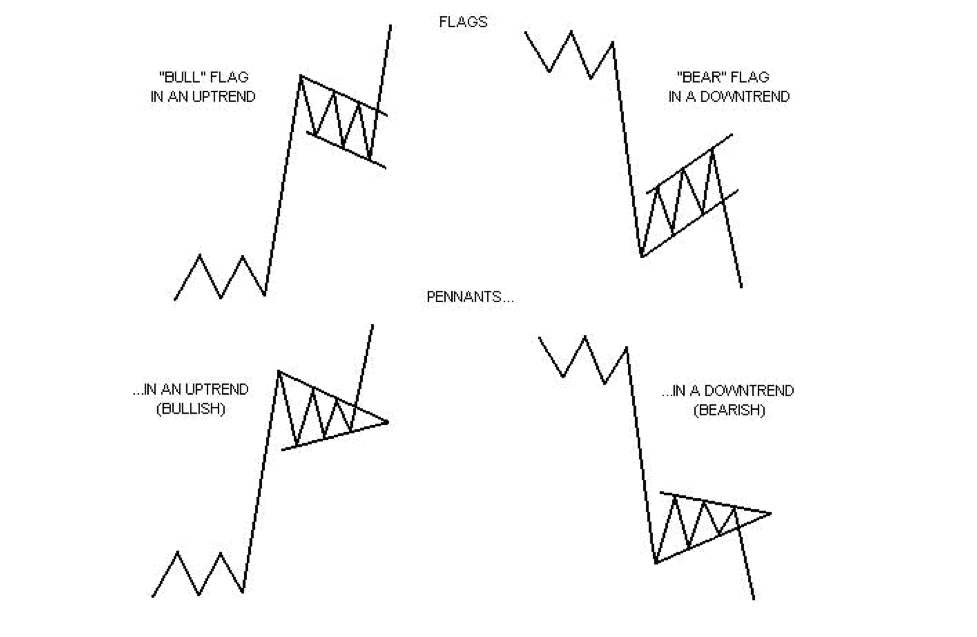

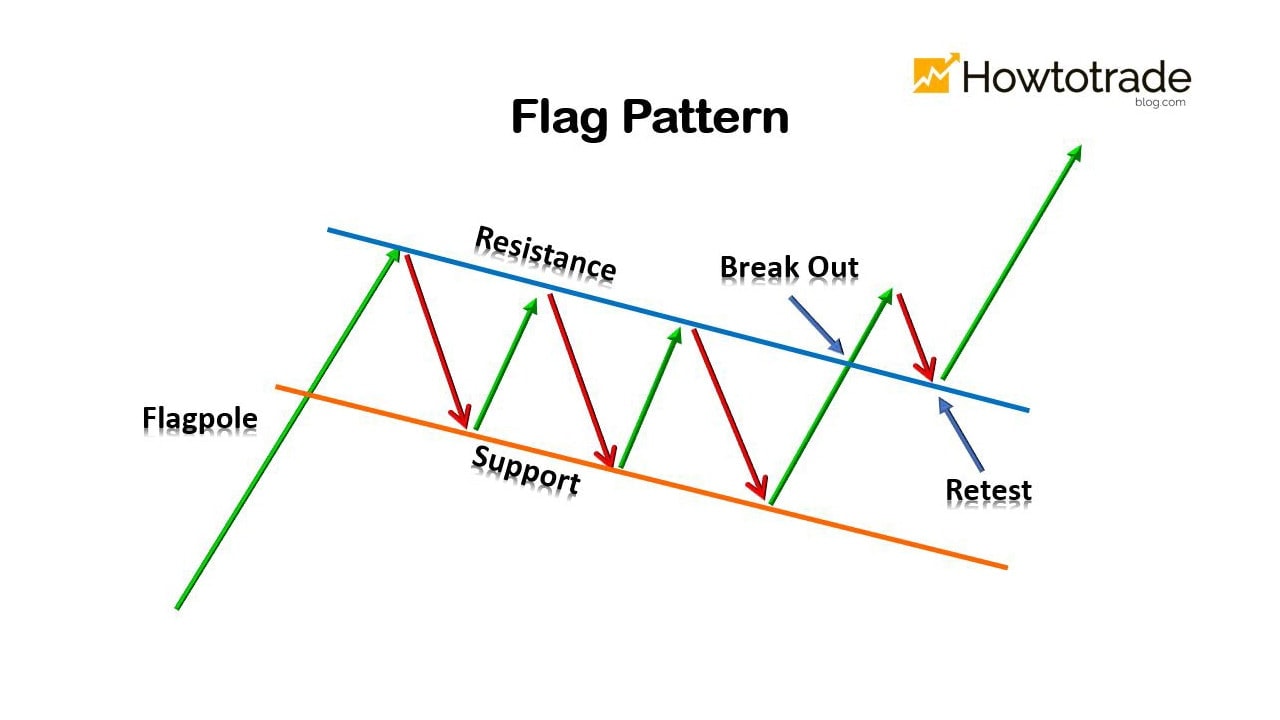

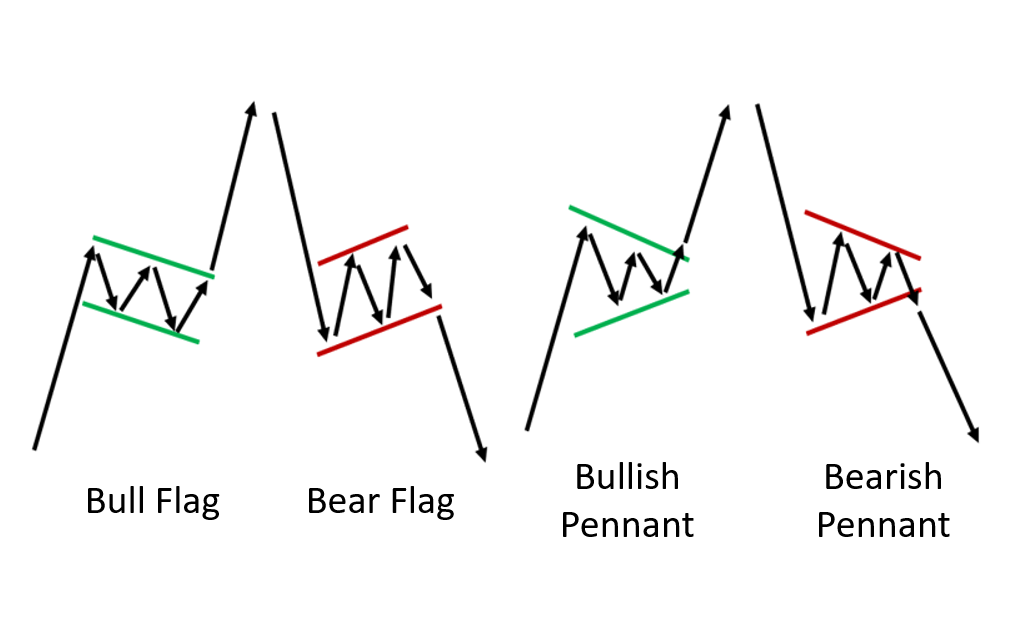

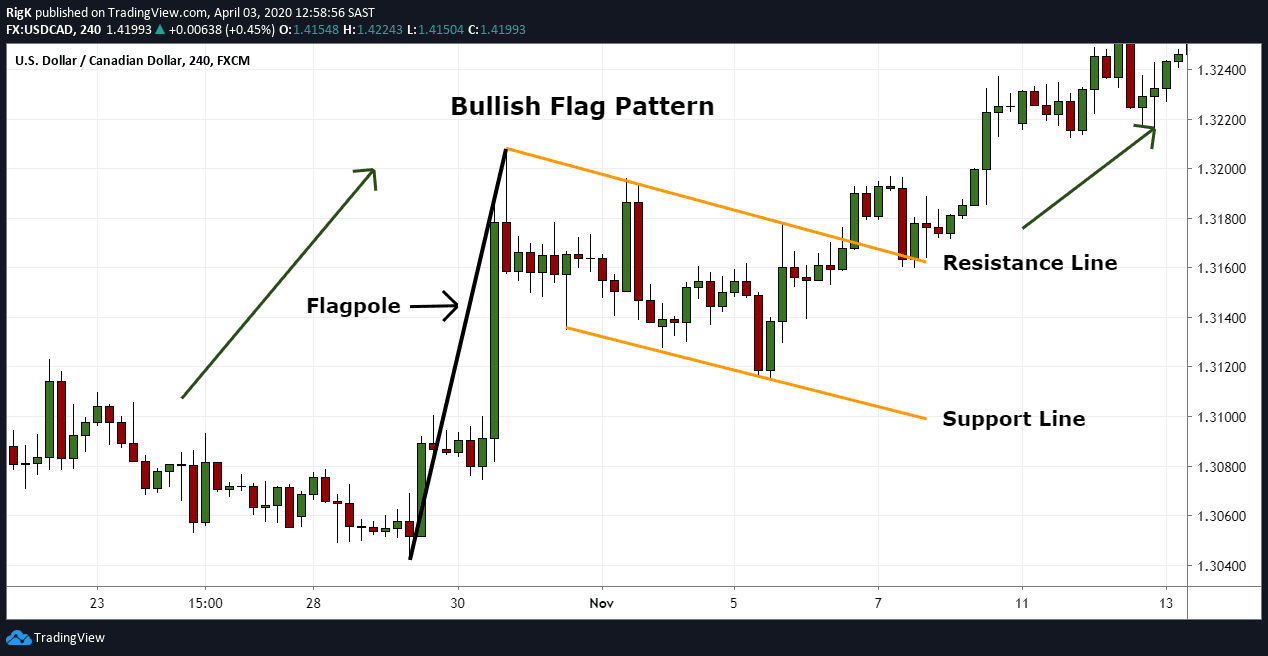

Trading Flag Pattern - Web the flag pattern is a continuation pattern that is characterized by a period of tight consolidation in the price movement of a security. The flag portion of the pattern must run between parallel lines and can either be slanted up, down, or even sideways. Shaun murison | analyst, johannesburg. Web how to trade the flag pattern. Web a flag chart pattern is formed when the market consolidates in a narrow range after a sharp move. How to trade the bull flag pattern? Sometimes there will not be specific reaction highs and lows from which to draw the trend lines, and the price action should be contained within the converging trend lines. In this article we look at how to trade these opportunities. The flag pattern is a simple but powerful chart pattern that i love to trade. Flag patterns are a useful visual tool to identify and evaluate changes in price over time. We start by discussing what flag patterns are and how they are presented on a chart. Web what is a bullish flag pattern? The flag portion of the pattern must run between parallel lines and can either be slanted up, down, or even sideways. Flag patterns are a useful visual tool to identify and evaluate changes in price over time.. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. How does bullish flag pattern? Flag patterns are a useful visual tool to identify and evaluate changes in price over time. August 11, 2022 6:35 am. The bull flag andthe bear flag. Whenever you see this pattern form on a chart, it means that there are high chances of the price action breaking out in the direction of the prevailing trend. Bull flag pattern on kirk daily timeframe: The flag pattern is the most common continuation patterns in technical analysis. Web the flag pattern is used to identify the possible continuation of. Web a flag, in technical analysis of the financial markets, is a continuation chart pattern that forms when the market consolidates in a narrow range after a sharp move. They represent a pattern of two parallel trendlines that meet at both the upper and lower points of an asset’s price, forming an approximate flag shape. The bullish flag pattern is. A bull flag pattern occurs after a strong upward price movement and the bear flag pattern occurs after a strong downward price movement. Sometimes there will not be specific reaction highs and lows from which to draw the trend lines, and the price action should be contained within the converging trend lines. Read on to learn more about the bull. Web the flag pattern is a powerful trend continuation chart pattern that appears in all markets and timeframes. Web bull flags represent one of the most powerful and dynamic patterns in trading, signaling continuation in an uptrend. Web mastering the bearish flag pattern in forex and gold trading. Web a flag chart pattern is formed when the market consolidates in. Bearish flag pattern for trading #trading#strategy#trade#tradeforyou#nse#bse#stock#intraday#stockmarket#indianexchange#foreignexchangemarket#trading#trader#tradeingsetup#tradibgstrategy. Web the flag pattern is a continuation pattern that is characterized by a period of tight consolidation in the price movement of a security. A “flag” is composed of an explosive strong price move that forms the flagpole, followed by an orderly and diagonally symmetrical pullback, which forms the flag. Whenever you see this. Whenever you see this pattern form on a chart, it means that there are high chances of the price action breaking out in the direction of the prevailing trend. , former senior financial writer. What are bull and bear flag patterns? A pennant is a small symmetrical triangle that begins wide and converges as the pattern matures (like a cone).. Recognized by a distinct flagpole and consolidation phase, this pattern offers traders actionable insights and clear entry points. We start by discussing what flag patterns are and how they are presented on a chart. Enter a trade when the prices break above or below the upper or lower trendline of the flag. Web a flag pattern is a trend continuation. They represent a pattern of two parallel trendlines that meet at both the upper and lower points of an asset’s price, forming an approximate flag shape. The flag portion of the pattern must run between parallel lines and can either be slanted up, down, or even sideways. The bearish flag pattern is a powerful technical analysis tool used by traders. They represent a pattern of two parallel trendlines that meet at both the upper and lower points of an asset’s price, forming an approximate flag shape. It is called a flag pattern because it resembles a flag and pole. A pennant is a small symmetrical triangle that begins wide and converges as the pattern matures (like a cone). Web a flag, in technical analysis of the financial markets, is a continuation chart pattern that forms when the market consolidates in a narrow range after a sharp move. Sometimes there will not be specific reaction highs and lows from which to draw the trend lines, and the price action should be contained within the converging trend lines. Web in simple terms, a flag pattern is a continuation chart pattern that occurs after a strong price movement, signaling a brief period of consolidation before the price resumes its previous direction. In this article we look at how to trade these opportunities. There are mainly 2 types of flag pattern in trading: What are flag patterns and how to identify them. A “flag” is composed of an explosive strong price move that forms the flagpole, followed by an orderly and diagonally symmetrical pullback, which forms the flag. Web the bull flag pattern is a “continuation” pattern that gives you a logical place to hop into the trend. Bull flag pattern on kirk daily timeframe: It often occurs after a big impulsive move. Read on to learn more about the bull flag and its use in your financial markets trading. As simple as it sounds but,. We start by discussing what flag patterns are and how they are presented on a chart.

How to use the flag chart pattern for successful trading

Flag Pattern Full Trading Guide with Examples

Bull Flag Chart Patterns The Complete Guide for Traders

Flag Pattern Full Trading Guide with Examples

Stock Trading Training Flag Patterns

What Is Flag Pattern? How To Verify And Trade It Efficiently

What Is Flag Pattern? How To Verify And Trade It Efficiently

Bull Flag & Bear Flag Pattern Trading Strategy Guide (Updated 2023)

Flag Pattern Forex Trading

Flag Pattern Full Trading Guide with Examples

The Flag Portion Of The Pattern Must Run Between Parallel Lines And Can Either Be Slanted Up, Down, Or Even Sideways.

How To Trade The Bull Flag Pattern?

How Does Bullish Flag Pattern?

Web A Flag Pattern Is A Technical Analysis Chart Pattern That Can Be Observed In The Price Charts Of Financial Assets, Such As Stocks, Currencies, Or Commodities.

Related Post: