Trading Candlestick Patterns

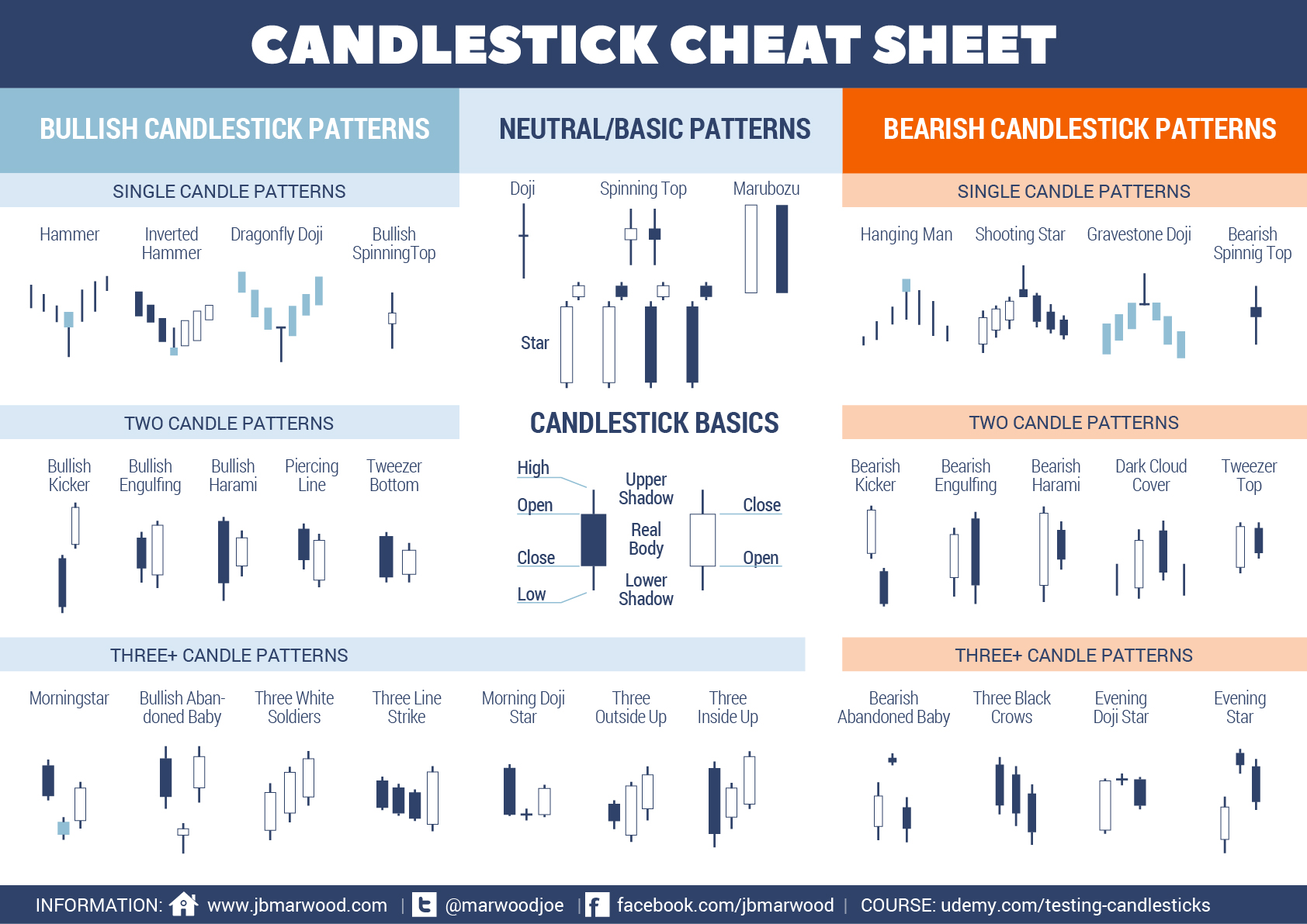

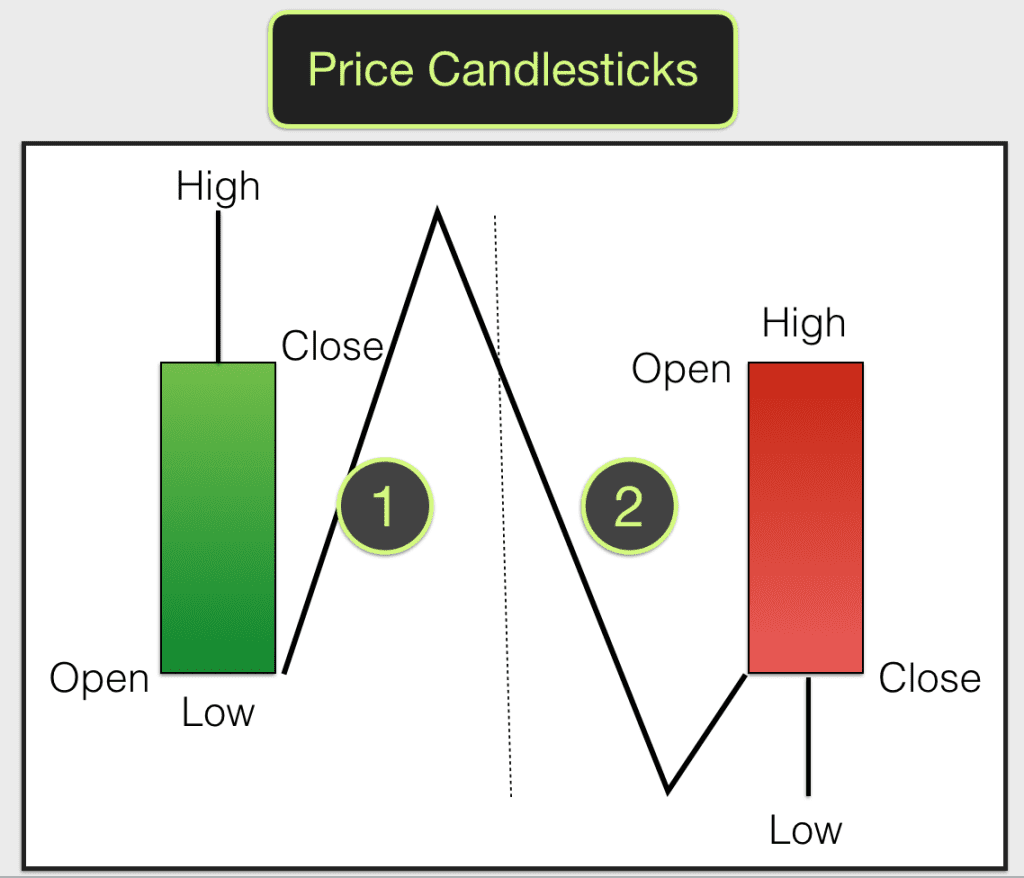

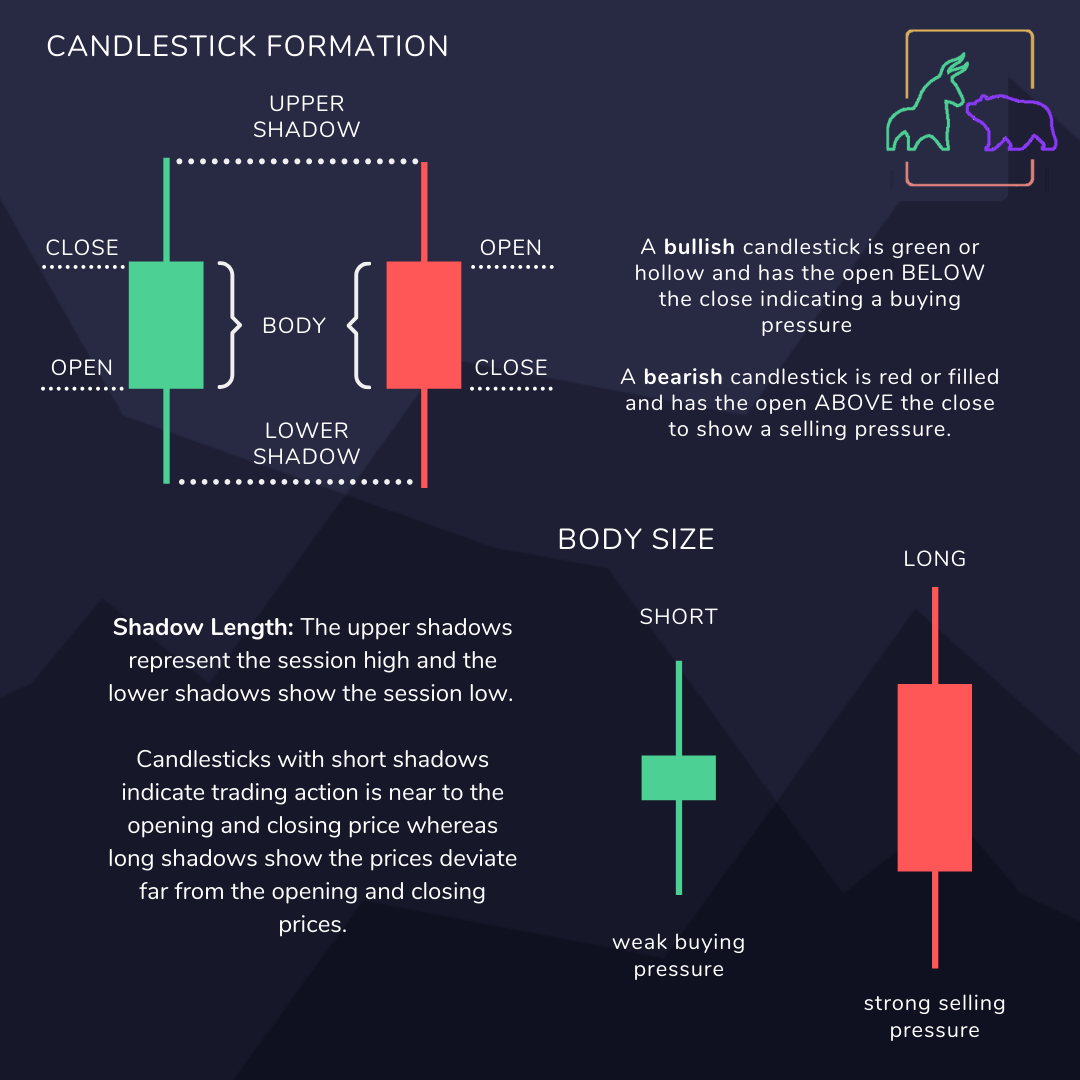

Trading Candlestick Patterns - A picture is worth a thousand words, so let’s use a few to shine a light on candlesticks. Web candlestick patterns are technical trading tools that have been used for centuries to predict price direction. Web traders use candlestick charts to determine possible price movement based on past patterns. Candlestick patterns are used to predict the future direction of price movement. Candlesticks are useful when trading as they show four price points (open, close, high, and low. The illustrations and explanations will help you learn to evaluate essential candlestick patterns and make investment decisions about where prices may be heading next. The bullish engulfing pattern is formed of two candlesticks. A candlestick must meet the following. Morning star & evening star. To that end, we’ll be covering the fundamentals of candlestick charting in this tutorial. A candlestick must meet the following. The third candle must be bullish. Let’s look at a single candle pattern named the bullish closing marubozu. Bullish engulfing & bearish engulfing. Candlestick patterns are used to predict the future direction of price movement. Candlesticks are useful when trading as they show four price points (open, close, high, and low. Hammer pattern & shooting star. Let’s look at a single candle pattern named the bullish closing marubozu. To that end, we’ll be covering the fundamentals of candlestick charting in this tutorial. Web trading without candlestick patterns is a lot like flying in the night. A candlestick must meet the following. Bullish closing marubozu candlestick pattern. Web each candlestick pattern has a distinct name and a traditional trading strategy. Sure, it is doable, but it requires special training and expertise. The first candle is a short red body that is completely engulfed by a larger green candle. Web traders use candlestick charts to determine possible price movement based on past patterns. Discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities. Web candlestick patterns are technical trading tools that have been used for centuries to predict price direction. A picture is worth a thousand words, so let’s use a. The second candlestick gaps up and has a narrow body. Ideally, the body of the second candle shouldn’t overlap with the bodies of the other two candles. Candlestick technical analysis doji pressure inverted hammer support and resistance. The first candle is a short red body that is completely engulfed by a larger green candle. The color of the second candle. Morning star & evening star. Web 16 candlestick patterns every trader should know. Candlestick patterns are used to predict the future direction of price movement. An evening star is a bearish reversal pattern where the first candlestick continues the uptrend. Hammer pattern & shooting star. Hanging man & inverted hammer. Web candlestick trading is a form of technical analysis that uses chart patterns, as opposed to fundamental analysis, which focuses on the financial health of assets. The second candle must be small compared to the others, like a doji or a spinning top. Though the second day opens lower than the first, the bullish market. Hammer pattern & shooting star. Web the first candle must be bearish. The first candle is a short red body that is completely engulfed by a larger green candle. The illustrations and explanations will help you learn to evaluate essential candlestick patterns and make investment decisions about where prices may be heading next. Candlestick technical analysis doji pressure inverted hammer. Hanging man & inverted hammer. Web traders use candlestick charts to determine possible price movement based on past patterns. The illustrations and explanations will help you learn to evaluate essential candlestick patterns and make investment decisions about where prices may be heading next. Web 16 candlestick patterns every trader should know. An evening star is a bearish reversal pattern where. Candlestick technical analysis doji pressure inverted hammer support and resistance. Let’s look at a single candle pattern named the bullish closing marubozu. Candlestick patterns are used to predict the future direction of price movement. Web trading without candlestick patterns is a lot like flying in the night with no visibility. Morning star & evening star. Piercing pattern & dark cloud cover. More importantly, we will discuss their significance and reveal 5 real examples of reliable. Web traders use candlestick charts to determine possible price movement based on past patterns. A picture is worth a thousand words, so let’s use a few to shine a light on candlesticks. Candlesticks are useful when trading as they show four price points (open, close, high, and low. Here is a long list of all the major reversal candlestick patterns: A candlestick must meet the following. An evening star is a bearish reversal pattern where the first candlestick continues the uptrend. Morning star & evening star. Ideally, the body of the second candle shouldn’t overlap with the bodies of the other two candles. The second candlestick gaps up and has a narrow body. Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers. Web the first candle must be bearish. Let’s look at a single candle pattern named the bullish closing marubozu. Candlestick technical analysis doji pressure inverted hammer support and resistance. Hanging man & inverted hammer..png)

4 Powerful Candlestick Patterns Every Trader Should Know

Candlestick Patterns Every trader should know PART 1

Candlestick Patterns Cheat Sheet New Trader U

Introduction to Technical Analysis Candlesticks & Candlestick

Candlestick Patterns The Definitive Guide (2021)

The best trading candlestick patterns

Trading 101 Common Candlestick Patterns BullBear Blog

![Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim](https://www.tradingsim.com/hubfs/Imported_Blog_Media/CANDLESTICKQUICKGUIDE-Mar-18-2022-09-42-46-01-AM.png)

Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim

TRADE ENTRY POINT FX & VIX Traders Blog

Trading 101 How to read candlestick patterns BullBear Blog

Sure, It Is Doable, But It Requires Special Training And Expertise.

Web Candlestick Trading Is A Form Of Technical Analysis That Uses Chart Patterns, As Opposed To Fundamental Analysis, Which Focuses On The Financial Health Of Assets.

The Third Candle Must Be Bullish.

There Are Dozens Of Different Candlestick Patterns With Intuitive, Descriptive Names.

Related Post: