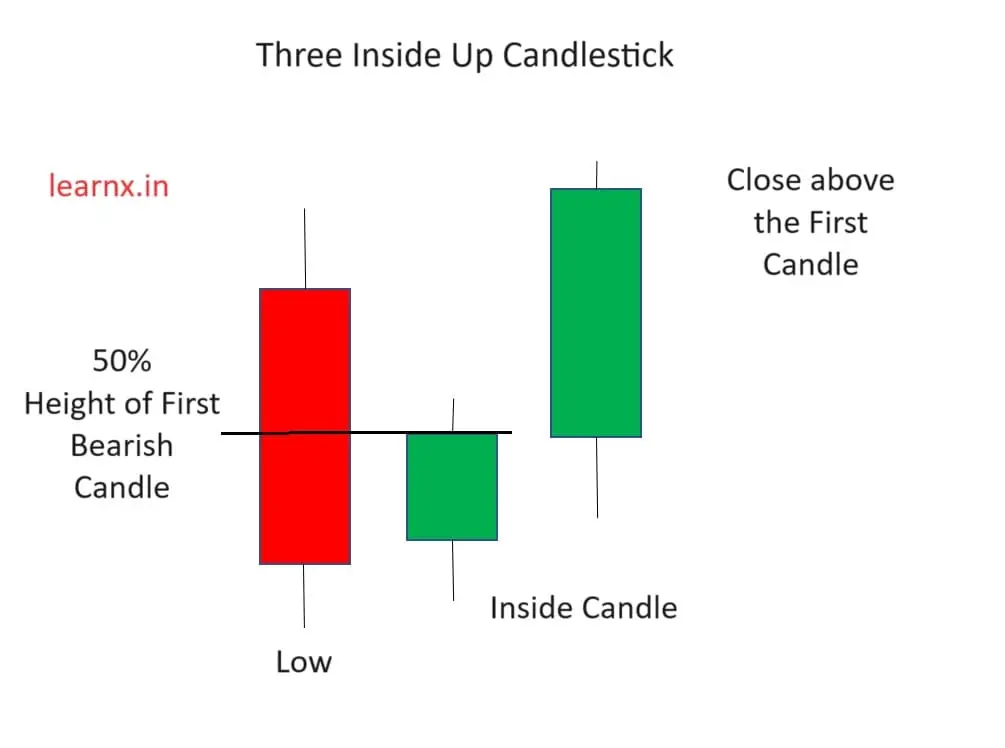

Three Inside Up Candlestick Pattern

Three Inside Up Candlestick Pattern - (2) white candle breaks the trendline (confirmation); The first candle is bearish, representing a downtrend. Web the phrases three inside up & three inside down correspond to two candle reversal patterns on candlestick charts, each comprising three different candles. A down candle, sometimes known as a black candle, implies a falling price. Typically, the fourth candle forms a bullish reversal pattern. The market must first be downtrend to see a three inside up candle pattern. Web the bullish three inside up candlestick pattern is just one of a series of candles that signify that either a reversal or a continuation of a trend is a highly probable event. The third and final candle is a solid. Third, a small white (or green) candle must form on the following day, and its body must be contained within the previous day’s body. Web the three inside up pattern signifies a potential bullish reversal. Usually, it appears after a price decline and shows rejection from lower prices. Web the phrases three inside up & three inside down correspond to two candle reversal patterns on candlestick charts, each comprising three different candles. This confirms the bullish reversal. The pattern’s appearance indicates that the market’s momentum is possibly shifting, hinting at a price increase. Web a. The pattern’s appearance indicates that the market’s momentum is possibly shifting, hinting at a price increase. Web the three inside up pattern is a bullish reversal pattern found in candlestick charting. A trader must only recognize the pattern as it forms and then prepare to execute a related strategy for gain, without the need to draw support/resistance lines or employ.. It shows there was a lot of buying and that the upward trend might keep going. The pattern is bullish because we expect to have a bull move after the three inside up appears at the right location. This signifies a temporary pause or consolidation. The pattern’s appearance indicates that the market’s momentum is possibly shifting, hinting at a price. Between a high wave and a white candle ); It consists of three candles, with the first two candles forming an inside bar that’s followed by a bullish breakout. This part of the pattern is a smaller candle that shows prices going down. It shows there was a lot of buying and that the upward trend might keep going. The. The pattern’s appearance indicates that the market’s momentum is possibly shifting, hinting at a price increase. A down candle, sometimes known as a black candle, implies a falling price. Web a three inside up on the chart is strong because: # bulkowski three inside up. This signifies a temporary pause or consolidation. A down candle, sometimes known as a black candle, implies a falling price. The first candle is bearish, the second is a spinning top or doji that forms a bullish harami, and the other two candles form higher highs. These patterns manifest as a sequence of three candles, signaling a potential loss of momentum in the current trend and a. The first candle will be a down candle with a large body. These patterns manifest as a sequence of three candles, signaling a potential loss of momentum in the current trend and a potential reversal in direction. The first thing a trader should ensure before. This confirms the bullish reversal. Web three inside up pattern. The third candle is bullish, closing above the high of the second candle. Second, a tall black (or red) candle must appear, continuing the downward movement. The pattern’s appearance indicates that the market’s momentum is possibly shifting, hinting at a price increase. The three inside up is a bullish reversal pattern that occurs at the end of a bearish trend.. On the other side, the three inside down pattern starts with a big green candle when an uptrend is finishing. Web three inside up/down: Web three inside up pattern. It shows there was a lot of buying and that the upward trend might keep going. This part of the pattern is a smaller candle that shows prices going down. (2) white candle breaks the trendline (confirmation); Third, a small white (or green) candle must form on the following day, and its body must be contained within the previous day’s body. One such pattern is the three inside up: The first candle is bearish, the second is a spinning top or doji that forms a bullish harami, and the other. It signifies a potential shift from a bearish to a bullish market sentiment and is composed of three specific candlesticks: The pattern’s appearance indicates that the market’s momentum is possibly shifting, hinting at a price increase. The first thing a trader should ensure before. This confirms the bullish reversal. The second candle is smaller and bullish, fully engulfing the body of the first candle. It consists of three candles, with the first two candles forming an inside bar that’s followed by a bullish breakout. Web the three inside up pattern signifies a potential bullish reversal. The first candle should be found at the. Web the three inside up candlestick pattern is a bullish reversal pattern found in technical analysis of financial markets. Web 🔵introduction 3 inside up and 3 inside down denote a duo of candlestick reversal patterns, each comprising three individual candles, commonly observed on candlestick charts. The first candle will be a down candle with a large body. Usually, it appears after a price decline and shows rejection from lower prices. Web the three inside up candlestick pattern is a signal for trend reversal from bearish to bullish.the best time to trade or use the three inside up candlestick pattern also depends on if the trader using it is a buyer or seller. A trader must only recognize the pattern as it forms and then prepare to execute a related strategy for gain, without the need to draw support/resistance lines or employ. Web three inside up pattern. Web to spot a three inside up candlestick pattern, look for the following criteria:

Three Inside Up Candlestick Pattern Explained & Backtested (2023

How To Trade Forex Effectively With Three Inside Up Candlestick Pattern

How To Trade Blog What Is Three Inside Up Candlestick Pattern? Meaning

What Is Three Inside Up Candlestick Pattern? How To Trade Blog

1 Guide to recognise and trade Three Inside candlestick pattern at

What Is Three Inside Up Candlestick Pattern? How To Trade Blog

What Is Three Inside Up Candlestick Pattern? How To Trade Blog

How To Trade Forex Effectively With Three Inside Up Candlestick Pattern

Three Inside Up Candlestick Pattern Explained

How To Trade Forex Effectively With Three Inside Up Candlestick Pattern

Web A Three Inside Up On The Chart Is Strong Because:

This Part Of The Pattern Is A Smaller Candle That Shows Prices Going Down.

# Bulkowski Three Inside Up.

The Pattern Is Supposed To Predict A Trend Reversal, But The Data Shows That Volatility Typically Comes First.

Related Post: