Three Black Crows Candlestick Pattern

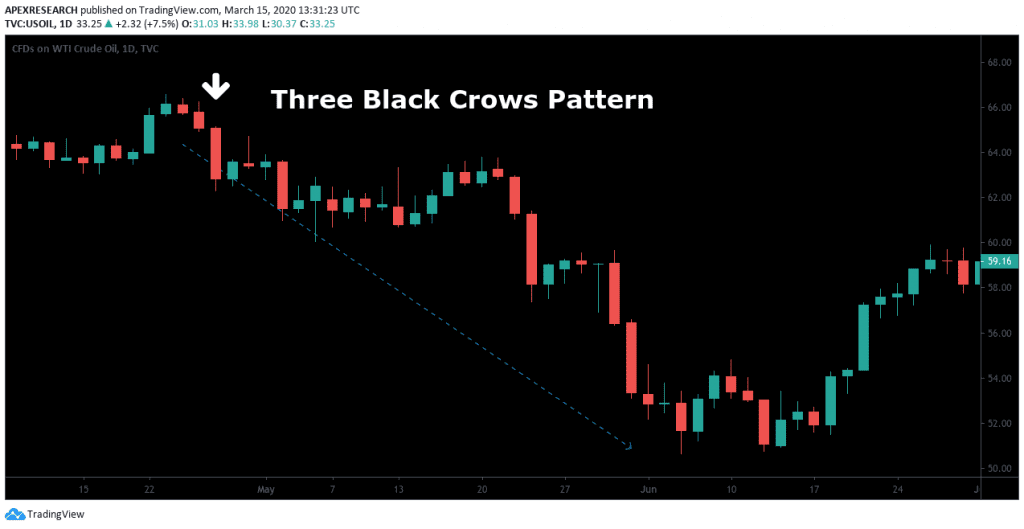

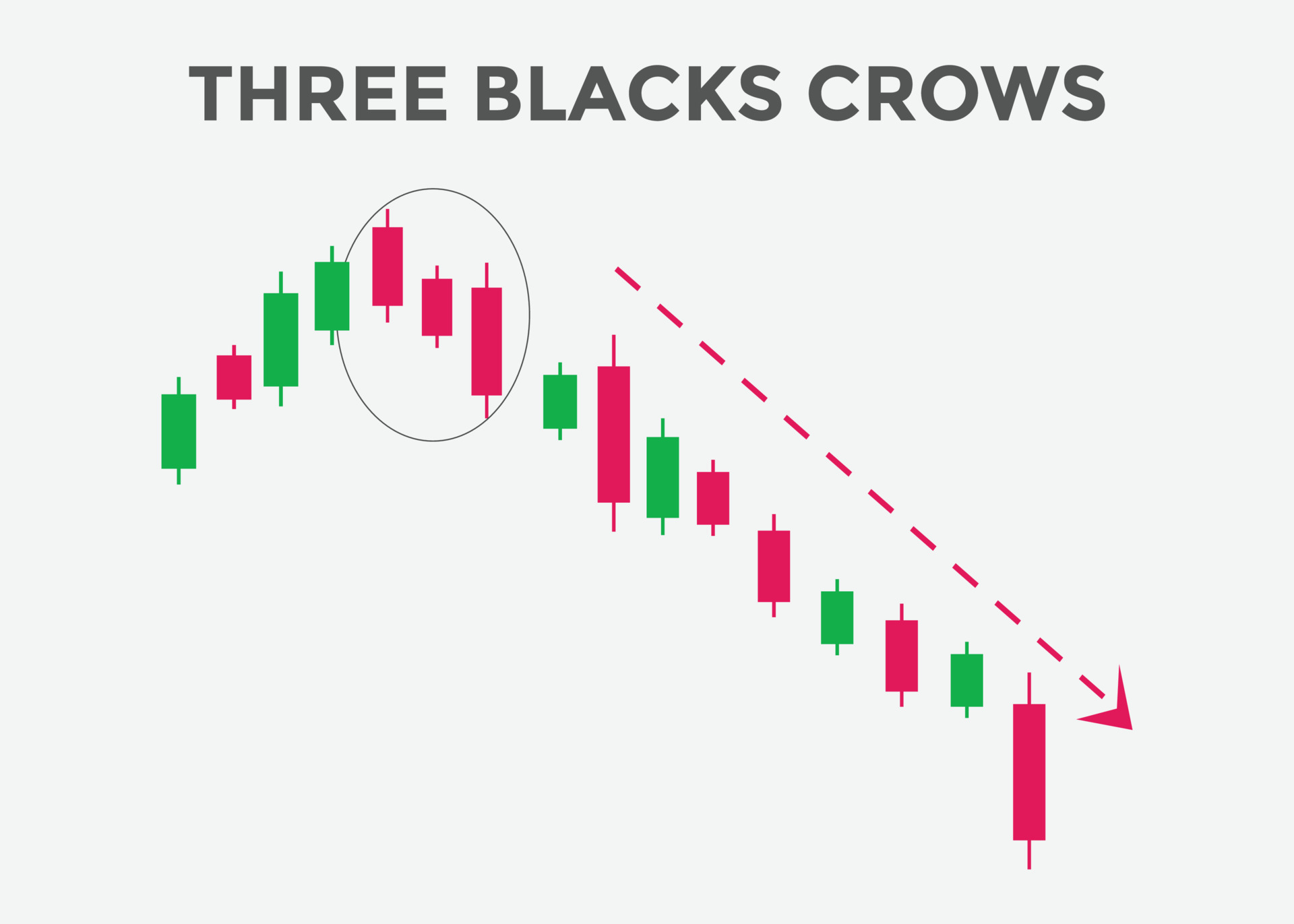

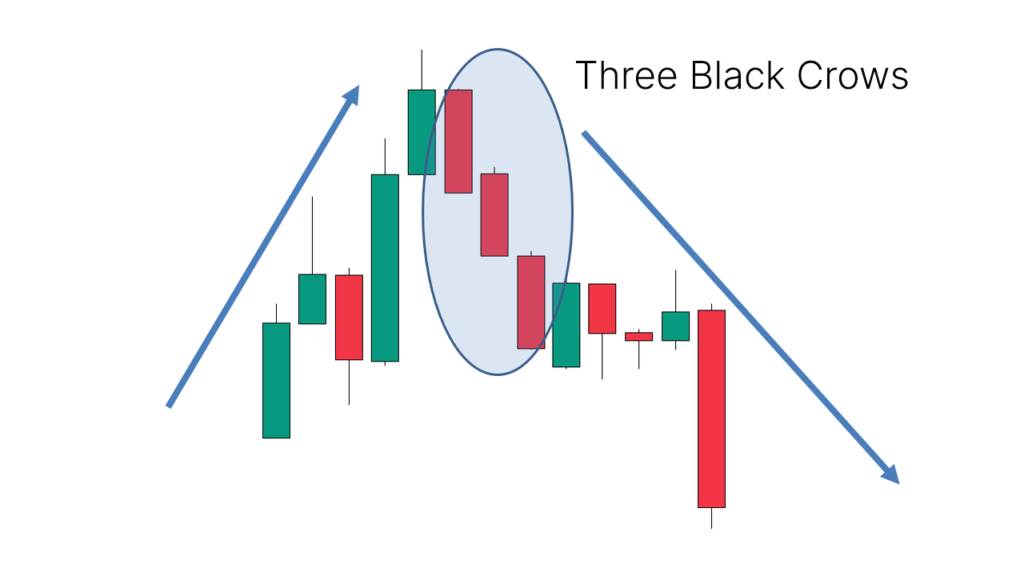

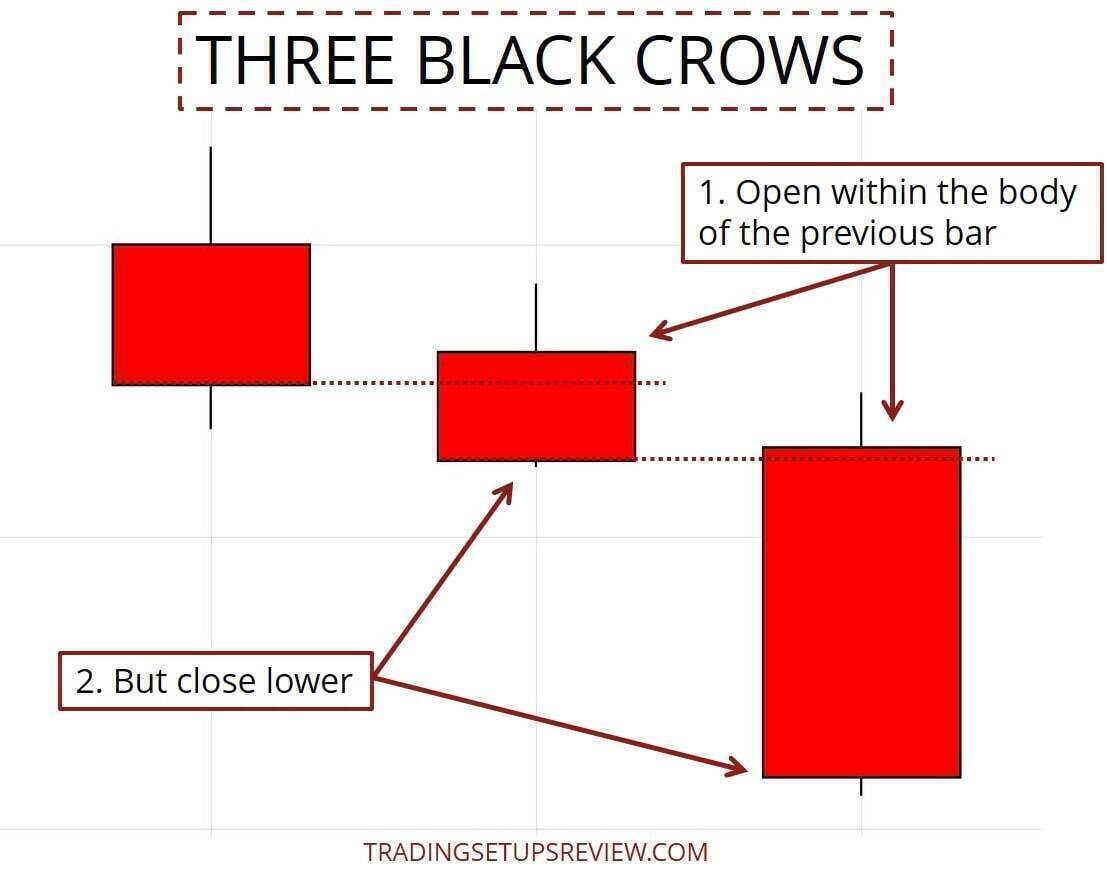

Three Black Crows Candlestick Pattern - The accuracy depends on the market conditions and the trading time frame. However, the accuracy of the pattern could depend on the individual scenarios as well. Web the three black crows candlestick pattern is a bearish price action formation that is commonly used by traders to identify the possible reversal of a prior uptrend. The second candle’s body should be bigger than the first candle and should close at or very near its low. In a bear market, the pattern is likely to be followed by additional declines. Web three black crows is a bearish candlestick pattern that is used to predict the reversal of the current uptrend. Web three black crows is a bearish three candlestick chart pattern formed by price action closing lower than the open and below the previous day’s low for three days in row. This is a bearish reversal formation which occurs near the top of the current uptrend, as it generates a reversal signal. Second scan to find the high volume breakout from 2 day. Web three black crows candlestick pattern indicates rising trend momentum (during downtrend) or an increased possibility for uptrend reversal (during positive market movements). One should note that these three candlesticks can be bearish marubozu. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. Web the three black crows chart pattern is a bearish reversal indicator. Web three black crows candlestick pattern indicates rising trend momentum (during downtrend) or an increased possibility. The stop loss is placed above the pattern, with profit. Web the three black crows candlestick pattern is a bearish price action formation that is commonly used by traders to identify the possible reversal of a prior uptrend. Mk trader | three black crows candlestick pattern 📈📊 #trading #stockmarket #sharemarket #mktrader #stock #sensex #banknifty #nifty #candlestick. Web three black crows. Web a three black crows candlestick pattern appears in a strong uptrend. Web the three black crows candlestick pattern is a bearish price action formation that is commonly used by traders to identify the possible reversal of a prior uptrend. Web three black crows is a bearish three candlestick chart pattern formed by price action closing lower than the open. Web how a three black crows pattern is interpreted. Understand the significance of each pattern in market analysis. These candles must open within the previous body or near the closing price. Candles can have little or no shadows. Three black crows candlestick pattern #trading #stockmarket #sharemarket #mktrader #stock #sensex #banknifty #nifty #candlestick.. It is characterized by three consecutive bearish candlesticks with similar characteristics, representing a shift in market sentiment from bullish to bearish. Web three black crows candlestick pattern indicates rising trend momentum (during downtrend) or an increased possibility for uptrend reversal (during positive market movements). To trade, a sell order is placed beneath the third candle of the pattern; The 3. Web 35 likes, tiktok video from syedumarshah (@syedumarshahcrypto): Web the three black crows chart pattern is a bearish reversal indicator. Learn to identify over 50 candlestick chart patterns. It consists of three negative candles that form during an uptrend. The “three black crows” mean the three red candles that generate after a trend. Second scan to find the high volume breakout from 2 day. Web three black crows is a bearish candlestick pattern that is used to predict the reversal of the current uptrend. The three black crows pattern is usually quite reliable, but it’s crucial to take factors like volume and trend. Stay updated with the latest trends and insights in the. Web three black crows is the name of a bearish candlestick pattern in stock trading. Incorporating the three black crows pattern in wealth. Stay updated with the latest trends and insights in the finance world. Web 35 likes, tiktok video from syedumarshah (@syedumarshahcrypto): The three black crows pattern is identified as a bearish candlestick pattern used to predict a. A pattern opposite the three white soldiers is called three black crows. Web the three black crows candlestick pattern is considered to be a strong signal for traders to sell their positions and take profits before the market falls further. Web candlestick patterns have become one of the most popular analysis methods available today, and there are quite a variety. Boost your profits in the crypto market with this comprehensive guide. Learn to identify over 50 candlestick chart patterns. Understand the significance of each pattern in market analysis. To trade, a sell order is placed beneath the third candle of the pattern; It unfolds across three trading sessions, and consists of three long candlesticks that trend downward like a staircase. Just because the market has closed lower 3 days in a row doesn’t mean the uptrend will reverse. It consists of three consecutive long red candlesticks, each with open and close prices lower than the previous ones. Three black crows candlestick pattern #trading #stockmarket #sharemarket #mktrader #stock #sensex #banknifty #nifty #candlestick.. Because the context of the market is more important than any. Stay updated with the latest trends and insights in the finance world. One should note that these three candlesticks can be bearish marubozu. “master the art of recognizing and utilizing the powerful candlestick pattern 3 black crows in your trading strategy. Web the three black crows candlestick pattern is considered to be a strong signal for traders to sell their positions and take profits before the market falls further. Three crows is a term used by stock market analysts to describe a market downturn. Forex and crypto traders that care about statistical significance shouldn’t trade this pattern and instead select strong candlestick patterns. In a bull market, the bulls may. The stop loss is placed above the pattern, with profit. It appears on a candlestick chart in the financial markets. The three black crows is a bearish reversal pattern therefore it should be considered only when it appears after an uptrend. Incorporating the three black crows pattern in wealth. To trade, a sell order is placed beneath the third candle of the pattern;

Candlestick Patterns The Definitive Guide (2021)

Three Black Crows Candlestick Pattern A Guide by Real Traders (2020)

Three Black Crows candlestick pattern. Powerful bearish Candlestick

Three Black Crows Candlestick Pattern What Is And How To Trade

What Are Three Black Crows Candlestick Patterns Explained ELM

Three Black Crows Candlestick Pattern Explained LearnX

How To Trade Blog How To Use Three Black Crows Candlestick Pattern

What Is The Three Black Crows Candlestick Pattern & How To Trade With

Three Black Crows Candlestick Pattern Trading Guide Trading Setups Review

How To Trade Blog How To Use Three Black Crows Candlestick Pattern

First Scan To Find Out The High Volume Breakout From 3 Day Inside Candle.

It Is Formed When Three Bearish Candles Follow A Strong Uptrend, Indicating That A Reversal Is In The Works.

Web How A Three Black Crows Pattern Is Interpreted.

Web 35 Likes, Tiktok Video From Syedumarshah (@Syedumarshahcrypto):

Related Post: