The Journal Entry To Close The Drawing Account Includes

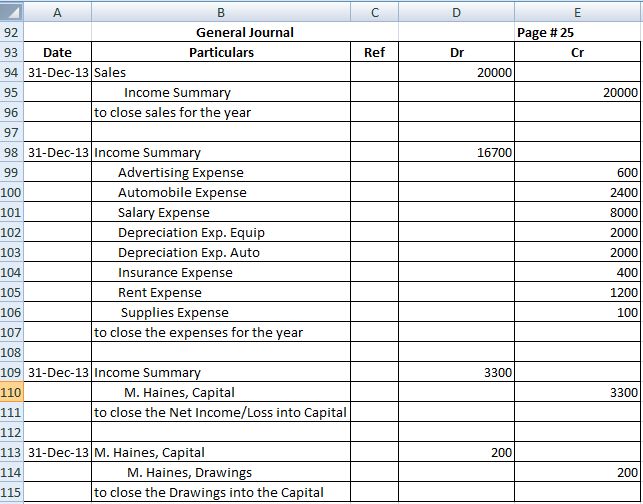

The Journal Entry To Close The Drawing Account Includes - Web the journal entry to close income summary includes which of the following entries: Web close the owner's drawing account to the owner's capital account. Let’s assume that at the end of the accounting year the account eve jones, drawing has a debit balance of $24,000. In corporations, this entry closes any dividend accounts to the retained earnings account. Say you want to withdraw $1,000 from your. Debiting the revenue accounts and crediting income summary. The journal entry to close income summary when there is a net income is. Web the closing entries are the journal entry form of the statement of retained earnings. In the context of drawing accounts, when an owner. Credit to income summary for $3,000. Web the closing entries are the journal entry form of the statement of retained earnings. Debit capital and credit drawing. Journalizing and posting closing entries. Web close the owner's drawing account to the owner's capital account. A.a debit to both the revenue and the retained earnings account. The goal is to make the posted balance of the retained earnings account match what we. What is the journal entry to close the drawing account? The journal entry to close revenue accounts includes a. In corporations, this entry closes any dividend accounts to the retained earnings account. Web example of the entry to close the drawing account. Web close the owner's drawing account to the owner's capital account. In the context of drawing accounts, when an owner. The journal entry to close income summary when there is a net income is. Web the journal entry to close the revenue account would include which of the following? The eighth step in the accounting cycle is preparing closing entries,. The goal is to make the posted balance of the retained earnings account match what we. Click the card to flip 👆. Say you want to withdraw $1,000 from your. Web let’s now look at how to prepare closing entries. Debiting the revenue accounts and crediting income summary. Web the journal entry to close the revenue account would include which of the following? The journal entry to close income summary when there is a net income is. Let’s assume that at the end of the accounting year the account eve jones, drawing has a debit balance of $24,000. Web the closing entries are the journal entry form of. The goal is to make the posted balance of the retained earnings account match what we. The eighth step in the accounting cycle is preparing closing entries, which includes. Debit capital and credit drawing. The journal entry to close revenue accounts includes a. A credit to both the. Web example of the entry to close the drawing account. Web the journal entry to close the revenue account would include which of the following? In corporations, this entry closes any dividend accounts to the retained earnings account. Say you want to withdraw $1,000 from your. The journal entry to close income summary when there is a net income is. What is the journal entry to close the drawing account? Web close the owner's drawing account to the owner's capital account. Say you want to withdraw $1,000 from your. Web the closing entries are the journal entry form of the statement of retained earnings. Web let’s now look at how to prepare closing entries. Debiting the revenue accounts and crediting income summary. What is the journal entry to close the drawing account? Web the closing entries are the journal entry form of the statement of retained earnings. Web the journal entry to close the revenue account would include which of the following? Click the card to flip 👆. A.a debit to both the revenue and the retained earnings account. The journal entry to close income summary when there is a net income is. Web example of the entry to close the drawing account. In the context of drawing accounts, when an owner. The goal is to make the posted balance of the retained earnings account match what we. Web the journal entry to close the income summary account (showing a profit) includes. A.a debit to both the revenue and the retained earnings account. Web let’s now look at how to prepare closing entries. Journalizing and posting closing entries. Credit to income summary for $3,000. A credit to both the. In corporations, this entry closes any dividend accounts to the retained earnings account. Web the journal entry below shows the closing entry and the balance transferred from the drawings account to the owner equity. The goal is to make the posted balance of the retained earnings account match what we. Debiting the drawing account and crediting income summary. Let’s assume that at the end of the accounting year the account eve jones, drawing has a debit balance of $24,000. Web the closing entries are the journal entry form of the statement of retained earnings. Web example of the entry to close the drawing account. The journal entry to close revenue accounts includes a. The journal entry to close income summary when there is a net income is. Web close the owner's drawing account to the owner's capital account.

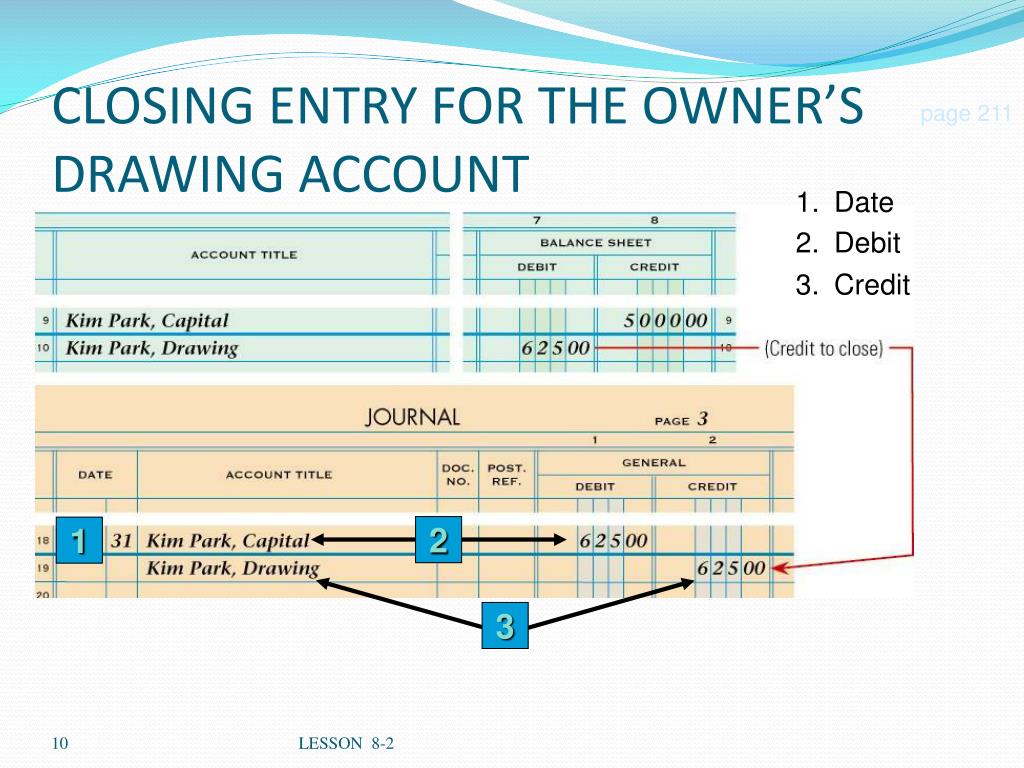

PPT Chapter 8 PowerPoint Presentation, free download ID6830467

Journal Entry of Interest on capital and Interest on Drawing in Accounting

:max_bytes(150000):strip_icc()/DrawingAccount-ebf43543399c4f2aaaa3bdec5e94f1ee.jpg)

Drawing Account What It Is and How It Works

Closing entries explanation, process and example Accounting for

Closing Entries I Summary I Accountancy Knowledge

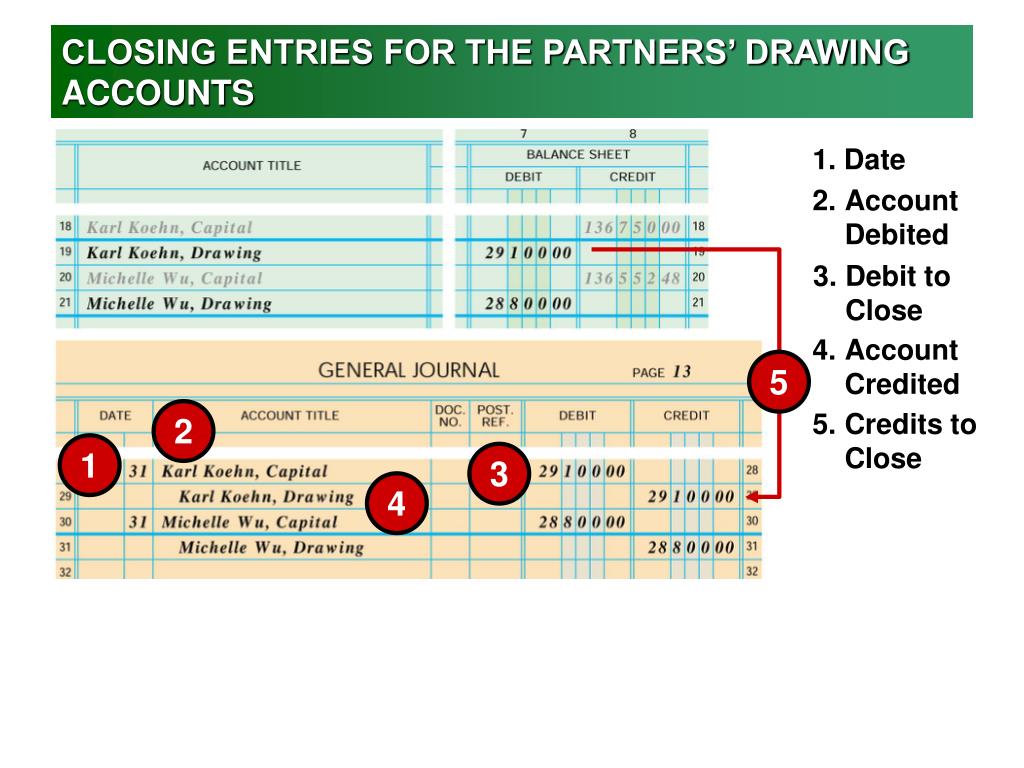

PPT Chapter 17 PowerPoint Presentation, free download ID6802498

PPT LESSON 81 PowerPoint Presentation, free download ID3063591

Accounting An Introduction

Closing Entries are journal entries made to close

Journal Entries Archives Double Entry Bookkeeping

Click The Card To Flip 👆.

Debit Capital And Credit Drawing.

Debiting The Revenue Accounts And Crediting Income Summary.

Web The Journal Entry To Close The Revenue Account Would Include Which Of The Following?

Related Post: