Template Hardship Letter To Creditors

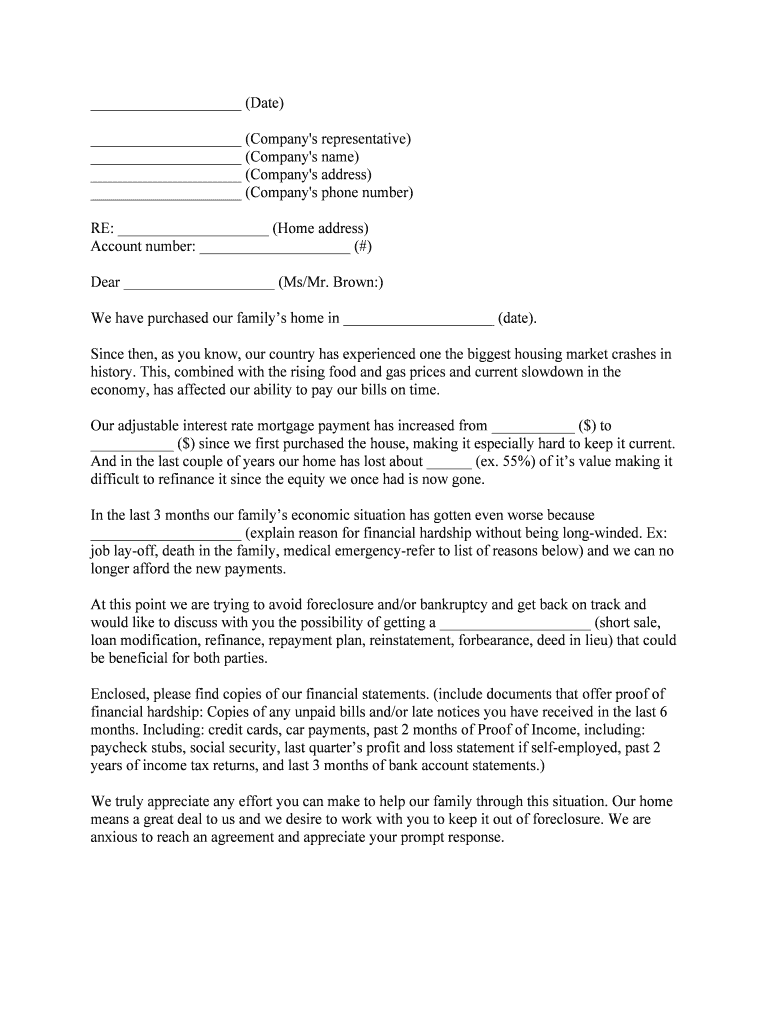

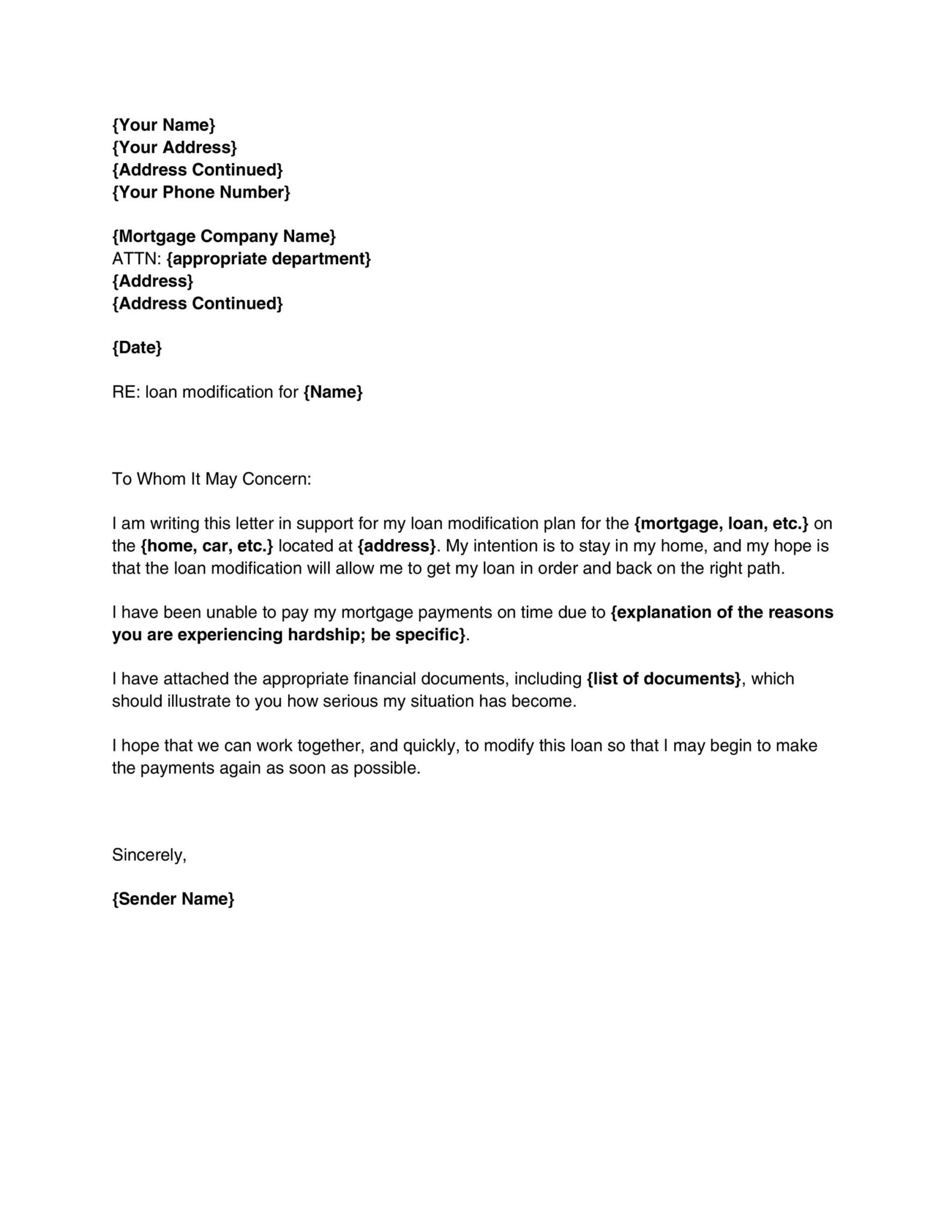

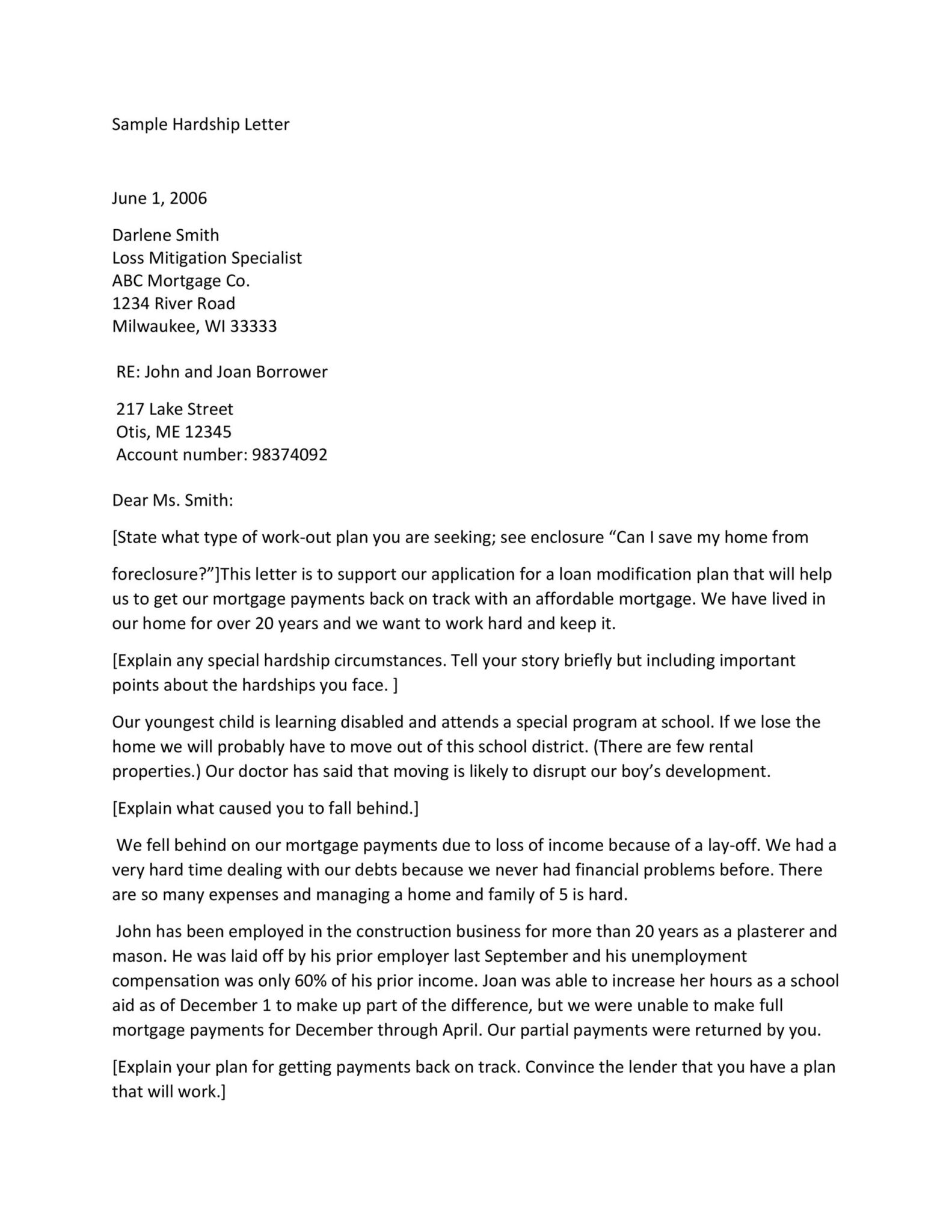

Template Hardship Letter To Creditors - Some key features of a hardship letter include the. Often prepared after the creditor's request for it, this document is useful if you have a debt as a result of unemployment, illness, death of a wage earner, or some other issues. Keep a copy for your records. Address the creditor or lender respectfully and thank them for their time. We also have a library of court forms. Download the hardship letter template. 5 adaptable sample letters for convenient and effortless writing. Begin your letter by stating your name, account number and the reason for your letter—to request financial assistance. Before using it, make sure you know how to communicate effectively with your creditors. Web a hardship letter template should include the following details: A typical hardship letter outlines your situation before the hardship occurred, and then describes your current financial situation and why you are unable to meet the payments due. Web a hardship letter helps address the lender with an earnest plea for special consideration in the event of your defaulting on your debt. It should be written on one page. Web. A hardship letter can help a creditor determine how they should proceed with collection of your debt. It’s also important when communicating with creditors to use the. Reasons could include job loss, illness, death in the family, divorce, or any other extreme event in your life. If a layoff or other financial hardship has made it impossible to meet your. Web a financial hardship letter is a formal document written by an individual to a creditor, lender, or relevant institution, explaining their current financial difficulties and inability to meet specific financial obligations. Web a hardship letter lets creditors know that you are experiencing a hardship that makes you unable to pay your bills. Web a hardship letter template should include. In addition to preventing the foreclosure of property, hardship letters help with medical bills and credit card debts. Download the hardship letter template. You can use the sample below and customize it to fit your own situation. Web write an introduction. Before using it, make sure you know how to communicate effectively with your creditors. Web a hardship letter helps address the lender with an earnest plea for special consideration in the event of your defaulting on your debt. Furthermore, by being honest and clear. You can come across challenges that make it difficult for you to keep up with your financial commitments. Use these for county court judgments (ccjs) and insolvency. This sample letter. Web sample letters for your creditors. Web explain that you are unable to pay the debt due to (detail your hardship). Usually, the objective of a hardship letter sent to a lender is obtaining payment deadlines leniency or outstanding debts consolidation. Address the creditor or lender respectfully and thank them for their time. This sample letter doesn’t work for every. Web sample credit card hardship letter. Begin your negotiation outrageously low, the creditor will counter your offer or, if you are lucky, might accept it. What you would like the lender to do to help resolve your issues. A hardship letter can help a creditor determine how they should proceed with collection of your debt. The letters have space for. Be sure to include information that is unique to your situation. Send your debt hardship letter via return receipt requested. Some key features of a hardship letter include the. Address the creditor or lender respectfully and thank them for their time. An explanation of the steps you have taken to resolve your cash flow/debt issues. In addition to preventing the foreclosure of property, hardship letters help with medical bills and credit card debts. Web a hardship letter for credit card debt is a written statement by the debtor sent to their creditor to explain the circumstances that led to the credit card debt. Clearly explain the situation that led to the late payment with. Web. If your current income is not enough. After all, it is requesting for help. Web a hardship letter is written to your landlord, creditor, or loan provider to request financial assistance if you are going through a difficult time financially. Web a financial hardship letter is a formal document written by an individual to a creditor, lender, or relevant institution,. Send your debt hardship letter via return receipt requested. Your letter should propose your ideal solution. Web a hardship letter is written to your landlord, creditor, or loan provider to request financial assistance if you are going through a difficult time financially. Usually, the objective of a hardship letter sent to a lender is obtaining payment deadlines leniency or outstanding debts consolidation. This sample letter doesn’t work for every situation. It should be courteous and kind; An injury, the loss of a significant source of income, or having to make an emergency payment can all disrupt your carefully planned budget. Begin your negotiation outrageously low, the creditor will counter your offer or, if you are lucky, might accept it. Web a hardship letter outlines the details of your financial circumstances and requests that creditors change or modify the terms of your debt agreement. A typical hardship letter outlines your situation before the hardship occurred, and then describes your current financial situation and why you are unable to meet the payments due. Use these for county court judgments (ccjs) and insolvency. Web a hardship letter lets creditors know that you are experiencing a hardship that makes you unable to pay your bills. A hardship letter can help a creditor determine how they should proceed with collection of your debt. The letters have space for your information. Be sure to include information that is unique to your situation. 5 adaptable sample letters for convenient and effortless writing.

Hardship Letter Template 10+ For Word, PDF Format

Mortgage Hardship Letter Template Sample Form Fill Out and Sign

40 Free Hardship Letter Template RedlineSP

Hardship Letter Template 10+ For Word, PDF Format

30 Effective Financial Hardship Letter Templates TemplateArchive

Hardship Letter To Creditors in Word, Google Docs, Pages Download

40 Free Hardship Letter Template RedlineSP

Financial Hardship Letter Business Mentor

Credit Card Hardship Letter Templates at

Free Hardship Letter Template & FAQs Rocket Lawyer

Web A Financial Hardship Letter Is A Correspondence You Send To A Creditor That Explains Why Your Current Financial Situation Prevents You From Making Debt Payments.

Clearly Explain The Situation That Led To The Late Payment With.

Reasons Could Include Job Loss, Illness, Death In The Family, Divorce, Or Any Other Extreme Event In Your Life.

We Have Letters For Making Complaints, Asking For Payment Holidays, And More.

Related Post: