Template For Charitable Donation Receipt

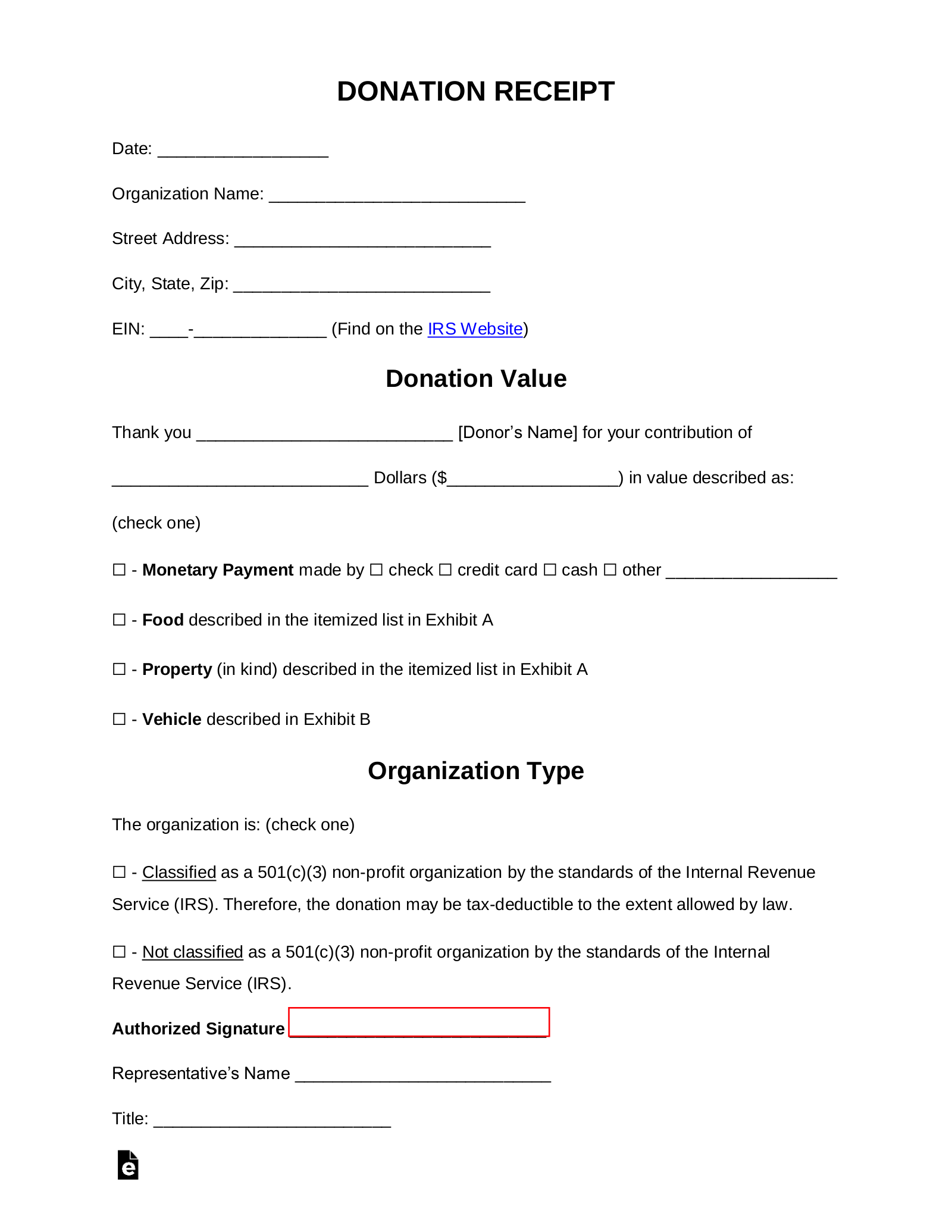

Template For Charitable Donation Receipt - If you are responsible for creating a document like this for your organization, these charitable donation receipt templates make it easy to acknowledge gifts from your donors in a variety of situations. They are a big part of the charitable sector. So, the eligible amount of the gift is $80,000. The amount of the advantage ($20,000) must be subtracted from the amount of the gift (the $100,000 value of the house). Our donation receipt templates can help you quickly send a receipt to all of your donors. Inform the recipient about recordkeeping. Web often a goodwill donation receipt is presented as a letter or an email, which is given or sent to the benefactor after the donation has been received. Microsoft word (.docx) cash donation receipt template. These free printable templates in pdf and word format simplify the. Charities are only required to submit 501c3 donation receipts for amounts greater than $250, but it is good practice to issue a 501c3 donation receipt for all donations. Web furthermore, donors need donation receipts if they want to claim charitable donations on their tax returns. Charitable donation receipt templates provide a practical and efficient way to generate accurate receipts that acknowledge and record donations. This is a standard donation receipt informing donors that their money has been received. It’s important to remember that without a written acknowledgment, the. Microsoft word (.docx) cash donation receipt template. A donor gives a charity a house valued at $100,000. Web a donation receipt acts as a written record that a donor is given, proving that a gift has been made to a legal organization. Inform the recipient about recordkeeping. Web donation value was based on the observed behavior. It works with most themes and is optimized for use with the free hello elementor theme. Microsoft word (.docx) cash donation receipt template. Donation receipts are administrative documents that also function as unique tokens of appreciation, affirming the profound impact of every contribution. The templates are meticulously designed to meet legal and relational needs. Deliver the written acknowledgment of the. Microsoft word (.docx) cash donation receipt template. Web donation receipt templates and letters. Web types of receipt templates. Just be sure to review your donation receipt templates annually to make any necessary updates. Inform the recipient about recordkeeping. If a donation exceeds $250,. From a legal perspective, donors need to obtain written acknowledgment from your organization in order to claim the charitable contribution on their federal income tax return. Just be sure to review your donation receipt templates annually to make any necessary updates. Web a 501c3 donation receipt template is issued only by registered charitable organizations and. Web this helps them track their donations and enables you to see how much each person contributed to your charity. Web live preview screenshots. Charities are only required to submit 501c3 donation receipts for amounts greater than $250, but it is good practice to issue a 501c3 donation receipt for all donations. Simplify your process and ensure transparency and gratitude. Then, you can customize this basic template based on donation type, such as noncash contributions or monetary support. Web donation receipt templates and letters. Web the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Web this helps them track their donations and enables you to see how much each person contributed. Web a donation receipt is a confirmation that you've received a gift from a donor. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Web in the charitable donation process, proper documentation is essential to ensure transparency, accountability, and compliance. Web often a goodwill donation. These free printable templates in pdf and word format simplify the. Here are some free 501 (c) (3) donation receipt templates for you to download and use; Web how to give a cash donation (3 steps) accept the donation from a recipient. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking. Web how to give a cash donation (3 steps) accept the donation from a recipient. Web how to create donation receipts (plus, real examples!) follow these five steps to build a donation receipt that checks all the boxes. Web a donation receipt provides documentation to those who give to your organization and serves as a record for tax purposes. A. Whatever the form, every receipt must include six items. It’s people like you who make what we do possible. Web using a (501) (c) (3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. A donor gives a charity a house valued at $100,000. Your donation of $250 on july 4, 2019, to our save the turtles! Simplify your process and ensure transparency and gratitude towards your generous donors with our professionally designed templates. Donation receipts can come in many shapes and sizes, each with its own form of automation: 2 the importance of information receipts for benefactors and beneficiary. Web how to create donation receipts (plus, real examples!) follow these five steps to build a donation receipt that checks all the boxes. Donation receipts serve both a legal and practical purpose. There are various types of receipts including the following: The amount of the advantage ($20,000) must be subtracted from the amount of the gift (the $100,000 value of the house). This is a standard donation receipt informing donors that their money has been received. Just be sure to review your donation receipt templates annually to make any necessary updates. Web a donation receipt provides documentation to those who give to your organization and serves as a record for tax purposes. As is typical with charitable giving data, these values were positively skewed (m = $211.54, sd = $266.57, range =.

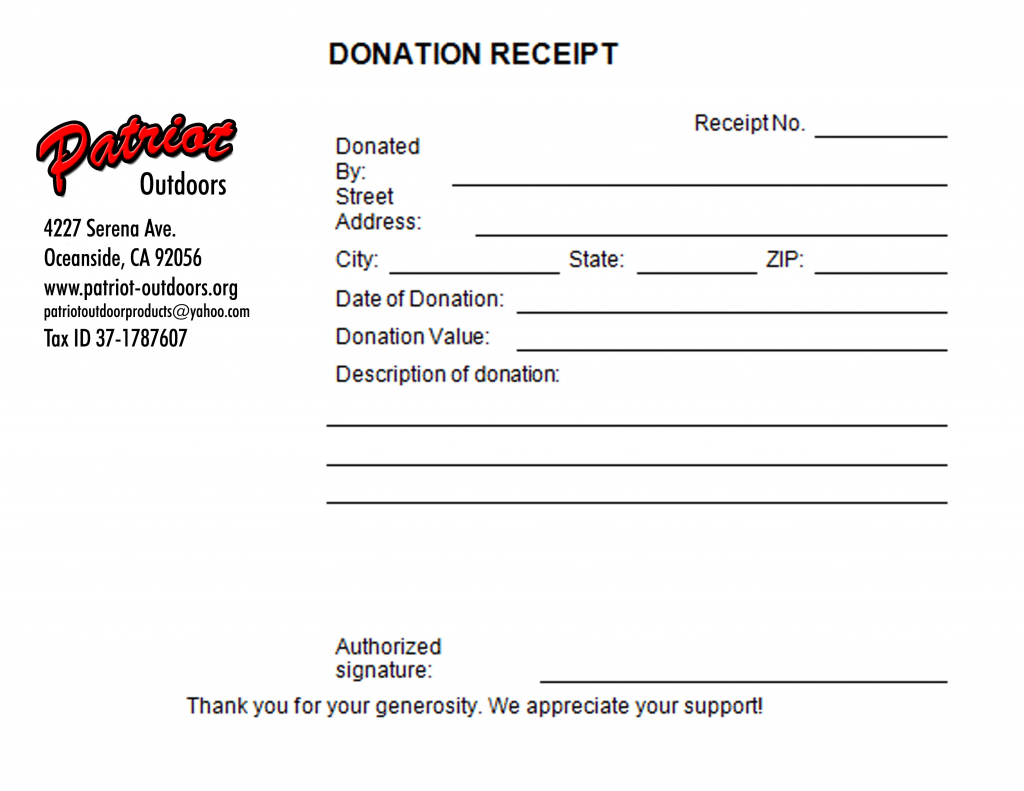

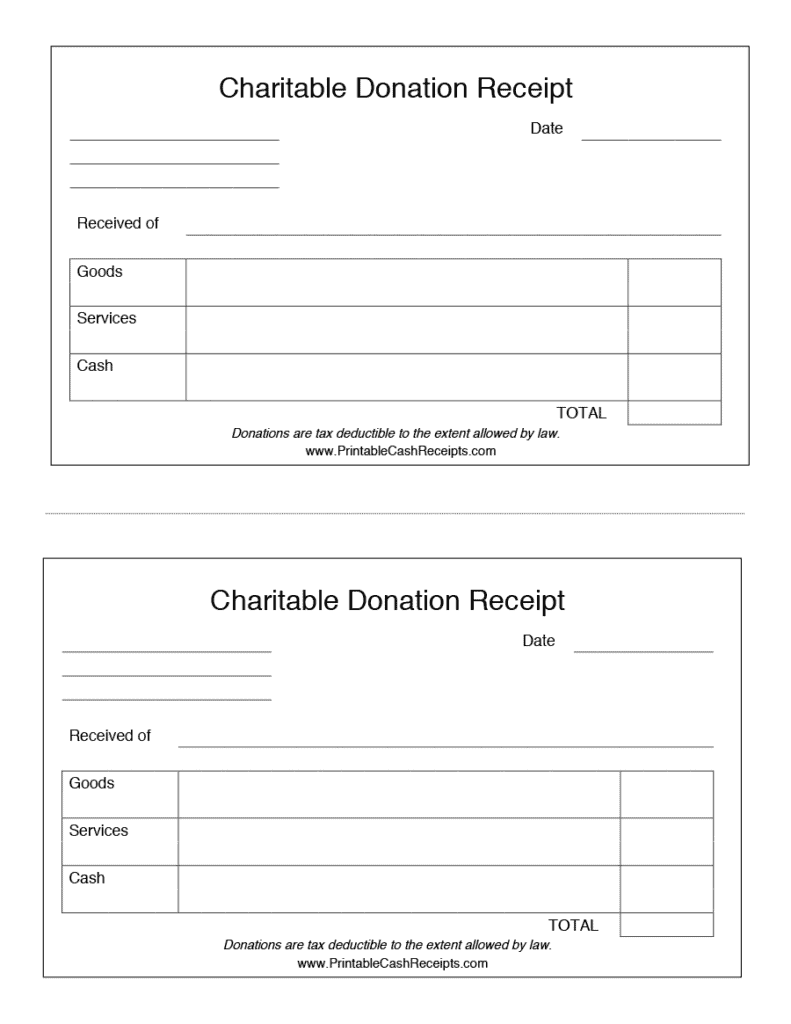

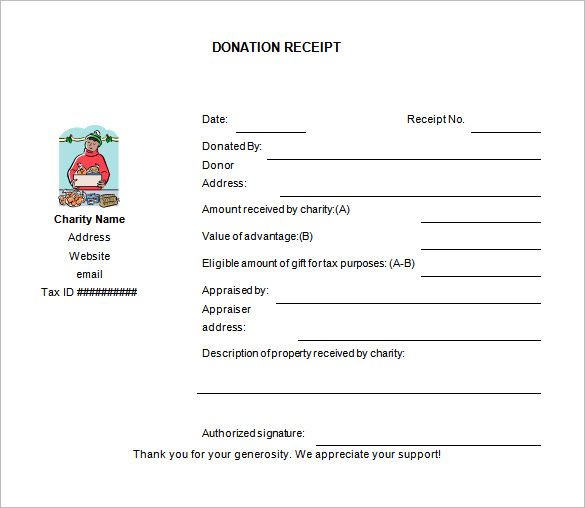

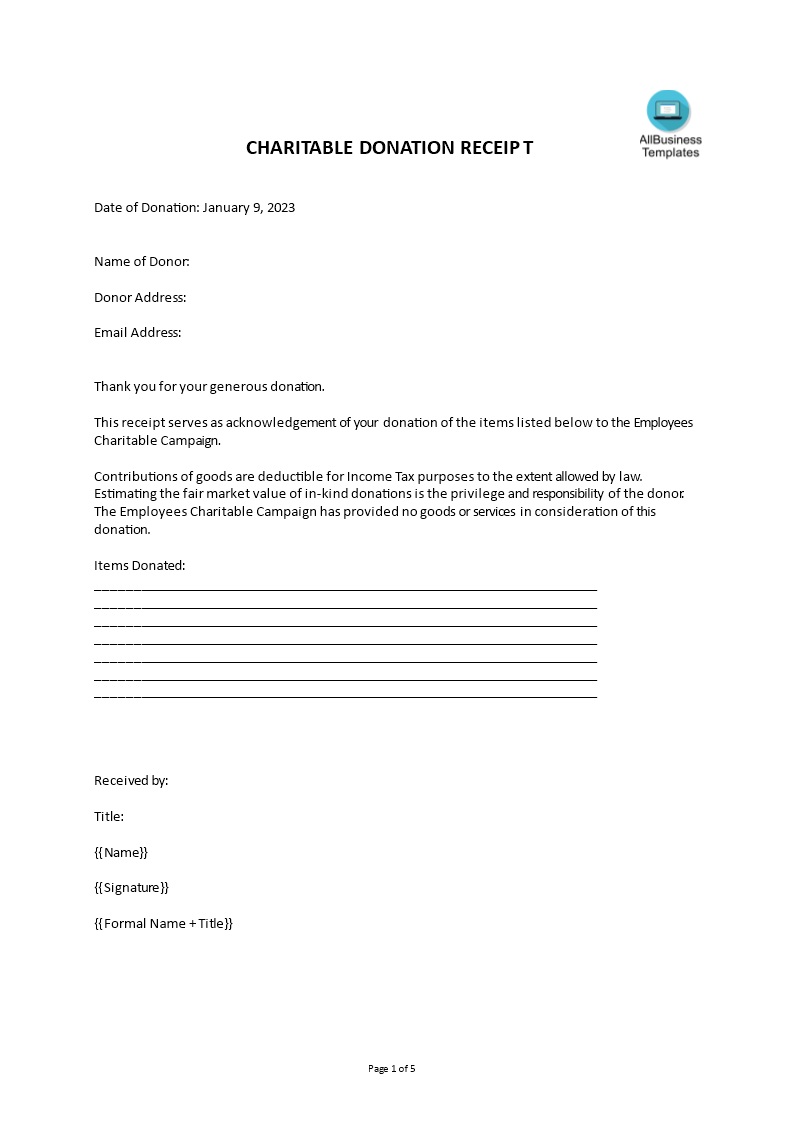

5 Charitable Donation Receipt Templates formats, Examples in Word Excel

6+ Free Donation Receipt Templates Word Excel Formats

50+ FREE Donation Receipt Templates (Word PDF)

Free Donation Receipt Templates Samples PDF Word eForms

14+ Printable Donation Receipt Sample Templates Sample Templates

Free Goodwill Donation Receipt Template PDF eForms

Donation Receipt Templates 17+ Free Word, Excel & PDF Formats

Charitable Donation Receipt Template FREE DOWNLOAD Aashe

In many countries today a charitable donation receipt template is used

Charitable Donation Receipt Templates at

Web A 501C3 Donation Receipt Template Is Issued Only By Registered Charitable Organizations And Allows Users To Claim Tax Benefits Based On Their Donations.

Web The Written Acknowledgment Required To Substantiate A Charitable Contribution Of $250 Or More Must Contain The Following Information:

Donation Receipts Are Administrative Documents That Also Function As Unique Tokens Of Appreciation, Affirming The Profound Impact Of Every Contribution.

These Free Printable Templates In Pdf And Word Format Simplify The.

Related Post: