Template Dispute Letter To Collection Agency

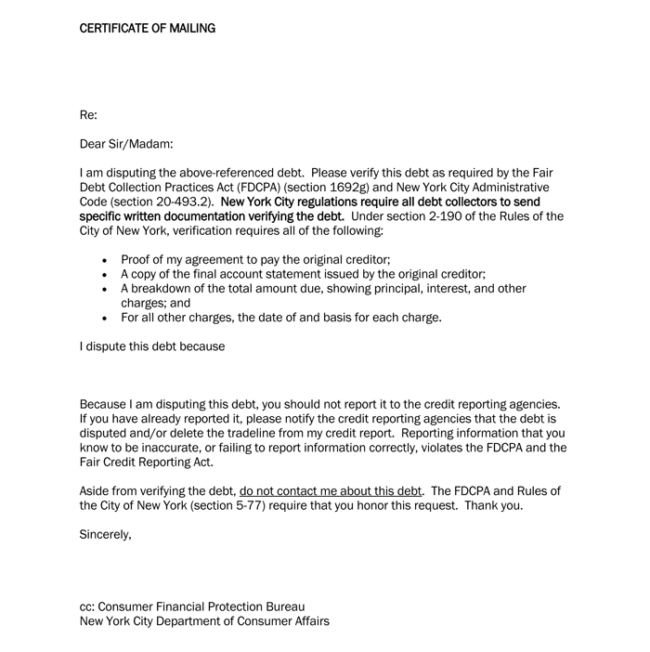

Template Dispute Letter To Collection Agency - Documentation showing you have verified that i am responsible for this. Your account number, if known] to whom it may concern: I wish to dispute the following charges that your company is attempting collection of: Here's a sample letter you can use to request debt validation. As such, collection agencies are required to provide the following information: I am disputing this debt because i do not owe it. Dispute of debt (account number: It's also generally a good idea to send the dispute by certified mail. The first step is to get the information in writing. Letters to send to the credit bureaus. Craft a collection dispute letter to the creditor or collection agency, explaining the inaccuracies and providing evidence. Writing a debt validation letter can keep you from paying a bogus debt collection. As such, collection agencies are required to provide the following information: The amount of the alleged debt; Web 1) your full name and address. Does the stated debt amount feel inflated or completely inaccurate? Web sample debt collection dispute letter. By following the steps outlined in this guide and utilizing the provided template, you can confidently navigate the process of disputing a debt. The collection agency is required to provide written notice to the consumer within five days of sending the collection letter that. By following the steps outlined in this guide and utilizing the provided template, you can confidently navigate the process of disputing a debt. [insert account number]) dear [collection agency’s name], Back to our advice for debtors page. 4) a request for the name of the original creditor. I wish to dispute the following charges that your company is attempting collection. Indicate the specific disputed debt details The following letters can be used to inform a collection agency of your intent not to pay, or to cease communication. Your account number, if known] to whom it may concern: The full name and mailing address of the original creditor for this alleged debt; [list charges] i dispute the charges for the following. Web updated on november 29, 2021. Collection agencies may have less information and debt buyers the least of all. Web write a dispute letter to the debt collector promptly, requesting validation of the debt and explaining your lack of recognition. Send a debt dispute letter Back to our advice for debtors page. 2) the collections agency's name and address. Web 1) your full name and address. Letters to send to the credit bureaus. Web if you dispute the debt, make a copy of your written dispute and send the original to the debt collector. The amount of the alleged debt; Dispute of debt (account number: Web the purpose of a debt validation letter is to help you determine whether you owe the debt that's being collected and that the details of your financial obligation are accurate. 4) a request for the name of the original creditor. Web updated on november 29, 2021. Web your letter should clearly identify each item. Web write a dispute letter: [your name] [your address] [city, state, zip code] [email address] [phone number] [date] [collection agency’s name] [collection agency’s address] [city, state, zip code] subject: Craft a collection dispute letter to the creditor or collection agency, explaining the inaccuracies and providing evidence. Provide personal and account details. If you send this letter within 30 days from. Letters to send to the credit bureaus. Web writing a dispute letter to a collection agency can be an effective way to address issues with your credit report or to contest a debt. Learn more about what to do when a debt collector contacts you. [insert account number]) dear [collection agency’s name], The following letters can be used to inform. The first step is to get the information in writing. Craft a collection dispute letter to the creditor or collection agency, explaining the inaccuracies and providing evidence. Your account number, if known] to whom it may concern: The full name and mailing address of the original creditor for this alleged debt; Back to our advice for debtors page. Documentation showing you have verified that i am responsible for this. Web collection agency’s name and address re: If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must stop all collection activities until it verifies the debt. If a consumer does not think the debt is theirs, thinks that the amount is incorrect, or believes that there is some other type of error, the consumer can send the collector a dispute letter. You may want to enclose a copy of your credit report with the items in question circled. Web mail the dispute form with your letter to: 4) a request for the name of the original creditor. I wish to dispute the following charges that your company is attempting collection of: Box 2000 chester, pa 19016. Web sample debt collection dispute letter. [list charges] i dispute the charges for the following reason(s): It's also generally a good idea to send the dispute by certified mail. Craft a collection dispute letter to the creditor or collection agency, explaining the inaccuracies and providing evidence. By following the steps outlined in this guide and utilizing the provided template, you can confidently navigate the process of disputing a debt. Here's a sample letter you can use to request debt validation. Perhaps late fees have ballooned to absurd proportions, or duplicate charges muddle the water.

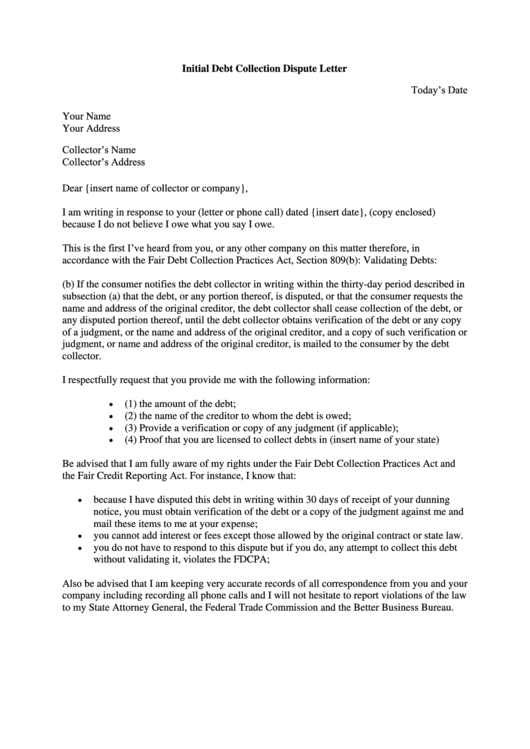

Initial Debt Collection Dispute Letter printable pdf download

Collection dispute letter template Fill out & sign online DocHub

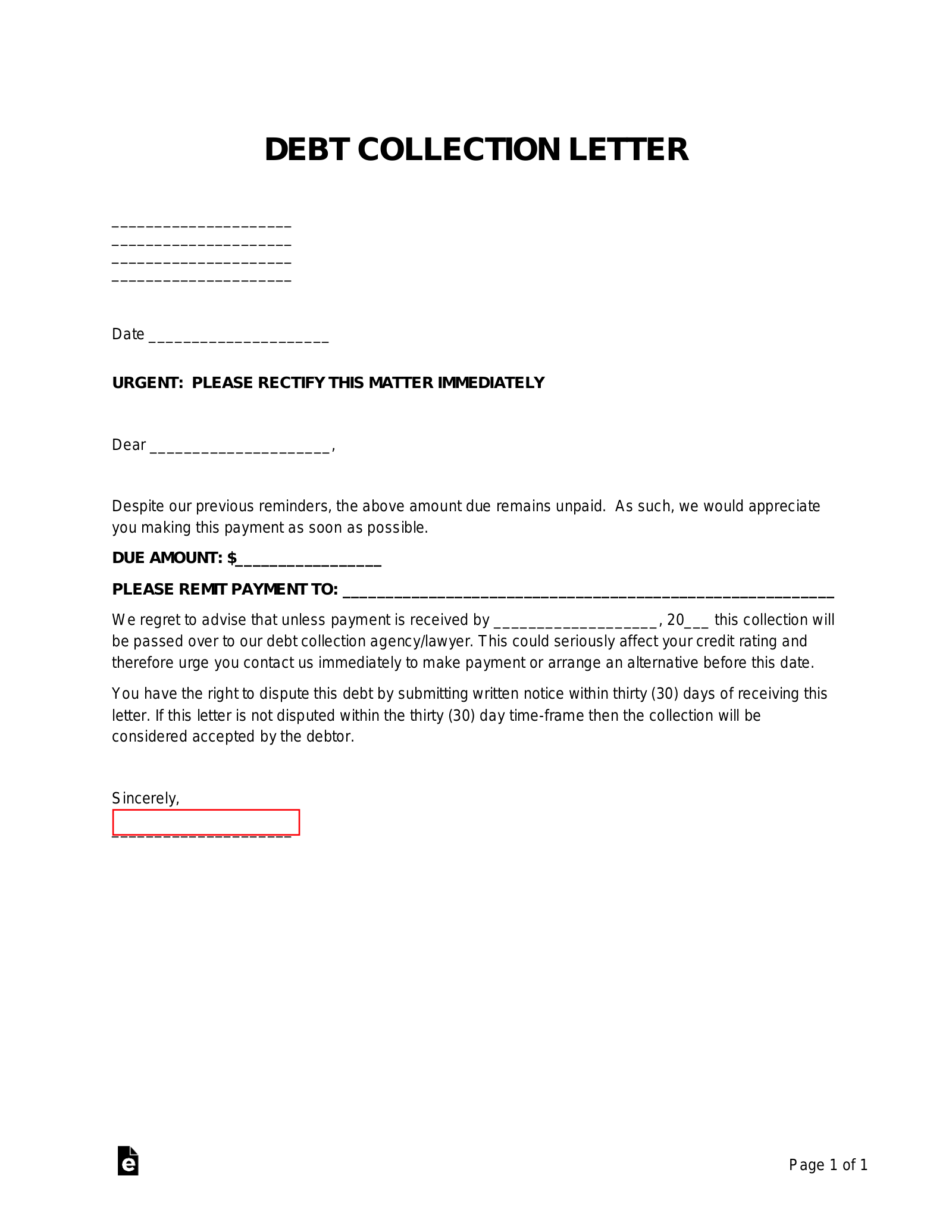

FREE 43+ Collection Letter Examples in Google Docs MS Word Pages PDF

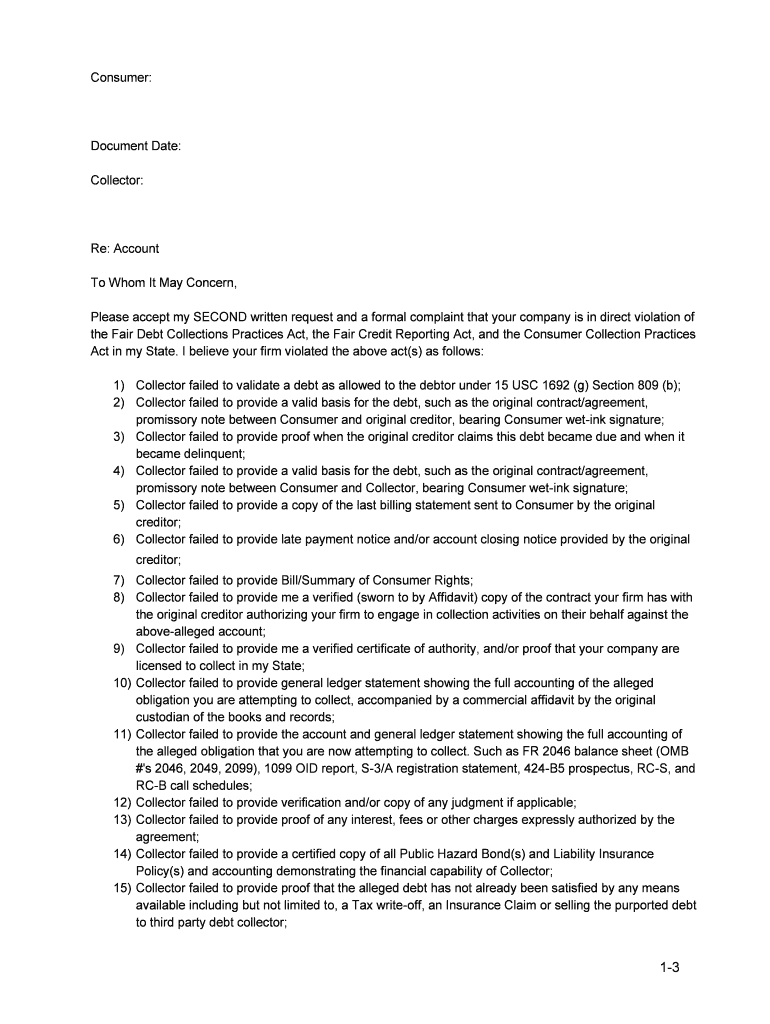

Debt Collection Letter Samples (for Debtors) Guide & Tips

FREE 43+ Collection Letter Examples in Google Docs MS Word Pages PDF

Template Dispute Letter To Collection Agency

Dispute Letter To Collection Agency For Your Needs Letter Template

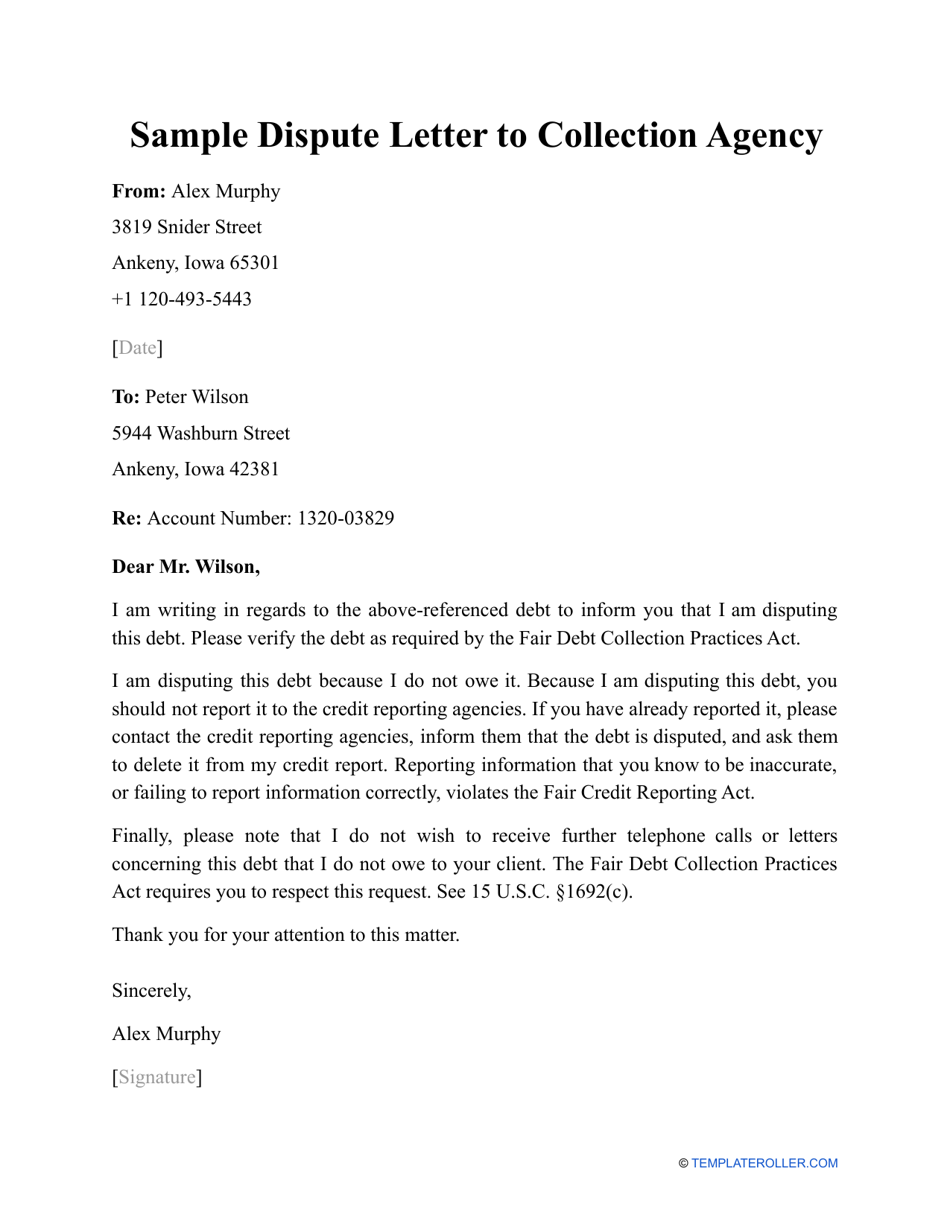

Sample Dispute Letter to Collection Agency Fill Out, Sign Online and

Collection Dispute Letter Template

![How to Write a Collection Dispute Letter? [With Template]](https://cdn-resources.highradius.com/resources/wp-content/uploads/2022/06/Sample-dispute-letter-for-credit-reporting-agency.png)

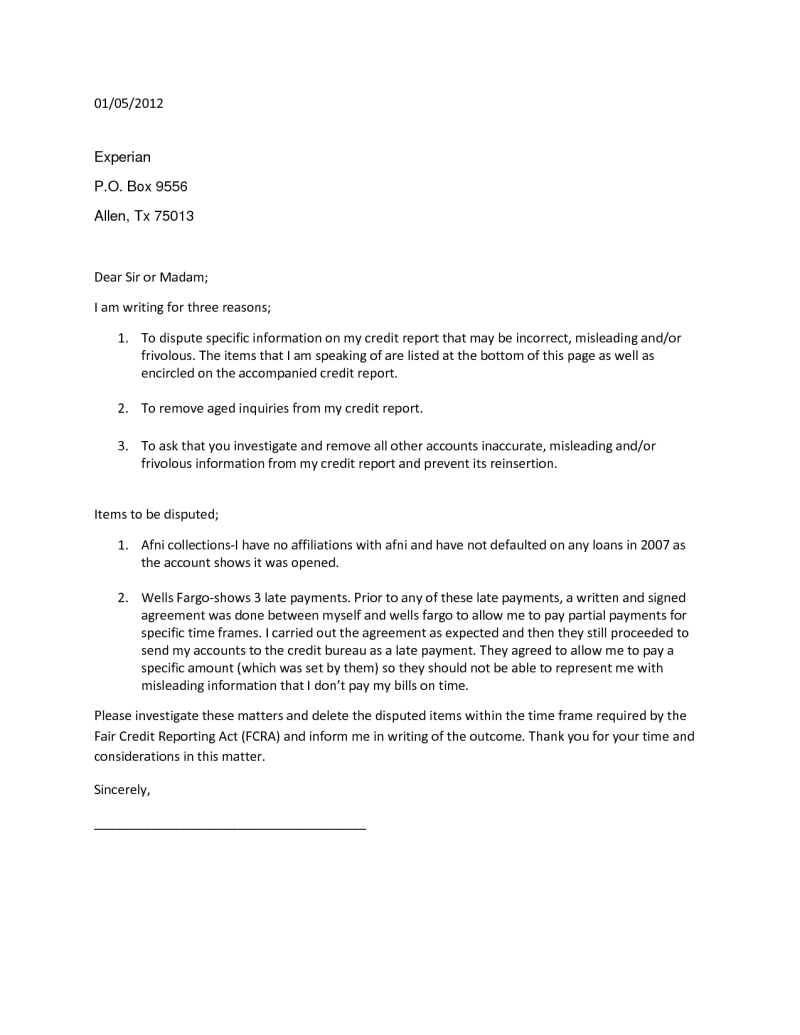

How to Write a Collection Dispute Letter? [With Template]

Disputing A Debt That Is Not Yours.

Web 1) Your Full Name And Address.

Identify The Owed Collection Debt.

The Following Letters Can Be Used To Inform A Collection Agency Of Your Intent Not To Pay, Or To Cease Communication.

Related Post: