Tax Expense Spreadsheet Template

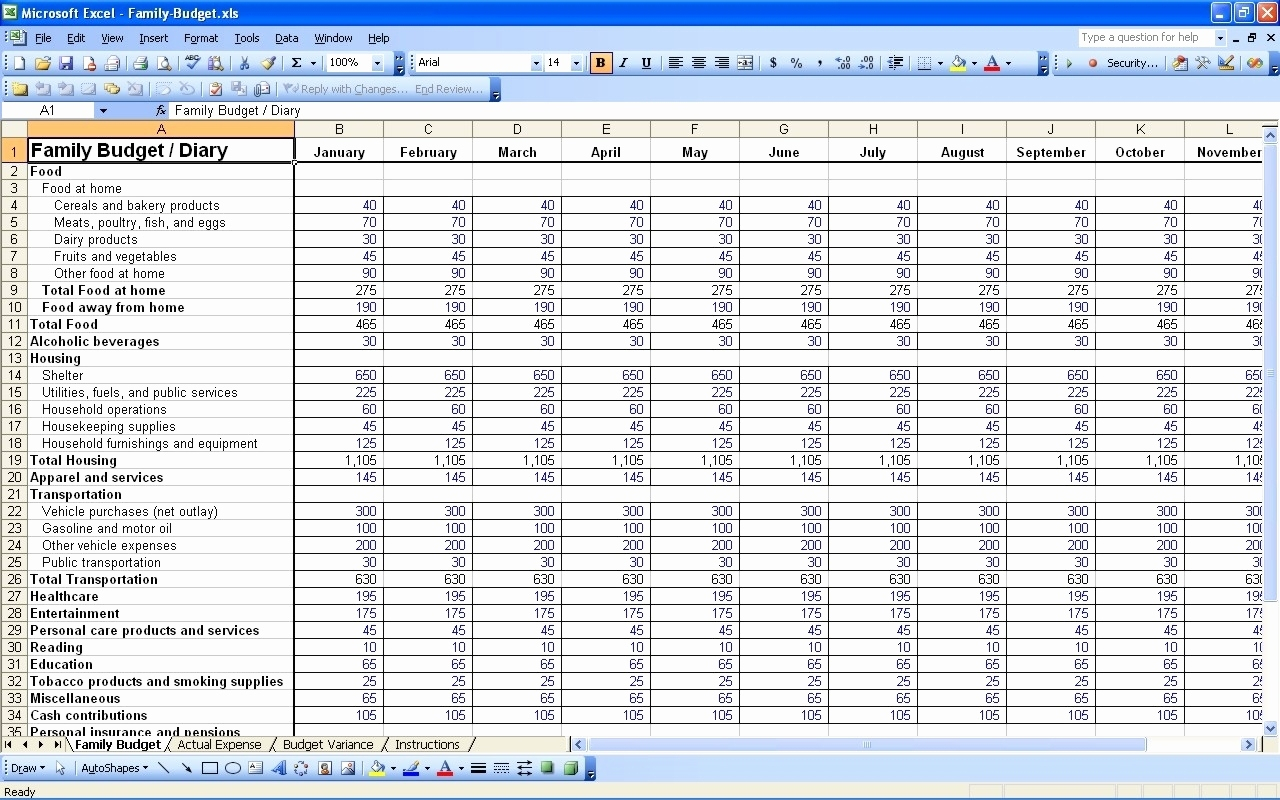

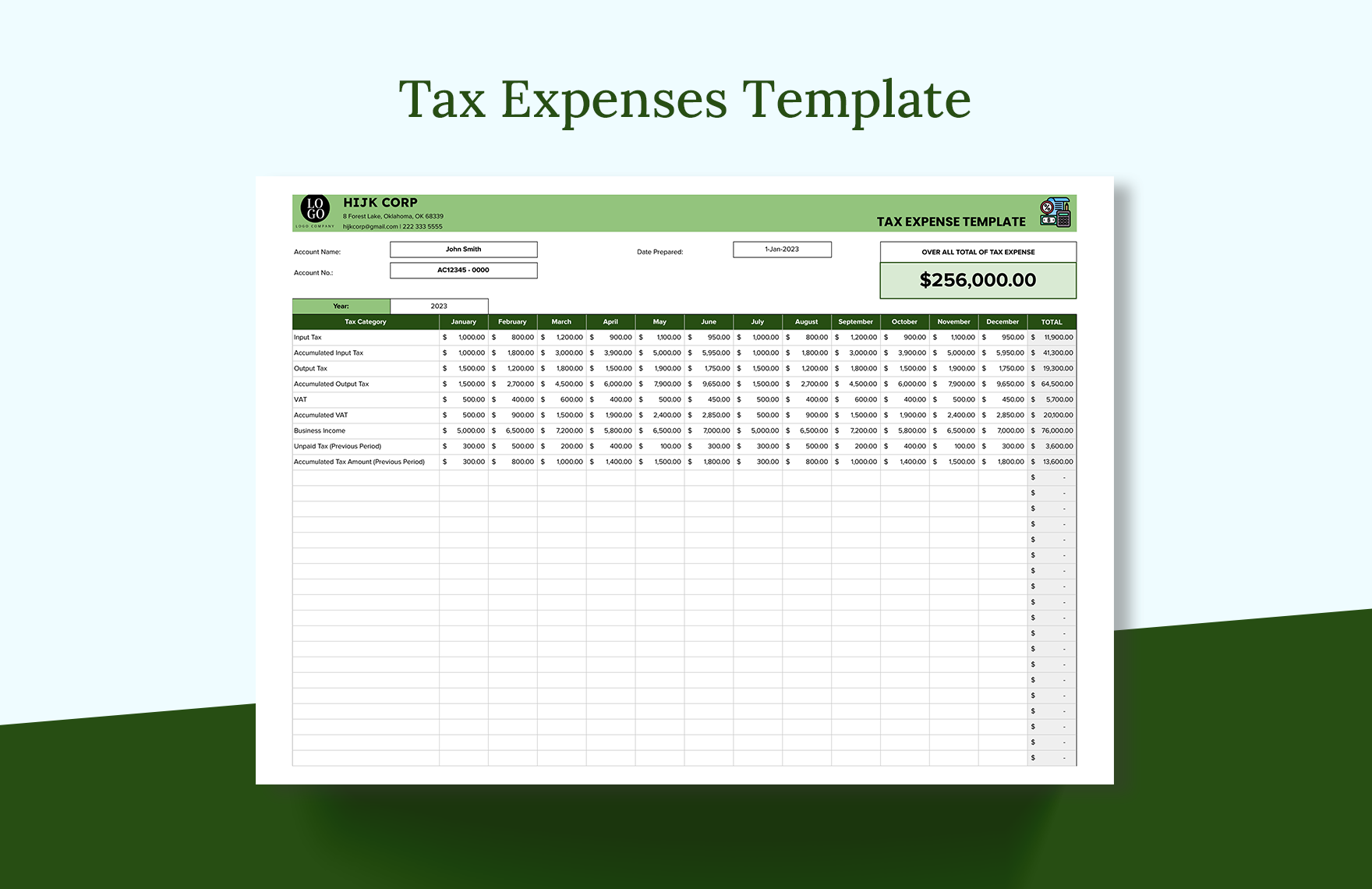

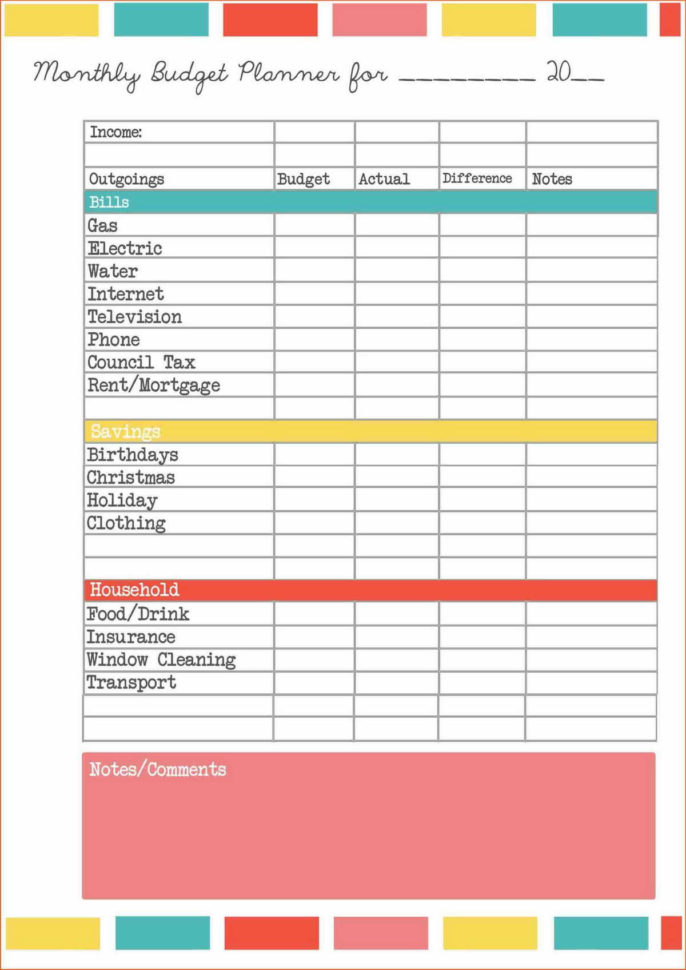

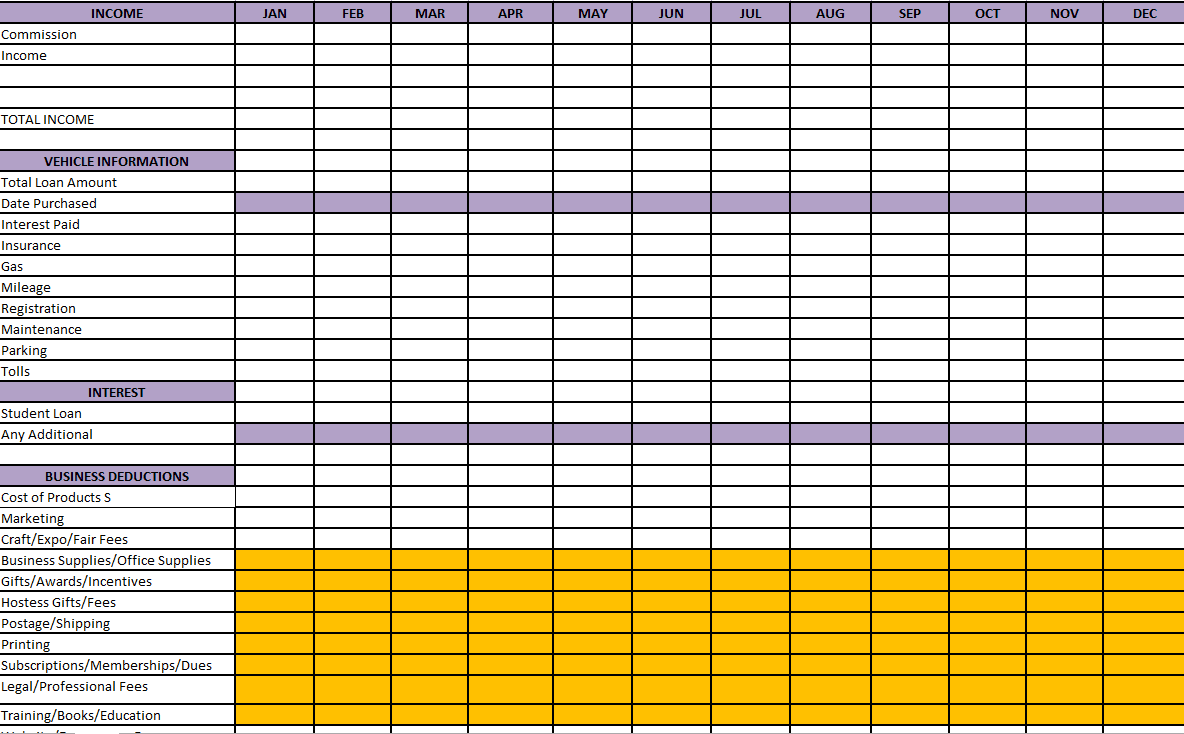

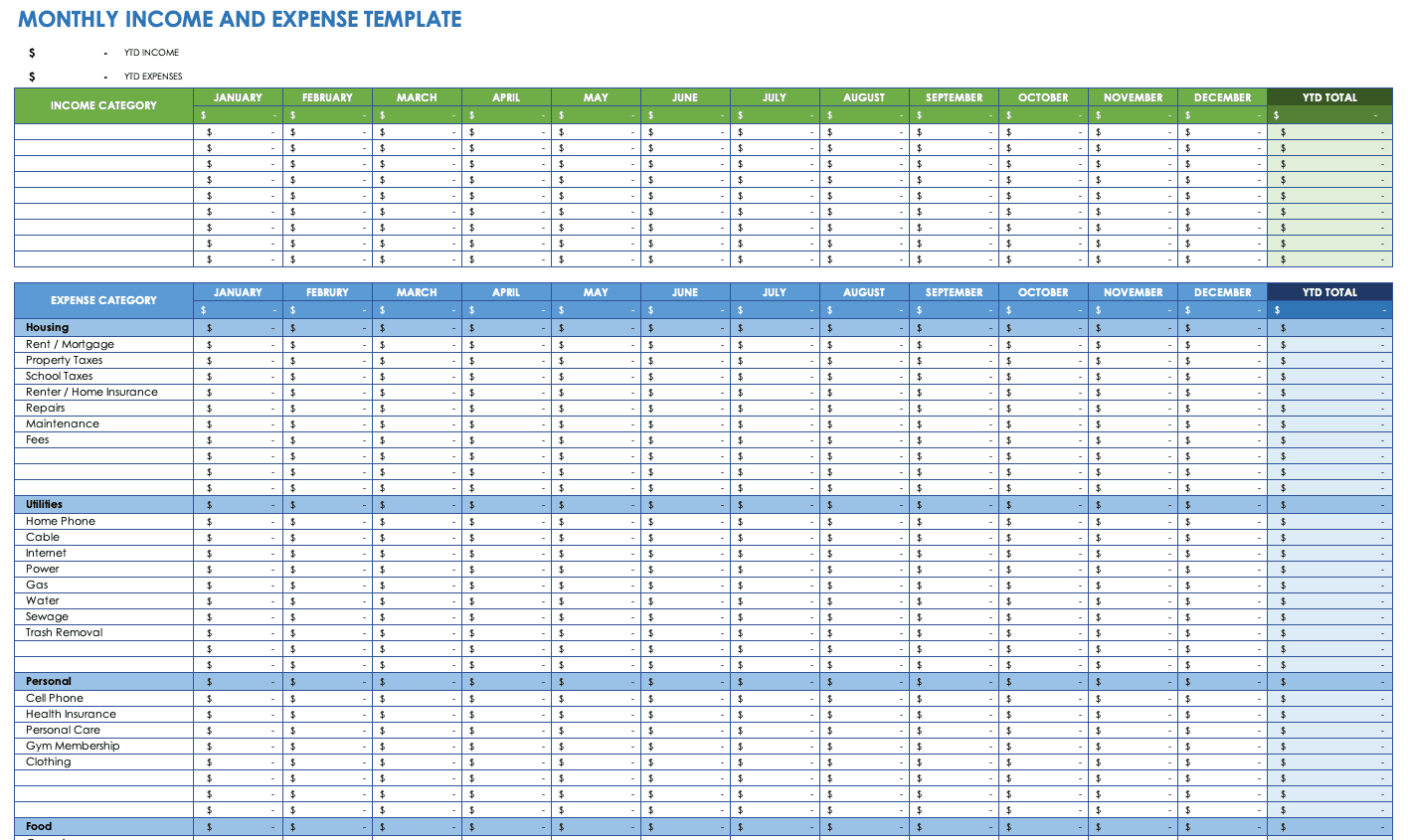

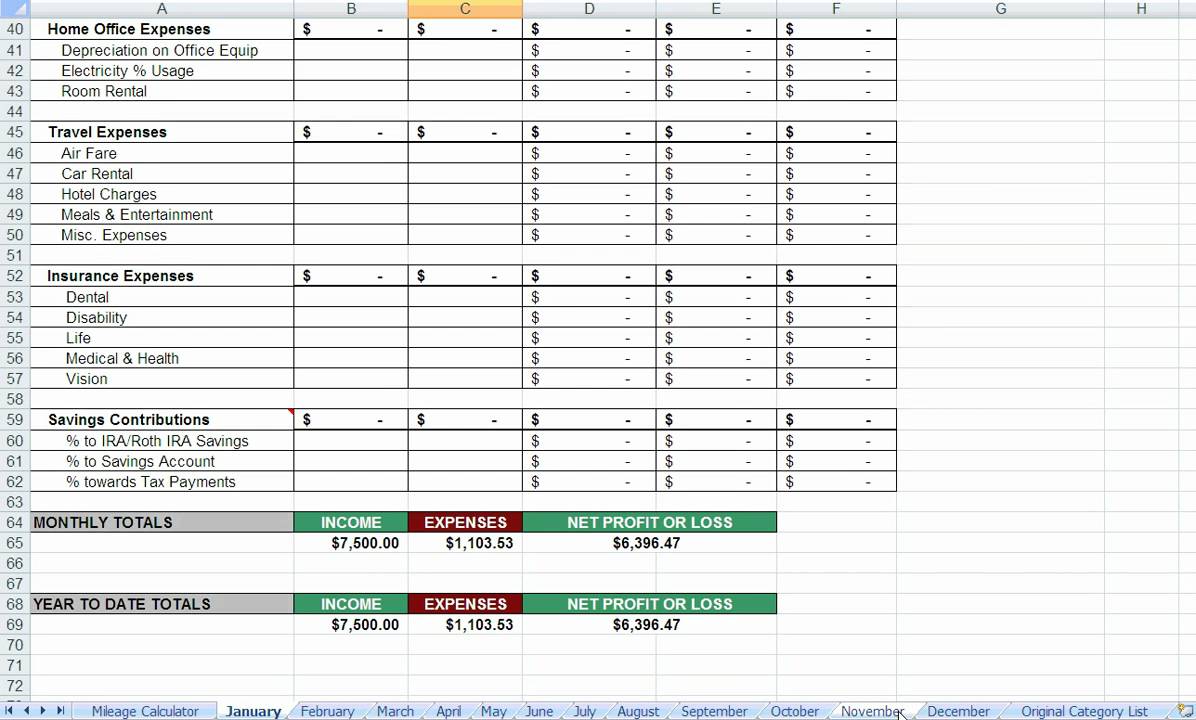

Tax Expense Spreadsheet Template - Shoeboxed—the best alternative to a printable expense tracker. Web an independent contractor expenses spreadsheet is also useful for identifying saving opportunities. Just click on the link above and make a copy in google sheets. Open a blank spreadsheet in google sheets. Maintaining these reports is crucial for budgeting and tax purposes. If you purchase alcohol, tobacco, or fuel for your business, you may be required to pay excise taxes.the good news is that you can deduct excise taxes on your tax return. Fill in the starting date, ending date, and purpose for your trip in the template’s reporting period fields. They’re only to help you estimate taxes. Use the show extensible attributes and hide extensible attributes. You can add or remove rows and columns, adjust formatting, and. Come tax time, a spreadsheet of your expenses is also helpful when claiming tax deductions. Enter the receipts' data into the spreadsheet. Web please note that these templates are only guides and aren’t meant to replace cpas or tax preparation services. Just click on the link above and make a copy in google sheets. If you purchase alcohol, tobacco, or. Web luckily, keeper's free template will make doing your taxes a little less painful — for your soul and for your wallet. For each expense, provide the date, a description, and category details. Enter the primary purpose for each expense, employee name, employee id, department, and manager. Unlike any app, when you track expenses in a spreadsheet you have complete. Web below are some of the expenses that should be tracked in an independent contractor expenses spreadsheet: Web enter data in the spreadsheet columns. Small businesses often benefit from integrating their expense spreadsheets with tax software. Record your expenses in their respective categories. Enter data in the designated columns in each of the four worksheets: Keep track of purchases and other expenses by recording the payment method, type of transaction, amount of payment, and other details. Assuming your effective tax rate is 20%, that $5,000 tax deduction will save you $1,000. Maintaining these reports is crucial for budgeting and tax purposes. This basic expense report template simplifies the business expense process for employees. Input all. Whether you drive, use public transportation,. Under use function select sum, and under add subtotal to, select transaction amount. Simple blue tax estimator from wps. It's been updated with all the latest info for you: Web tracking monthly expenses in a budget spreadsheet or template can make managing your money a little easier. Come tax time, a spreadsheet of your expenses is also helpful when claiming tax deductions. Small businesses often benefit from integrating their expense spreadsheets with tax software. Open a blank spreadsheet in google sheets. Here are some steps you can follow to create your template: Excel expense tracker templates are customizable, meaning you can change them based on your needs. Personal property taxes paid on business property are deductible.“personal” in this context refers to property that can be. Rename and save the template to your google drive. Tax tracker excel template from goskills. This is super helpful at tax time. Web the worksheet will automatically calculate your deductible amount for each purchase in column f. Use this spreadsheet to track payments, itemize expenses, and more. How to create an expense tracker in google sheets. You can add or remove rows and columns, adjust formatting, and. Web download the simple expense report template in google sheets on this page. Web benefits of using a tax sheet template 1. If you purchase alcohol, tobacco, or fuel for your business, you may be required to pay excise taxes.the good news is that you can deduct excise taxes on your tax return. Enter data in the designated columns in each of the four worksheets: Web the worksheet will automatically calculate your deductible amount for each purchase in column f. Tracking business. For each expense, provide the date, a description, and category details. If you travel for work, expenses such as airfare, lodging, and rental car expenses should be recorded in your spreadsheet. If you purchase alcohol, tobacco, or fuel for your business, you may be required to pay excise taxes.the good news is that you can deduct excise taxes on your. 1099 expenses spreadsheet from keeper. Customers, contacts, reference accounts, customer bank accounts. Use the show extensible attributes and hide extensible attributes. Web the totals can then be used for tax time when reporting tax deductions. Just click on the link above and make a copy in google sheets. Use the existing category names or enter your own column headings to best track business expenses. By using this worksheet, you can gain insights into your commuting expenses, make informed decisions to optimize your transportation options and maintain financial awareness. How to create an expense tracker in google sheets. Enter the primary purpose for each expense, employee name, employee id, department, and manager. Maintaining these reports is crucial for budgeting and tax purposes. Another aspect of creating or using a spreadsheet for cost tracking is finding the points where you might be overspending. Open a blank spreadsheet in google sheets. Web tracking monthly expenses in a budget spreadsheet or template can make managing your money a little easier. They’re only to help you estimate taxes. Assuming your effective tax rate is 20%, that $5,000 tax deduction will save you $1,000. Web please note that these templates are only guides and aren’t meant to replace cpas or tax preparation services.![]()

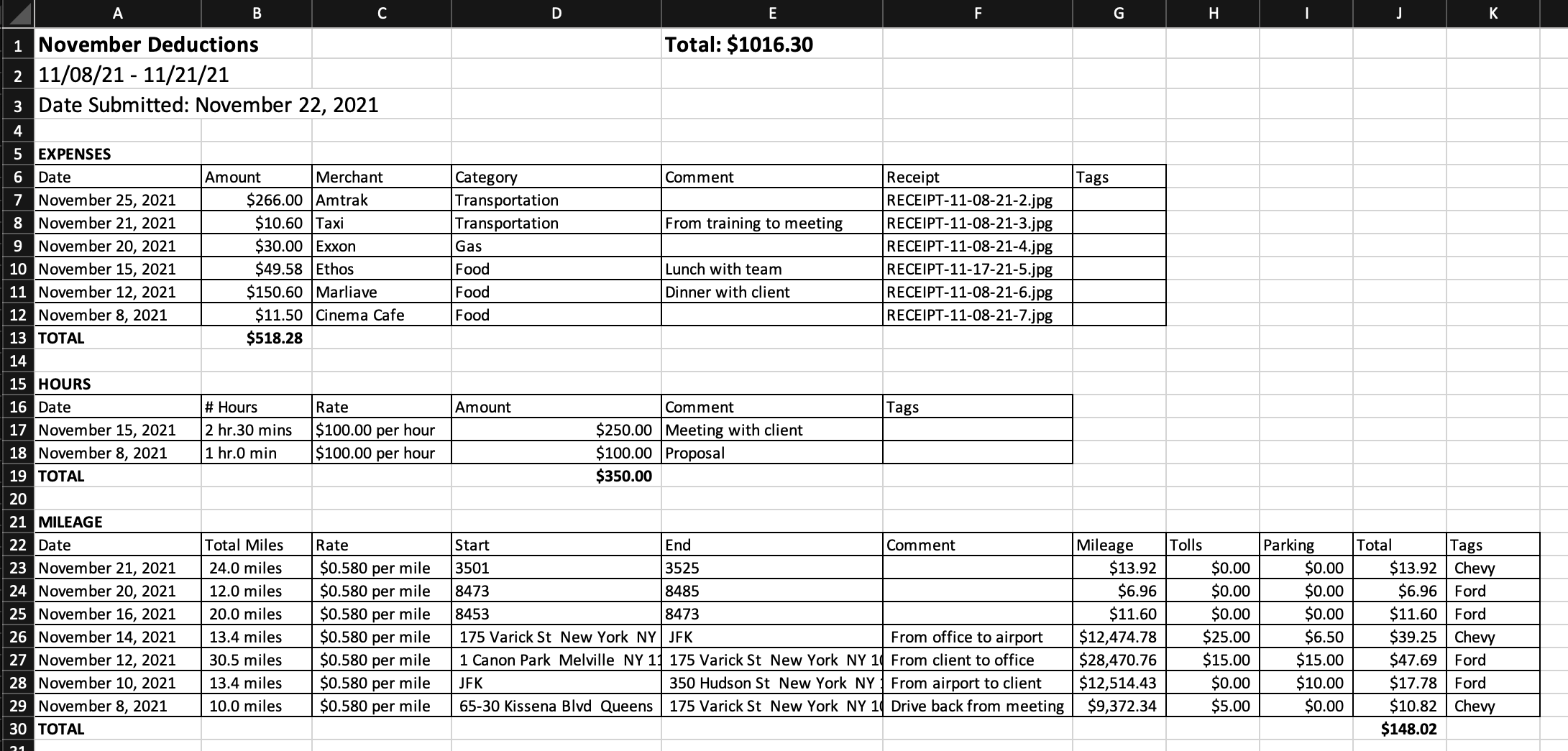

FREE 7+ Sample Expense Tracking Templates in PDF MS Word Excel

The Best Expense Report Template in Excel

Tax Expense Spreadsheet Template

Tax Expenses Template Excel, Google Sheets

Tax Expense Spreadsheet Template

Tax Expenses Spreadsheet Template Printable Templates

Free Expense Report Templates Smartsheet

EXCEL of and Expense.xlsx WPS Free Templates

Free 1099 Template Excel (With StepByStep Instructions!)

spreadsheet for tax expenses —

Keep Track Of Purchases And Other Expenses By Recording The Payment Method, Type Of Transaction, Amount Of Payment, And Other Details.

Collect All Receipts And Invoices.

Web The Worksheet Will Automatically Calculate Your Deductible Amount For Each Purchase In Column F.

Depreciation, Stock Based Compensation Expense, Unrealized Loss On Marketable Equity Securities, Change In The Fair Value Of Notes Payable And Unrealized.

Related Post: