Tax Donation Letter Template

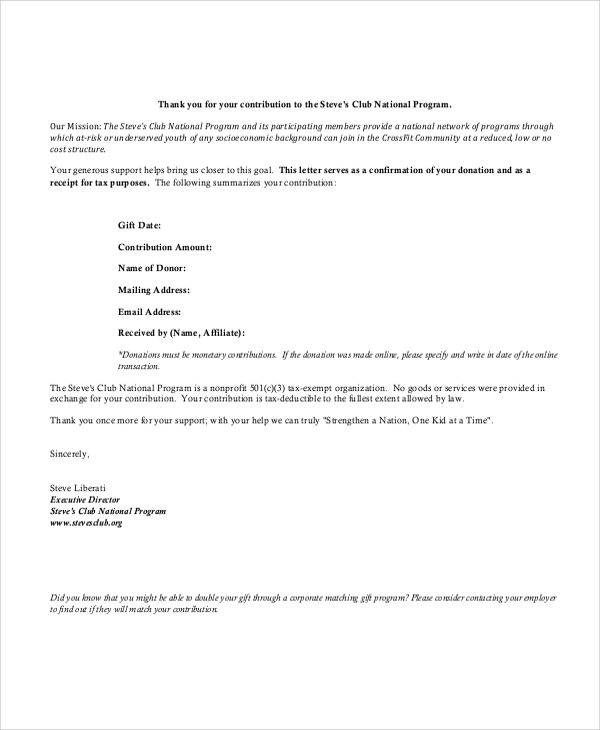

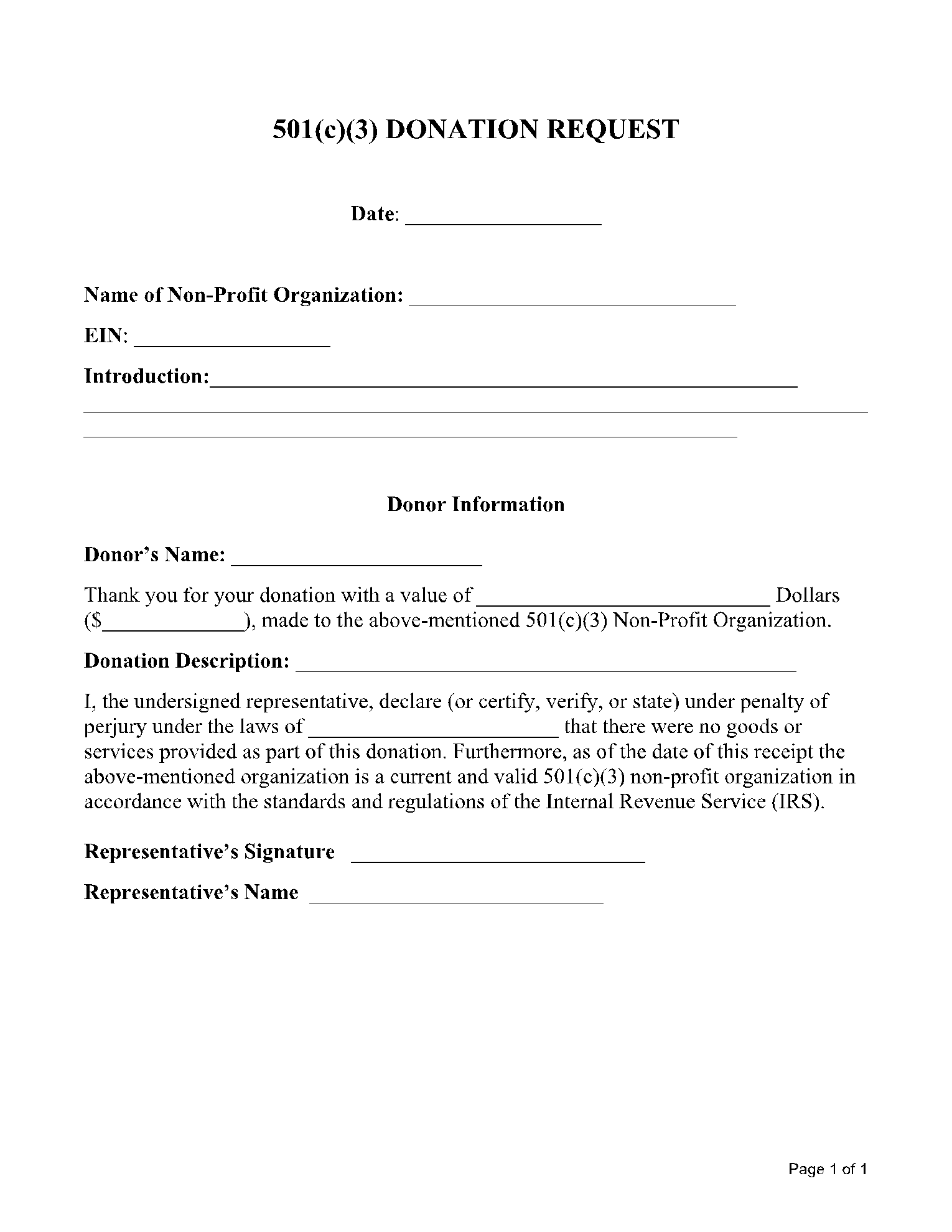

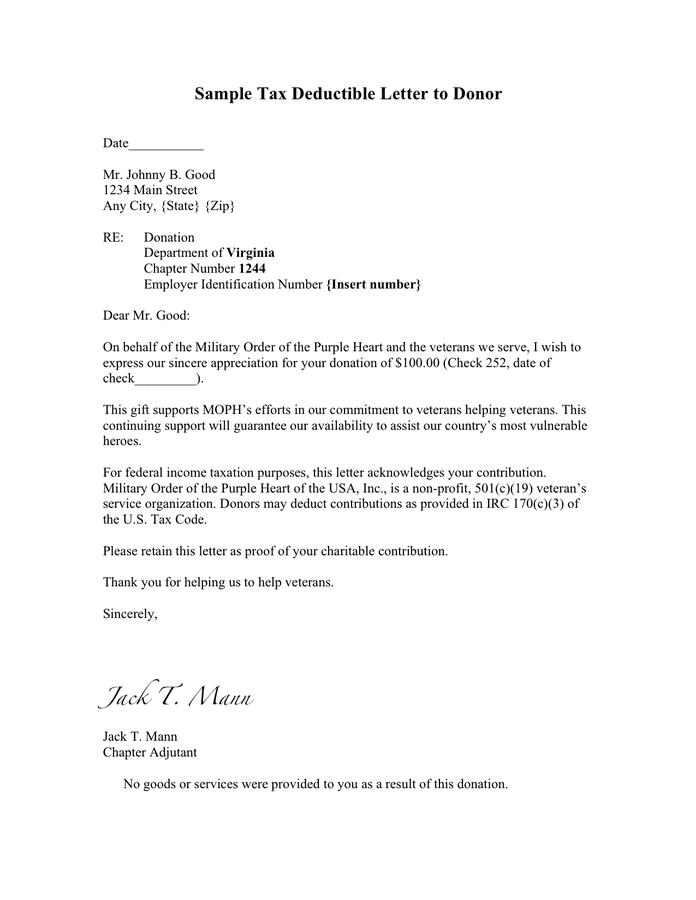

Tax Donation Letter Template - Benefits of an automated donation receipt process. The irs requires nonprofits to send receipts for any charitable gift over $250, and we all know how critical it is to keep the. When you write their donation receipt/letter, be sure to. Web if your organization uses kindful, it’s easy to create templates for your donation receipts. The donor will use this letter as proof of his or her donation to claim a tax deduction. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. Benefits of a 501c3 donation receipt. The written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Web acknowledgment letters are a good way to say thank you to your donors as well as a way to formally acknowledge the appropriate details of each contribution, which will help your donors when they are filing their personal tax returns. Below, you will find a receipt for your records. Web cullinane law group jan 19, 2023. Web acknowledgment letters are a good way to say thank you to your donors as well as a way to formally acknowledge the appropriate details of each contribution, which will help your donors when they are filing their personal tax returns. The donor will use this letter as proof of his or her. To ensure irs compliance, you need to send your donation acknowledgment letters by january 31 each year. Primarily, the receipt is used by organizations for filing purposes and. Donor acknowledgment letters are more than just a “thank you” letter. After all, donation letters are one of the most effective ways to connect with your supporters and inspire them to contribute. Web use these nonprofit donation receipt letter templates for the different types of donations your nonprofit receives: Web remember to pay attention to the items for donors who have given a gift of $250 or more. Edit on any device24/7 tech supportpaperless solutions Web if your organization uses kindful, it’s easy to create templates for your donation receipts. Benefits of. Each letter should include the. Web when creating your donation receipt template, be sure to abide by irs requirements by including the following information: We’ve included the following 2 samples. Web acknowledgment letters are a good way to say thank you to your donors as well as a way to formally acknowledge the appropriate details of each contribution, which will. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. Donation receipts are important for a few reasons. Below, you will find a receipt for your records. Edit on any device24/7 tech supportpaperless solutions When you write their donation receipt/letter, be sure to. The formal name of your nonprofit. Cash with advantage/merchandise deduction donation receipt. Web for donations over $250, the irs requires certain information be placed in a donor acknowledgment letter. Donation receipts are important for a few reasons. Web cullinane law group jan 19, 2023. Primarily, the receipt is used by organizations for filing purposes and. What they will need from you, the nonprofit they donated to, is a written document (an email or letter) that. Web updated december 18, 2023. Web when creating your donation receipt template, be sure to abide by irs requirements by including the following information: To ensure irs compliance, you. The formal name of your nonprofit. Web 🕑 12 min read. The donor will use this letter as proof of his or her donation to claim a tax deduction. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. From there, it’s just a. After all, donation letters are one of the most effective ways to connect with your supporters and inspire them to contribute to your nonprofit. We’ve included the following 2 samples. From there, it’s just a matter of creating templates that include the information that’s required and are compelling for your donors. Benefits of a 501c3 donation receipt. Donation receipts are. Benefits of an automated donation receipt process. Web use these nonprofit donation receipt letter templates for the different types of donations your nonprofit receives: Web for donations over $250, the irs requires certain information be placed in a donor acknowledgment letter. To ensure irs compliance, you need to send your donation acknowledgment letters by january 31 each year. The written. Web acknowledgment letters are a good way to say thank you to your donors as well as a way to formally acknowledge the appropriate details of each contribution, which will help your donors when they are filing their personal tax returns. Donation receipts are important for a few reasons. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. The irs requires nonprofits to send receipts for any charitable gift over $250, and we all know how critical it is to keep the. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. To make sure you cover your. Web when creating your donation receipt template, be sure to abide by irs requirements by including the following information: Web if your organization uses kindful, it’s easy to create templates for your donation receipts. Each letter should include the. Web cullinane law group jan 19, 2023. Edit on any device24/7 tech supportpaperless solutions Donor acknowledgment letters are more than just a “thank you” letter. The formal name of your nonprofit. Benefits of a 501c3 donation receipt. Benefits of an automated donation receipt process. When you write their donation receipt/letter, be sure to.

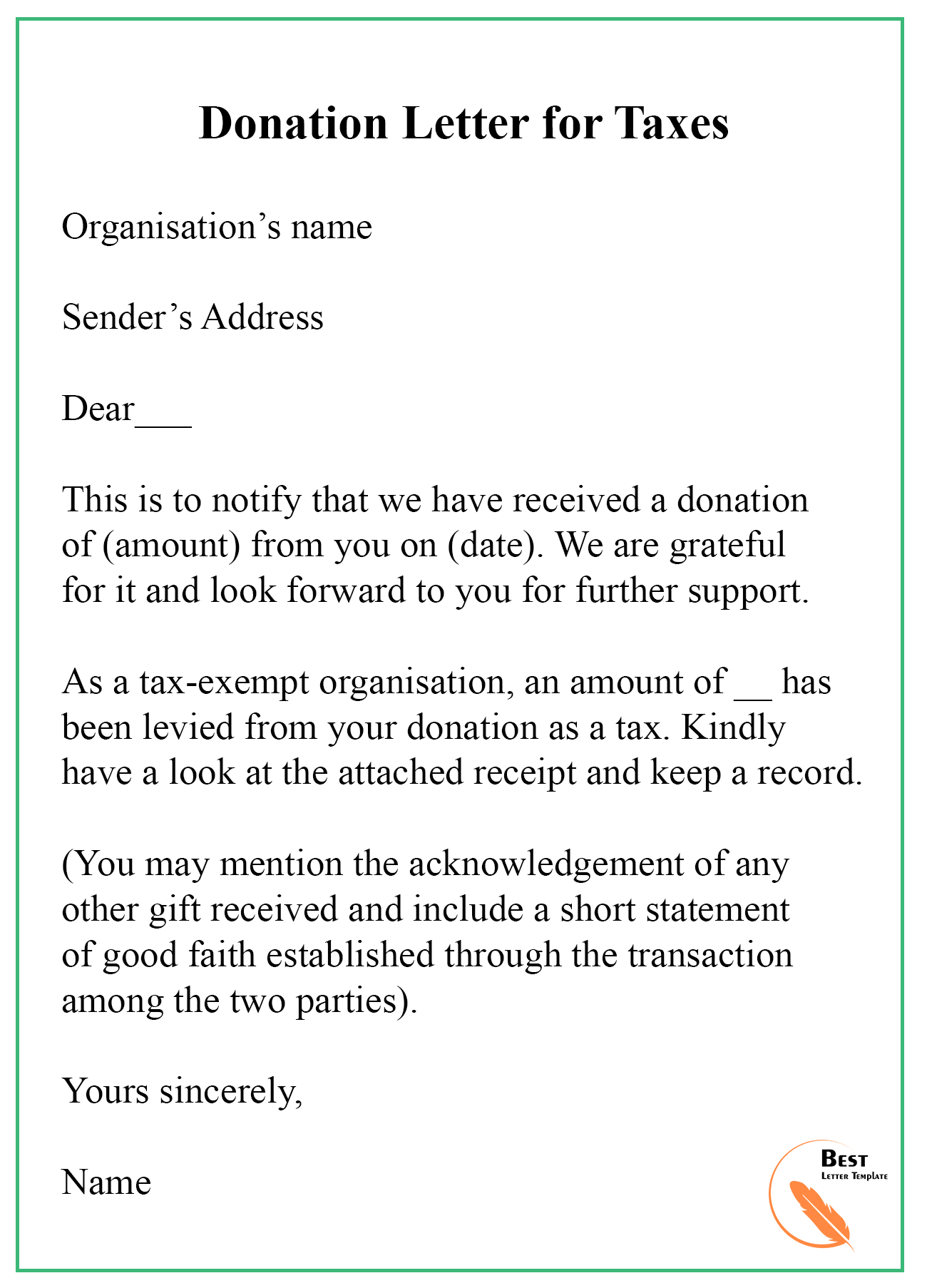

Donation Letter for Taxes Template in PDF & Word

13+ Free Donation Letter Template Format, Sample & Example

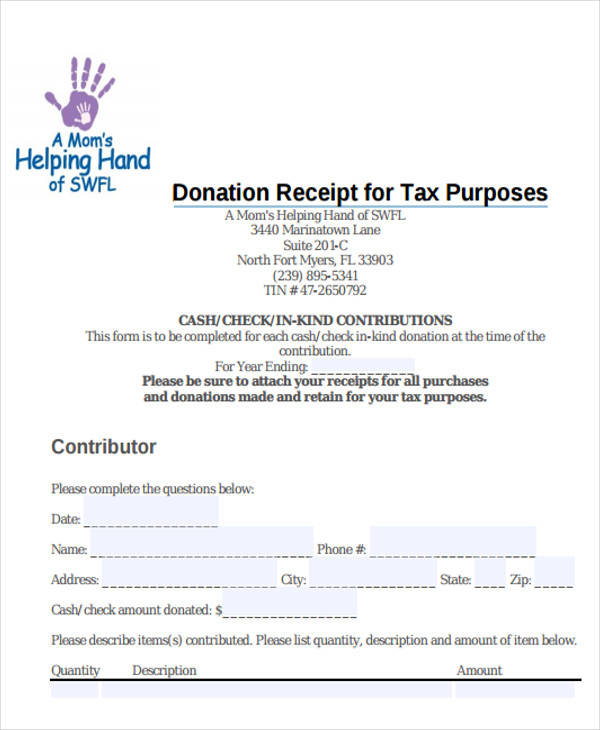

FREE 8+ Sample Donation Receipts in PDF

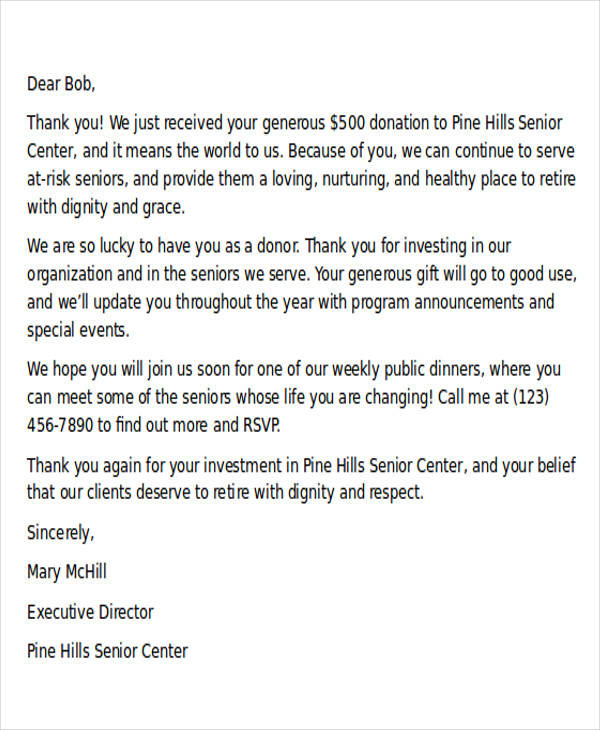

FREE 7+ Sample Donation Receipt Letter Templates in PDF MS Word

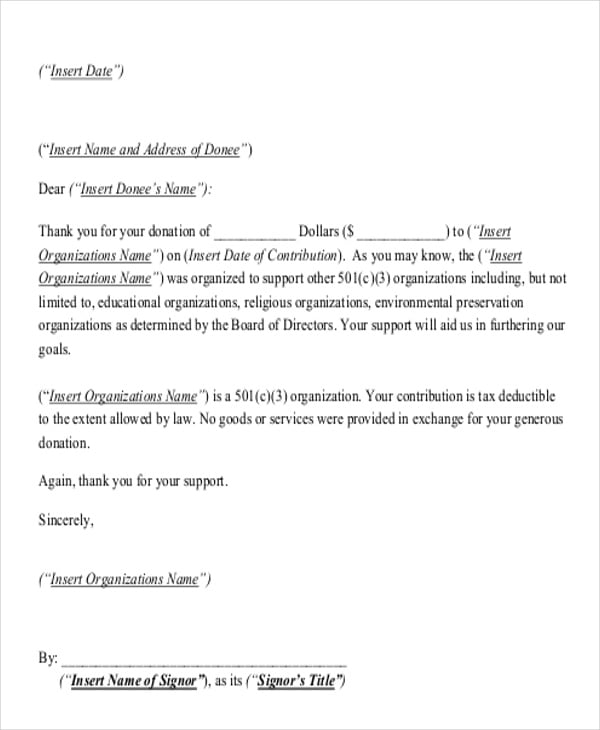

501(c)(3) Donation Receipt

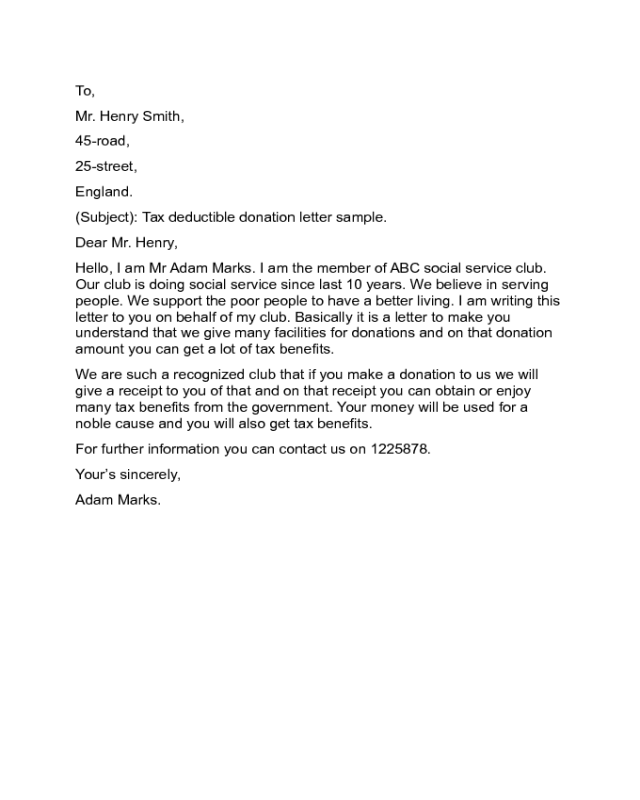

Sample tax deductible letter to donor in Word and Pdf formats

FREE 7+ Tax Receipts for Donation in MS Word PDF

Tax Deductible Donation Letter Sample Edit, Fill, Sign Online Handypdf

FREE 51+ Sample Donation Letter Templates in MS Word Pages Google

8+ Donation Acknowledgement Letter Templates Free Word, PDF Format

Web Use These Nonprofit Donation Receipt Letter Templates For The Different Types Of Donations Your Nonprofit Receives:

To Ensure Irs Compliance, You Need To Send Your Donation Acknowledgment Letters By January 31 Each Year.

Content Marketing Manager, Neon One.

We’ve Included The Following 2 Samples.

Related Post: