Symmetrical Wedge Pattern

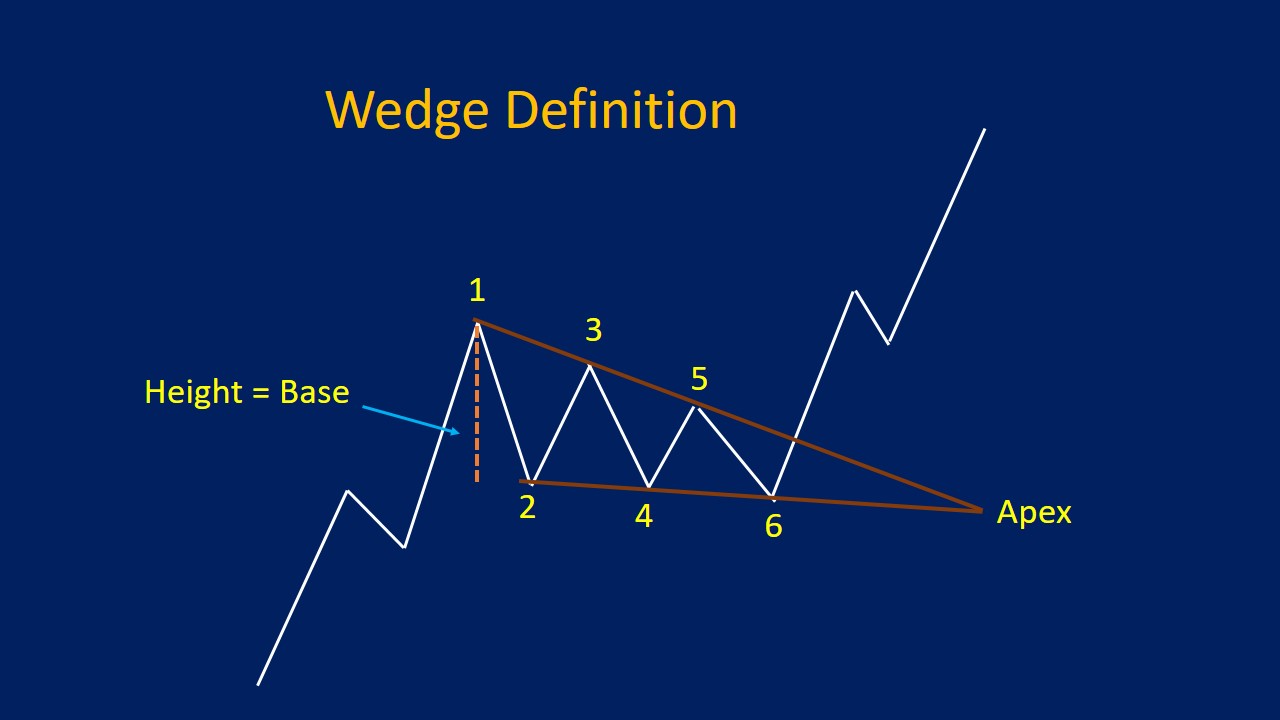

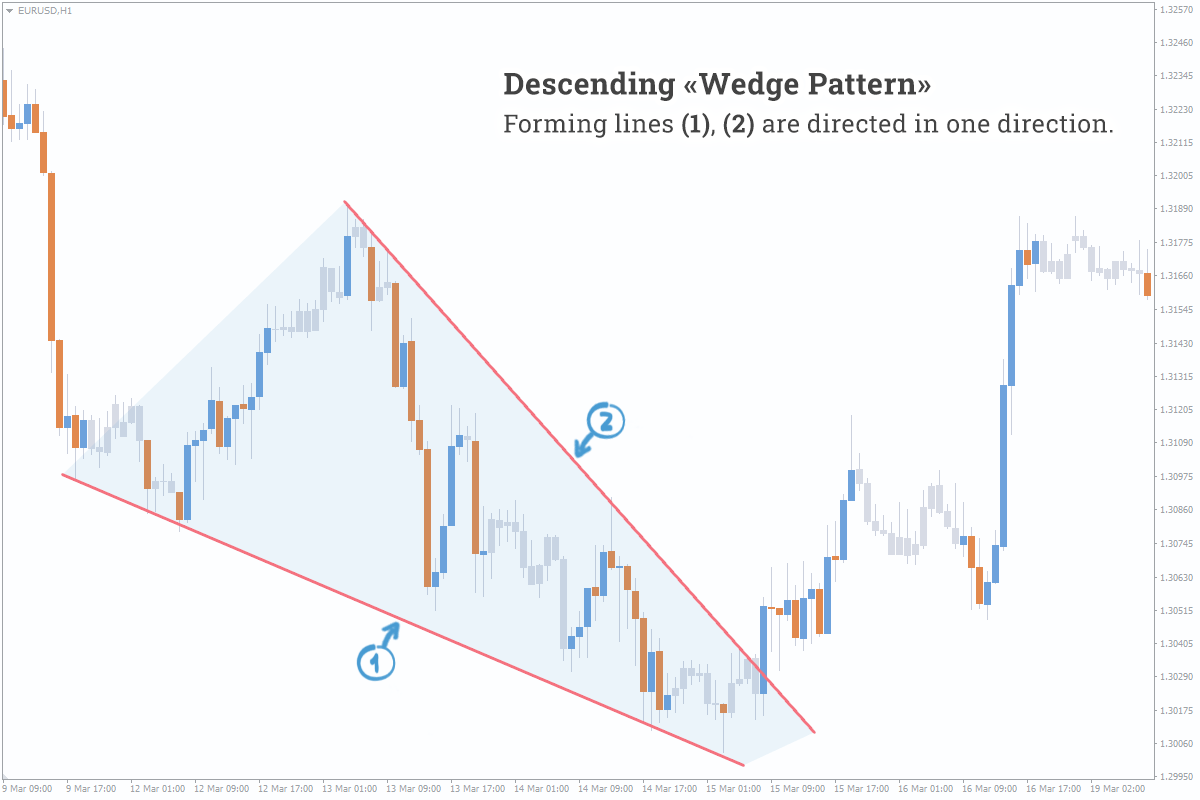

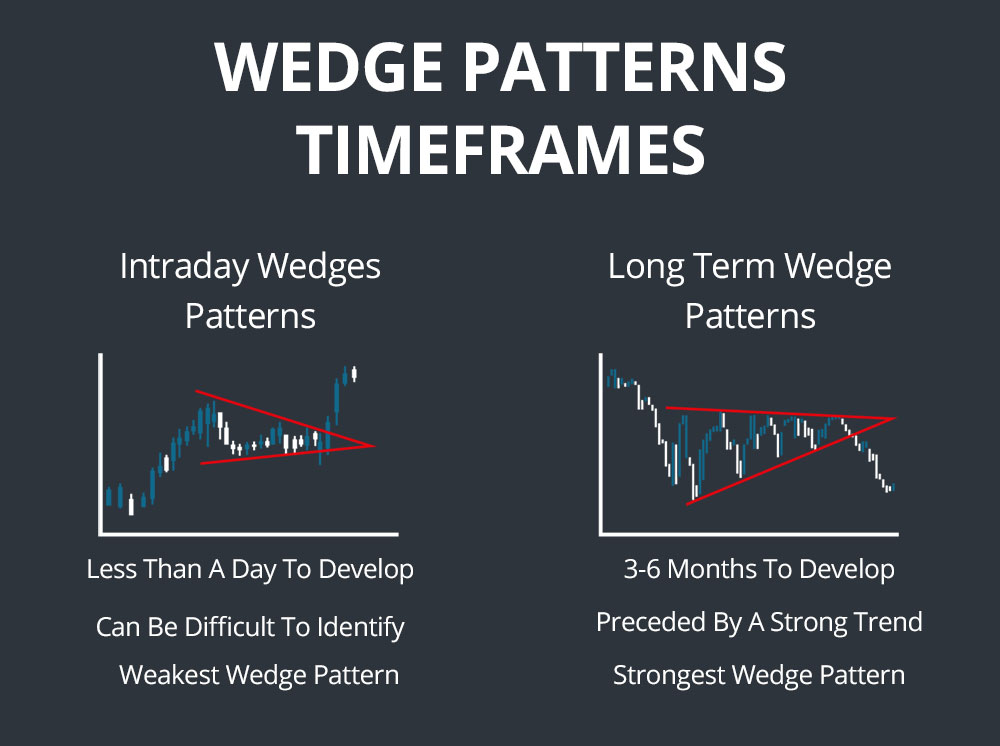

Symmetrical Wedge Pattern - Web the rising wedge is a technical chart pattern used to identify possible trend reversals. Wedge patterns can be difficult to recognize and trade effectively since they often look much like background trading activity on charts. It is considered a bullish chart formation but can indicate both reversal and continuation patterns. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. This pattern often signifies a period of consolidation before. Wait until you can spot on the price chart the structure of a falling wedge pattern and draw the two trendlines that connects the highs and the lows. In contrast to symmetrical triangles, which have no definitive slope and no bias, falling wedges definitely slope down and have a bullish bias. What is a symmetrical triangle pattern? We see the execution of both in the example charts below. However, it has a key distinguisher, which is a noticeable slant either downward or upward. Web the symmetrical triangle pattern is a neutral chart formation. A breakout from the upper trend line marks the continuation of an uptrend while a breakdown from the lower trend line marks the start of a new bearish trend. The bears are gradually pushing the price downwards while the bulls are pushing it upwards from the support line. It is. Web the symmetrical triangle is usually a continuation pattern. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. It represents a pause in the existing uptrend after which the original uptrend gets resumes. It is considered a bullish chart formation but can indicate both reversal and continuation patterns. In contrast. Web a symmetrical triangle is a key chart pattern used in technical analysis, characterized by two converging trend lines representing sequential peaks and troughs. Wait until you can spot on the price chart the structure of a falling wedge pattern and draw the two trendlines that connects the highs and the lows. Two converging lines are moving to each other. In contrast to symmetrical triangles, which have no definitive slope and no bias, falling wedges definitely slope down and have a bullish bias. You could also think of it as a contracting wedge, wide at the beginning and narrowing over time. Because of their shape, they can act as either a continuation or a reversal pattern. These patterns are bullish. Web this is the fundamental difference between a triangle pattern (symmetrical or ascending) and a wedge. Web a symmetrical triangle is a chart pattern characterized by two converging trendlines connecting a series of sequential peaks and troughs. Web understanding the wedge pattern. The other trendline consists of a series of higher lows, acting as support. It is formed by the. The other trendline consists of a series of higher lows, acting as support. Web symmetrical wedge pattern explained. Web the symmetrical triangle pattern is a neutral chart formation. This triangle chart pattern is formed when a security’s price action converges, creating a series of lower highs and higher lows. A breakout from the upper trend line marks the continuation of. Web a symmetrical triangle also known as a coil is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. Web what is a symmetrical triangle chart pattern and how does it work? A wedge pattern is formed by two converging straight lines. This means volatility in the market is shrinking and a.. We see the execution of both in the example charts below. Web a symmetrical triangle is a key chart pattern used in technical analysis, characterized by two converging trend lines representing sequential peaks and troughs. Web the symmetrical triangle pattern is a neutral chart formation. The bears are gradually pushing the price downwards while the bulls are pushing it upwards. These trend lines should converge. Symmetrical triangles form with lower highs and higher lows. Web the pattern contains at least two lower highs and two higher lows. As the space between two converging lines gets narrower, the likelihood of. In contrast to symmetrical triangles, which have no definitive slope and no bias, falling wedges definitely slope down and have a. Web symmetrical triangle pattern breakout: Web the symmetrical triangle pattern is a neutral chart formation. Two converging lines are moving to each other as the market makes the lower highs and the higher lows. Web the symmetrical triangle pattern is a prevalent chart pattern observed in various financial markets, giving traders insight into the future price direction. The bears are. This pattern often signifies a period of consolidation before. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. Web the falling wedge is a bullish pattern that begins wide at the top and contracts as prices move lower. It represents a pause in the existing uptrend after which the original uptrend gets resumes. The bears are gradually pushing the price downwards while the bulls are pushing it upwards from the support line. The two straight lines are the support and resistance that move in the direction of the market price. What is a symmetrical triangle pattern? However, it has a key distinguisher, which is a noticeable slant either downward or upward. It is formed by the converging support and resistance lines. Two converging lines are moving to each other as the market makes the lower highs and the higher lows. A breakout from the upper trend line marks the continuation of an uptrend while a breakdown from the lower trend line marks the start of a new bearish trend. A symmetrical triangle, also known as a symmetrical wedge pattern, is a formation that relates to the triangle group, which also includes ascending and descending triangles. These patterns are bullish with an expectation of a breakout. A universal pattern that can either continue the trend or go against it. Web symmetrical triangle pattern breakout: Wedge patterns can be difficult to recognize and trade effectively since they often look much like background trading activity on charts.

Symmetricalwedgepattern — TradingView — India

Pattern In A Chart Double Tops & Bottoms, Head and Shoulders, Wedge

5 Chart Patterns Every Beginner Trader Should Know Brooksy

Wedge Pattern Rising & Falling Wedges, Plus Examples

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

![[Short Term]Symmetrical Wedge Pattern in MCDOWELL_N for NSEMCDOWELL_N](https://s3.tradingview.com/i/IdrgIVYD_big.png)

[Short Term]Symmetrical Wedge Pattern in MCDOWELL_N for NSEMCDOWELL_N

Falling Wedge Pattern Trading 4 Step Wedge Strategy Exposed

Forex Wedge Patterns Fast Scalping Forex Hedge Fund

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Symmetricalwedgepattern — TradingView — India

Web The Pattern Contains At Least Two Lower Highs And Two Higher Lows.

The Other Trendline Consists Of A Series Of Higher Lows, Acting As Support.

Web Symmetrical Wedge Pattern Explained.

This Will Be Signaled By The Breakout.

Related Post: