Strongest Bullish Candlestick Pattern

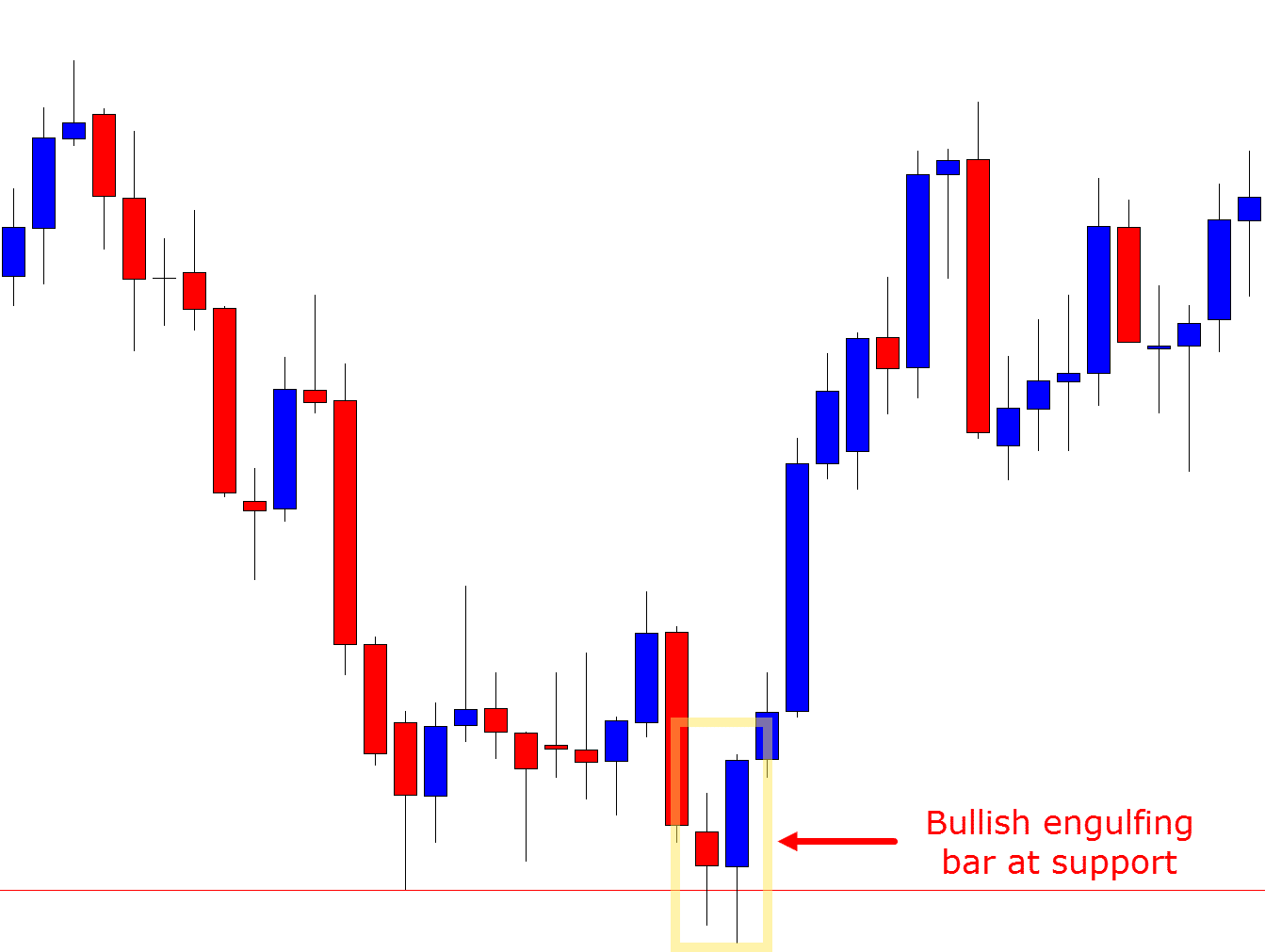

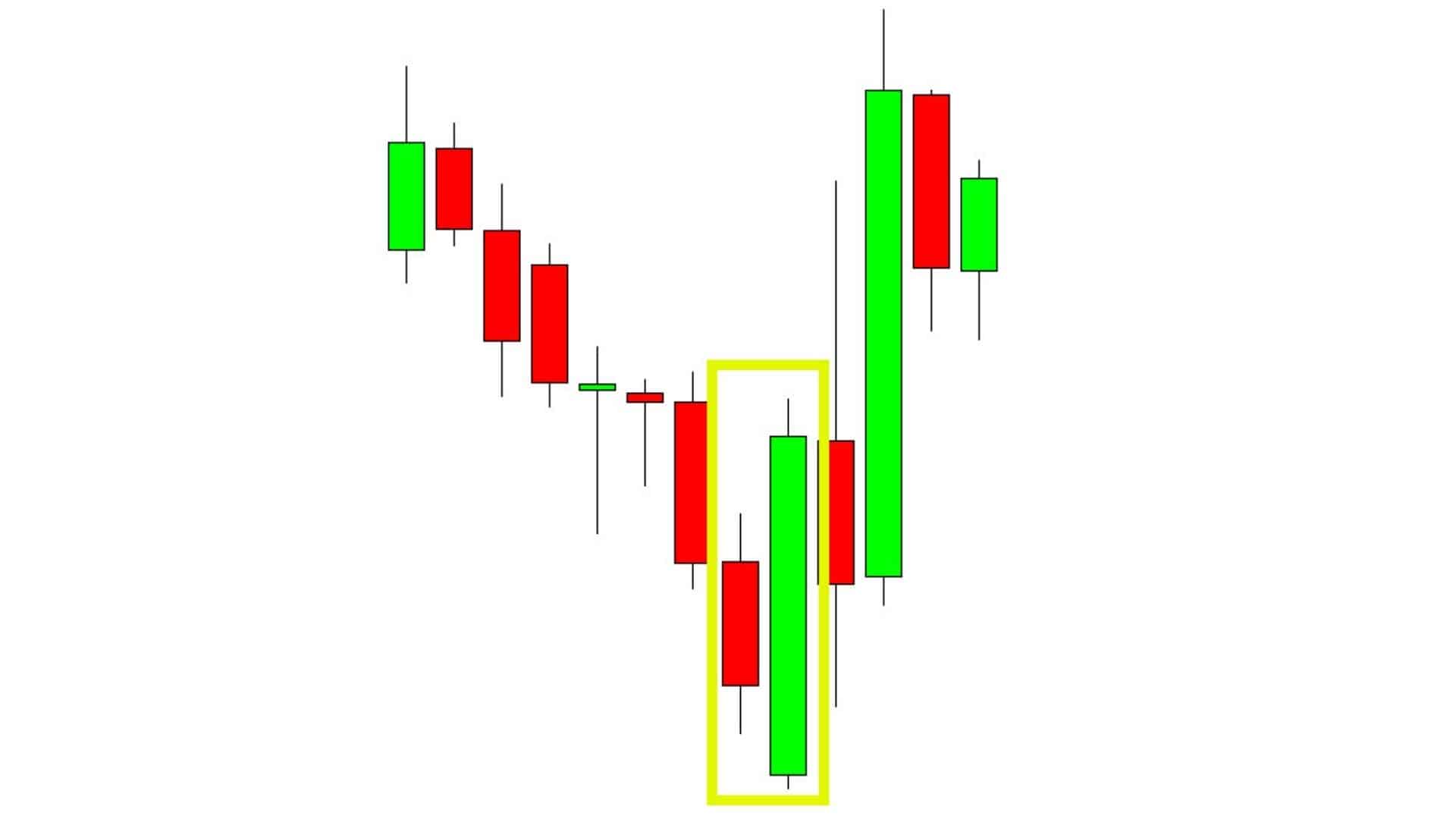

Strongest Bullish Candlestick Pattern - Web a candle pattern is best read by analyzing whether it’s bullish, bearish, or neutral (indecision). This bullish candlestick pattern is formed when the open and low prices are almost the same. For a complete list of bullish (and bearish) reversal patterns, see greg morris' book, candlestick charting explained. Bullish engulfing candle is one of my favorite ones. The likelihood of encountering a bullish marubozu pattern increases during robust bullish trends, signaling momentum in that direction. Web traders use these patterns to time their entry into the market with the goal of capitalizing on the anticipated price increase. A candlestick pattern that forms in conjunction with a. A candlestick must meet the following to be a valid bullish closing marubozu: Web before we delve into individual bullish candlestick patterns, note the following two principles: The hammer is a bullish reversal pattern, which signals that a. For an extra fee you can purchase amibroker code for all the 75 candlestick patterns. This bullish candlestick pattern is formed when the open and low prices are almost the same. The fundamentals of charting, trendlines represent the broader direction in which the market moves. Web before we delve into individual bullish candlestick patterns, note the following two principles: But. Web 8 strongest candlestick patterns. The most reliable japanese candlestick chart patterns — three bullish and five bearish patterns — are rated as strong.strong candlestick patterns are at least 3 times as likely to resolve in the indicated direction (greater than or equal to 75% probability). Web traders use these patterns to time their entry into the market with the. Following a strong downtrend, the appearance of a bullish engulfing pattern indicates that the bulls have regained control of the market, and the price is likely to rise even further. The main element of this pattern is a relatively. Web we will focus on five bullish candlestick patterns that give the strongest reversal signal. This shows the presence of sellers. Hammer is a bullish reversal candlestick pattern that occurs at the bottom of a downtrend. Web a bullish candlestick pattern forming around a major fibonacci retracement level (like 61.8%) can enhance the conviction behind a potential upward move. But as the saying goes, context is everything. Web 8 strongest candlestick patterns. Much like the hanging man, the hammer is a. The hammer is a bullish reversal pattern, which signals that a. This article will focus on the other six patterns. Watching a candlestick pattern form can be time consuming and irritating. The main element of this pattern is a relatively. Much like the hanging man, the hammer is a bullish candlestick reversal candle. A single candlestick pattern characterized by a small body and a long lower wick, signaling a potential bullish reversal after a downtrend. The fundamentals of charting, trendlines represent the broader direction in which the market moves. Following a strong downtrend, the appearance of a bullish engulfing pattern indicates that the bulls have regained control of the market, and the price. The hammer or the inverted hammer. We have covered 75 different candlestick patterns in the. Web hammer (1) inverted hammer (1) morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were covered in the article introduction to candlesticks. Web the truth is that bullish candlestick patterns are essentially chart patterns on the lower timeframe. Web 8 strongest. Bullish closing marubozu candlestick pattern. A single candlestick pattern characterized by a small body and a long lower wick, signaling a potential bullish reversal after a downtrend. For a complete list of bullish (and bearish) reversal patterns, see greg morris' book, candlestick charting explained. Web the truth is that bullish candlestick patterns are essentially chart patterns on the lower timeframe.. Web a bullish candlestick pattern forming around a major fibonacci retracement level (like 61.8%) can enhance the conviction behind a potential upward move. Bullish engulfing candle is one of my favorite ones. The first is a bearish candle, the second is a doji, and the third is a bullish candle representing the buyers’ power. Web 8 strongest candlestick patterns. If. The hammer is a bullish reversal pattern, which signals that a. This pattern should consist of a lower shadow which is twice as long as the real body. The likelihood of encountering a bullish marubozu pattern increases during robust bullish trends, signaling momentum in that direction. Hammer is a bullish reversal candlestick pattern that occurs at the bottom of a. It usually indicates the initiation of a bullish movement after a strong bearish wave. A close price very close to the high. A candlestick must meet the following to be a valid bullish closing marubozu: It represents the number of shares or. Continuations tend to resolve in the same direction as the prevailing trend: Web we will focus on five bullish candlestick patterns that give the strongest reversal signal. The most reliable japanese candlestick chart patterns — three bullish and five bearish patterns — are rated as strong.strong candlestick patterns are at least 3 times as likely to resolve in the indicated direction (greater than or equal to 75% probability). For a complete list of bullish (and bearish) reversal patterns, see greg morris' book, candlestick charting explained. Volume plays a crucial role in confirming the strength of a bullish candlestick pattern. Web the candlestick pattern is explained in plain english, then clearly showed on a graph, and then decoded into rules than can be backtested. Web before we delve into individual bullish candlestick patterns, note the following two principles: Web the truth is that bullish candlestick patterns are essentially chart patterns on the lower timeframe. Much like the hanging man, the hammer is a bullish candlestick reversal candle. The hammer or the inverted hammer. We have covered 75 different candlestick patterns in the. Web this pattern often signals a reversal from a downtrend to an uptrend — the larger green candle indicates that bullish sentiment has become dominant in the market.

Candlestick Patterns The Definitive Guide (2021)

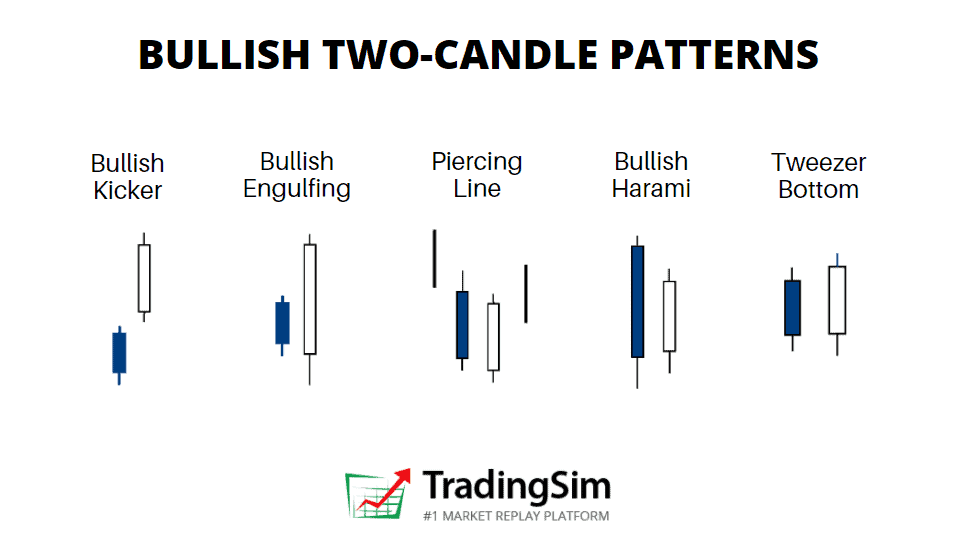

6 Reliable Bullish Candlestick Pattern TradingSim

What are Bullish Candlestick Patterns?

6 Reliable Bullish Candlestick Pattern TradingSim

Candlestick Patterns The Definitive Guide (2021)

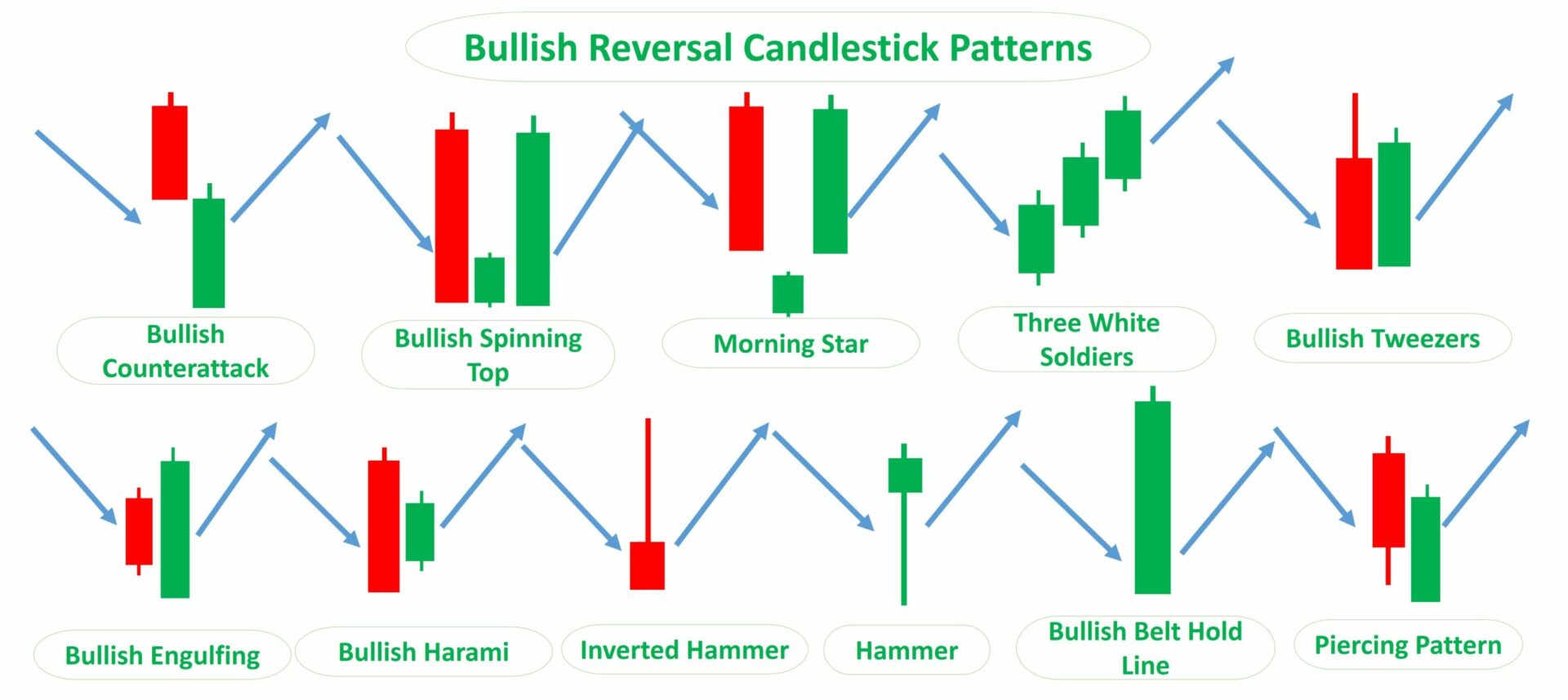

Top Reversal Candlestick Patterns

Bullish Candlestick Patterns PDF Guide Free Download

Bullish Candlestick Patterns Pdf Candle Stick Trading Pattern

Using 5 Bullish Candlestick Patterns To Buy Stocks

.png)

4 Powerful Candlestick Patterns Every Trader Should Know

The Hammer Is A Bullish Reversal Pattern, Which Signals That A.

However, The Candlestick Chart Is Easier To Read And Visually More Appealing.japanese Candlestick Charting Techniques Are Very.

The First Is A Bearish Candle, The Second Is A Doji, And The Third Is A Bullish Candle Representing The Buyers’ Power.

Web The Morning Star Candlestick Consists Of 3 Candles.

Related Post: