Stocks Forming Cup And Handle Pattern

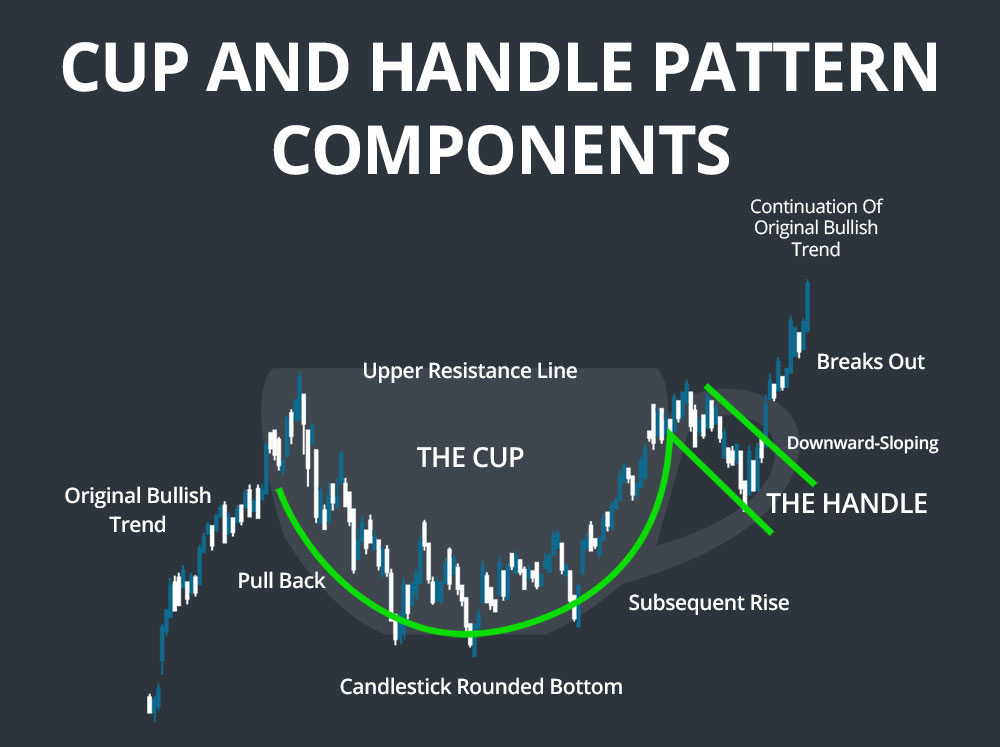

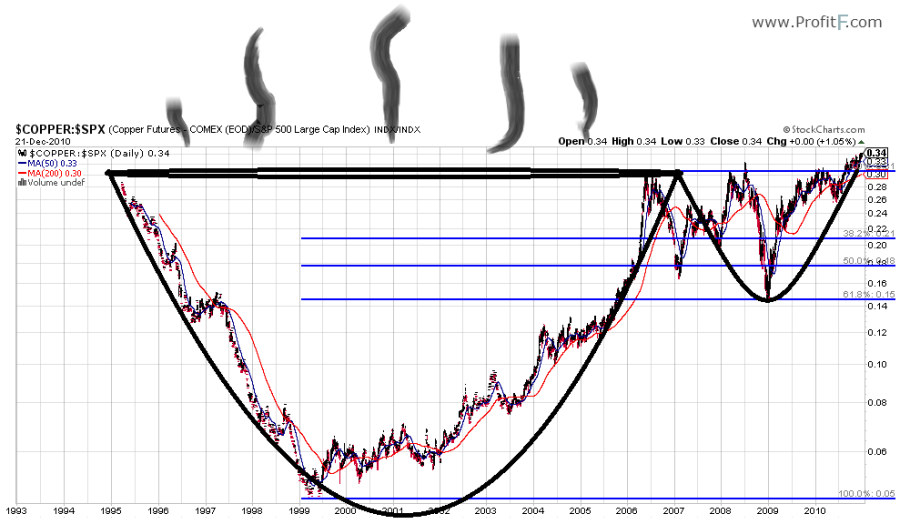

Stocks Forming Cup And Handle Pattern - The cup represents a market consolidation period marked by two distinct price movements: Web a cup and handle is a chart pattern made by an asset’s price indicative of a future uptrend. There are two parts to the pattern: Web the cup and handle chart pattern is a technical analysis trading strategy in which the trader attempts to identify a breakout in asset price to profit from a strong. The beginning, or left side, of cup. What is the cup and handle pattern? The price rallies back to the point where the fall started, which creates a “u” or cup shape. At some the profit taking starts taking place and the stock begins. Web cup & handle pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web what is a cup and handle pattern. Web a cup and handle pattern is formed when there is a price rise followed by a fall. Explanation of chart patterns in financial trading. Web cup & handle pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web a cup and handle is a chart. Explanation of chart patterns in financial trading. Web traders use the cup and handle pattern when they see a stock’s price has formed a “u” shape, followed by a slight pullback forming a “handle” shape. The price rallies back to the point where the fall started, which creates a “u” or cup shape. Web a cup and handle pattern resembles. Web cup and handle. The cup represents a market consolidation period marked by two distinct price movements: Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. Web the cup and handle chart pattern is a technical analysis trading strategy in which the trader attempts to identify a breakout in. The price rallies back to the point where the fall started, which creates a “u” or cup shape. Definition and characteristics of the cup and handle pattern. Web a cup and handle is a chart pattern made by an asset’s price indicative of a future uptrend. Web a cup and handle is a bullish technical price pattern that appears in. The cup represents a market consolidation period marked by two distinct price movements: At some the profit taking starts taking place and the stock begins. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. Explanation of chart patterns in financial trading. Learn how it works with an example, how. In simple terms, the cup and handle form when a stock price traces out a rounded cup shape, pulls back to form a smaller handle, and then breaks out above the price highs forming the cup rim. Identifying the cup and handle pattern. The price rallies back to the point where the fall started, which creates a “u” or cup. Identifying the cup and handle pattern. Explanation of chart patterns in financial trading. The cup represents a market consolidation period marked by two distinct price movements: Web a cup and handle pattern is formed when there is a price rise followed by a fall. Learn how it works with an example, how to. Web a cup and handle pattern resembles the shape of a cup or the letter u, with a rounded bottom forming the cup and a subsequent consolidation or retracement. Web cup & handle pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web the cup and. Web named for its distinctive shape, the cup and handle pattern is a powerful, bullish signal that can indicate a stock or crypto is likely to see a price increase in the. Web the cup and handle chart pattern is a technical analysis trading strategy in which the trader attempts to identify a breakout in asset price to profit from. Illustration with a visual example. Web what is a cup and handle pattern. Web named for its distinctive shape, the cup and handle pattern is a powerful, bullish signal that can indicate a stock or crypto is likely to see a price increase in the. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation. Web cup and handle. Web the cup and handle chart pattern is a technical analysis trading strategy in which the trader attempts to identify a breakout in asset price to profit from a strong. At some the profit taking starts taking place and the stock begins. It´s one of the easiest patterns to. Learn how to trade this pattern to improve your odds of making. Web cup & handle pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. The price then forms the handle, which is a small trading range that should be less than one third of the size of the cup. Web traders use the cup and handle pattern when they see a stock’s price has formed a “u” shape, followed by a slight pullback forming a “handle” shape. Key elements to look for in the pattern. In simple terms, the cup and handle form when a stock price traces out a rounded cup shape, pulls back to form a smaller handle, and then breaks out above the price highs forming the cup rim. The price rallies back to the point where the fall started, which creates a “u” or cup shape. The beginning, or left side, of cup. What is the cup and handle pattern? Understanding the significance of the pattern. Web a cup and handle pattern resembles the shape of a cup or the letter u, with a rounded bottom forming the cup and a subsequent consolidation or retracement. Web a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart.

How to Trade the Cup and Handle Chart Formation Video

Cup and Handle Patterns Comprehensive Stock Trading Guide

.png)

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

Cup and Handle Patterns Comprehensive Stock Trading Guide

:max_bytes(150000):strip_icc()/CupandHandleDefinition1-bbe9a2fd1e6048e380da57f40410d74a.png)

Cup and Handle Definition

Cup and Handle Patterns Comprehensive Stock Trading Guide

Trading the Cup and Handle Chart pattern

Cup And Handle Pattern How To Verify And Use Efficiently How To

Cup and Handle Patterns Comprehensive Stock Trading Guide

CupAndHandle Pattern Definition Finance Strategists

Web William O'neil's Cup With Handle Is A Bullish Continuation Pattern That Marks A Consolidation Period Followed By A Breakout.

Explanation Of Chart Patterns In Financial Trading.

Web What Is A Cup And Handle Pattern.

A Cup And Handle Can Be Used As An Entry Pattern For The Continuation Of An Established Bullish Trend.

Related Post: