Stock Wedge Pattern

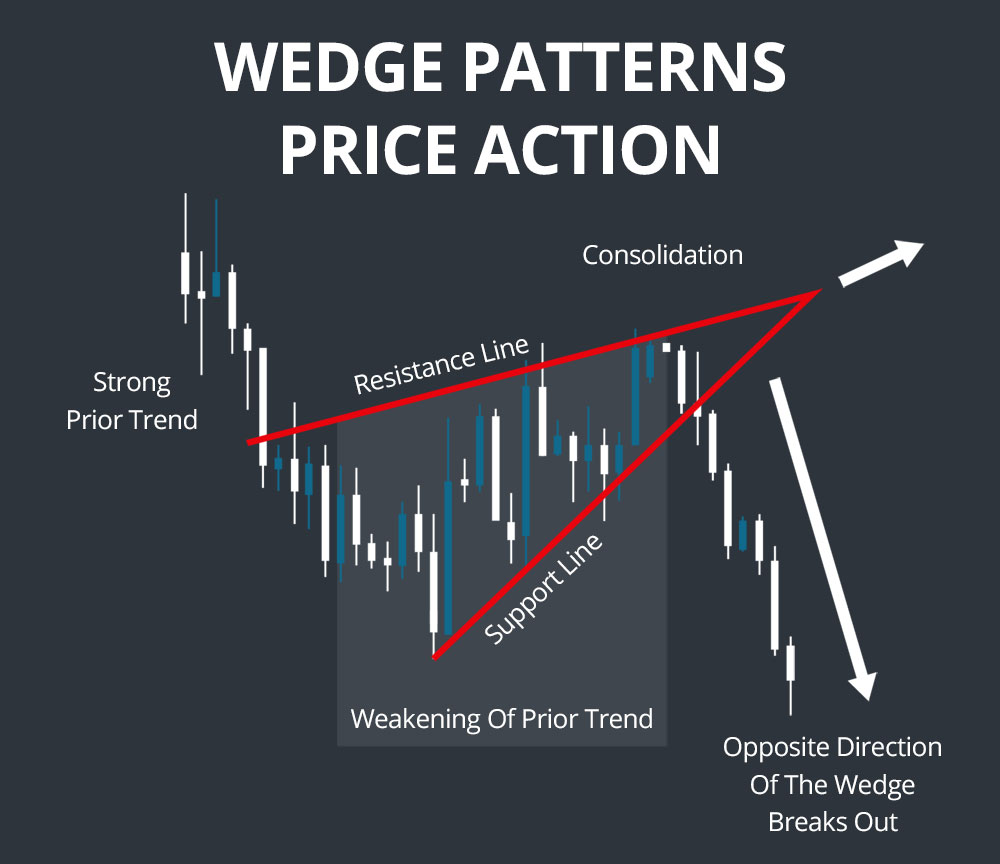

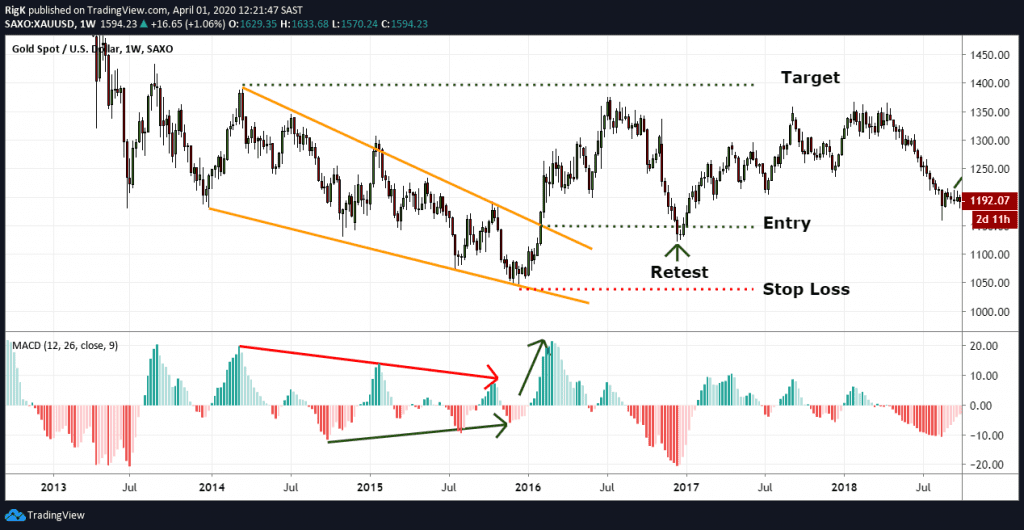

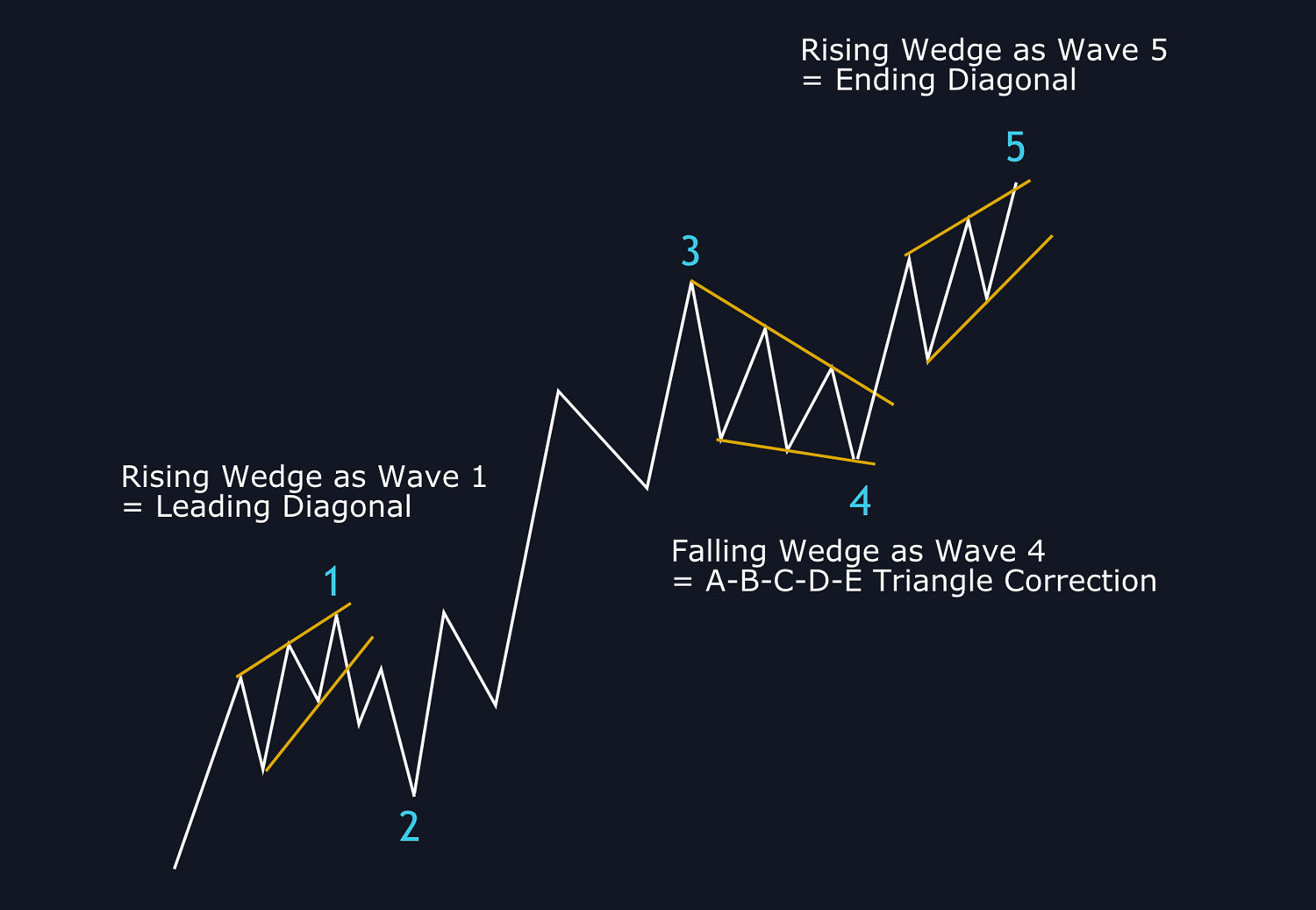

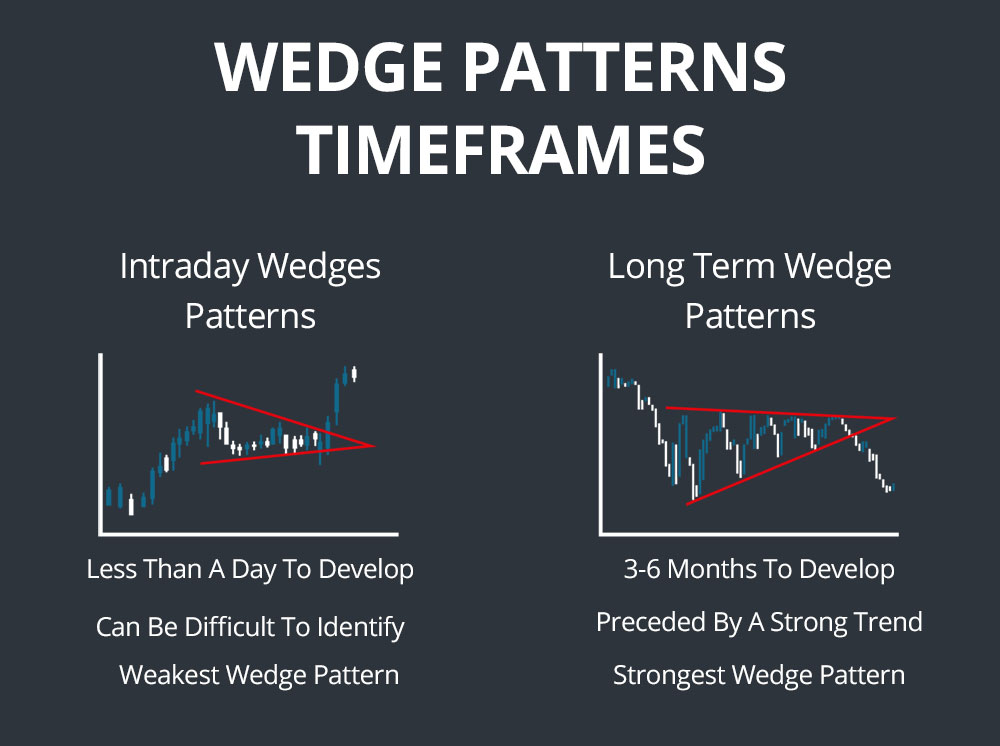

Stock Wedge Pattern - Web the rising wedge pattern is a very common formation that appears in any market and timeframe. It is considered a bullish chart formation. We’ll cover identifying wedge patterns, analyzing market context, monitoring. Web learn how to spot and predict the breakout direction of rising and falling wedge patterns, which are technical chart patterns used to predict trend continuations. In contrast to symmetrical triangles,. Web on the technical analysis chart, a wedge pattern is a market trend commonly found in traded assets (stocks, bonds, futures, etc.). There are 2 types of wedges indicating. The pattern is characterized by a contracting. Whether the price reverses the prior trend or. Wedges take many forms — rising, falling, expanding,. They are composed of the support and resistance trend lines that move in the same direction as the channel gets. Web paypal share price has formed a rising wedge pattern on the daily and weekly charts. Web wedge patterns are chart patterns similar to symmetrical triangle patterns in that they feature trading that initially takes place over a wide price. Web in this blog post, we’ll delve into the intricacies of trading with stock wedge patterns. Most importantly, the stock has formed a rising wedge pattern that is shown. Within this pull back, two converging trend lines. The lines show that the highs and the lows are either rising or falling at differing rates, giving the appearance of a. Web. Wedges take many forms — rising, falling, expanding,. Web a wedge pattern is a signal formed on a price chart when two distinct trend lines appear to converge with each successive trading session. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. Within this pull back, two converging trend lines.. The breakout direction from the wedge determines whether. It is considered a bullish chart formation. Wedge patterns are trend reversal patterns. The pattern is characterized by a contracting. There are 2 types of wedges indicating. Web a wedge pattern is a signal formed on a price chart when two distinct trend lines appear to converge with each successive trading session. Web a wedge is a common type of trading chart pattern that helps to alert traders to a potential reversal or continuation of price direction. Web in this guide, we will delve into the different. Web paypal share price has formed a rising wedge pattern on the daily and weekly charts. Web in this guide, we will delve into the different types of wedge patterns, such as the rising wedge and the falling wedge, and explore how to spot them on price. Web the falling wedge pattern occurs when the asset’s price is moving in. Web a wedge is a common type of trading chart pattern that helps to alert traders to a potential reversal or continuation of price direction. The pattern is characterized by a contracting. We’ll cover identifying wedge patterns, analyzing market context, monitoring. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines.. Whether the price reverses the prior trend or. The pattern is characterized by a contracting. Web on the technical analysis chart, a wedge pattern is a market trend commonly found in traded assets (stocks, bonds, futures, etc.). There are 2 types of wedges indicating. Web the rising wedge is a chart pattern used in technical analysis to predict a likely. We’ll cover identifying wedge patterns, analyzing market context, monitoring. Within this pull back, two converging trend lines. The breakout direction from the wedge determines whether. The lines show that the highs and the lows are either rising or falling at differing rates, giving the appearance of a. Web the rising wedge is a chart pattern used in technical analysis to. They are composed of the support and resistance trend lines that move in the same direction as the channel gets. Most importantly, the stock has formed a rising wedge pattern that is shown. A wedge is a price pattern marked by converging trend lines on a price chart. Web the rising wedge is a bearish pattern that begins wide at. Web a wedge is a common type of trading chart pattern that helps to alert traders to a potential reversal or continuation of price direction. Web the wedge pattern can either be a continuation pattern or a reversal pattern, depending on the type of wedge and the preceding trend. Wedges take many forms — rising, falling, expanding,. The breakout direction from the wedge determines whether. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. Web in this guide, we will delve into the different types of wedge patterns, such as the rising wedge and the falling wedge, and explore how to spot them on price. Web on the technical analysis chart, a wedge pattern is a market trend commonly found in traded assets (stocks, bonds, futures, etc.). Web a wedge pattern is a popular trading chart pattern that indicates possible price direction changes or continuations. They are composed of the support and resistance trend lines that move in the same direction as the channel gets. It is considered a bullish chart formation. Web these trading wedge patterns emerge on charts when trend direction conflicts with volatility contraction. Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows. Most importantly, the stock has formed a rising wedge pattern that is shown. Web there are 6 broadening wedge patterns that we can separately identify on our charts and each provide a good risk and reward potential trade setup when carefully selected and. Web paypal share price has formed a rising wedge pattern on the daily and weekly charts. We’ll cover identifying wedge patterns, analyzing market context, monitoring.

Wedge Patterns How Stock Traders Can Find and Trade These Setups

How to Trade the Rising Wedge Pattern Warrior Trading

The Falling Wedge Pattern Explained With Examples

Wedge Pattern Reversal and Continuation Financial Freedom Trading

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Wedge Patterns How Stock Traders Can Find and Trade These Setups

5 Chart Patterns Every Beginner Trader Should Know Brooksy

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

Falling Wedge Pattern Trading 4 Step Wedge Strategy Exposed

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

Web The Rising Wedge Is A Chart Pattern Used In Technical Analysis To Predict A Likely Bearish Reversal.

This Article Provides A Technical Approach.

The Pattern Is Characterized By A Contracting.

In Contrast To Symmetrical Triangles,.

Related Post: