Stock W Pattern

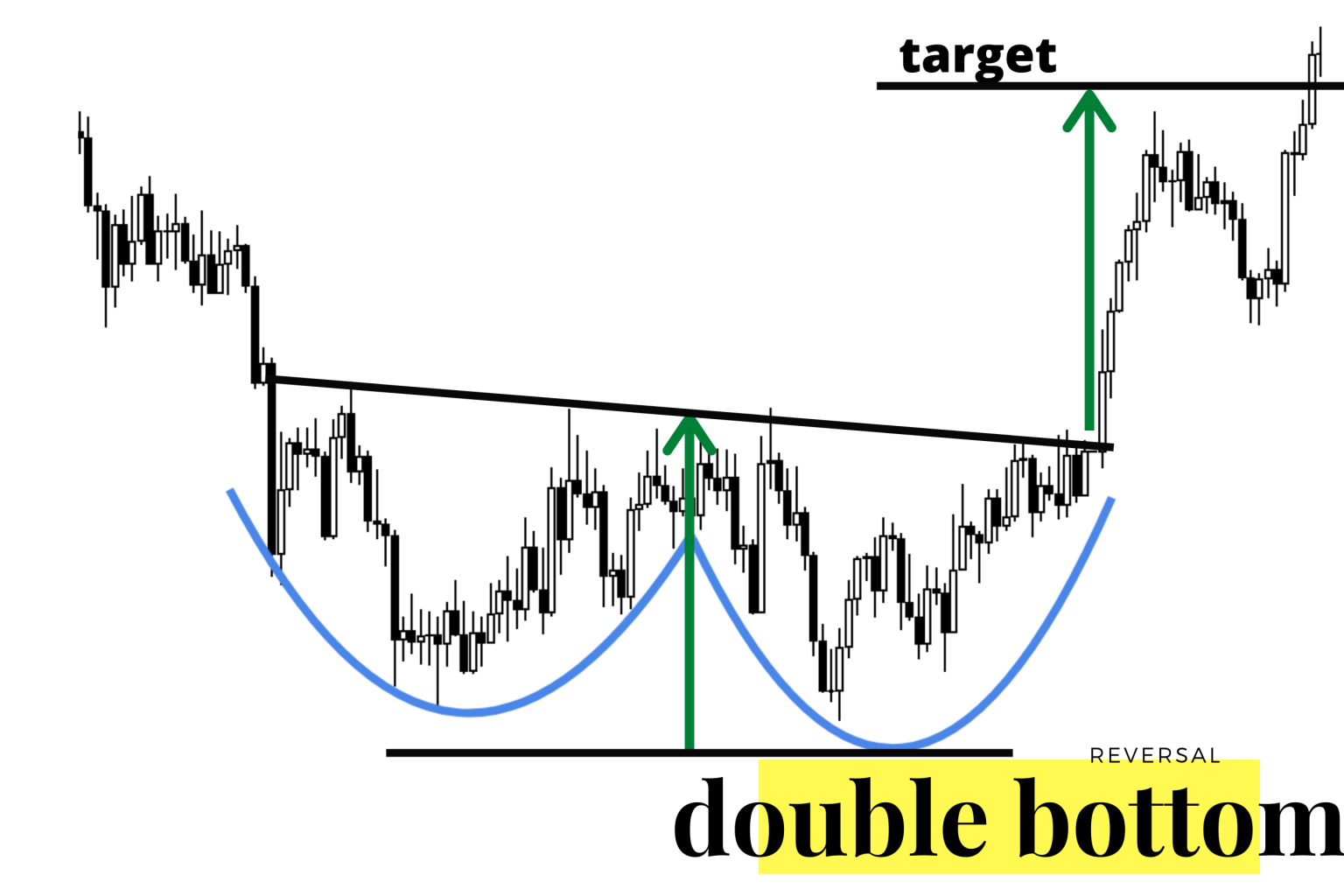

Stock W Pattern - Web the w chart pattern is a reversal pattern that is bullish as a downtrend holds support after the second test and rallies back higher. Web when the stock w pattern completes, it illustrates that buyers have become active again and suggests the prior downtrend may be over. Web a double bottom chart pattern is a chart pattern used in technical analysis to describe the fall in price of a stock or index, followed by a rebound, then another drop to a level that’s roughly similar to the original drop (sound familiar?), and finally another rebound. The pattern confirms as a valid one when price closes above the highest. “w” pattern with the right bottom being lower than the previous bottom. Recedes 69% of the time. This pattern is created when a key price support level on a chart is tested twice with a rally between the two support level tests creating a visual w pattern on the chart. When reading stock charts, traders typically use one or more of. Web this pattern is a is a mirror image of m pattern. 📈 whether you're a beginner or an experienced trader, understanding this do. To interpret these chart patterns. Free webinarfind the right stocksexpert advice$7 trial offer It resembles the letter ‘w’ due to its structure formed by two consecutive price declines and recoveries. Web double top and bottom: Recedes 69% of the time. One popular pattern that traders often look out for is the double bottom, also known as the w pattern. Web the w pattern in trading is a formation on price charts that signifies a potential bullish reversal after a downward trend. The rise between the valleys of the double bottom is 10% to 20% or more. To interpret these chart. Web the w pattern in trading is a formation on price charts that signifies a potential bullish reversal after a downward trend. The “w” pattern comes in various forms, but here are two variations. Inside outside with bollinger band technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield. There will be two lows in between. When reading stock charts, traders typically use one or more of. Traders will watch for w pattern in forex at the end of a bearish trend to signal an opportunity to buy. Web a new w pattern. Web when the stock w pattern completes, it illustrates that buyers have become active again and. Generally speaking, each period consists of several data points, including the opening, high, low, and/or closing prices. Rollover your 401(k)improve how you investcompare ira options There will be three peaks in a neckline. Consequently, the double bottom chart pattern resembles the letter “w.”. The rise between the valleys of the double bottom is 10% to 20% or more. The rectangle top is the most profitable, with an average win of 51%. Web double top and bottom: For a “w” pattern to be qualified for trading, look for the following characteristics. To interpret these chart patterns. Web when the stock w pattern completes, it illustrates that buyers have become active again and suggests the prior downtrend may be over. Free webinarfind the right stocksexpert advice$7 trial offer The w can be either rounded or have straight. This pattern denotes the prices are going to rise. “w” pattern with the right bottom being lower than the previous bottom. Web this pattern is a is a mirror image of m pattern. Stock passes all of the below filters in cash segment: Web click on bars to view stock details filtered at the given time. A double bottom is a charting pattern used in technical analysis. The pattern forms a double bottom which is a powerful reversal signal in technical analysis. To interpret these chart patterns. Generally speaking, each period consists of several data points, including the opening, high, low, and/or closing prices. Inside outside with bollinger band technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web identifying the w pattern with renko charts. 📈 whether you're a beginner or an experienced. “w” pattern with the right bottom being lower than the previous bottom. Chart patterns in which the quote for the underlying investment moves in a similar pattern to the letter w (double bottom) or m (double top). Web explore the power of the w pattern in this comprehensive chart analysis video. Web the w trading pattern embodies a cornerstone concept. Web identifying the w pattern with renko charts. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web the w pattern in trading is a formation on price charts that signifies a potential bullish reversal after a downward trend. Web a double bottom chart pattern is a chart pattern used in technical analysis to describe the fall in price of a stock or index, followed by a rebound, then another drop to a level that’s roughly similar to the original drop (sound familiar?), and finally another rebound. Web the stock market is unpredictable, and even the most reliable patterns can fail. In the world of forex trading, understanding patterns and trends can make all the difference between profit and loss. Delayed data as of 11:04 am, get realtime scans in our premium subscription. Web when the stock w pattern completes, it illustrates that buyers have become active again and suggests the prior downtrend may be over. Web price charts visualize the trading activity that takes place during a single trading period (whether it's five minutes, 30 minutes, one day, and so on). A pattern is identified by a line. 📈 whether you're a beginner or an experienced trader, understanding this do. “w” pattern with the right bottom being lower than the previous bottom. “w” pattern with a double bottom. Generally speaking, each period consists of several data points, including the opening, high, low, and/or closing prices. Web the w chart pattern is a reversal pattern that is bullish as a downtrend holds support after the second test and rallies back higher. This pattern is created when a key price support level on a chart is tested twice with a rally between the two support level tests creating a visual w pattern on the chart.

W Pattern Double Bottom Is a Reliable Bullish Trading Signal

Three Types of W Patterns MATI Trader

Three Types of W Patterns MATI Trader

wpattern TRESORFX

MAKING " W ' PATTERN ON DAILY CHART LOOKING BULLISH สำหรับ NSEEXIDEIND

Wpattern — TradingView

W Pattern Trading The Forex Geek

Wpattern — TradingView

W Forex Pattern Fast Scalping Forex Hedge Fund

W Pattern Trading New Trader U

It Resembles The Letter ‘W’ Due To Its Structure Formed By Two Consecutive Price Declines And Recoveries.

What Is A W Pattern?

A Double Bottom Is A Charting Pattern Used In Technical Analysis.

The Rectangle Top Is The Most Profitable, With An Average Win Of 51%.

Related Post: