Stock Triangle Pattern

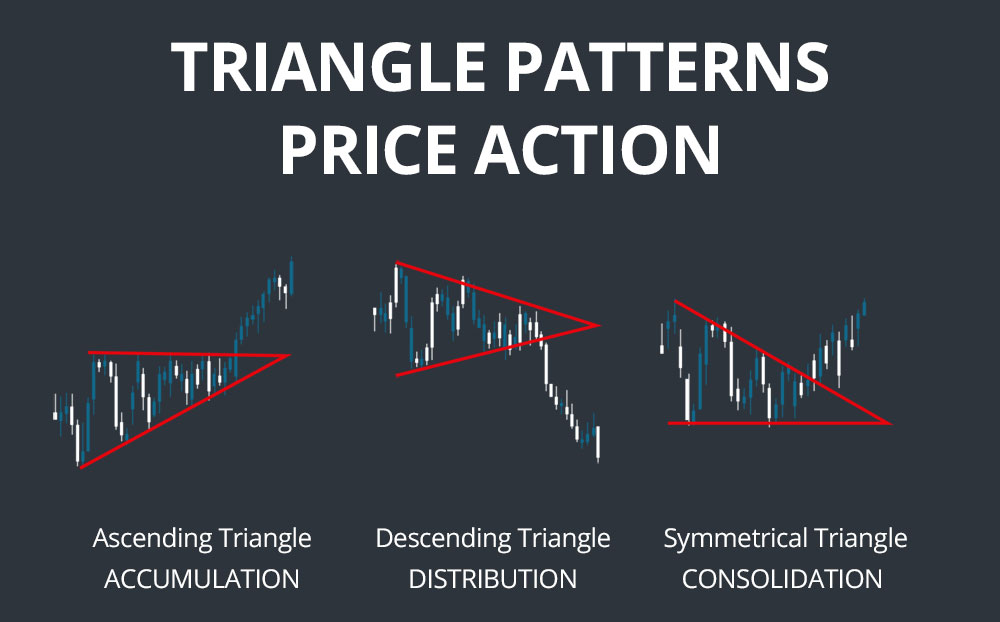

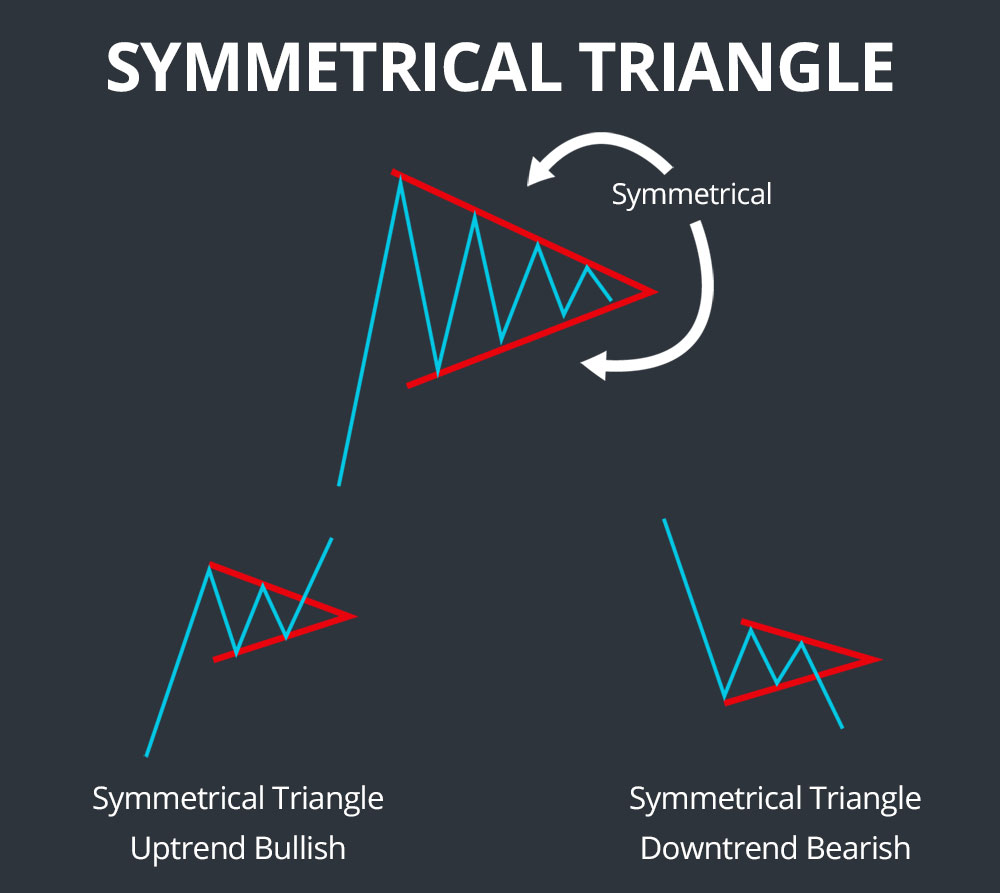

Stock Triangle Pattern - Web traders use triangles to highlight when the narrowing of a stock or security's trading range after a downtrend or uptrend occurs. The picture below depicts all three. Web the three most common types of triangles are symmetrical triangles, ascending triangles, and descending triangles. Web triangle patterns are a chart pattern commonly identified by traders when a stock price’s trading range narrows following an uptrend or downtrend. Web what is a triangle pattern in trading? They consist of support and resistance lines, where the price action occurs between these levels. That said, it also signals a trend reversal. A descending triangle pattern is a price chart formation used in technical analysis. What is a descending triangle pattern? So what will be the next move? That said, it also signals a trend reversal. Web here are 10 of the most dependable stock chart patterns to know. The picture below depicts all three. This chart pattern helps indicate the continuation of a bearish or bullish trend. It is a reversal price action pattern that quite accurately indicates the exhaustion of a bullish trend. Web price did not have trending movement on friday. Web there are three types of triangle patterns: Updated on january 5, 2022. These are important patterns for a number of reasons: Web here are 10 of the most dependable stock chart patterns to know. Web there are three types of triangle patterns: © 2024 millionaire media, llc. 1️⃣ the first type of triangle is called a descending triangle. Web here are 10 of the most dependable stock chart patterns to know. Web a symmetrical triangle chart pattern is a period of consolidation before the price is forced to break out or down. Web roughly scans ascending triangle pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. The triangle is one of my favorite chart patterns. A breakdown from the lower trend line marks the start of a new bearish. A triangle pattern often signals a trend continuation or. They consist of support and resistance lines, where the price action occurs between these levels. However, it can also occur as a consolidation in an uptrend as well. A breakdown from the lower trend line marks the start of a new bearish. Web whether bullish or bearish, a descending triangle pattern is a tried and tested approach that helps traders. 28, 2024, at 3:49 p.m. 1️⃣ the first type of triangle is called a descending triangle. These chart patterns can last anywhere from a couple of weeks to several. When these points are connected, the lines converge as they are extended and the symmetrical triangle takes shape. Web there are three types of triangle patterns: Web price did not have trending movement on friday. When the price breaks below the lower support, it. Web hey traders, in this post, we will discuss 3 simple and profitable types of a triangle pattern. They show a decrease in volatility that could eventually expand again. Web the descending triangle pattern is a type of chart pattern often used. Web traders use triangles to highlight when the narrowing of a stock or security's trading range after a downtrend or uptrend occurs. They are named triangles as the upper and lower trend line eventually meet to form a tip and connecting the starting points of both trend lines completes a triangle shape. Web a triangle chart pattern in technical analysis. Web what is a triangle pattern in trading? That said, it also signals a trend reversal. There are three potential triangle variations that can develop as. However, it can also occur as a consolidation in an uptrend as well. The triangle pattern, in its three forms, is one of the common stock patterns for day trading that you should be. Web an ascending triangle is a chart pattern used in technical analysis. There are instances when ascending triangles form as reversal patterns at the end of a downtrend, but they are typically continuation patterns. Web a symmetrical triangle chart pattern is a period of consolidation before the price is forced to break out or down. Traders use these stock trading. They are named triangles as the upper and lower trend line eventually meet to form a tip and connecting the starting points of both trend lines completes a triangle shape. A breakdown from the lower trend line marks the start of a new bearish. When these points are connected, the lines converge as they are extended and the symmetrical triangle takes shape. It is created by price moves that allow for a horizontal line to be drawn along the swing highs and a rising trendline to be. A descending triangle pattern is a price chart formation used in technical analysis. Web here are 10 of the most dependable stock chart patterns to know. 1️⃣ the first type of triangle is called a descending triangle. The picture below depicts all three. When the price breaks below the lower support, it. Web the symmetrical triangle, which can also be referred to as a coil, usually forms during a trend as a continuation pattern. Web a triangle chart pattern in technical analysis is formed by drawing upper and lower trendlines that converge as the asset’s price temporarily moves sideways. It is a reversal price action pattern that quite accurately indicates the exhaustion of a bullish trend. Published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and descending triangle. Web hey traders, in this post, we will discuss 3 simple and profitable types of a triangle pattern. Web an ascending triangle is a chart pattern used in technical analysis. A triangle pattern often signals a trend continuation or reversal.

Triangle Pattern Characteristics And How To Trade Effectively How To

:max_bytes(150000):strip_icc()/Triangles_AShortStudyinContinuationPatterns1-bba0f7388b284f96b90ead2b090bf9a8.png)

The Ascending Triangle Pattern What It Is, How To Trade It

Triangle Chart Patterns Complete Guide for Day Traders

Triangle Pattern Characteristics And How To Trade Effectively How To

How to Trade Triangle Chart Patterns FX Access

Triangle Chart Patterns Complete Guide for Day Traders

Triangle Chart Patterns Complete Guide for Day Traders

Triangle Chart Patterns Complete Guide for Day Traders

Triangle Pattern Characteristics And How To Trade Effectively How To

Triangle Chart Patterns Complete Guide for Day Traders

Web Triangle Patterns Are A Chart Pattern Commonly Identified By Traders When A Stock Price’s Trading Range Narrows Following An Uptrend Or Downtrend.

However, It Can Also Occur As A Consolidation In An Uptrend As Well.

As You Read The Breakdown For Each Pattern, You Can Use This Picture As A Point Of Reference, A Helpful Visualization Tool You Can Use To Get A Mental Picture Of What Each Pattern Might Look Like.

Web A Popular Chart Pattern Used By Traders, Descending Triangles Clearly Show That Demand For An Asset, Derivative, Or Commodity Is Weakening.

Related Post: