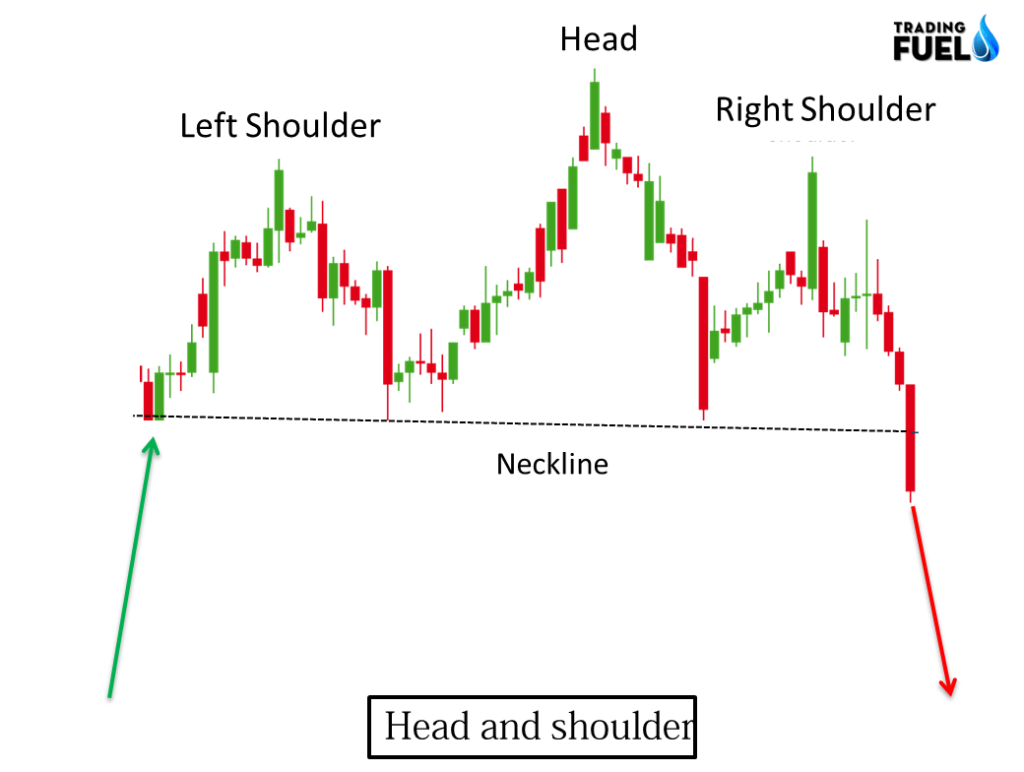

Stock Head And Shoulder Pattern

Stock Head And Shoulder Pattern - Web the head and shoulders is a bearish candlestick pattern that occurs at the end of an uptrend and indicates a trend reversal. Web on a stock chart, the head and shoulders pattern has three peaks, with the middle peak being the highest. It is considered a reliable and accurate chart pattern and is often used by traders and investors to. Web the inverse head and shoulders chart pattern is a bullish chart formation that signals a potential reversal of a downtrend. The line connecting the 2 valleys is the neckline. It typically forms at the end of a bullish trend. Web a head and shoulders pattern is a bearish reversal pattern in technical analysis that signals a price reversal from a bullish to bearish trend. The height of the last top can be higher than the first, but not higher than the head. To understand the pattern name, think of the two outside peaks as the shoulders and the middle peak as the head. The height of the last top can be higher than the first, but not higher than the head. It is considered one of the most reliable chart patterns and is identified by three peaks. Dal) head and shoulders chart pattern (source:. Web the head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. The height of the last top can be higher than the first, but. Traders often study trends and patterns when analyzing the market, in hopes of detecting the next most probable price movement. Web november 2, 2023 lee bohl. It is considered a reliable and accurate chart pattern and is often used by traders and investors to. Web there are four components of a head and shoulders pattern: What is a head and. Web november 2, 2023 lee bohl. 💎 if the price breaks above the resistance level, we can target the next resistance levels. Web a head and shoulders pattern is a technical indicator with a chart pattern of three peaks, where the outer two are close in height, and the middle is the highest. It is the opposite of the head. It consists of 3 tops with a higher high in the middle, called the head. It typically forms at the end of a bullish trend. The left shoulder forms when the stock price rises. Web head and shoulder pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield. Web there are four components of a head and shoulders pattern: It is the opposite of the head and shoulders chart pattern, which. The height of the last top can be higher than the first, but not higher than the head. The height of the last top can be higher than the first, but not higher than the head. Dal). Web the head and shoulders chart pattern is a technical analysis chart formation used to identify potential reversals in the trend of a stock. The left shoulder forms when the stock price rises. By its very nature, it always appears at the top of an uptrend, although it's alter ego, the. It has three distinctive parts: Web the inverse head. It consists of 3 tops with a higher high in the middle, called the head. Web head and shoulders pattern is a useful chart pattern to identify reversal stock trends. Web the head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. The left shoulder forms when a. What is a head and shoulders pattern. Web a head and shoulders pattern is a technical indicator with a chart pattern of three peaks, where the outer two are close in height, and the middle is the highest. 💎 if the price breaks above the resistance level, we can target the next resistance levels. If so, you've come to the. Web a head and shoulders reversal pattern forms after an uptrend, and its completion marks a trend reversal. It consists of 3 tops with a higher high in the middle, called the head. Web what is a head and shoulder pattern? It consists of 3 tops with a higher high in the middle, called the head. The pattern is shaped. Web what is a head and shoulder pattern? Web november 2, 2023 lee bohl. Web the head and shoulders stock pattern is a common tool to help identify the fall of a previously rising stock. Web the head and shoulders chart pattern is a technical analysis chart formation used to identify potential reversals in the trend of a stock. Head. It has three distinctive parts: There are four main components of the head and shoulders pattern shown in the image below. Web the head and shoulders chart pattern is a technical analysis chart formation used to identify potential reversals in the trend of a stock. 💎 if the price breaks above the resistance level, we can target the next resistance levels. Web a head and shoulders pattern is a bearish reversal pattern in technical analysis that signals a price reversal from a bullish to bearish trend. Web there are four components of a head and shoulders pattern: Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend has exhausted itself. The line connecting the 2 valleys is the neckline. The line connecting the 2 valleys is the neckline. The head and shoulders pattern is a bearish reversal pattern. As such, it is a bearish pattern that signals a reversal. Web the head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. It is considered one of the most reliable chart patterns and is identified by three peaks. Web november 2, 2023 lee bohl. The left shoulder forms when a stock's price rises from a baseline, forms a peak, then drops back down to a. Web the head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend.

Stock Chart Head And Shoulders Pattern

The Head and Shoulders Pattern A Trader’s Guide

a diagram showing the head and shoulders in detail with arrows pointing

:max_bytes(150000):strip_icc()/dotdash_Final_Head_And_Shoulders_Pattern_Sep_2020-01-4c225a762427464699e42461088c1e86.jpg)

What Is a Head and Shoulders Chart Pattern in Technical Analysis?

Head and Shoulders Pattern Trading Strategy Guide Pro Trading School

Head and Shoulders Pattern Quick Trading Guide StockManiacs

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Trade_the_Head_and_Shoulders_Pattern_Jul_2020-01-d955fe7807714feea05f04d7f322dfaf.jpg)

How to Trade the Head and Shoulders Pattern

Chart Pattern Head And Shoulders — TradingView

How to Trade the Head and Shoulders Pattern Trading Pattern Basics

Head and Shoulders pattern How To Verify And Trade Efficiently How

The Head And Shoulders Pattern Is Quite Popular Amongst The Market Participants Due To Its Reliability In The Past And Of Course The Success Ratio.

The Height Of The Last Top Can Be Higher Than The First, But Not Higher Than The Head.

The Height Of The Last Top Can Be Higher Than The First, But Not Higher Than The Head.

It Consists Of 3 Tops With A Higher High In The Middle, Called The Head.

Related Post: