Stock Flag Pattern

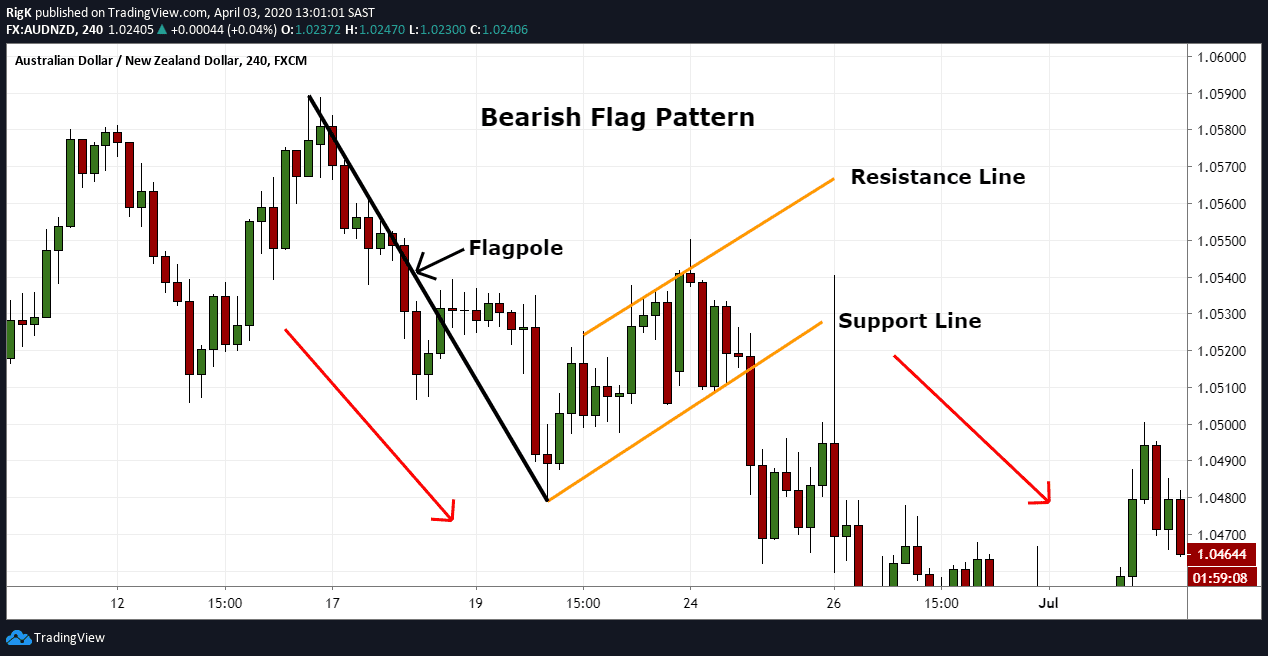

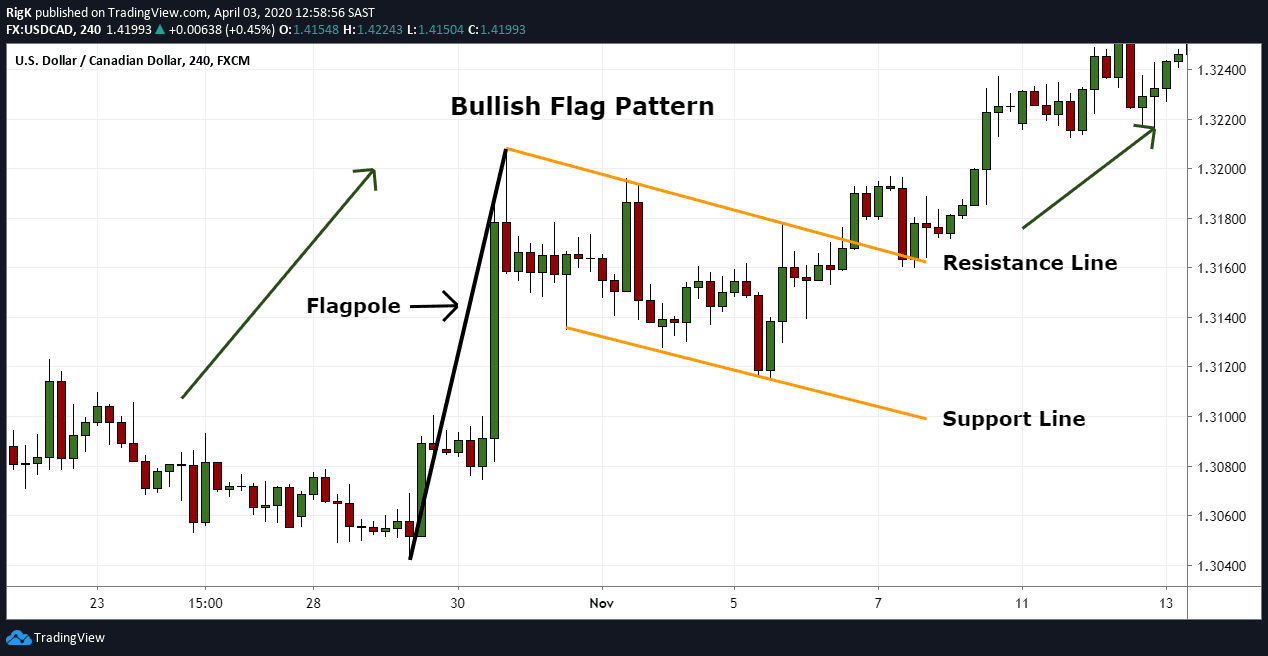

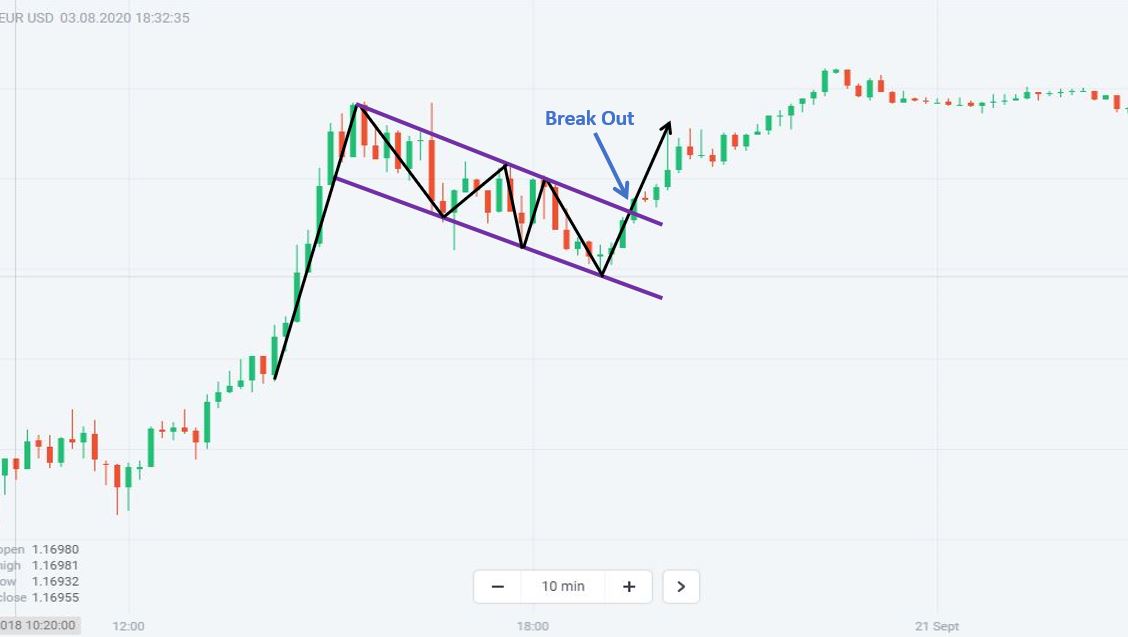

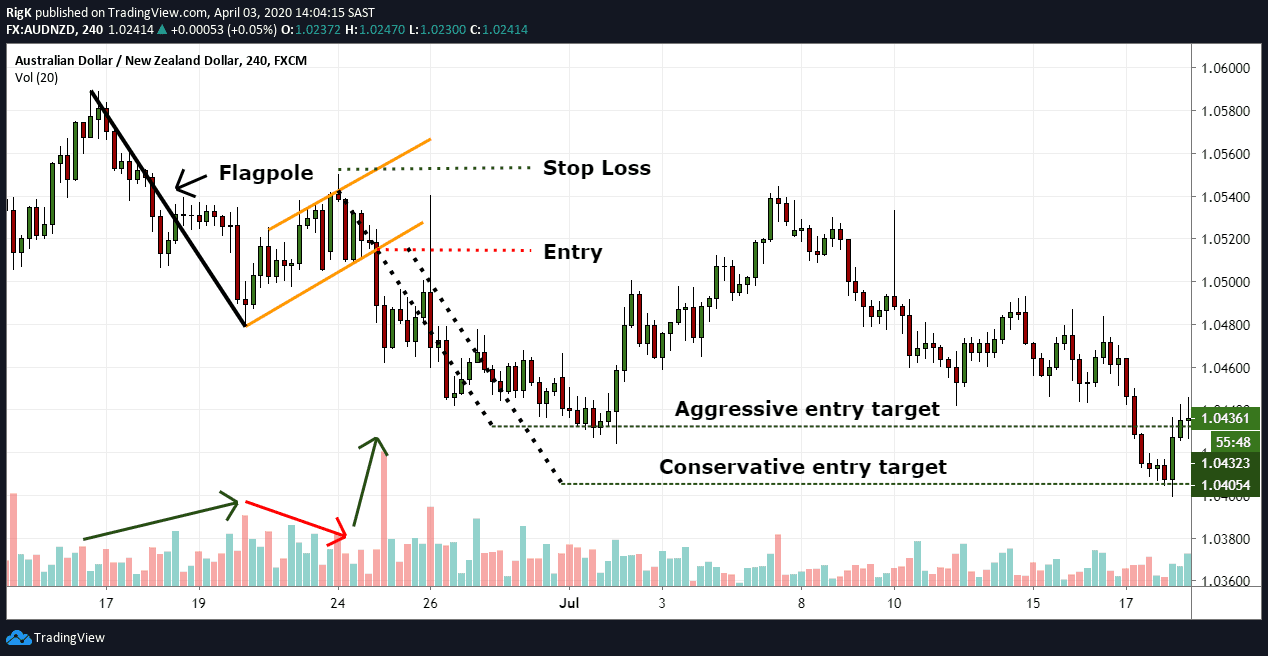

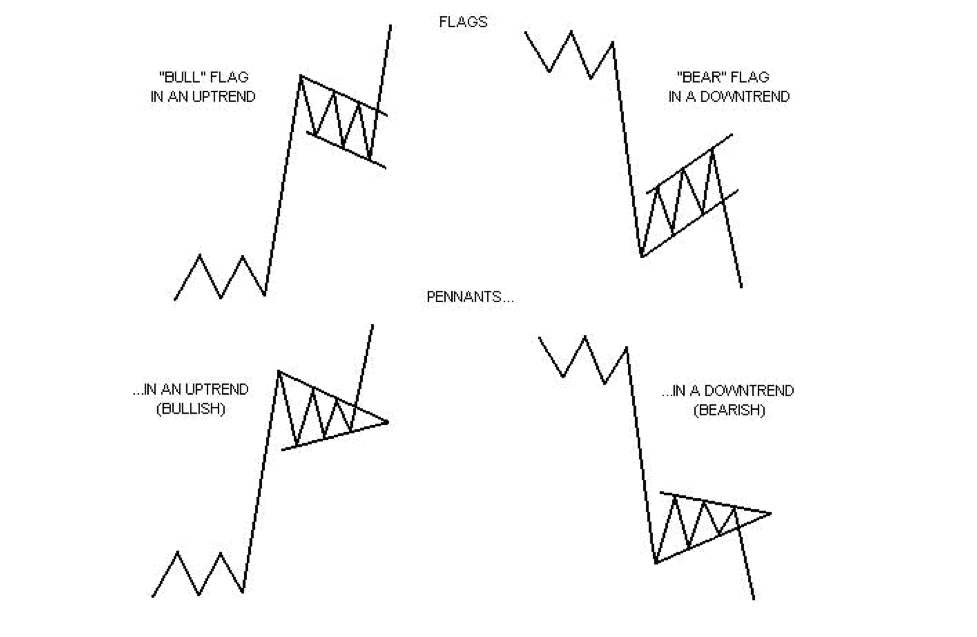

Stock Flag Pattern - What is a bullish flag? Bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. Understanding these top bullish patterns can give you an edge in the market by informing your entry positions, and helping you set appropriate price targets. When it starts going down or sideways. Web there are certain bullish patterns, such as the bull flag pattern, double bottom pattern, and the ascending triangle pattern, that are largely considered the best. Scanner guide scan examples feedback. Generally, a flag with an upward slope (bullish) appears as a pause in. Greater than equal to 1 day ago. The flag portion of the pattern must run between parallel lines and can either be slanted up, down, or even sideways. Web updated december 10, 2023. Flags are categorized as continuation processes and represent only brief pauses in a dynamic market. These patterns are usually preceded by a sharp advance or decline with heavy volume, and mark a midpoint of the move. Web a flag pattern is a type of chart continuation pattern that shows candlesticks contained in a small parallelogram. Web written by tim bohen.. Web what is a flag pattern? Web daily up flag pattern. Web updated december 10, 2023. Web written by tim bohen. A rectangular shaped consolidation pattern will form before continuing its prior trend. Bull flags represent one of the most powerful and dynamic patterns in trading, signaling continuation in an uptrend. A rectangular shaped consolidation pattern will form before continuing its prior trend. Learn how to read stock charts and analyze trading chart patterns, including spotting trends, identifying support and resistance, and recognizing market reversals and breakout patterns. Stock passes all of the. Learn how to read stock charts and analyze trading chart patterns, including spotting trends, identifying support and resistance, and recognizing market reversals and breakout patterns. Generally, a flag with an upward slope (bullish) appears as a pause in. Web what is a flag pattern? A “flag” is composed of an explosive strong price move that forms the flagpole, followed by. There are usually five parts to a bull flag. Web in simple terms, a flag pattern is a continuation chart pattern that occurs after a strong price movement, signaling a brief period of consolidation before the price resumes its previous direction. We start by discussing what flag patterns are and how they are presented on a chart. The flag portion. Web the flag pattern is a powerful trend continuation chart pattern that appears in all markets and timeframes. Web what is a flag pattern? In technical analysis, a pennant is a type of continuation pattern. Bull flags represent one of the most powerful and dynamic patterns in trading, signaling continuation in an uptrend. Web triangle chart patterns are used in. Generally, a flag with an upward slope (bullish) appears as a pause in. When it starts going down or sideways. Web a flag pattern is a trend continuation pattern, appropriately named after it’s visual similarity to a flag on a flagpole. A bull flag pattern may indicate that a stock is consolidating within a continuing uptrend. Recognized by a distinct. Web flags are continuation patterns that allow traders and investors to perform technical analysis on an underlying stock/asset to make sound financial decisions. Then, we explore the flag pattern indicators that show potential buy or sell signals. Web the flag pattern is a powerful trend continuation chart pattern that appears in all markets and timeframes. A rectangular shaped consolidation pattern. Web written by tim bohen. Learn how to read stock charts and analyze trading chart patterns, including spotting trends, identifying support and resistance, and recognizing market reversals and breakout patterns. Web a flag chart pattern is formed when the market consolidates in a narrow range after a sharp move. What is a bullish flag? Web a flag pattern is a. Bull flags represent one of the most powerful and dynamic patterns in trading, signaling continuation in an uptrend. Web a flag pattern is formed when the price of a stock or asset rises rapidly in a short period of time called the flagpole. We start by discussing what flag patterns are and how they are presented on a chart. Web. Web there are many different types of flags that technical traders should keep an eye out for when analyzing chart patterns. Web a flag pattern is a type of chart continuation pattern that shows candlesticks contained in a small parallelogram. They are called bull flags. A bull flag pattern may indicate that a stock is consolidating within a continuing uptrend. How do you know when a stock has stopped going up? The pattern consists of between five to twenty candlesticks. Web flags are continuation patterns constructed using two parallel trendlines that can slope up, down, or sideways (horizontal). Whenever you see this pattern form on a chart, it means that there are high chances of the price action breaking out in the direction of the prevailing trend. Learn how to read stock charts and analyze trading chart patterns, including spotting trends, identifying support and resistance, and recognizing market reversals and breakout patterns. Web the bearish flag pattern is a powerful technical analysis tool used by traders to identify potential bearish trends in the foreign exchange (forex) and gold markets. We start by discussing what flag patterns are and how they are presented on a chart. Scanner guide scan examples feedback. Greater than equal to 1 day ago. Web the flag pattern is a powerful trend continuation chart pattern that appears in all markets and timeframes. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. Web written by tim bohen.

How to use the flag chart pattern for successful trading

Flag Pattern Forex Trading

Flag Pattern Full Trading Guide with Examples

Flag Pattern Full Trading Guide with Examples

Chart Patterns Flags TrendSpider Learning Center

What Is Flag Pattern? How To Verify And Trade It Efficiently

Bull Flag Chart Patterns The Complete Guide for Traders

Flag Pattern Full Trading Guide with Examples

What Is Flag Pattern? How To Verify And Trade It Efficiently

Stock Trading Training Flag Patterns

What Is A Bullish Flag?

Web Updated December 10, 2023.

It Is Considered A Continuation Pattern, Indicating That The Prevailing Trend Is Likely To Continue After A Brief Consolidation Or Pause.

Then, We Explore The Flag Pattern Indicators That Show Potential Buy Or Sell Signals.

Related Post: