Stock Cup Pattern

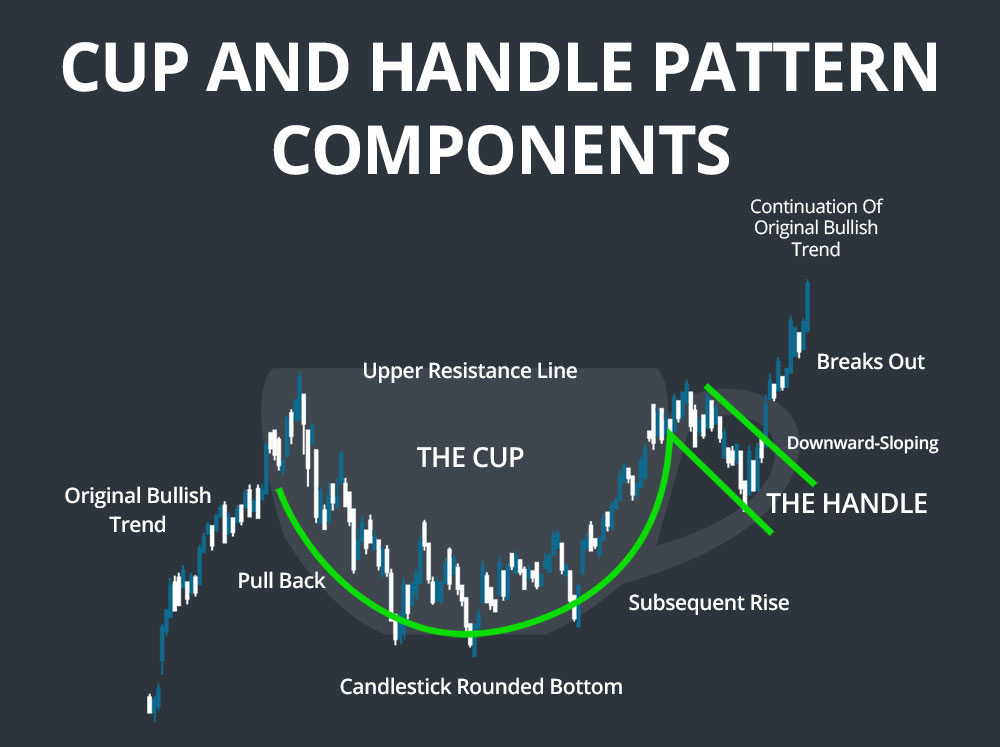

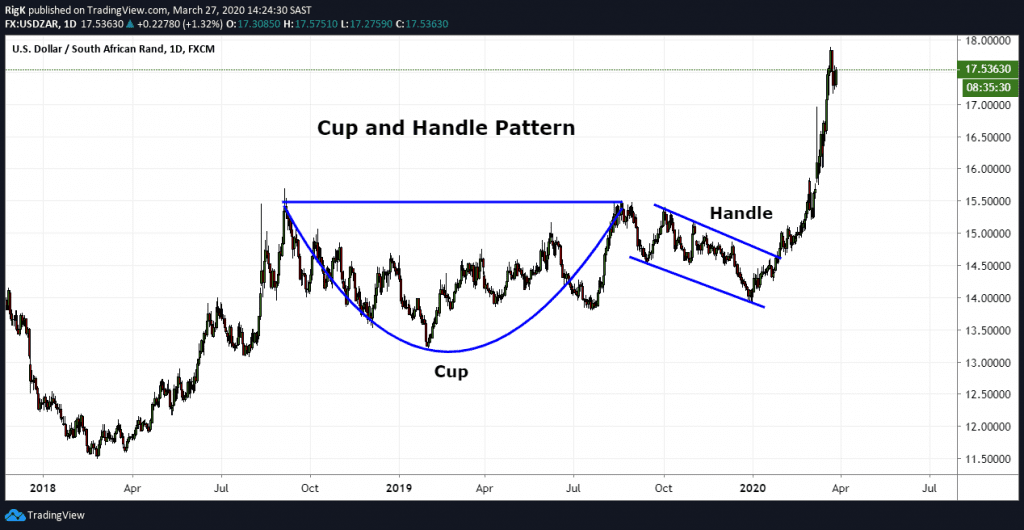

Stock Cup Pattern - Web among the eight principal base patterns — including the ascending base, base on base, double bottom, flat base, high, tight flag, ipo base and saucer — the cup with handle remains to this day. 2 cup and handle pattern recognition; One of the most famous chart patterns when trading stocks is the cup with handle. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. Web a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. Web the cup and handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. It gets its name from the tea cup shape of the pattern. Web the cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. Web with examples from meta, nvidia and netflix, see how to spot the three common chart patterns: Idex) 4.2 nightfood holdings inc (otcqb: The pattern is called cup and handle because it has two distinct parts: It is considered a signal of an uptrend in the stock market and is used to discover opportunities to go long. Cup with handle, double bottom and flat base. Technical analysis is the practice of using past trading activity, such as price and volume, to predict a. Web 08:00 am et 04/14/2022. Sometimes you might see it abbreviated as cwh. 1.1 is the cup and handle a bullish pattern? Ngtf) 4.3 polymet mining corporation (amex:. Web with examples from meta, nvidia and netflix, see how to spot the three common chart patterns: Learn how to trade this pattern to improve your odds of making profitable trades. If you think finding bases in stock charts is too hard, try starting with the cup without handle. 1.1 is the cup and handle a bullish pattern? The cup and handle pattern was first introduced in 1988 by analyst william o’neill and has since become a. Click on to see current price, volume and other stats. As its name implies, there are two parts to the pattern—the cup and the handle. The cup forms after an advance and looks like a bowl or rounding bottom. Web 08:00 am et 04/14/2022. The cup forms when this decline reaches at least 20%. Web the cup and handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. Our cup and handle chart pattern screener finds stocks ready to breakout tomorrow. Web 08:00 am et 04/14/2022. Web among the eight principal base patterns — including the ascending base, base on base, double bottom, flat base, high, tight flag, ipo. It can be used to spot shares potentially poised for growth if. The cup and the handle. Idex) 4.2 nightfood holdings inc (otcqb: I had seen similar breakout in pbfintech (policybazaar). It gets its name from the tea cup shape of the pattern. Web the cup and handle security trading pattern is a bullish continuation pattern used in technical analysis. Web 1 what is the cup and handle pattern? It is a bullish pattern that indicates a potential trend reversal or continuation of an upward trend. I had seen similar breakout in pbfintech (policybazaar). But how do you recognize when a cup is. Web the cup and handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. Web cup & handle pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. 4 examples of the cup and handle pattern. There are two parts to the. 3 how does the cup and handle work? Web the cup and handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. Sometimes you might see it abbreviated as cwh. As its name implies, there are two parts to the pattern—the cup and the handle. The cup and the handle. If you think finding bases in stock charts is too hard, try starting with the cup without handle. Sometimes you might see it abbreviated as cwh. It was developed by william o'neil and introduced in his 1988 book, how to make money in stocks. Learn how it works with an example, how to identify a target. The cup and handle. The pattern is called cup and handle because it has two distinct parts: I had seen similar breakout in pbfintech (policybazaar). It also holds the crowd proclaimed title as one of the. Today's cup and handle pattern alerts. Web 08:00 am et 04/03/2024. Web a ‘cup and handle’ is a chart pattern that can help you predict future price movements. The cup and handle pattern was first introduced in 1988 by analyst william o’neill and has since become a favored chart pattern among traders because it is relatively straightforward to recognize and trade on. Cup with handle, double bottom and flat base. And once you do, where is. The cup and handle chart pattern is considered reliable based on 900+ trades, with a 95% success rate in bull markets. Web cup and handle chart pattern stocks ready to breakout. Web the cup and handle chart pattern is a technical analysis trading strategy in which the trader attempts to identify a breakout in asset price to profit from a strong uptrend. Idex) 4.2 nightfood holdings inc (otcqb: Price makes a straight or nearly straight down move before reversing and heading up. Our cup and handle chart pattern screener finds stocks ready to breakout tomorrow. Web 08:00 am et 04/14/2022.

Cup And Handle Pattern How To Verify And Use Efficiently How To

.png)

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

Cup and Handle Patterns Comprehensive Stock Trading Guide

:max_bytes(150000):strip_icc()/CupandHandleDefinition1-bbe9a2fd1e6048e380da57f40410d74a.png)

Cup and Handle Definition

The Cup and Handle Chart Pattern (Trading Guide)

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup And Handle Pattern How To Verify And Use Efficiently How To

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup And Handle Pattern How To Verify And Use Efficiently How To

One Of The Most Famous Chart Patterns When Trading Stocks Is The Cup With Handle.

There Are Two Parts To The Pattern:

Web A Cup And Handle Is A Bullish Technical Price Pattern That Appears In The Shape Of A Handled Cup On A Price Chart.

It Can Be Used To Spot Shares Potentially Poised For Growth If.

Related Post: